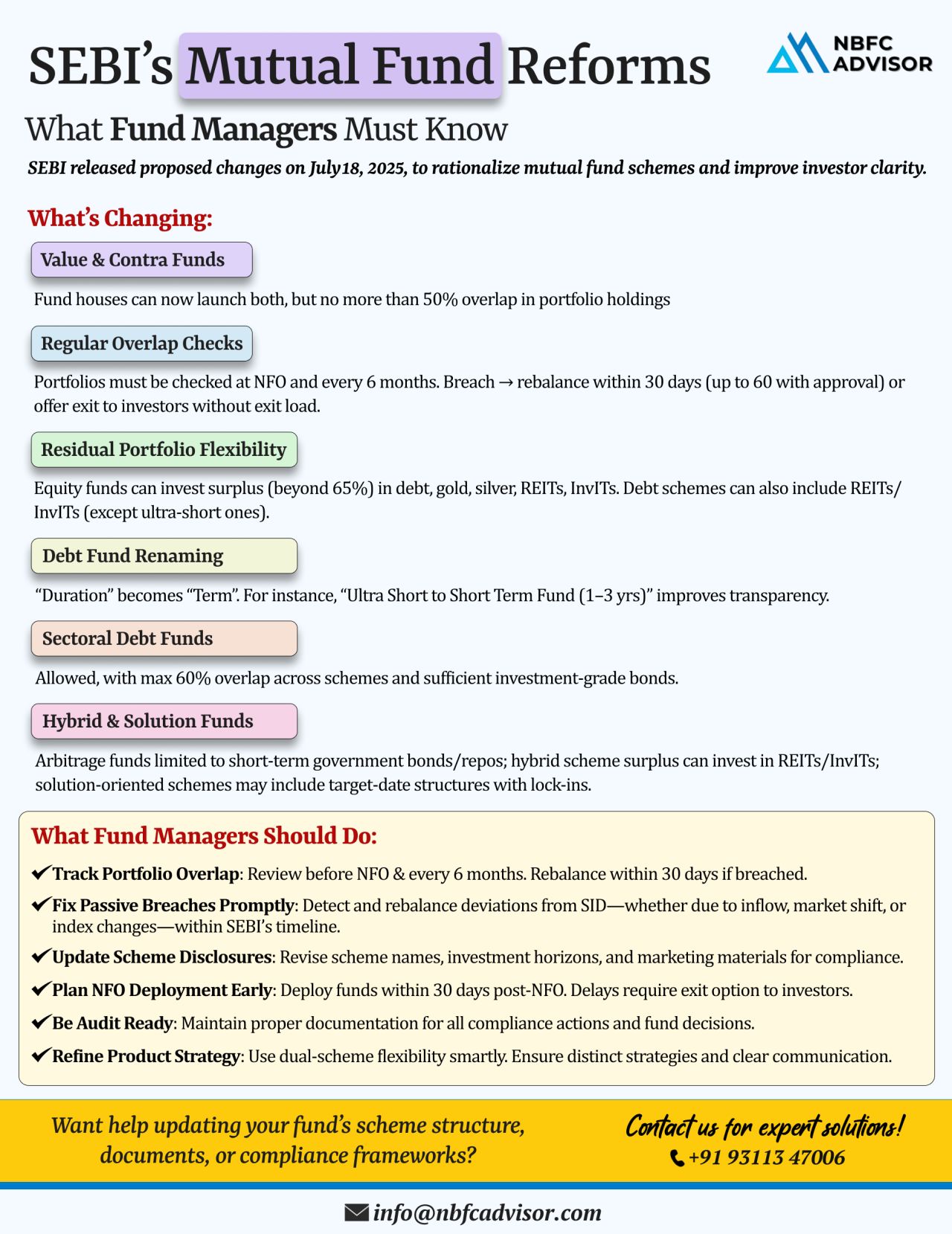

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment strategies. These reforms are designed to protect investors’ interests and help fund houses operate with better structure and transparency.

🔄 What’s Changing in SEBI’s New Mutual Fund Rules?

✅ Value & Contra Funds – Now Coexisting with Limits

SEBI now permits both value and contra schemes under one fund house, provided they keep portfolio overlap below 50%, ensuring they serve distinct investment strategies.

📊 Regular Overlap Checks Made Mandatory

Fund houses must now perform overlap analysis:

-

At the time of New Fund Offers (NFOs)

-

Every 6 months thereafter

This helps avoid unintentional risk duplication across schemes.

💰 Residual Fund Allocation Gets More Flexibility

Equity and debt funds can now deploy surplus or idle funds into other instruments such as:

-

REITs (Real Estate Investment Trusts)

-

InvITs (Infrastructure Investment Trusts)

-

Gold and other approved assets

This allows more efficient use of capital.

🏷️ Clearer Terminology for Debt Funds

SEBI plans to replace the word “Duration” with “Term” (e.g., “1–3 years”) in debt fund names. This change aims to help retail investors easily understand the expected investment tenure.

🏦 Sectoral Debt Funds Now Permitted (With Conditions)

The reforms allow the launch of sector-specific debt funds, provided there are adequate risk controls and disclosures to prevent overexposure.

🔁 Structured Changes in Hybrid and Solution-Oriented Schemes

SEBI seeks to streamline these fund categories by setting:

-

Defined lock-in periods

-

Clear allocation rules

-

Consistent scheme classification

💡 Why These Changes Matter

These regulatory updates aim to:

-

Prevent portfolio duplication

-

Simplify mutual fund classifications

-

Provide better visibility into fund objectives

-

Empower investors with more transparent and structured choices

-

Allow AMCs greater flexibility without compromising investor safety

👩💼 What Fund Managers Need to Do Now

To stay aligned with SEBI’s new framework, fund managers should:

✔ Monitor and limit portfolio overlap

✔ Rebalance schemes if markets cause threshold breaches

✔ Rename schemes to match their investment time frame

✔ Deploy NFO proceeds within 30 days

✔ Maintain audit-ready records and compliance reports

✔ Use flexibility in fund structures responsibly

📞 Need Assistance With Compliance or Strategy?

These reforms may impact how you structure, manage, or promote your funds. If you’re looking to adapt quickly and compliantly, we’re here to help.

📲 Schedule a FREE consultation today

Call: +91 93113 47006

📌 Hashtags:

#SEBI #MutualFunds #FundManagers #InvestmentStrategy #SEBIGuidelines #Compliance #NBFCAdvisor #InvestorAwareness #AssetManagement