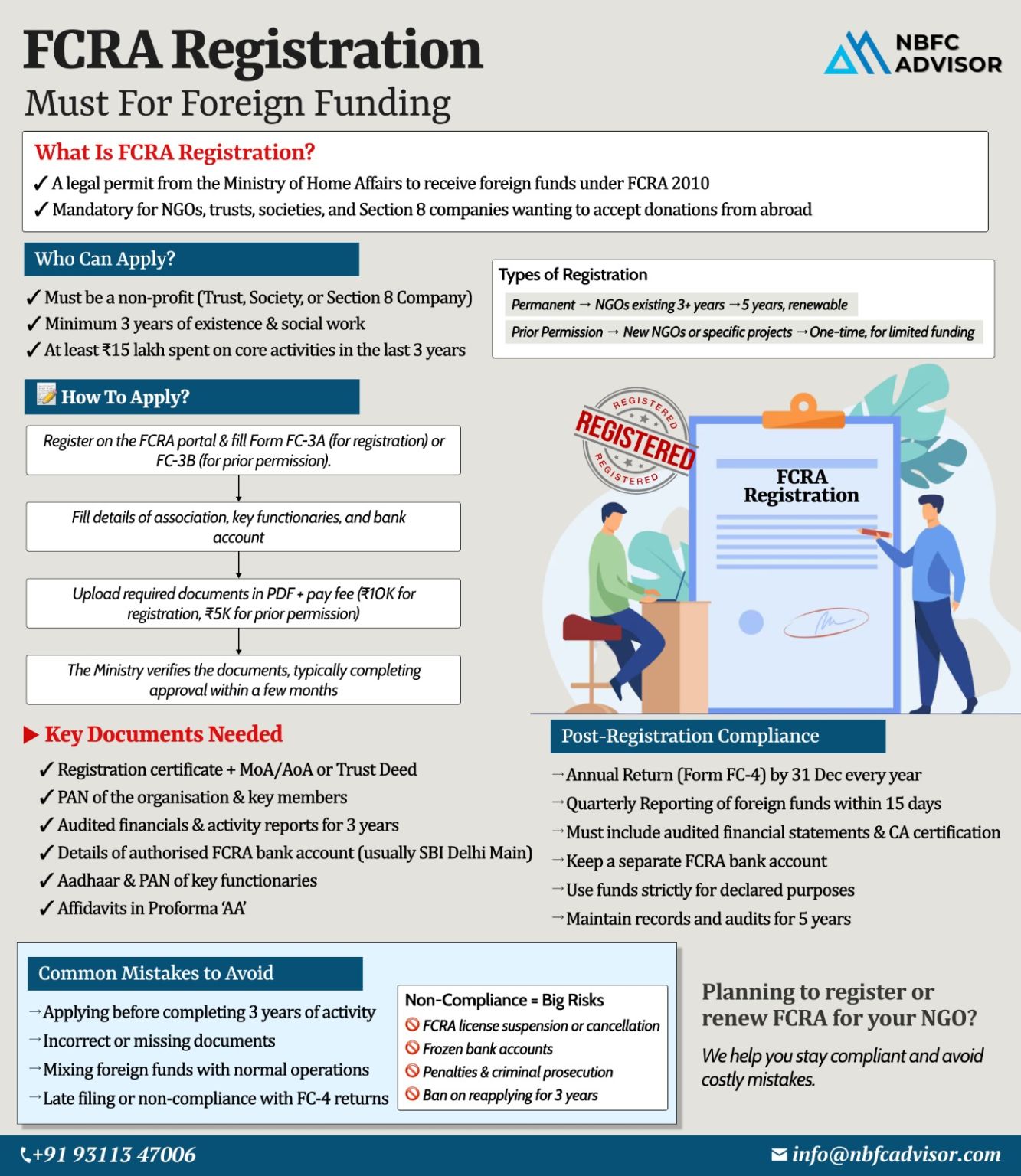

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

Foreign funding can be a lifeline for NGOs working in education, healthcare, human rights, environment, and social welfare. Yet every year, hundreds of NGOs in India lose their ability to ...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘶𝘭𝘦𝘴 𝘈𝘳𝘦 𝘊𝘩𝘢𝘯𝘨𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under an entirely new regulatory framework—and the implications are significant for startups, inves...

