NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

Cheques Will Clear in Just Hours – Rolling Out October 2025

Big changes are coming for India’s banking sector! The Reserve Bank of India (RBI) is all set to transform cheque clearance, cutting down waiting times from days to only a few...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

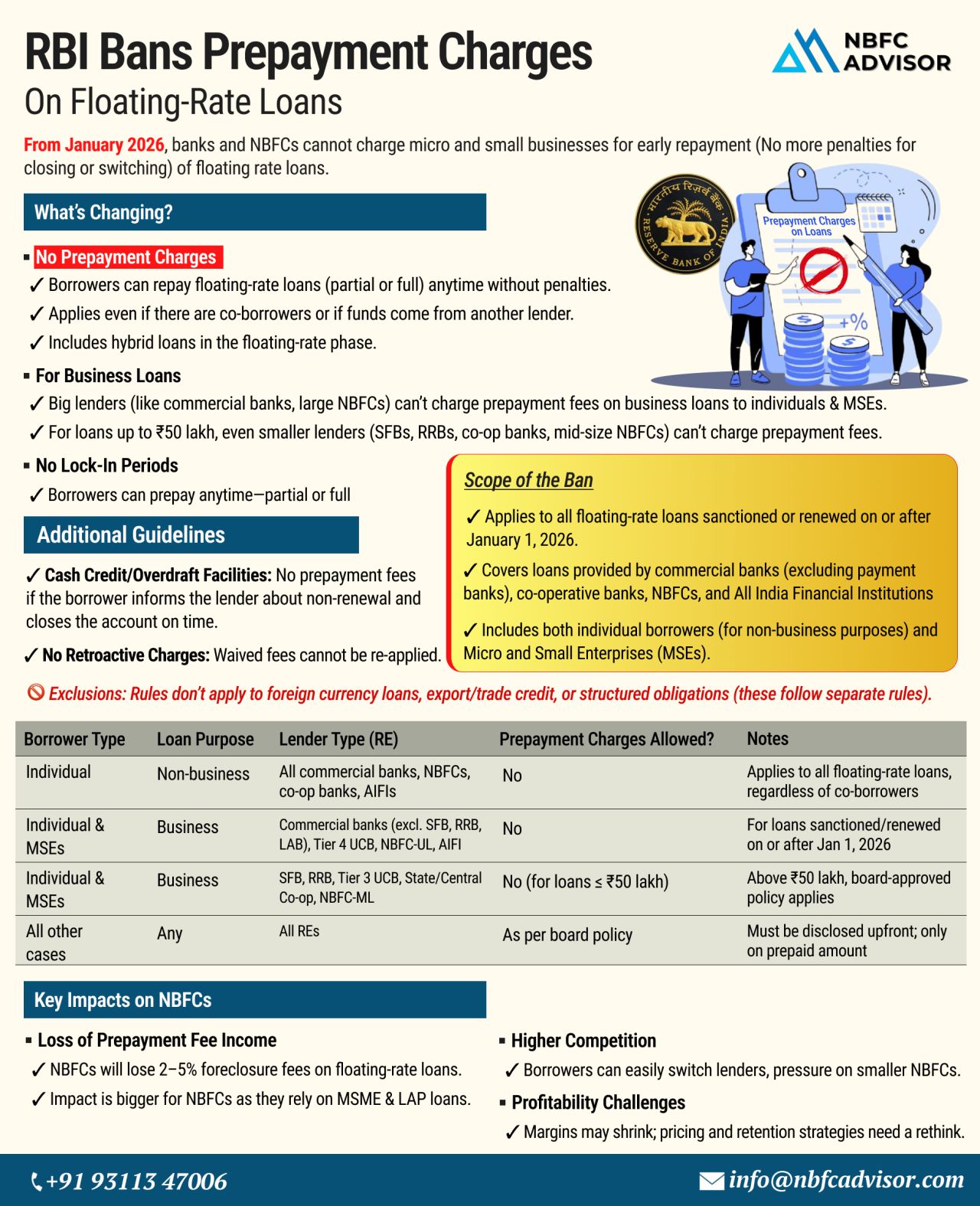

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

India’s NBFC sector is projected to reach ₹60 trillion by FY26—now is the perfect time to enter the market.

Why Start an NBFC?

✔ Fintech NBFCs are growing rapidly

✔ Huge demand in credit-deprived sectors

✔ Faster loan disbursals t...

In the era of Open Finance, NBFC Account Aggregators (AA) are revolutionizing how financial data is shared, accessed, and utilized. If you're a fintech, NBFC, or financial service provider, an NBFC-AA license could be your key to unlocking a futu...

The Reserve Bank of India (RBI) has imposed fines on six NBFCs for violating key regulatory norms under the RBI Act, 1934. These penalties, totaling over ₹60 lakh, highlight RBI’s tightening grip on governance and compliance.

Who Got Fined...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)