Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compliance requirements.

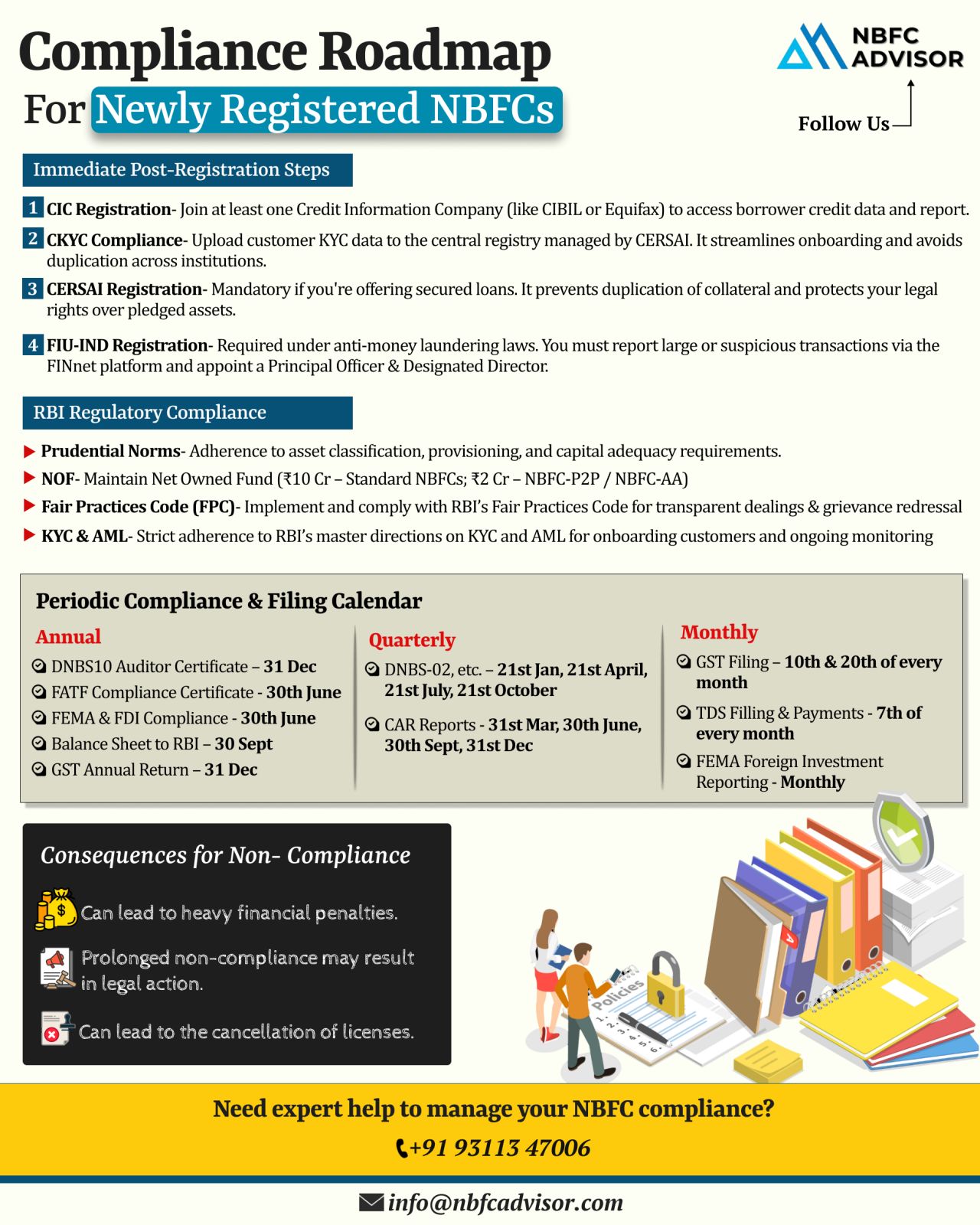

Immediate Compliance Steps for New NBFCs

Soon after registration, every NBFC must complete a set of essential compliances, including:

- CIC Registration – To access borrower credit history from Credit Information Companies.

- CKYC Uploads – Submission of customer information to the Central KYC Registry.

- CERSAI Registration – Mandatory for recording secured assets and preventing fraud.

- FIU-IND Reporting – Filing reports under Anti-Money Laundering (AML) regulations.

Ongoing Compliance Duties

Compliance is not a one-off activity but an ongoing responsibility. NBFCs are required to:

- Comply with prudential norms and the Fair Practices Code.

- Maintain the minimum Net Owned Funds (NOF) at all times.

- Implement robust KYC and AML frameworks.

- File periodic returns and certificates—monthly, quarterly, and annually—with the regulator.

Why Compliance Cannot Be Ignored

Ignoring compliance obligations can expose an NBFC to:

- Costly penalties

- Regulatory actions or investigations

- Even cancellation of the RBI license in severe cases

How We Support NBFCs

We assist NBFCs in navigating their compliance requirements efficiently—from registrations to routine filings—so that you can focus on scaling your operations and driving growth.

Get in touch for a free consultation: +91 93113 47006

#NBFCAdvisor #Compliance #RBI #FinancialServices #RiskManagement #DigitalLending #NBFCRegistration #AMLCompliance #Fintech #NBFC