NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

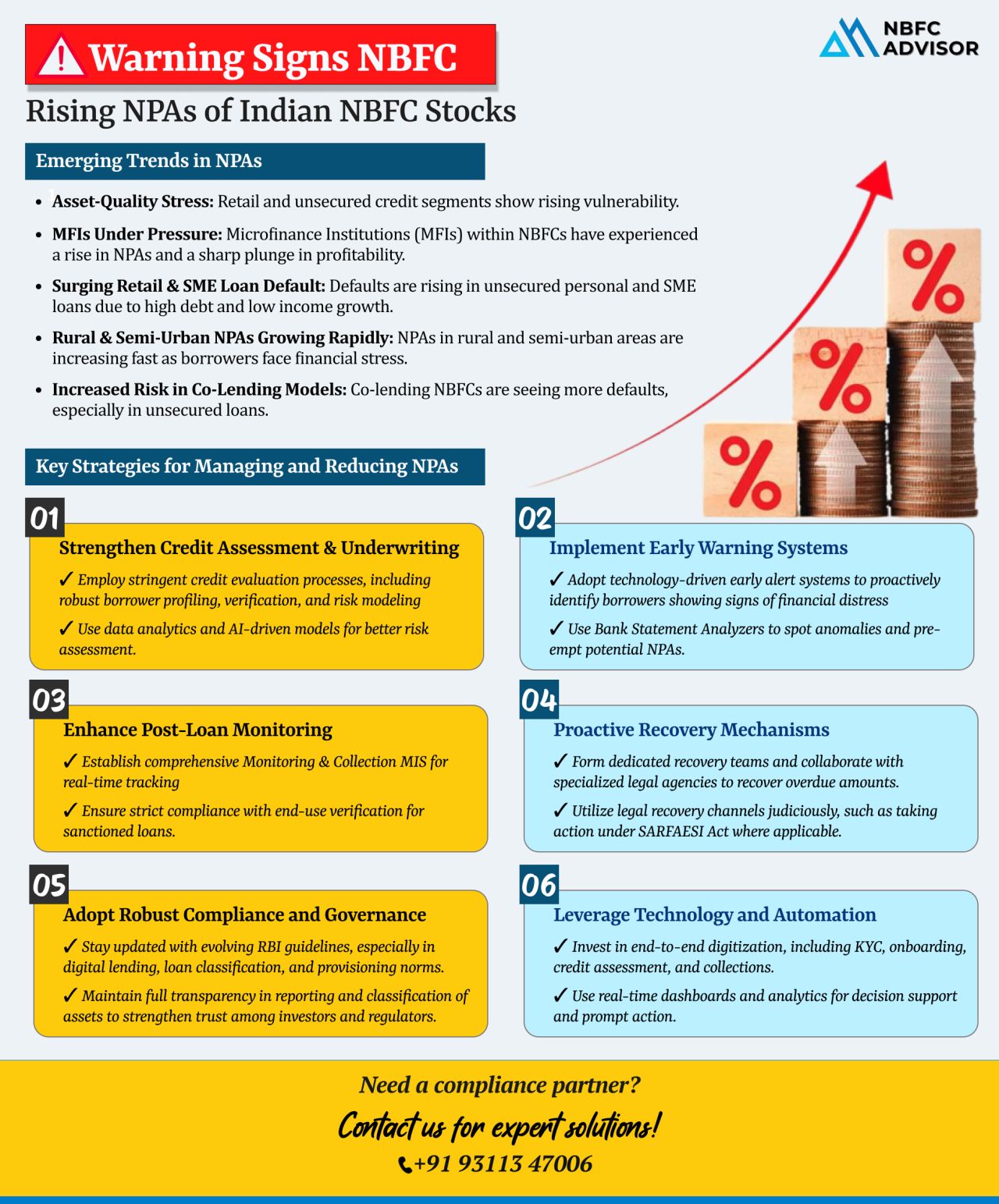

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

NBFC Accounting Services by NBFC Advisor

Looking for accurate, reliable, and hassle-free financial management for your NBFC?

At NBFC Advisor, we specialize in providing comprehensive accounting solutions exclusively for Non-Banking Financial Comp...

The Reserve Bank of India (RBI) has launched the PRAVAAH Portal — a centralized online platform designed to streamline all regulatory approval processes.

What is PRAVAAH?

PRAVAAH (Platform for Regulatory Application, Validation, and Autho...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

.jpeg)

.jpeg)