Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come higher risks—and many funds underestimate how fast things can go wrong.

A minor market correction, liquidity crunch, or misjudged exposure can trigger significant losses, reputational damage, and regulatory challenges. For fund managers and advisors, risk management is not optional—it is a survival requirement.

Biggest Challenges in AIFs Today

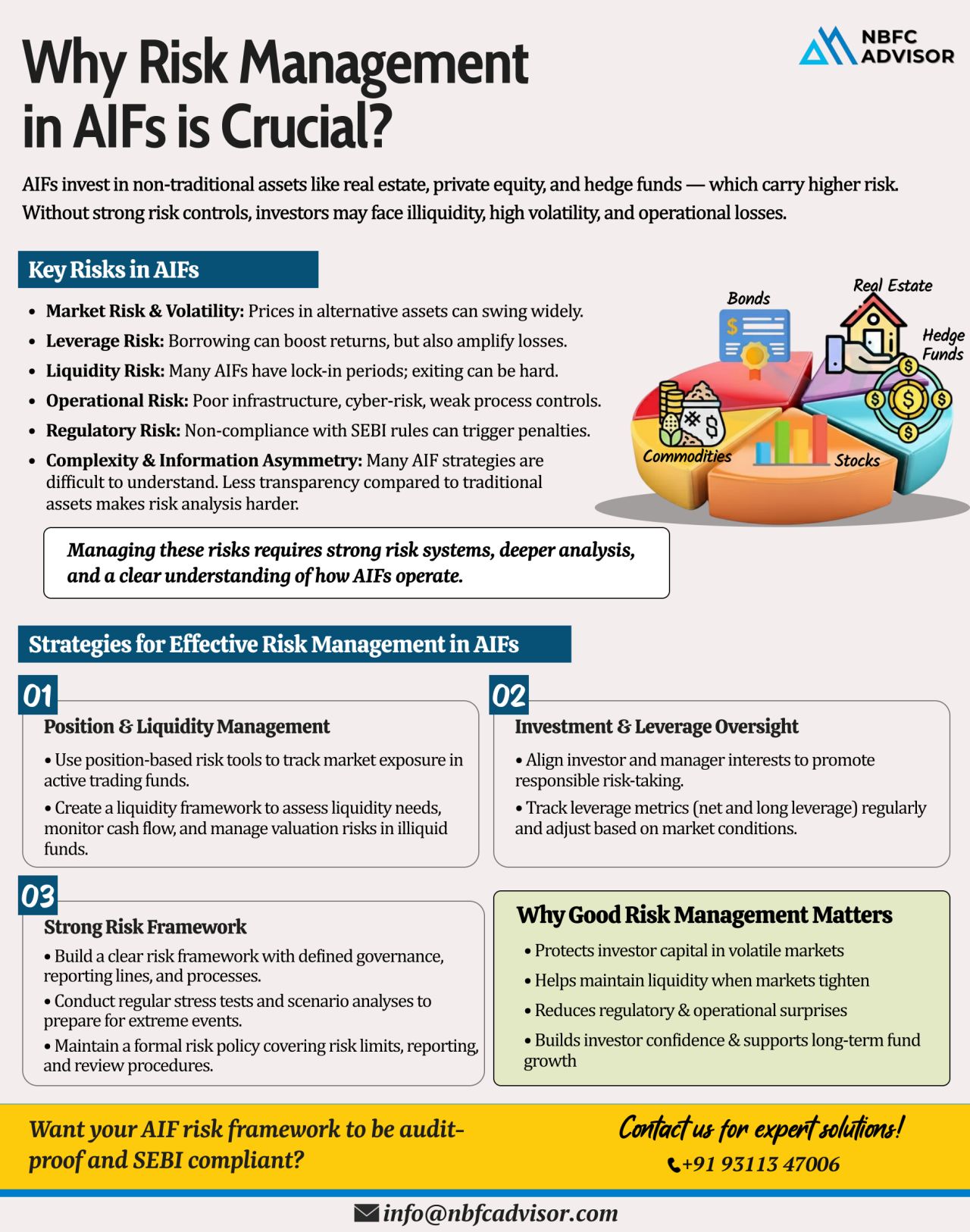

AIFs operate in a dynamic and often unpredictable environment. The major risks include:

✓ Sharp Market Swings

Volatility in equity, debt, or alternative assets can quickly erode returns and distort portfolio performance.

✓ High Leverage Exposure

Excessive borrowing magnifies both gains and losses. Without monitoring, leverage can threaten fund stability.

✓ Lock-Ins and Liquidity Gaps

Long lock-in periods and illiquid assets make it difficult to exit during downturns or honor investor withdrawals.

✓ Weak Internal Controls

Inadequate systems, poor governance, and manual processes increase operational and compliance risks.

✓ Low Transparency & Complex Structures

Opaque investment structures can hide critical risks from investors, auditors, and even fund managers.

Why Strong Risk Management Is Essential for AIFs

A robust risk framework is the foundation of a healthy, compliant, and trustworthy fund. It ensures:

✔ Capital Protection

Safeguards investor money against unpredictable market movements.

✔ SEBI Compliance

AIFs must follow strict reporting, valuation, and governance requirements. Strong controls prevent regulatory penalties.

✔ Long-Term Credibility

Funds with transparent processes and stable performance attract better investors and larger commitments.

✔ Operational Efficiency

Well-designed systems reduce manual errors and support faster decision-making.

Key Strategies to Manage AIF Risks Effectively

Here are simple, actionable practices every AIF must adopt:

1. Real-Time Risk Monitoring

Track market movements, sector exposure, NAV fluctuations, and portfolio risk daily.

2. Stress Testing & Scenario Analysis

Test how the portfolio reacts to extreme events—even those unlikely to occur.

3. Clear Valuation Policies

Use standardized, SEBI-approved valuation methods to avoid misreporting.

4. Strong Internal Controls

Automate processes, segregate roles, and implement audit trails to prevent lapses.

5. Leverage & Liquidity Limits

Set strict borrowing limits and ensure sufficient liquidity buffers.

6. Transparent Reporting

Provide investors and regulators with clear, timely, and accurate updates.

A well-structured risk system not only protects the fund but also enhances investor confidence.

Conclusion: Risk Ignored Is Wealth Destroyed

AIFs thrive on performance, but performance is built on strong governance, transparency, and risk preparedness. If you manage, operate, or advise an AIF, having a solid and audit-ready risk framework is essential—not just for SEBI compliance, but for safeguarding investor wealth.

Need help making your AIF risk systems SEBI compliant and audit-ready?

We assist AIF managers in building robust risk systems, documentation, controls, and governance frameworks.

📞 Call for a Free Consultation: +91 93113 47006

#NBFCAdvisor #AIF #RiskManagement #Compliance #FundManagement #AlternativeInvestments #PrivateEquity #VC #SEBI