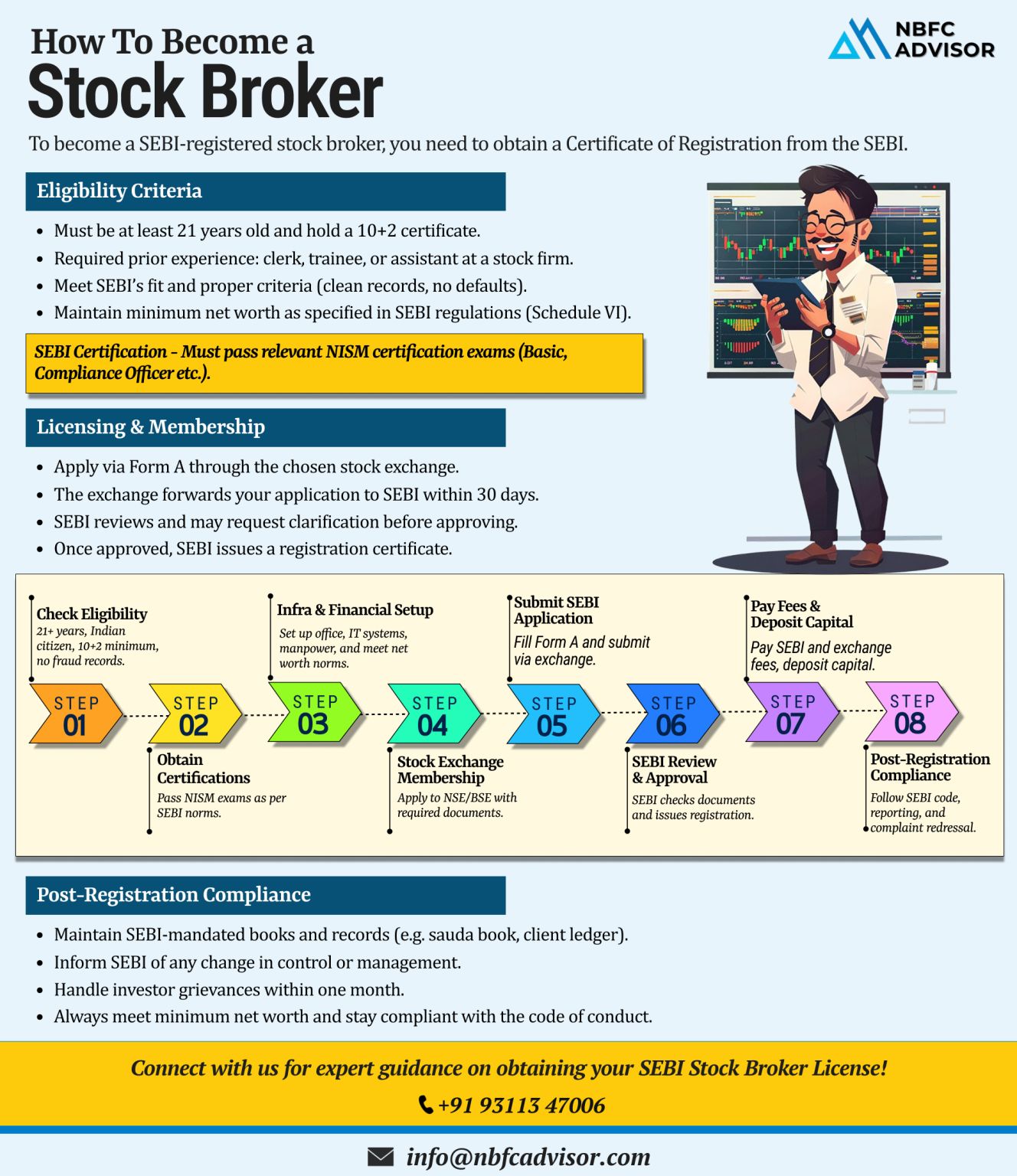

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

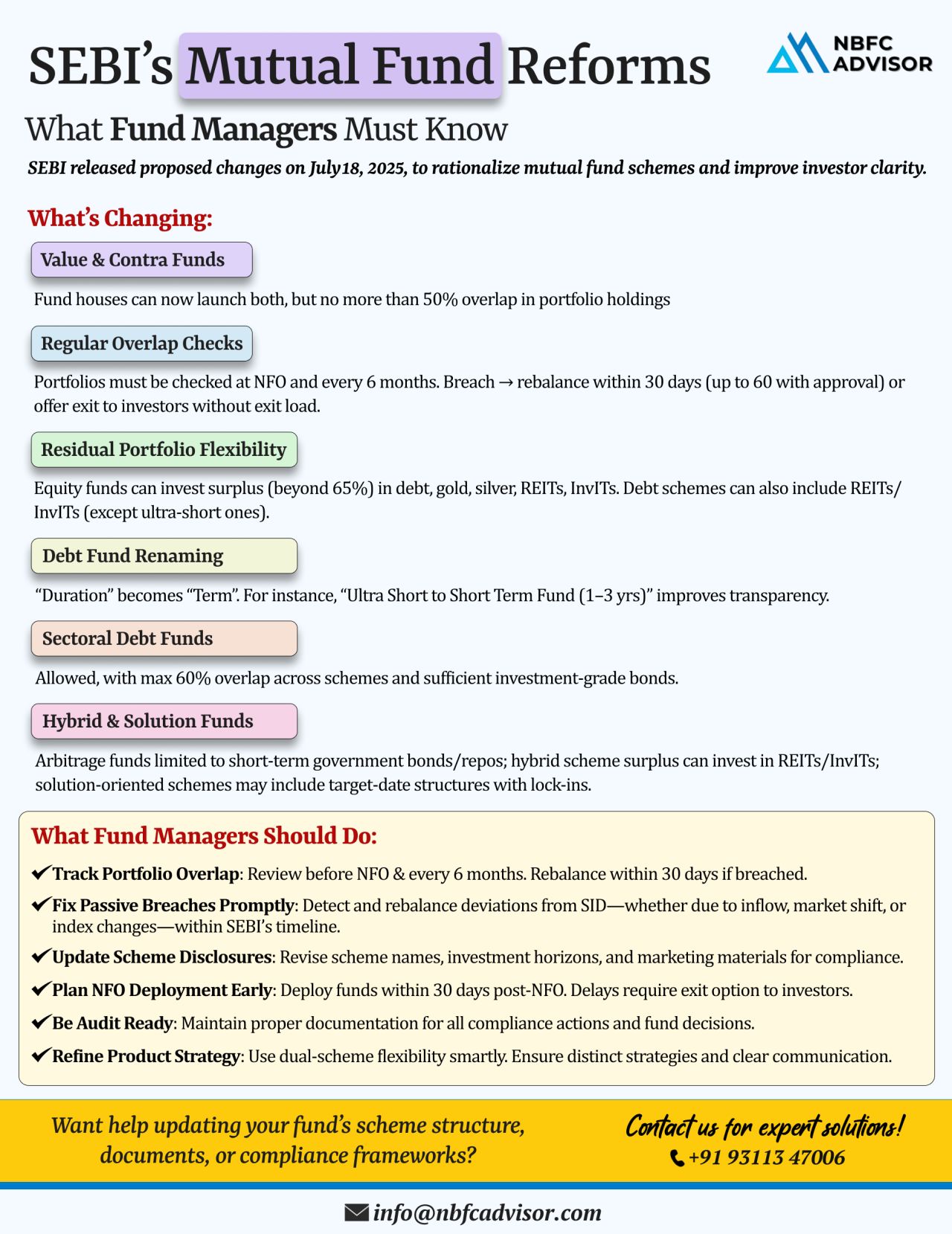

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

The RBI has recently canceled multiple NBFC registrations, leading to financial and operational disruptions. If your NBFC is affected, you have 30 days to appeal!

Key Reasons for Cancellation:

✔ Non-compliance with the RBI Act

✔ Inadequate cap...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

.jpeg)

.jpeg)