Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Running a Non-Banking Financial Company (NBFC) in India is not just about lending, growth, and profitability. In today’s tightly regulated environment, compliance failures...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

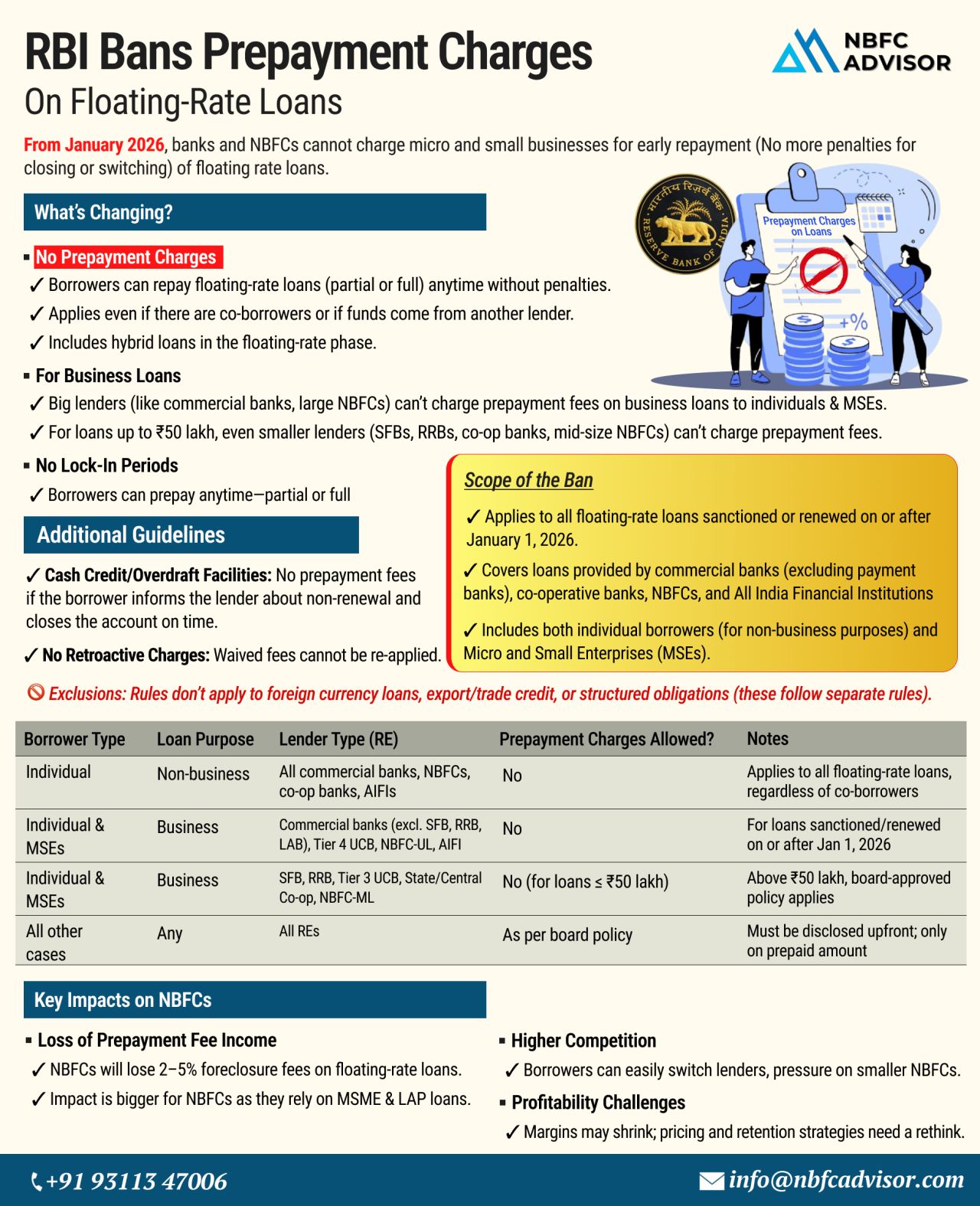

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

₹12 lakh income? No tax.

₹12,10,000 income? ₹61,500 tax?

What happens if your income exceeds ₹12 lakh by just ₹1?

Did you know that earning just ₹1 extra above ₹12 lakh could shoot up your tax liability disproportionately?

That’s wh...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

Are you an entrepreneur with a vision to venture into the financial sector in India? Are you looking to establish a Non-Banking Financial Company (NBFC) but unsure of where to begin? Look no further! In this article, we'll delve into the intricac...

.jpeg)

.jpeg)