Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

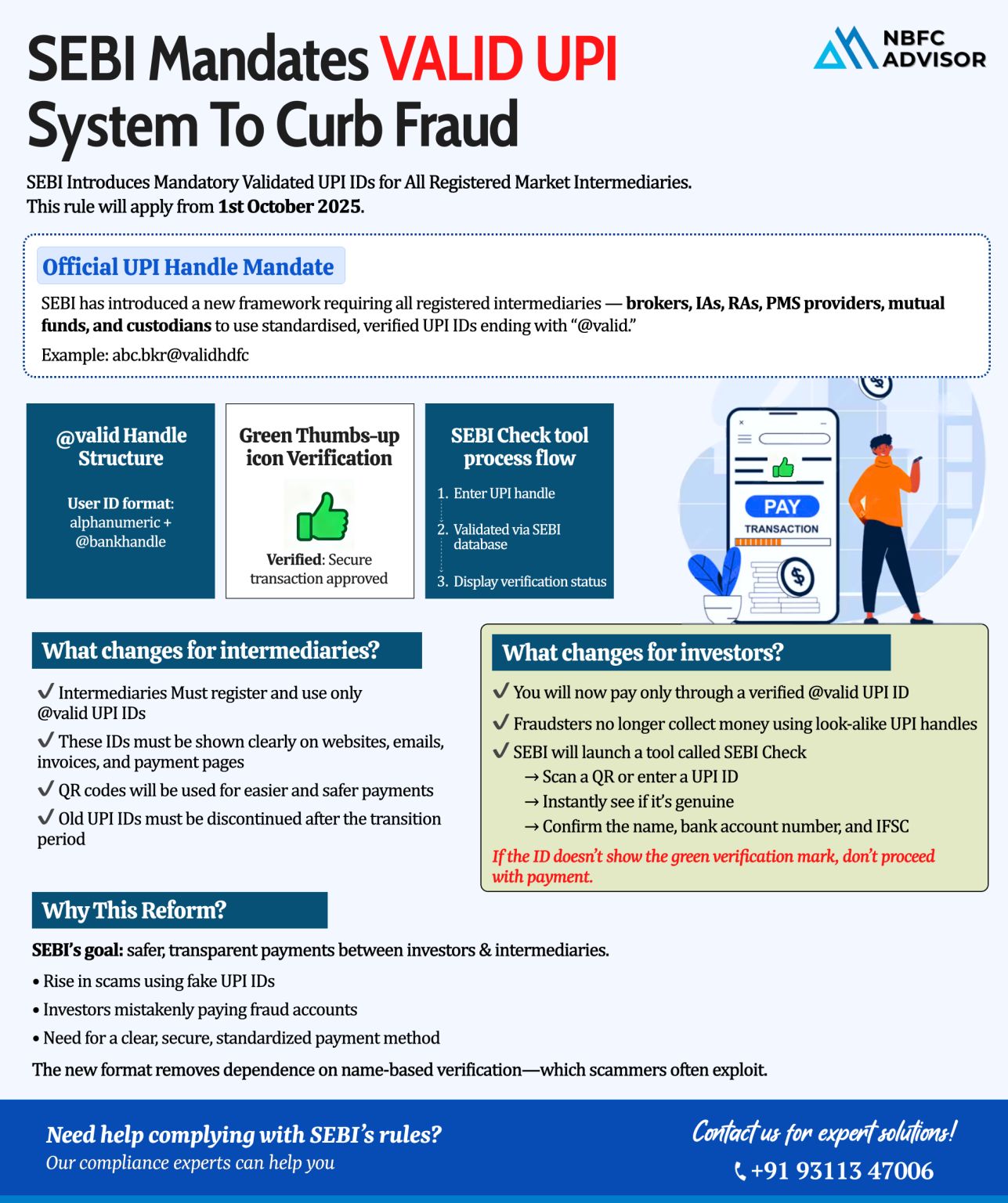

SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fa...

