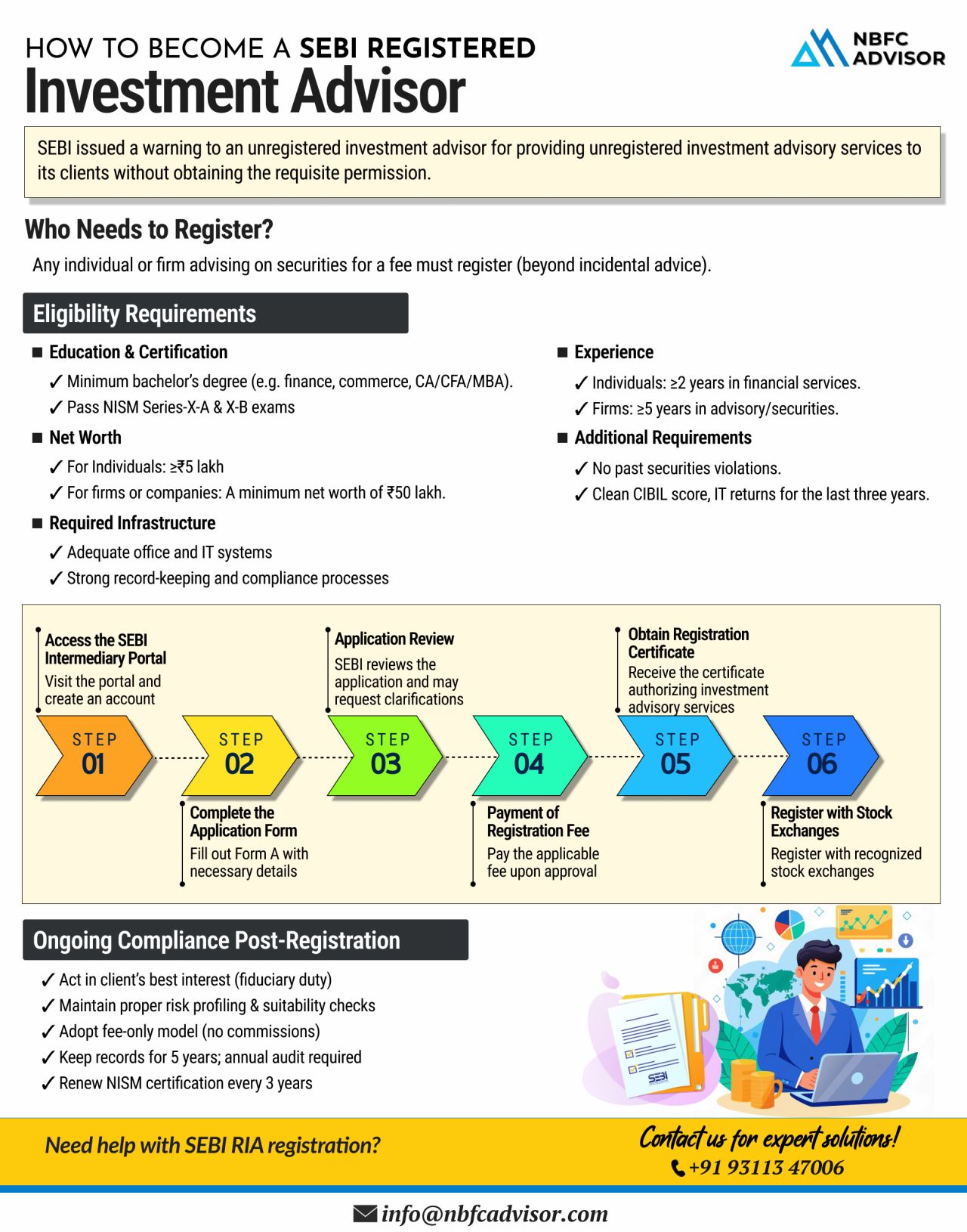

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

The gold loan industry in India is experiencing rapid growth. It is expected to cross ₹10 lakh crore in FY25 and reach ₹15 lakh crore by 2027.

NBFCs Are Leading the Surge

Non-Banking Financial Companies (NBFCs) are playing a major role in this ...

The buzz around Non-Banking Financial Companies (NBFCs) is louder than ever, fueled by Digital Transformation and Regulatory Adaptation.

As India moves towards a $7 trillion economy by 2030, NBFCs are playing a pivotal role—powering MSMEs, a...

The Reserve Bank of India (RBI), led by Governor Sanjay Malhotra, recently held a crucial meeting with leading Non-Banking Financial Companies (NBFCs)—his first such interaction since taking office. The meeting brought together MDs and CEOs fro...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

.png)

.jpeg)