Thinking of Starting an NBFC? Here’s Why a Takeover Might Be Smarter Than a Fresh Registration

If you’re planning to enter the lending and finance industry, setting up a Non-Banking Financial Company (NBFC) can be a powerful way to grow your business. But before jumping in, it’s crucial to understand the difference between starting a new NBFC and taking over an existing one.

Let’s break it down 👇

New NBFC Registration – A Long Road Ahead

Starting a new NBFC from scratch may seem exciting, but it comes with several challenges:

- Long RBI approval timelines – Getting approval from the Reserve Bank of India can take many months.

- High capital requirement – Most NBFC categories need a ₹10 crore net owned fund, which is a big entry barrier.

- Complex compliance process – Regulatory documentation and scrutiny can be intense.

- No business operations until approval – You can’t start lending or operations until you receive the RBI license.

So, while it’s a legitimate route, it’s often slow and capital-intensive.

NBFC Takeover – A Faster Route to Market

Instead of waiting months for approvals, many smart entrepreneurs are choosing the NBFC takeover route. Here’s why:

- Faster entry – The process takes about 3–6 months, much quicker than a fresh application.

- License already in place – You get an existing, RBI-approved NBFC.

- Immediate operations – Start business activities right after transfer approval.

- Leverage existing compliance & credibility – Build on the company’s operational history and goodwill.

That’s why founders, fintech startups, and investors increasingly prefer NBFC takeovers — it’s simply faster, smoother, and more strategic.

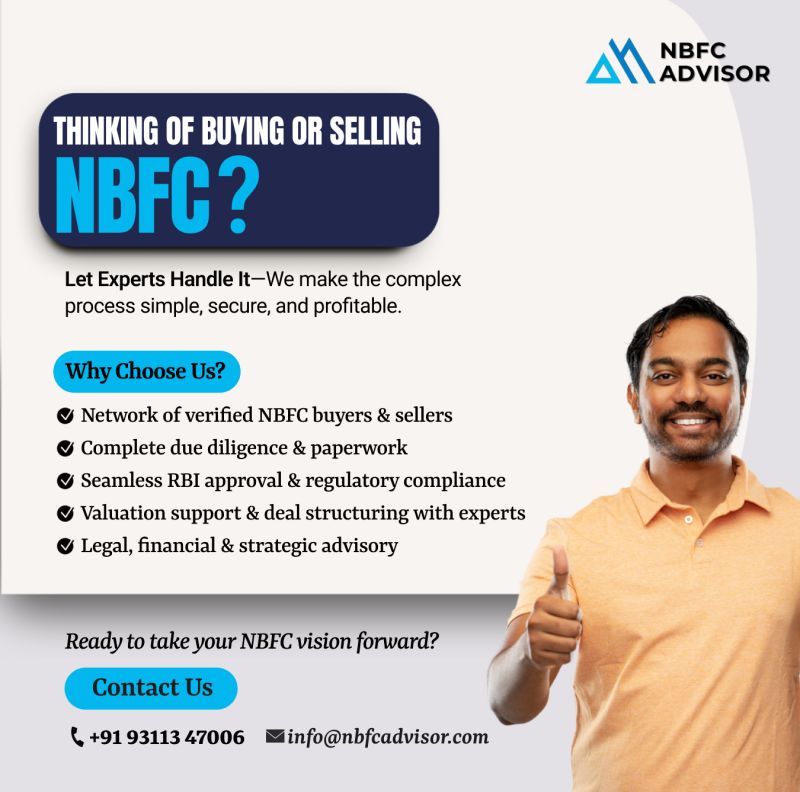

Why Work with NBFC Advisor

If you’re serious about entering the lending business, don’t spend months waiting for RBI approval — get started faster with NBFC Advisor.

We help you with:

- Connecting with verified NBFCs for sale

- RBI approval & due diligence support

- Valuation, compliance, and deal structuring assistance

With our expertise, you can step confidently into the financial sector — with compliance and credibility on your side.

Ready to explore NBFC takeover opportunities?

Let’s talk today.

Call: +91 93113 47006

#NBFCAdvisor #Finance #Compliance #RBI #Fintech #Entrepreneurship #Investors #Lending #NBFCTakeover #NBFC