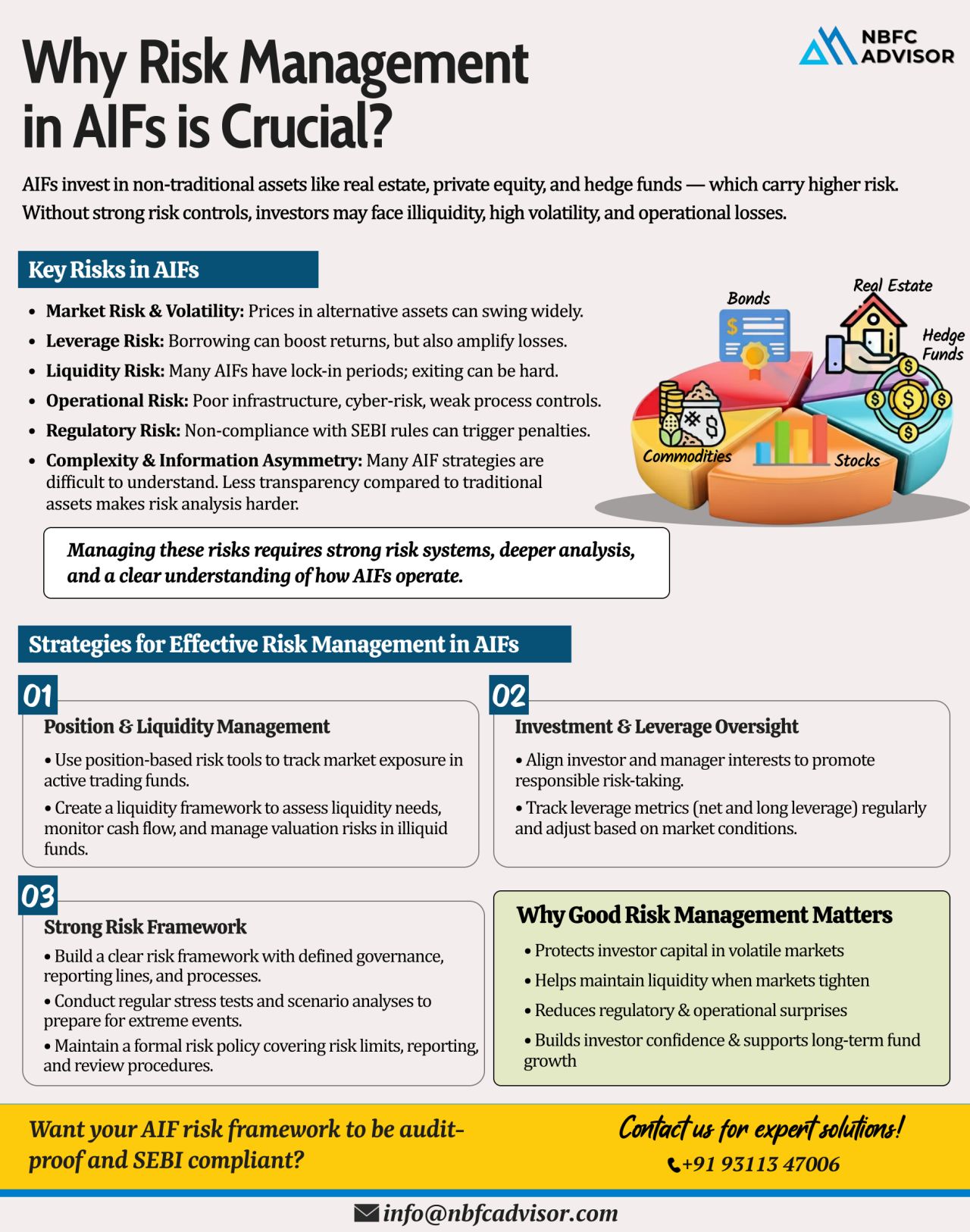

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

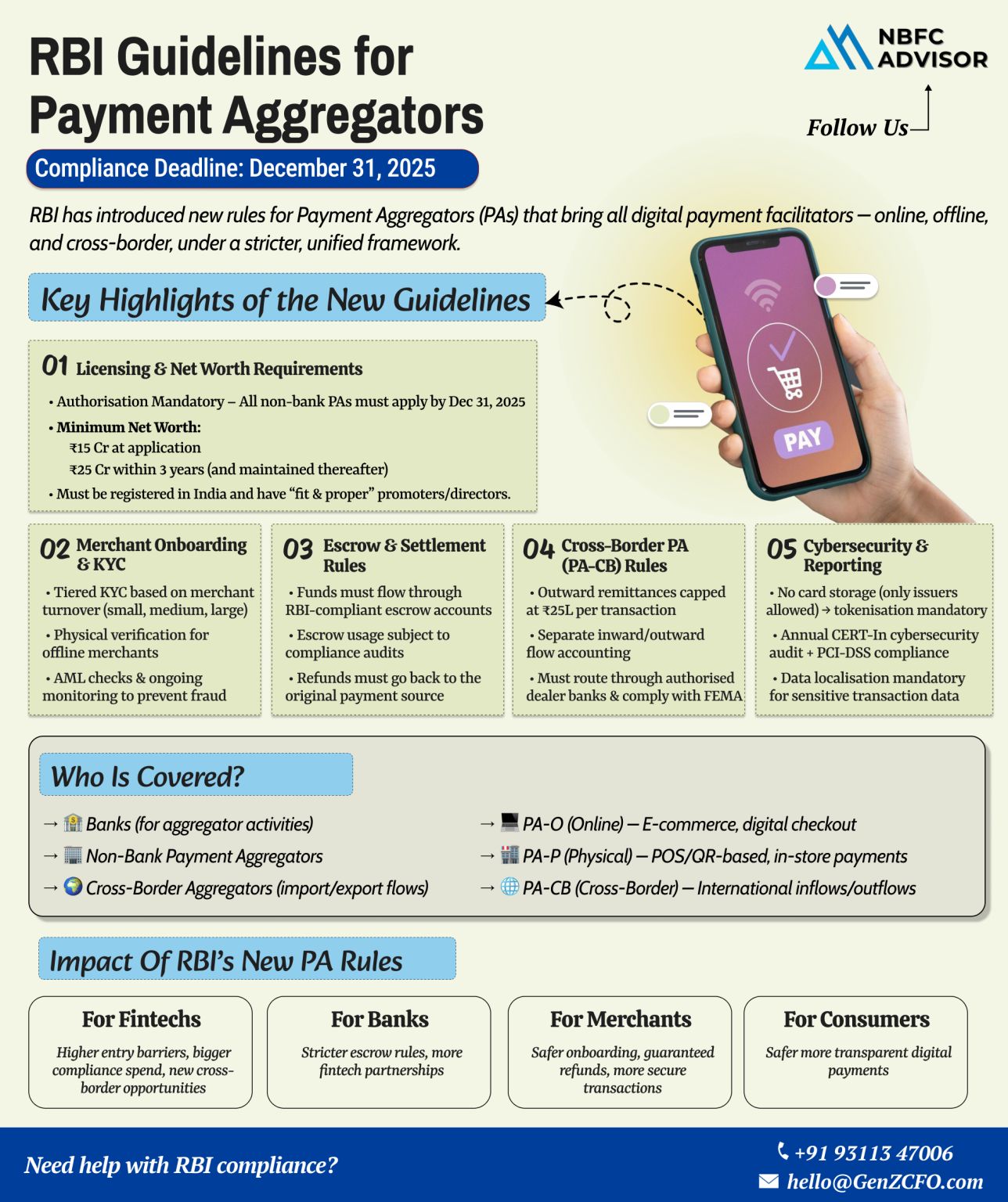

RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovatio...

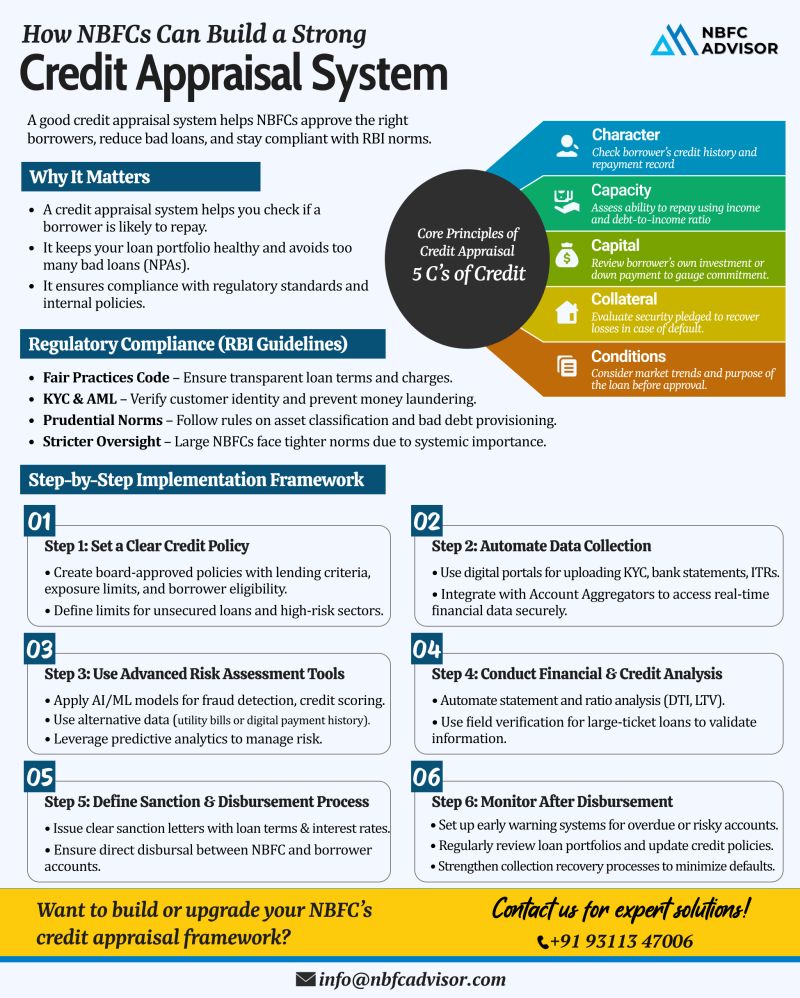

Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain por...

