RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

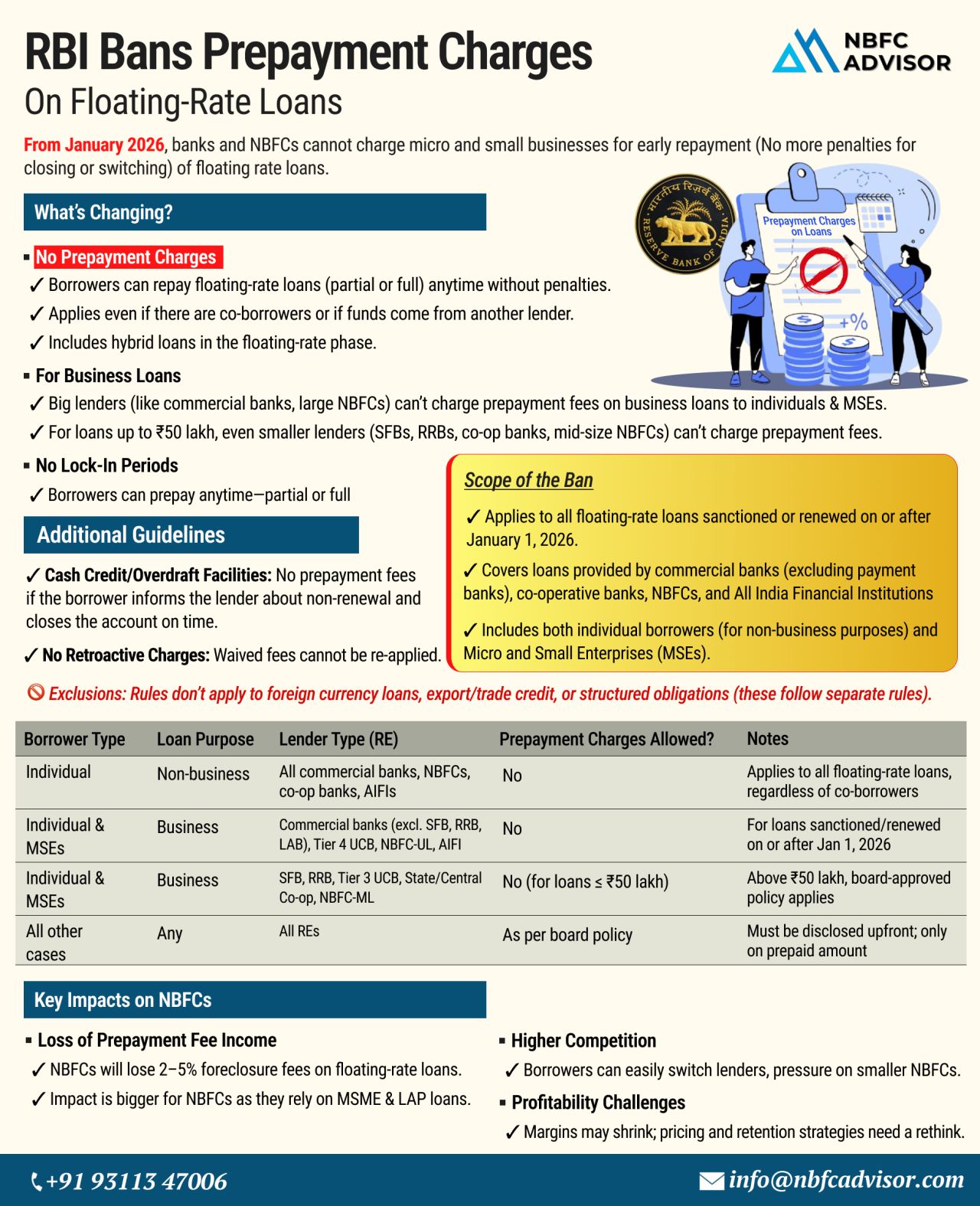

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financial Companies (NBFCs). Starting January 1, 2026, no prepayment penalties can be charged on floating-rate loans to individuals and Micro & Small Enterprises (MSEs), even if there are co-borrowers involved.

🔍 What’s Changing?

✅ No Prepayment Penalties:

Lenders can no longer charge penalties or fees for early repayment of floating-rate loans taken by individuals or MSEs.

✅ Applicable to Small & Mid-Sized Lenders:

The rule applies to Small Finance Banks, Regional Rural Banks (RRBs), and mid-sized NBFCs for loans up to ₹50 lakh.

✅ Prepay Anytime:

Borrowers can repay their loans partially or fully at any point — without a lock-in period or hidden charges.

✅ Transparency Required:

Lenders must clearly disclose prepayment terms and charges (if any, for other loan types) in all loan documents.

⚠ How Will This Impact NBFCs?

While this move empowers borrowers, it creates several challenges for NBFCs:

🔻 Revenue Loss:

NBFCs often charge 2–5% of the loan amount as prepayment charges. This stream of income will now vanish.

🔁 Higher Borrower Mobility:

With no financial penalty, borrowers are more likely to switch lenders, especially to those offering better rates or digital convenience.

📉 Increased Competition:

Larger lenders with cheaper funds (like banks or big fintechs) may attract quality borrowers, leaving smaller NBFCs more vulnerable.

💡 What Should NBFCs Do Now?

To stay competitive and compliant, NBFCs must adapt quickly:

-

Rework Pricing Models:

Focus on sustainable interest rates and transparent fee structures to retain customers long-term. -

Boost Customer Experience:

Invest in digital platforms, faster turnaround times, and proactive customer service to build loyalty. -

Enhance Operational Efficiency:

Cut costs and improve internal processes to maintain profit margins despite tighter regulations.

🤔 Not Sure How This Affects Your Business?

Whether you're an NBFC looking to revise your loan offerings or a lender assessing the impact of these regulatory changes, we’re here to help. Our team specializes in NBFC compliance, strategy, and transformation.

📞 Contact Us for a Free Consultation

Call: +91 93113 47006

Email: [Insert Email]

Website: [Insert Website]

🔖 #NBFCAdvisor #NBFCCompliance #PrepaymentCharges #RBIUpdates #NBFCs #DigitalLending #Fintech #RegulatoryChanges