Selling Stock Tips on Telegram, WhatsApp, or Instagram? SEBI Has Strict Rules You Must Follow

In recent years, social media has become a major hub for stock market discussions. From Telegram channels to WhatsApp groups and Instagram pages, thousands of people now offer paid stock tips, intraday calls, swing trades, and “sure-shot” profit strategies.

But here’s the truth most people don’t know:

📢 Selling paid stock market advice in India is regulated — and strictly monitored by SEBI.

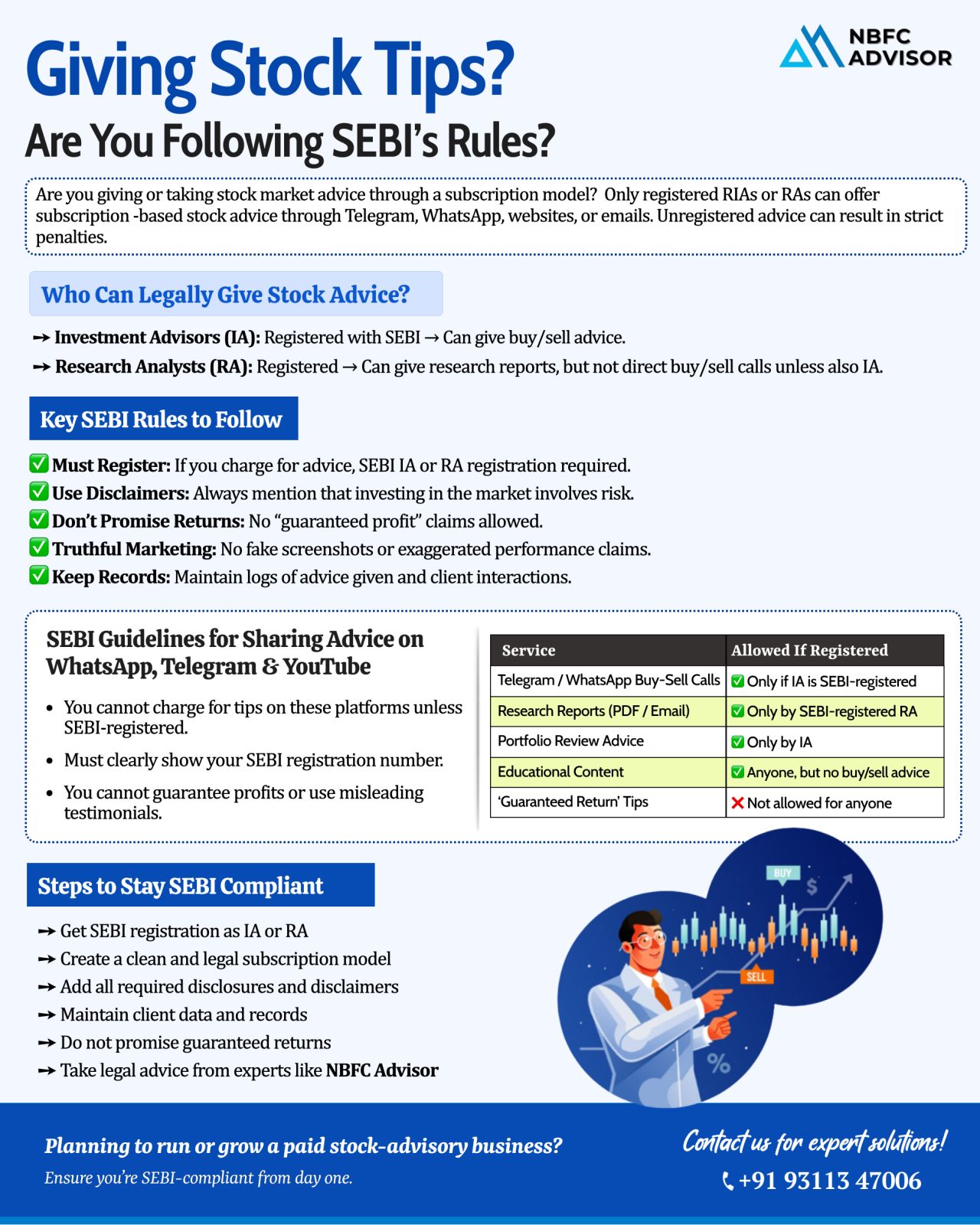

If you charge for investment tips, trading calls, subscriptions, or research reports, you must be registered with the Securities and Exchange Board of India (SEBI) as either an:

-

Investment Adviser (IA)

-

Research Analyst (RA)

Without proper registration, your activity becomes illegal.

🔍 What SEBI Says About Paid Stock Tips

SEBI has clearly defined rules to protect investors from fraud, manipulation, and misleading financial advice. If you're offering stock tips online, these rules apply to you:

✓ Paid stock tips without SEBI registration are prohibited

Anyone charging money for advice, signals, calls, or predictions must be registered. No exceptions.

✓ No promises of guaranteed returns

Claims like “100% profit,” “sure-shot calls,” “jackpot trade,” or “daily income” are strictly banned.

✓ No posting screenshots of profits or misleading performance

Screenshots of MTM, P&L, or past trades can mislead investors. SEBI prohibits such promotional tactics.

✓ No fake testimonials or paid reviews

Any testimonial that creates unrealistic expectations violates SEBI’s advertising code.

✓ Full disclosures are mandatory

If you are an IA or RA, you must disclose:

-

Registration number

-

Validity

-

Conflict of interest

-

Risk disclaimer

-

Fee structure

✓ Heavy penalties for violations

Violating SEBI guidelines can lead to:

-

Monetary penalties

-

Permanent or temporary bans

-

Refunds to clients

-

Prosecution in serious cases

Why These Rules Matter

With the rise of social media finance influencers, thousands of retail investors have been misled by false promises, manipulated stock tips, and fraudulent advisory schemes. SEBI’s strict framework ensures:

-

Investor protection

-

Transparent advisory practices

-

Accountability of market professionals

-

Reduction in financial frauds

If you genuinely want to offer advisory or research services, proper compliance is not just a legal requirement — it's a credibility booster.

Thinking of Starting Paid Stock Advisory or Research Services?

Make sure you’re compliant before you begin.

Whether you want to operate as an IA or a Research Analyst, you must meet SEBI’s regulatory requirements, disclosure norms, and documentation standards.

📞 Need Help Getting SEBI Registration?

We assist individuals, startups, and firms in obtaining SEBI IA/RA registration, building compliance frameworks, and ensuring regulatory adherence.

Contact us for a FREE consultation:

📞 +91 93113 47006