Comprehensive Financial & Tax Services for Non-Residents (NRIs & Foreign Nationals)

Meta Title: Expert Services for Non-Residents (NRIs & Foreign Nationals) | Tax, FEMA, and RBI Consultancy

Meta Description: Simplify your India-relate...

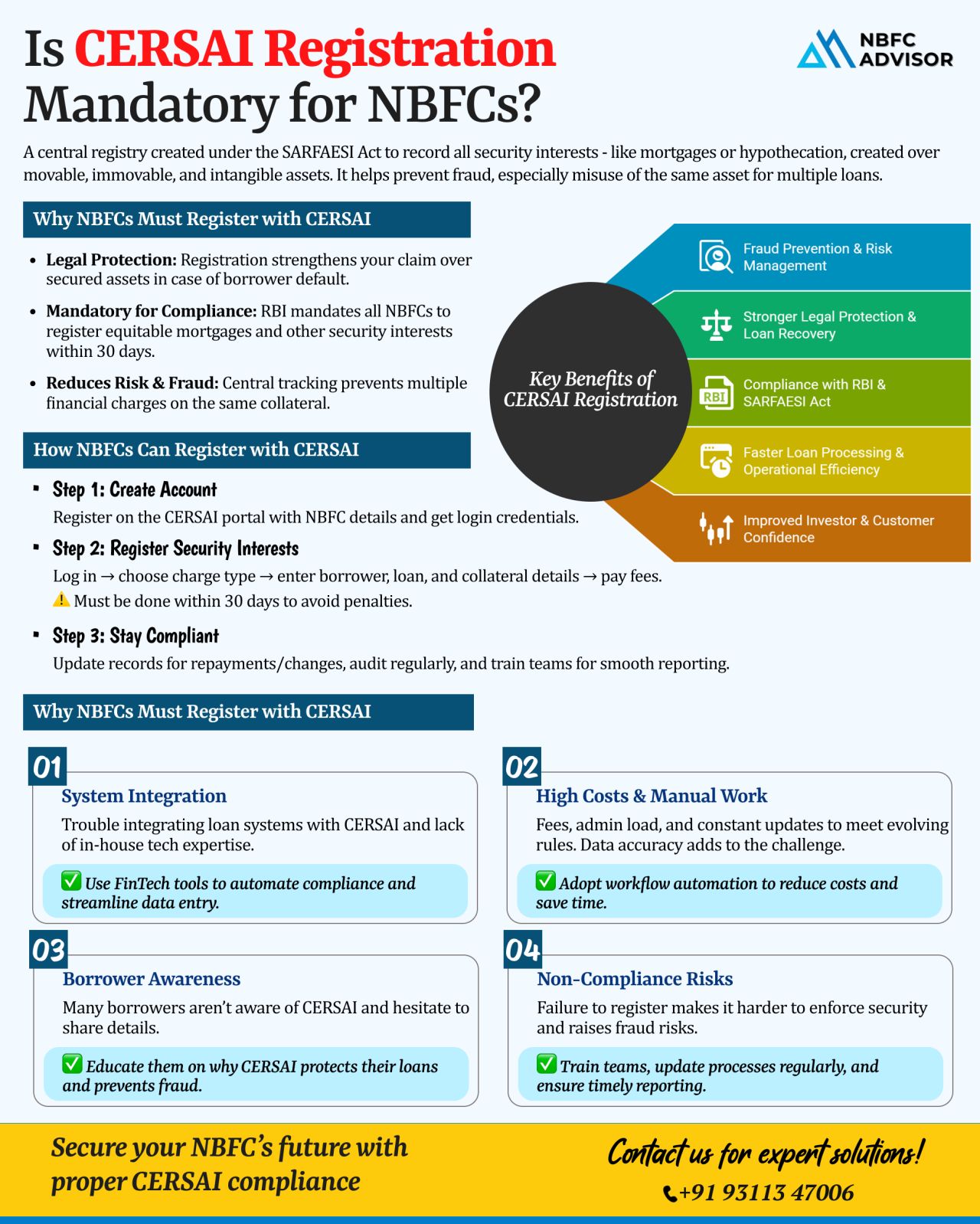

Is CERSAI Registration Mandatory for NBFCs?

