Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

Cheques Will Clear in Just Hours – Rolling Out October 2025

Big changes are coming for India’s banking sector! The Reserve Bank of India (RBI) is all set to transform cheque clearance, cutting down waiting times from days to only a few...

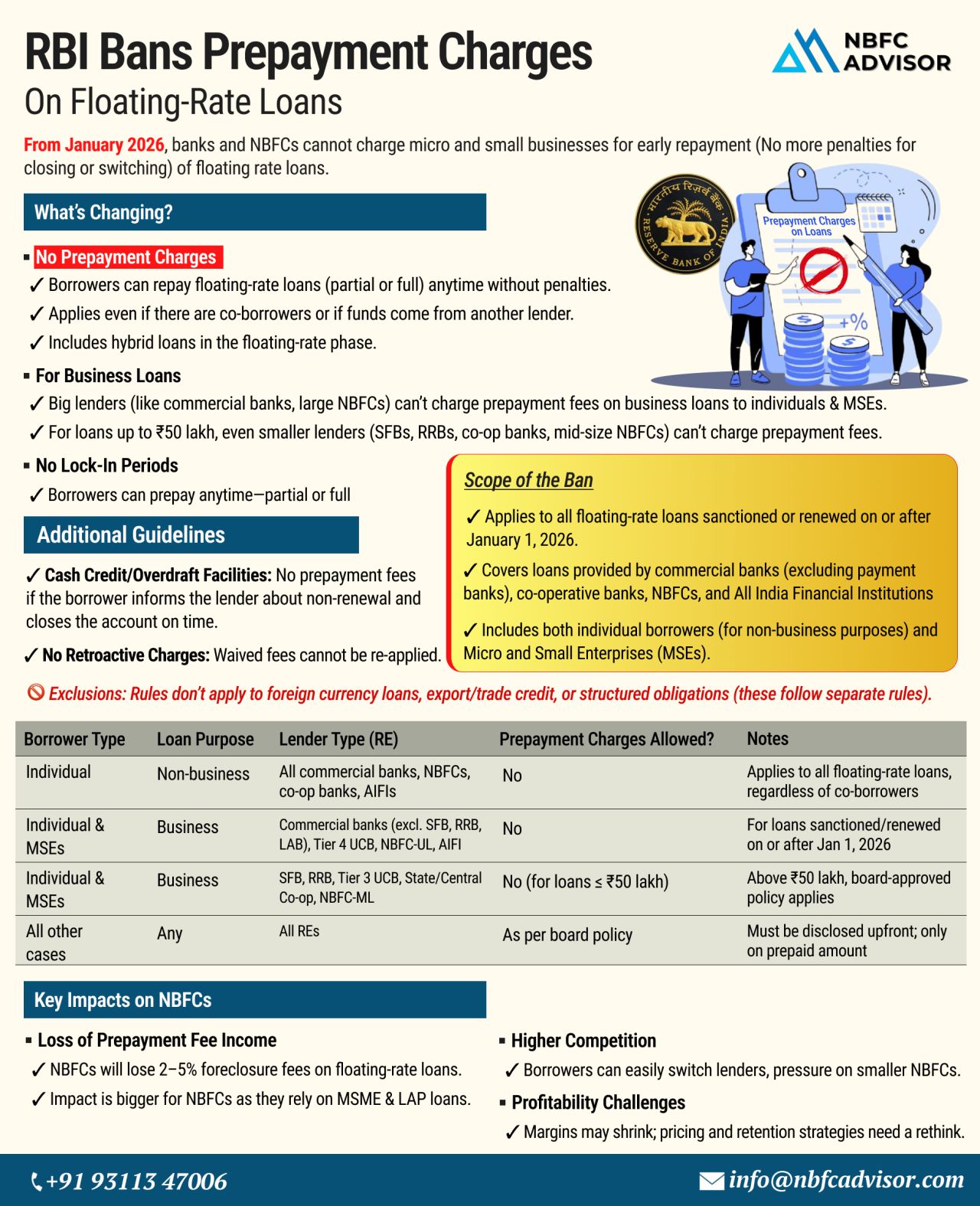

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

In a landmark move towards enhancing transparency, efficiency, and digital convenience, the Securities and Exchange Board of India (SEBI) has made DigiLocker integration mandatory for all intermediaries.

This mandate is a significant step forward ...

In today’s rapidly evolving financial landscape, co-lending has emerged as a significant force reshaping how loans are disbursed in India. The model, which enables banks and Non-Banking Financial Companies (NBFCs) to jointly disburse loans, has...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

The fintech industry is experiencing an unprecedented evolution, driven by groundbreaking innovations that are transforming how we manage, invest, and think about money. From artificial intelligence to blockchain, the financial landscape is being red...

India is on the verge of a financial revolution, thanks to its growing economy and diverse demographics. However, there still exists a significant credit gap, especially among businesses and individuals. This gap is obstructing the country's econ...

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)