📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to license cancellations, NBFCs that fall short of compliance may find themselves in serious trouble.

But the real risk?

Most NBFCs don’t even realize they’re making these mistakes—until it’s too late.

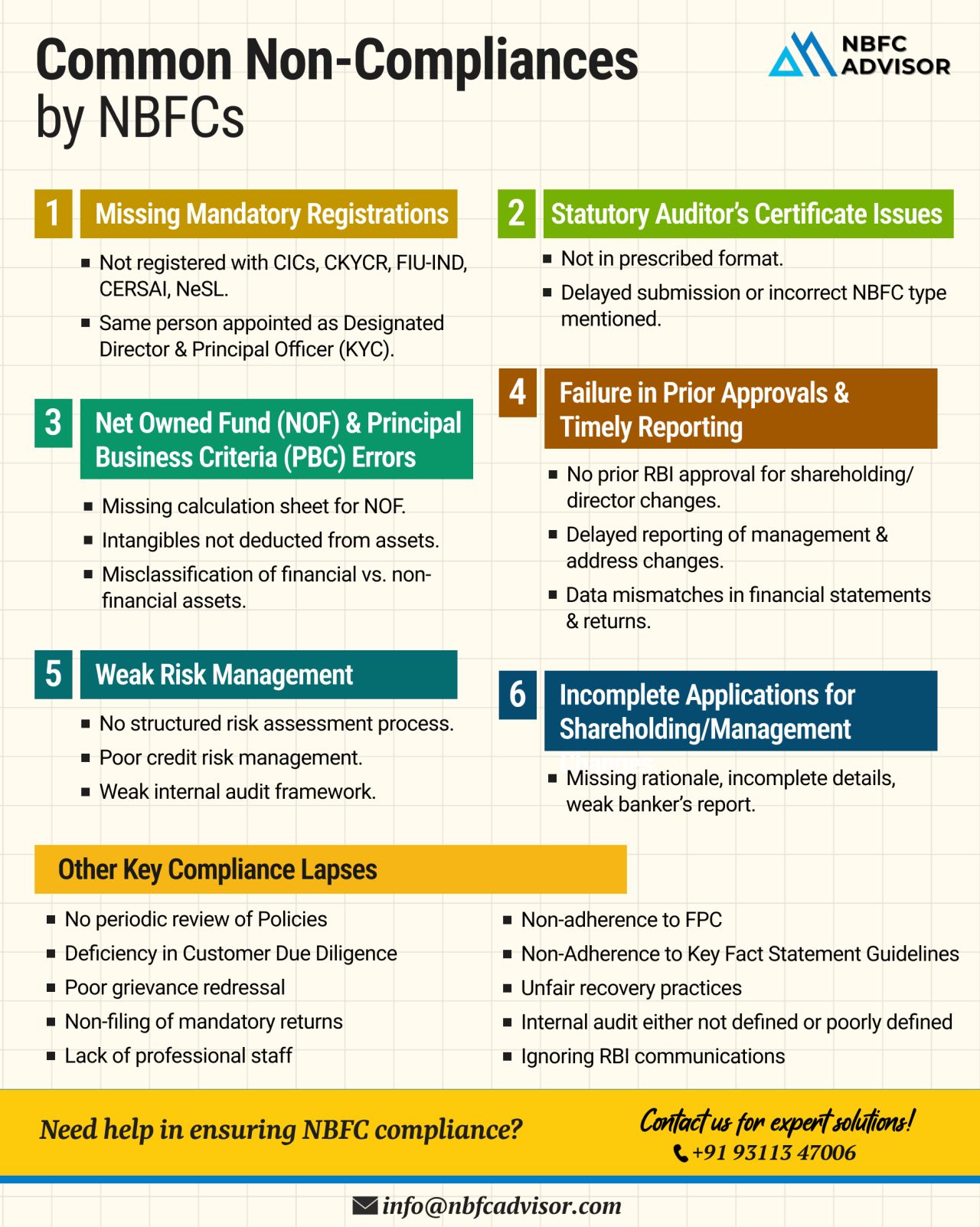

⚠️ Common Compliance Errors Putting NBFCs at Risk:

Even well-established NBFCs can unknowingly commit regulatory missteps. Here are some of the most common ones:

🔹 Missing mandatory registrations

(Central KYC Registry, Financial Intelligence Unit - India (FIU-IND), Credit Information Companies, etc.)

🔹 Weak or outdated risk management frameworks

Failing to monitor credit, operational, or market risks effectively.

🔹 Delayed regulatory reporting or approval processes

Missing timelines on CRILC, NBS returns, and other filings can trigger RBI scrutiny.

🔹 Inadequate internal audits

Poor audit trails and internal controls that fail to detect or prevent irregularities.

Each of these oversights can result in:

✔ RBI penalties

✔ Regulatory inspections

✔ Reputation loss with customers and investors

✔ Potential revocation of license

✅ How We Help NBFCs Stay RBI-Ready

At Aishwaraya Lakshya Advisory, we specialize in proactive NBFC compliance management. Our team works with NBFCs across India to:

✔ Conduct deep-dive compliance audits

✔ Identify existing gaps and rectify them

✔ Strengthen internal controls and documentation

✔ Ensure full alignment with evolving RBI guidelines

✔ Keep you audit-ready all year round

🚫 Don’t Let Small Oversights Turn into Big Setbacks

Your NBFC’s reputation and license are too valuable to risk on compliance blind spots. Stay ahead of RBI audits and inspections—before they happen.

📞 Contact us for a free consultation

+91 93113 47006

#NBFCAdvisor #NBFC #Compliance #RBI #NBFCCompliance #RiskManagement #Fintech