One of the most overlooked compliance areas for NBFCs is CERSAI registration. While RBI norms, customer due diligence, and credit processes get proper attention, many lenders fail to recognize that CERSA...

Cheques Will Clear in Just Hours – Rolling Out October 2025

Big changes are coming for India’s banking sector! The Reserve Bank of India (RBI) is all set to transform cheque clearance, cutting down waiting times from days to only a few...

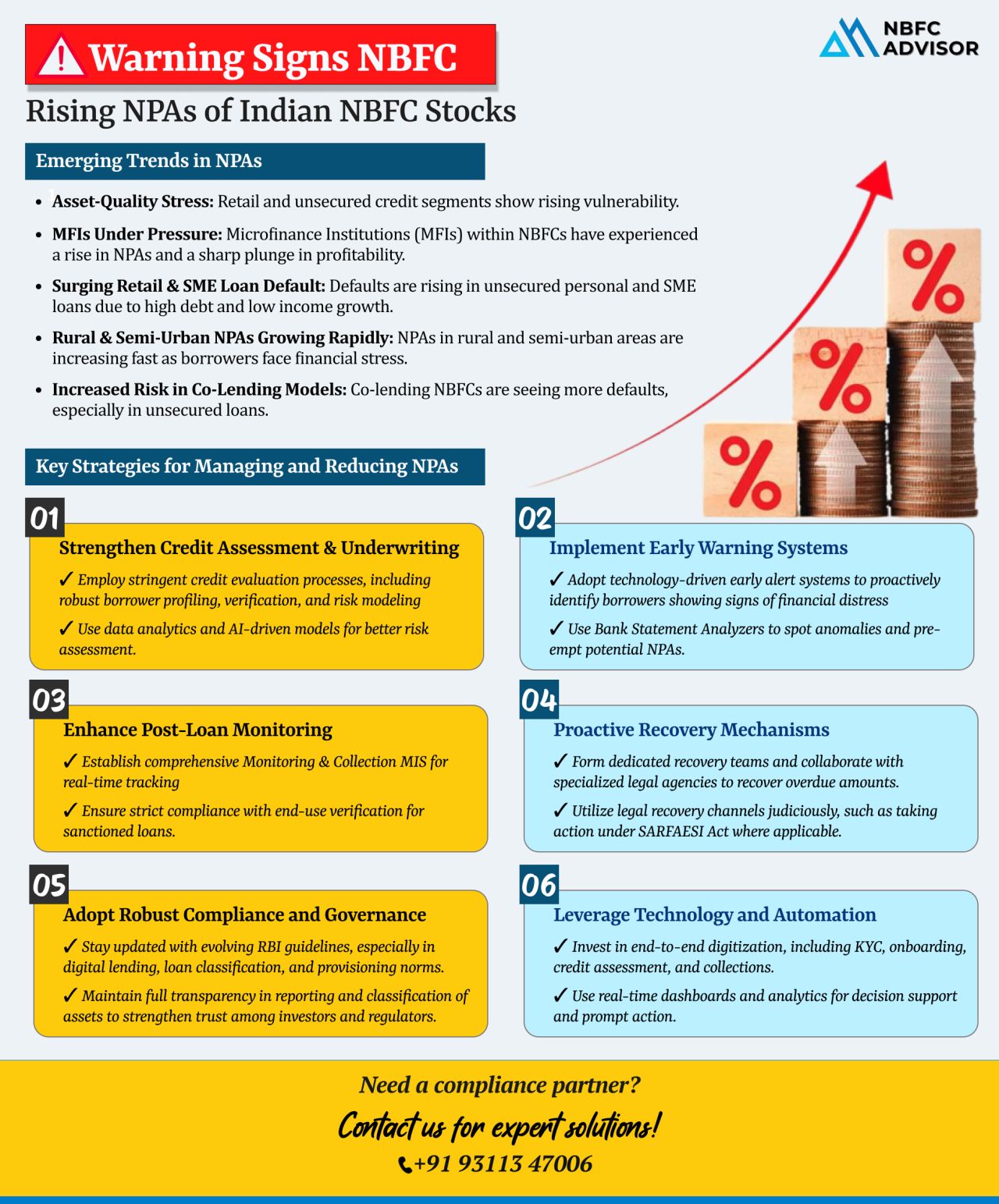

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

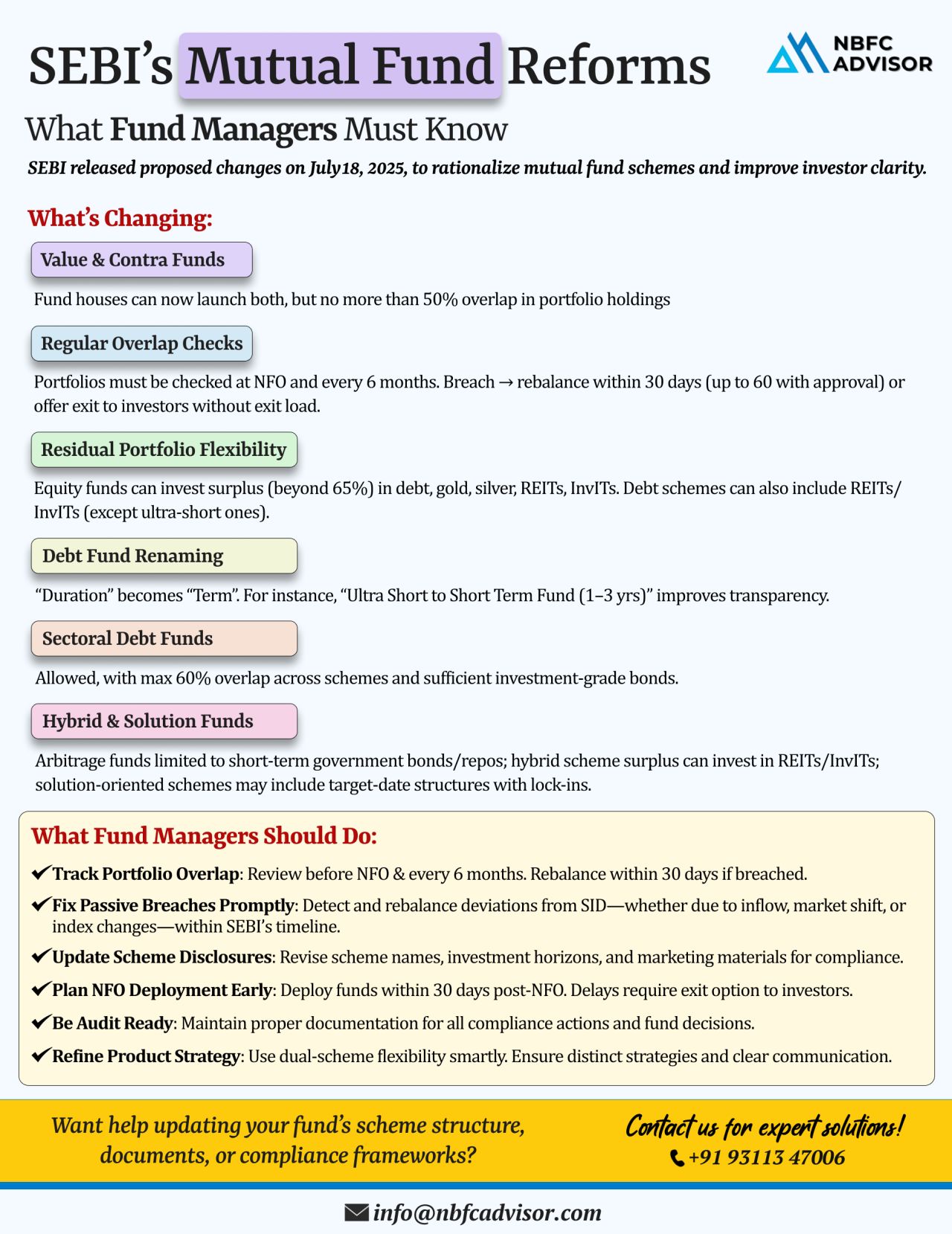

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

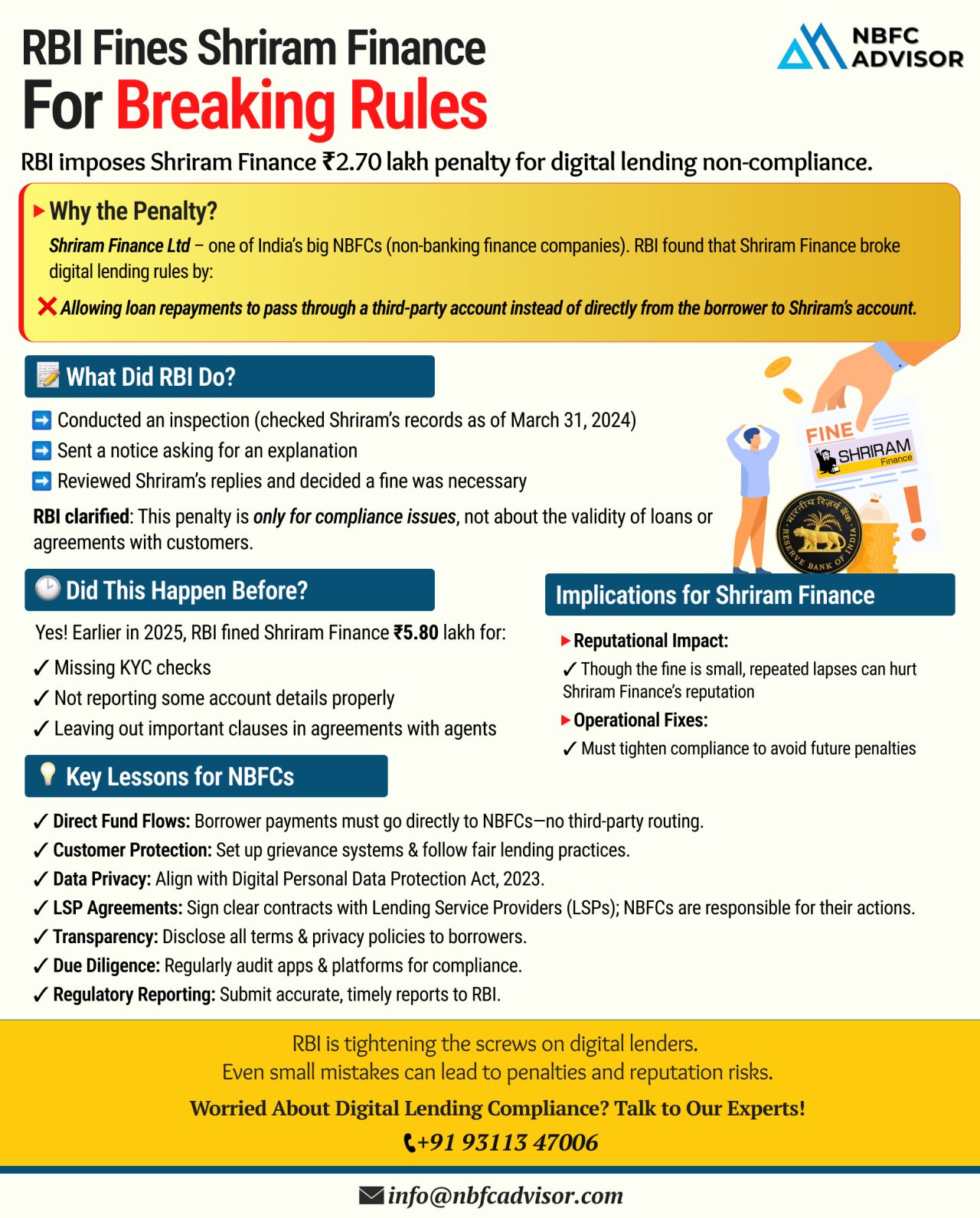

