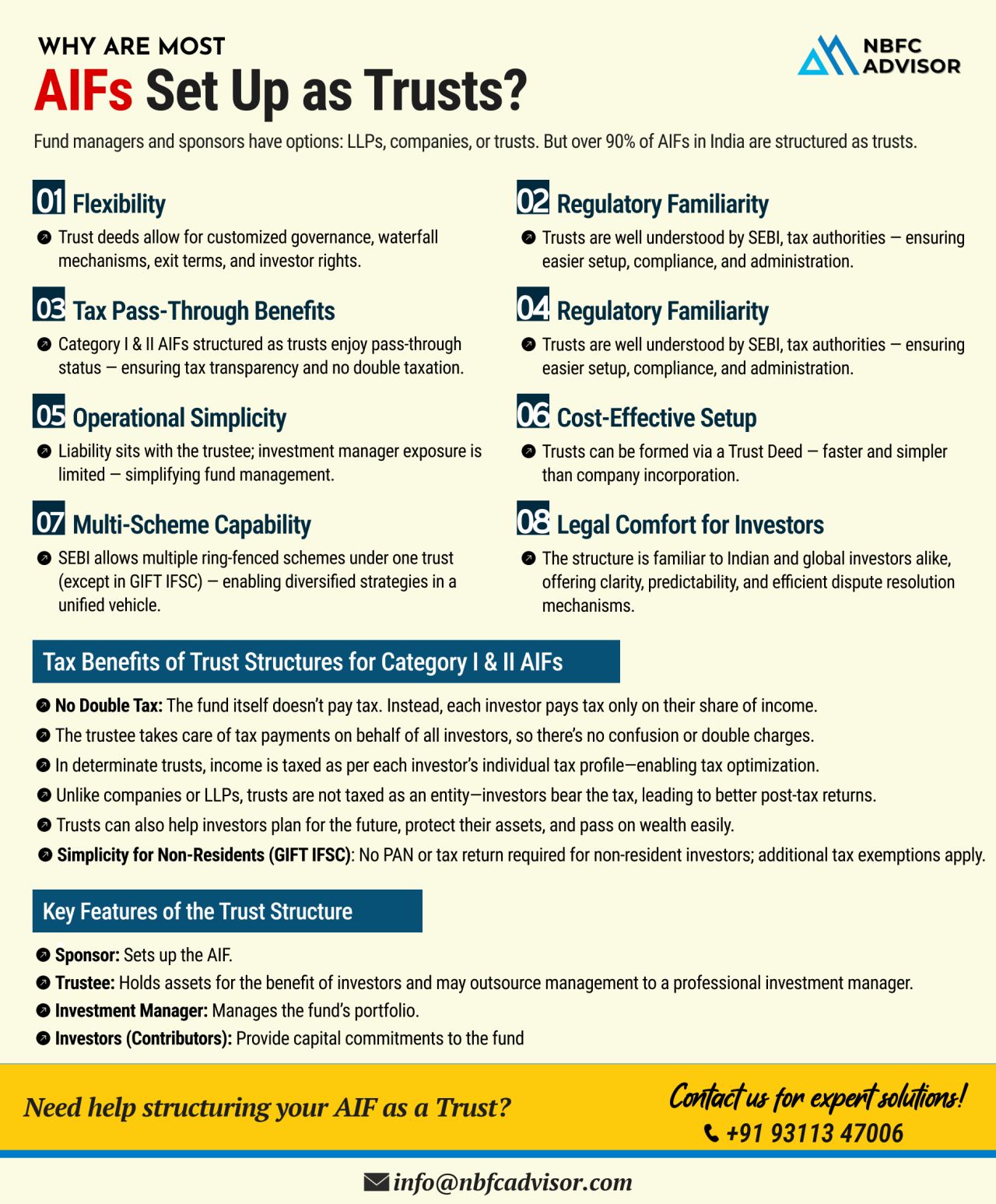

When setting up an Alternative Investment Fund (AIF), one of the most critical decisions is choosing the right legal structure. Should you go for an LLP, a Company, or a Trust?

Let’s break down why most AIFs prefer the Trust route.

Why Fund Managers Prefer Trusts:

-

Flexible Rules:

Trusts allow fund managers to customize the fund’s operations. They can set specific rules in the trust deed, offering greater control over how the fund is managed compared to the rigid frameworks of LLPs or Companies. -

Limited Risk Exposure:

In a Trust structure, the liabilities of the fund are typically ring-fenced and don’t extend to the personal assets of the fund manager or trustees. This makes risk management more straightforward. -

Simpler Taxation:

Tax treatment under Trusts is generally more streamlined. Unlike companies, which may face double taxation (company and shareholder level), Trusts often offer pass-through taxation, making them tax-efficient. -

Faster Setup:

Establishing a Trust is usually quicker and involves fewer formalities than setting up an LLP or a company, making it an attractive choice for fund managers who want to launch quickly.

Why Investors Prefer Trusts:

-

Familiar and Widely Accepted:

The Trust model is well-known and commonly used in the investment ecosystem. It gives investors a sense of comfort and familiarity. -

Custom Dispute Mechanisms:

Trust deeds can include tailor-made dispute resolution clauses, offering clear pathways to settle any disagreements between the fund, managers, and investors. -

No Double Taxation:

In Trust structures, investors are taxed only on the income they receive. The Trust itself may not be taxed at the fund level, avoiding the double taxation scenario often seen in company structures. -

Less Compliance Burden:

Trusts generally involve less regulatory paperwork and lighter ongoing compliance compared to LLPs or companies. This efficiency reduces administrative costs and makes fund management smoother.

Quick Comparison: Trusts vs. LLPs/Companies

| Feature | Trust | LLP/Company |

|---|---|---|

| Setup Time | Faster | Slower |

| Taxation | Pass-through | Potential double taxation |

| Governance | Flexible | Strict board/compliance norms |

| Risk Exposure | Limited to the fund | Limited but with stricter regulatory oversight |

| Compliance Load | Lower | Higher under Companies Act/LLP Act |

Final Thoughts:

If you’re considering launching an AIF, Trusts offer a powerful combination of flexibility, simplicity, and speed. They are both fund-manager and investor-friendly, which is why they remain the most popular choice.

👉 Need expert guidance to structure your AIF as a Trust?

📞 Contact us for a free consultation:

+91 93113 47006

We’re here to help you set up the right foundation for your investment journey.