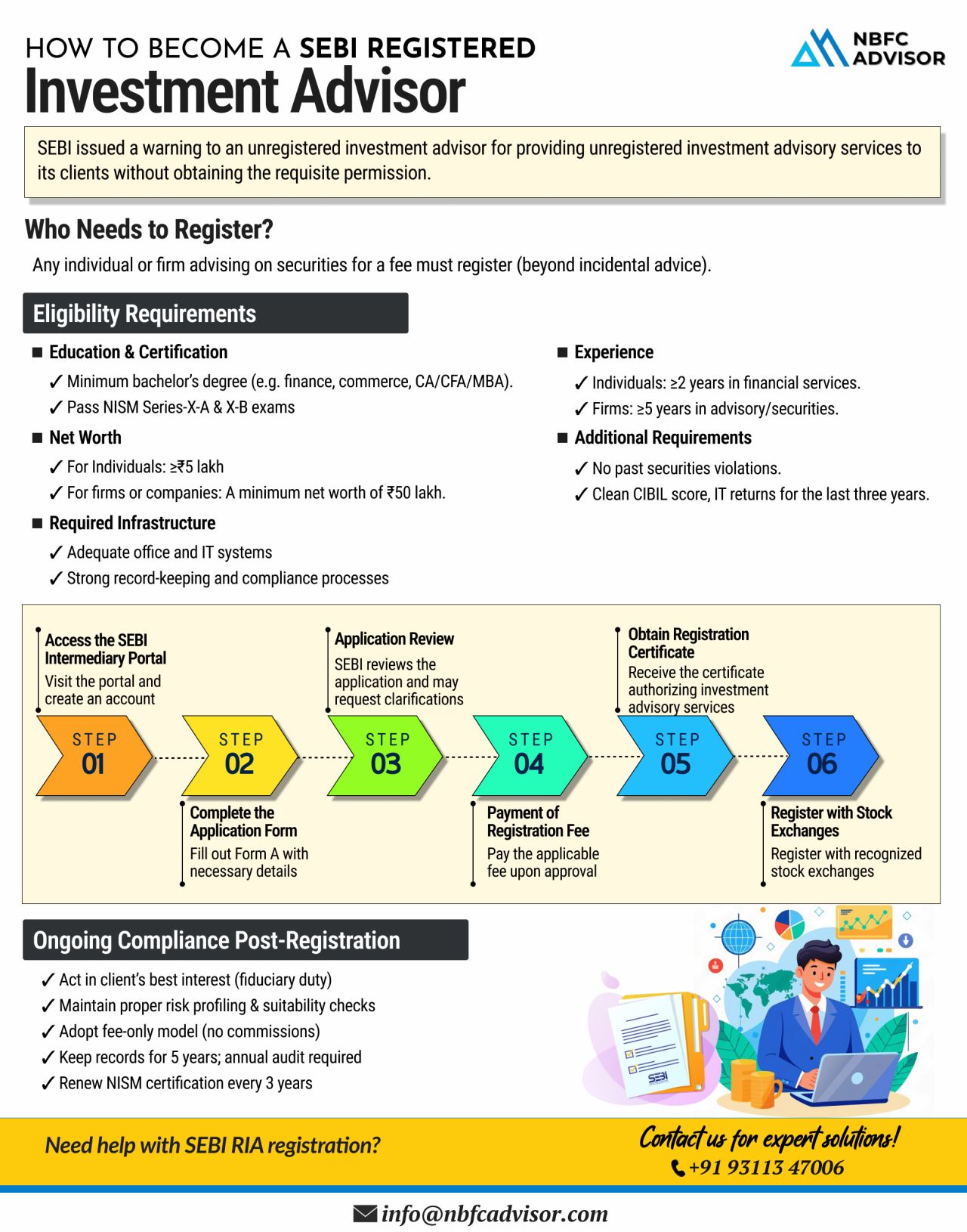

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

The gold loan industry in India is experiencing rapid growth. It is expected to cross ₹10 lakh crore in FY25 and reach ₹15 lakh crore by 2027.

NBFCs Are Leading the Surge

Non-Banking Financial Companies (NBFCs) are playing a major role in this ...

Did you know? Gold loans in India are projected to cross ₹10 lakh crore in FY25 and surge to ₹15 lakh crore by 2027!

🏆 NBFCs are leading the charge, growing at 17-19% YoY, thanks to:

✅ Faster approvals

✅ Flexible repayment options

✅ Higher LTV...

₹12 lakh income? No tax.

₹12,10,000 income? ₹61,500 tax?

What happens if your income exceeds ₹12 lakh by just ₹1?

Did you know that earning just ₹1 extra above ₹12 lakh could shoot up your tax liability disproportionately?

That’s wh...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

.jpeg)