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Most loan defaults don’t happen because of bad customers — they happen because of bad credit decisions.

Yet, many NBFCs still rely on outdated, unstructured loan assessment methods.

If you’re serious about scaling safely and s...

Traditional KYC is slow, expensive, and vulnerable to fraud. Video KYC (vKYC) is revolutionizing the process by making it faster, safer, and more efficient.

✅ Faster Approvals – Complete KYC in 10-15 minutes, loan disbursal within 48 hours.

...

Thousands do—and they pay a heavy price.

🚨 Scammers are getting smarter! They pose as NBFCs, run flashy ads, and promise instant loans. But once you download their app, they steal your contacts, messages, and photos—leading to harassm...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

To combat rising cyber threats and protect consumers from online fraud, the Reserve Bank of India (RBI) has launched a dedicated domain—‘.bank.in’—exclusively for Indian banks. This initiative aims to establish a secure, relia...

India’s digital lending space has witnessed tremendous growth, making credit more accessible to individuals and MSMEs. However, with this growth has come a dark side—a rise in unregulated lenders engaging in:

❌ Predatory inte...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

The LendingTech sector in India is witnessing rapid growth, driven by the rising demand for digital lending solutions that target unbanked and underserved populations. This article delves into how LendingTech startups are differentiating themselves, ...

