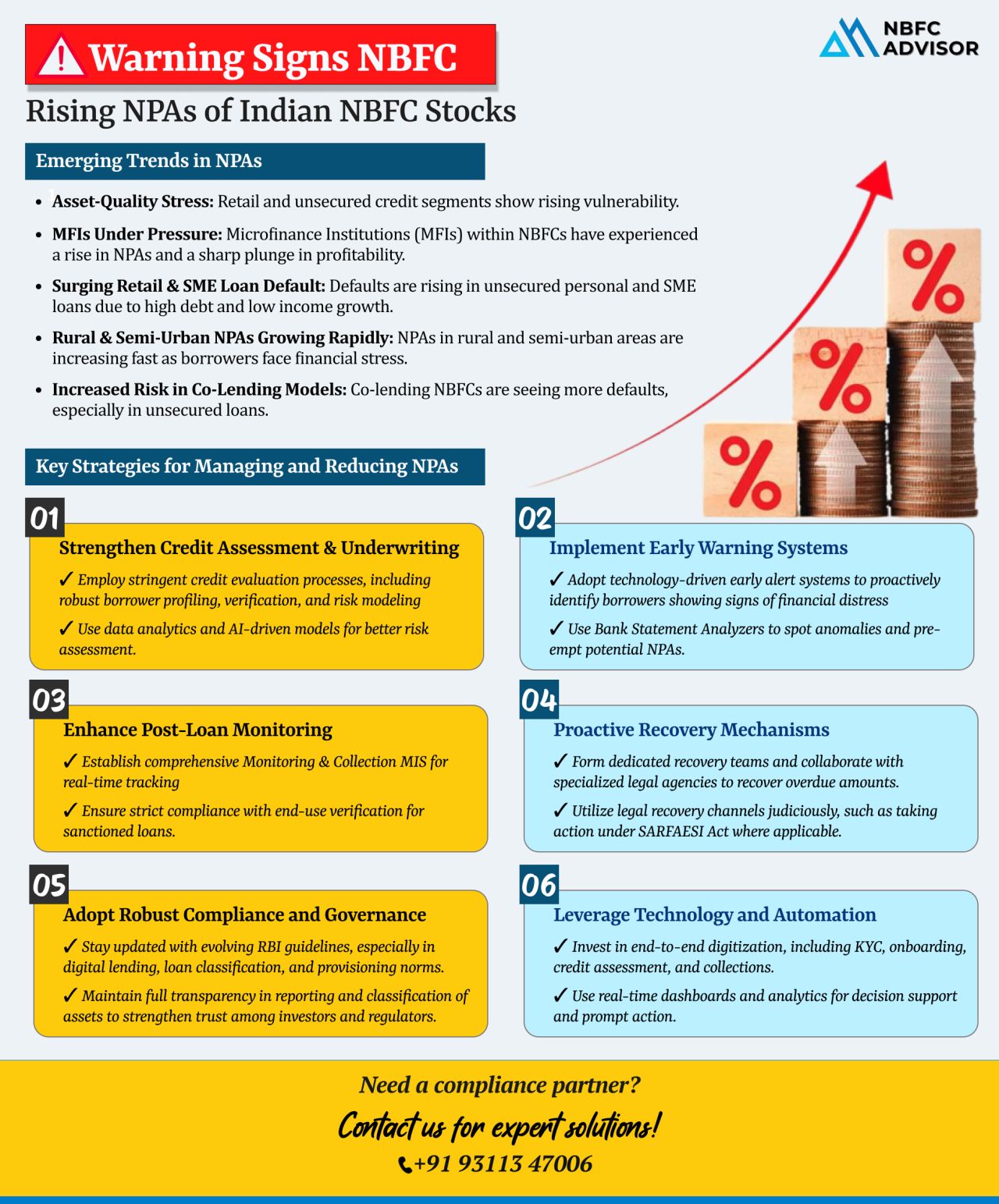

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

In today’s financial landscape, trust is everything—and Non-Banking Financial Companies (NBFCs) that prioritize ethical lending practices stand out from the rest. Beyond regulatory compliance, ethical conduct helps NBFCs build long-term c...

The SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act) is a powerful legal tool that enables NBFCs to recover bad loans without lengthy court proceedings.

Who Can Use It?

NBFCs with an ...

Non-Banking Financial Companies (NBFCs) are grappling with mounting defaults, prolonged legal processes, and tightening cash flows. In today’s landscape, debt recovery isn’t just about compliance—it’s about business continuity...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Microfinance has long been a cornerstone of financial inclusion in India, supporting small businesses and underserved communities. However, the latest Micrometer Q3 FY 2024-25 report unveils alarming trends, raising concerns about the sector's st...

The NBFC sector is a pillar of India’s financial ecosystem, but it faces regulatory, liquidity, and operational hurdles that impact growth and stability.

🔍 Top Challenges NBFCs Face:

⚠️ Regulatory Hurdles – Stricter RBI norms lead ...

In a landmark move, the Karnataka government has strengthened its stance against the coercive recovery tactics used by Microfinance Institutions (MFIs). The latest draft of the Karnataka Microfinance (Prevention of Coercive Actions) Ordinance, 2025 i...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

.png)

.png)