📈 India’s PMS Industry Is Booming – Here’s Why You Should Pay Attention

India’s Portfolio Management Services (PMS) industry is witnessing unprecedented growth — and it’s only just getting started. With total assets under management (AUM) now crossing ₹7.08 lakh crore, PMS is rapidly emerging as a powerful wealth management avenue for High-Net-Worth Individuals (HNIs) and Ultra-HNIs.

Backed by a robust 33% CAGR, the PMS industry is becoming an increasingly attractive alternative for both seasoned investors and financial professionals looking to enter a high-potential market.

🔍 What’s Driving This Rapid Growth?

Several key factors are fueling the expansion of the PMS space:

-

Rising demand from HNIs and ultra-HNIs for customised and actively managed investment portfolios.

-

A shift away from traditional investment vehicles like fixed deposits and mutual funds.

-

India’s growing economy and pro-investment policy reforms.

-

Investors seeking greater control, transparency, and tailored strategies for wealth management.

PMS offers a more personalised approach compared to traditional funds, giving clients access to expert fund managers and strategies tailored to their financial goals.

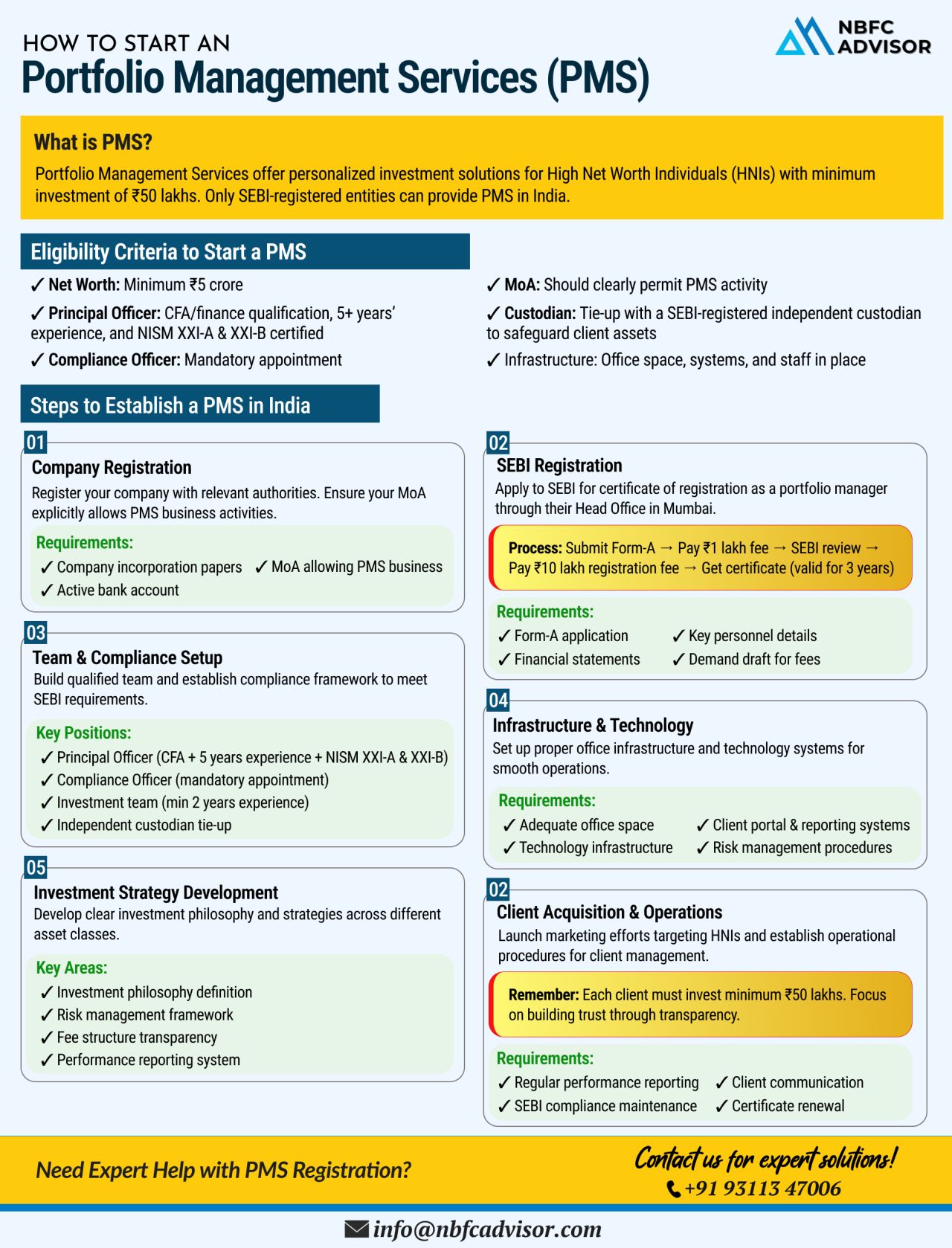

💼 Want to Start a PMS? Here's What You Need

Setting up a Portfolio Management Service in India requires meeting SEBI’s regulatory framework and ensuring operational readiness. Here’s a quick checklist:

✔️ Minimum Requirements to Start a PMS:

-

Net worth of ₹5 crore

-

A qualified Principal Officer with:

-

CFA/NISM Series XXI certification

-

At least 5 years of relevant experience

-

-

Appoint a Compliance Officer and build an experienced investment team

-

Partner with a SEBI-registered custodian

-

Define a clear fee structure and implement a robust risk management framework

-

Minimum investment from each client: ₹50 lakh

Establishing a PMS allows firms to build deep, long-term relationships with high-value clients and manage portfolios with a high level of customization and control.

🤝 Need Help Setting Up a PMS?

From navigating SEBI registration to setting up compliance systems and building your investment framework, we provide end-to-end assistance for launching a PMS.

📞 Book your FREE consultation today

+91 93113 47006

Take advantage of India’s booming PMS opportunity and position your firm at the forefront of high-end wealth management.