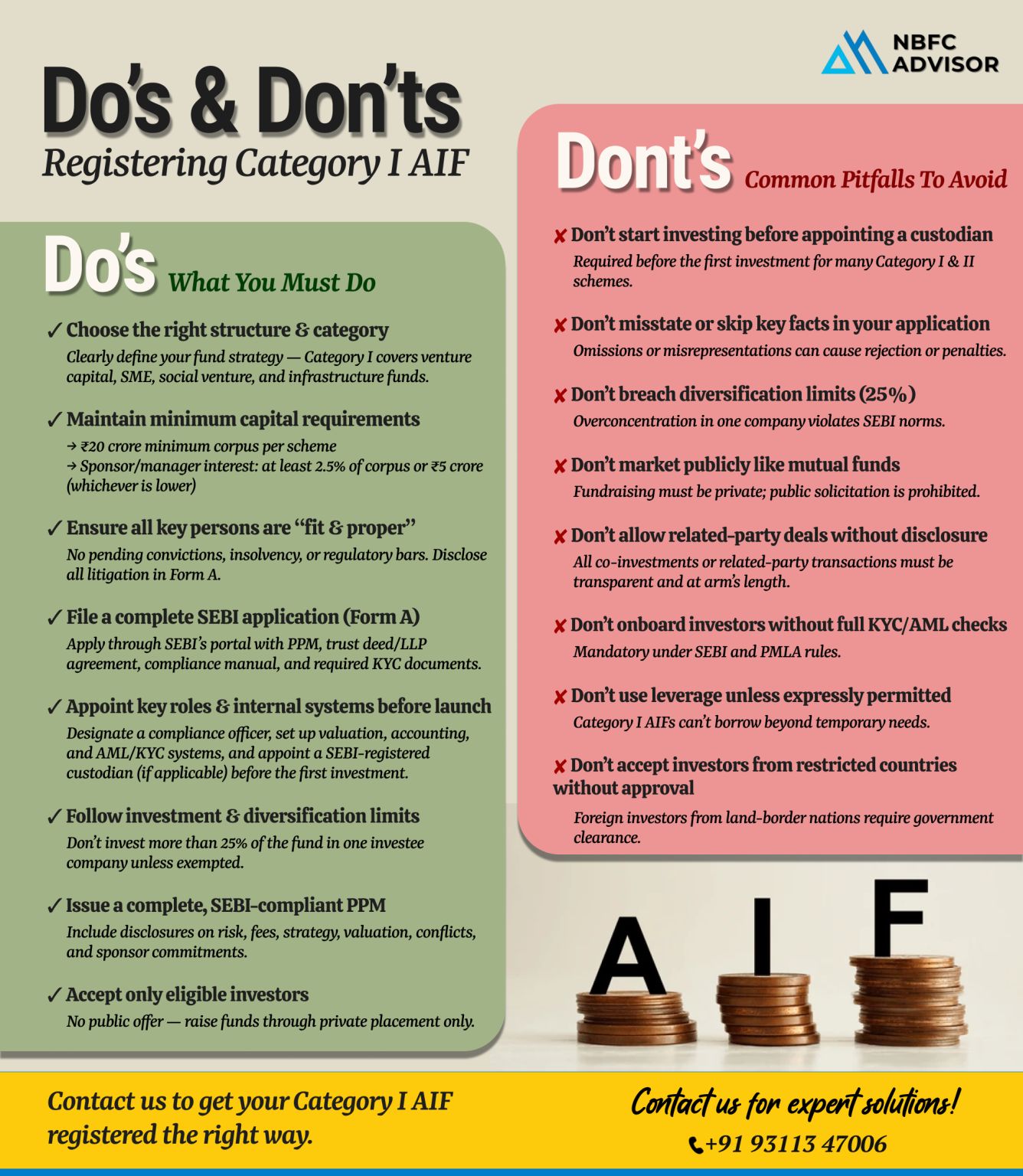

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

Co-lending, a collaborative lending model where multiple lenders join forces to provide financing to a borrower, has become increasingly popular in the financial sector. This approach allows lenders to capitalize on their individual strengths while s...

In a significant move reinforcing its commitment to maintaining financial stability and consumer protection, the Reserve Bank of India (RBI) recently canceled the licenses of two non-banking financial companies (NBFCs) - Polytex India Ltd, based in M...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

The Reserve Bank of India recently announced major changes in the Non-Banking Financial Company (NBFC) sector. The RBI revealed that 15 NBFCs, including notable entities such as Tata Capital Financial Services and Revolving Investments, have voluntar...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In the dynamic realm of Non-Banking Financial Companies (NBFCs), takeover processes play a crucial role in shaping market landscapes and strategic trajectories. Let’s delve into the intricacies of NBFC takeovers, exploring the reasons behind th...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)