SEBI’s New Co-Investment Vehicle (CIV) Framework: A Game Changer for India’s Private Capital Market

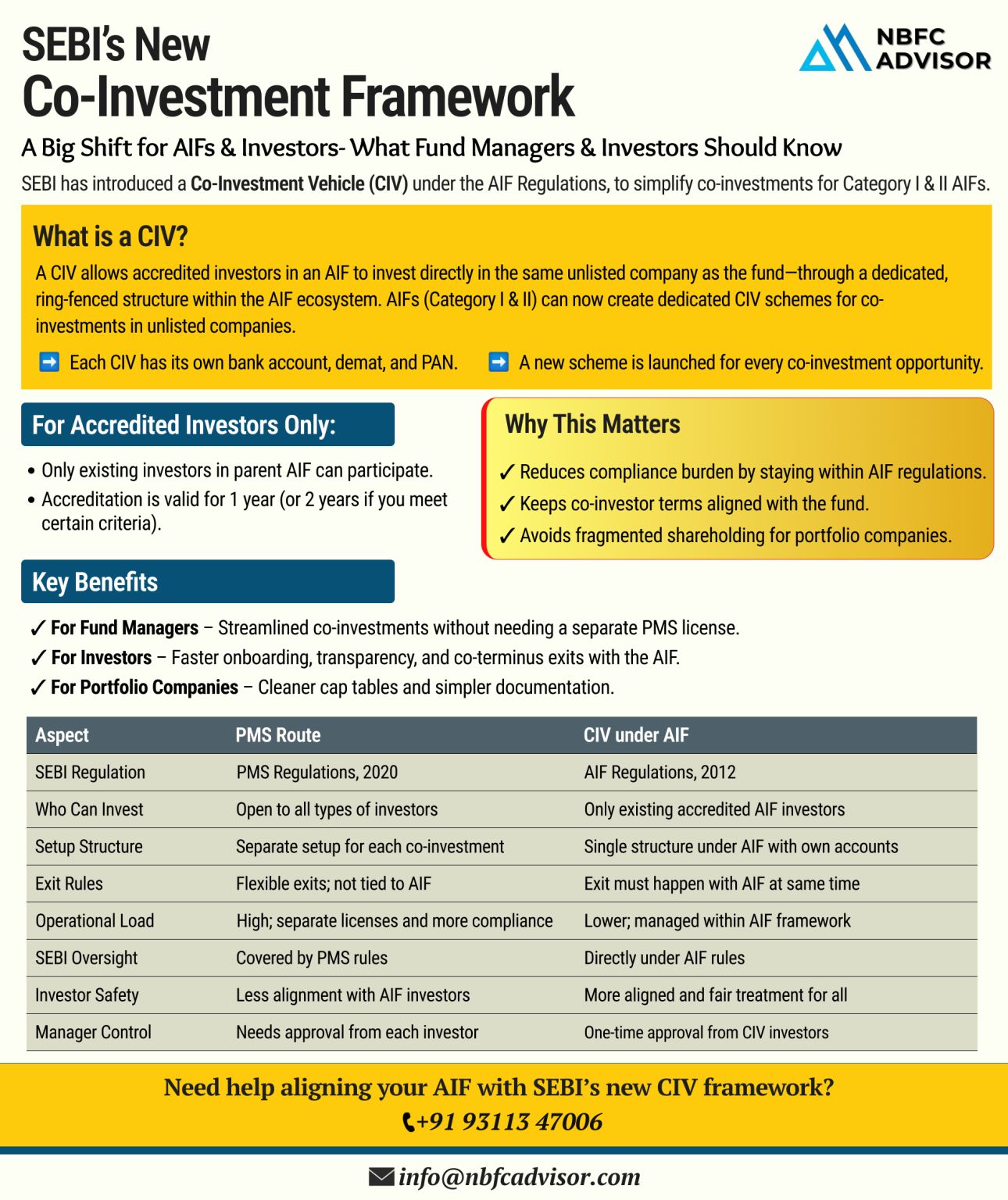

In a major regulatory development, the Securities and Exchange Board of India (SEBI) has introduced the Co-Investment Vehicle (CIV) structure under the Alternative Investment Funds (AIF) Regulations.

This move aims to streamline co-investment opportunities for Category I and II AIFs, making the process more efficient, transparent, and compliant.

What Is a CIV and Why It Matters

A Co-Investment Vehicle is a dedicated scheme within an AIF that allows accredited investors to invest directly in the same unlisted companies as the fund—on the same terms and conditions, including exit timelines.

Key features of the CIV framework include:

-

No need for a separate PMS license

-

Aligned investment terms between the fund and co-investors

-

Simplified compliance and cleaner cap tables for investee companies

Who Benefits from This Framework?

🧩 Fund Managers:

Execute co-investments effortlessly within the AIF structure without additional regulatory burdens.

💼 Accredited Investors:

Access select investment opportunities with faster onboarding and greater legal clarity.

🚀 Portfolio Companies:

Experience simplified shareholding structures and improved governance with fewer fragmented investors.

Why This Is a Significant Move for India’s Investment Ecosystem

SEBI’s introduction of CIVs marks a big step forward in strengthening India’s alternative investment landscape. By making co-investments more accessible and transparent, the framework encourages greater participation from domestic investors in growth-stage ventures.

This regulatory shift will:

-

Enhance capital efficiency

-

Improve fund governance and transparency

-

Boost investor confidence in the AIF ecosystem

Is Your AIF Ready for the New CIV Norms?

With this framework now live, AIF managers and investors must evaluate their structures to remain competitive and compliant. The CIV model presents a timely opportunity to unlock new capital flows with fewer regulatory roadblocks.