Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

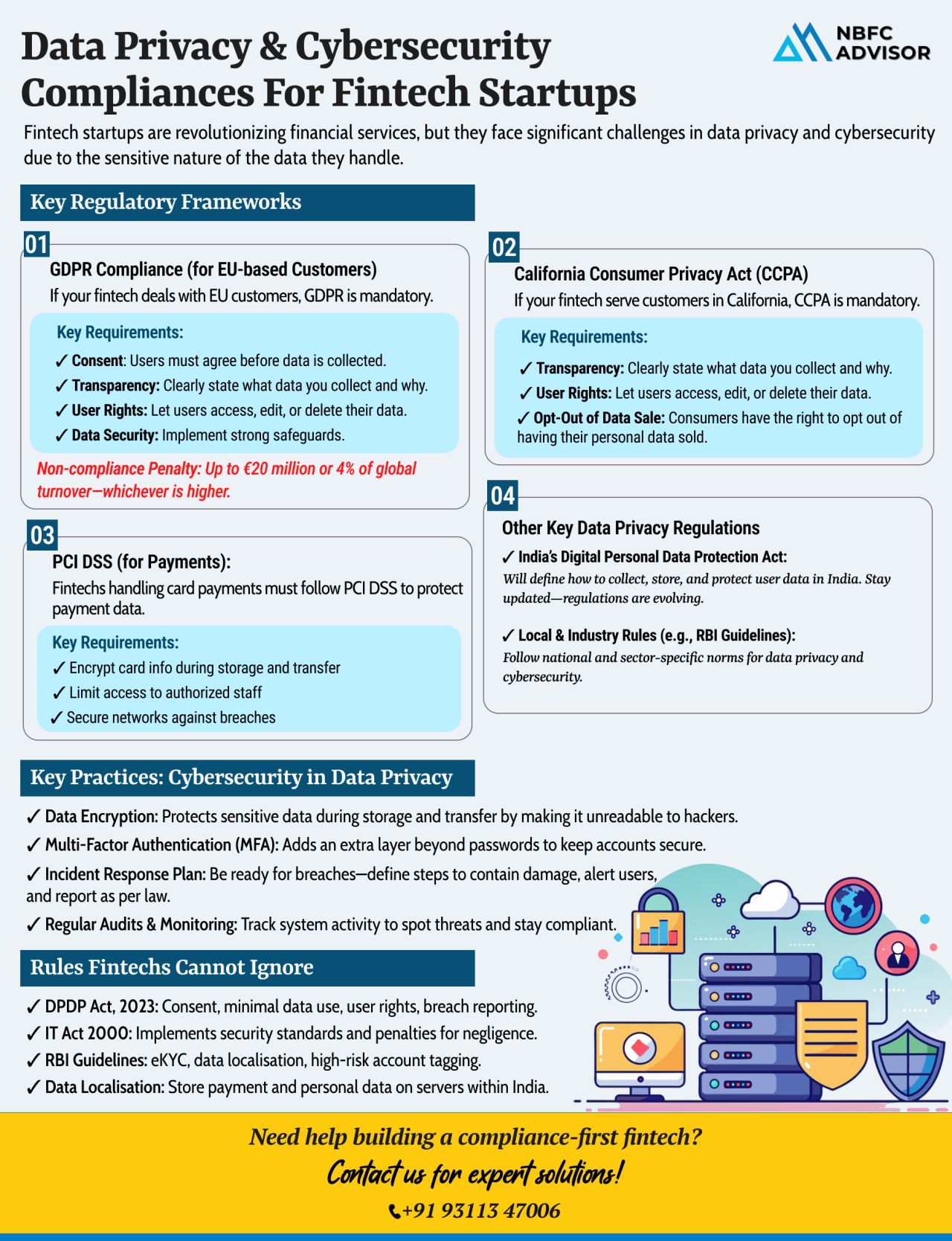

Building a Fintech Startup? One Data Breach Could Cripple Everything

In the high-stakes world of fintech, innovation isn’t enough—security and compliance are your foundation. With sensitive financial data at the heart of your operation...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

RBI Is Cracking Down on NBFCs — Is Your Company Compliance-Ready?

The Reserve Bank of India (RBI) has intensified its scrutiny of Non-Banking Financial Companies (NBFCs)—and the message is loud and clear: compliance is no longer negoti...

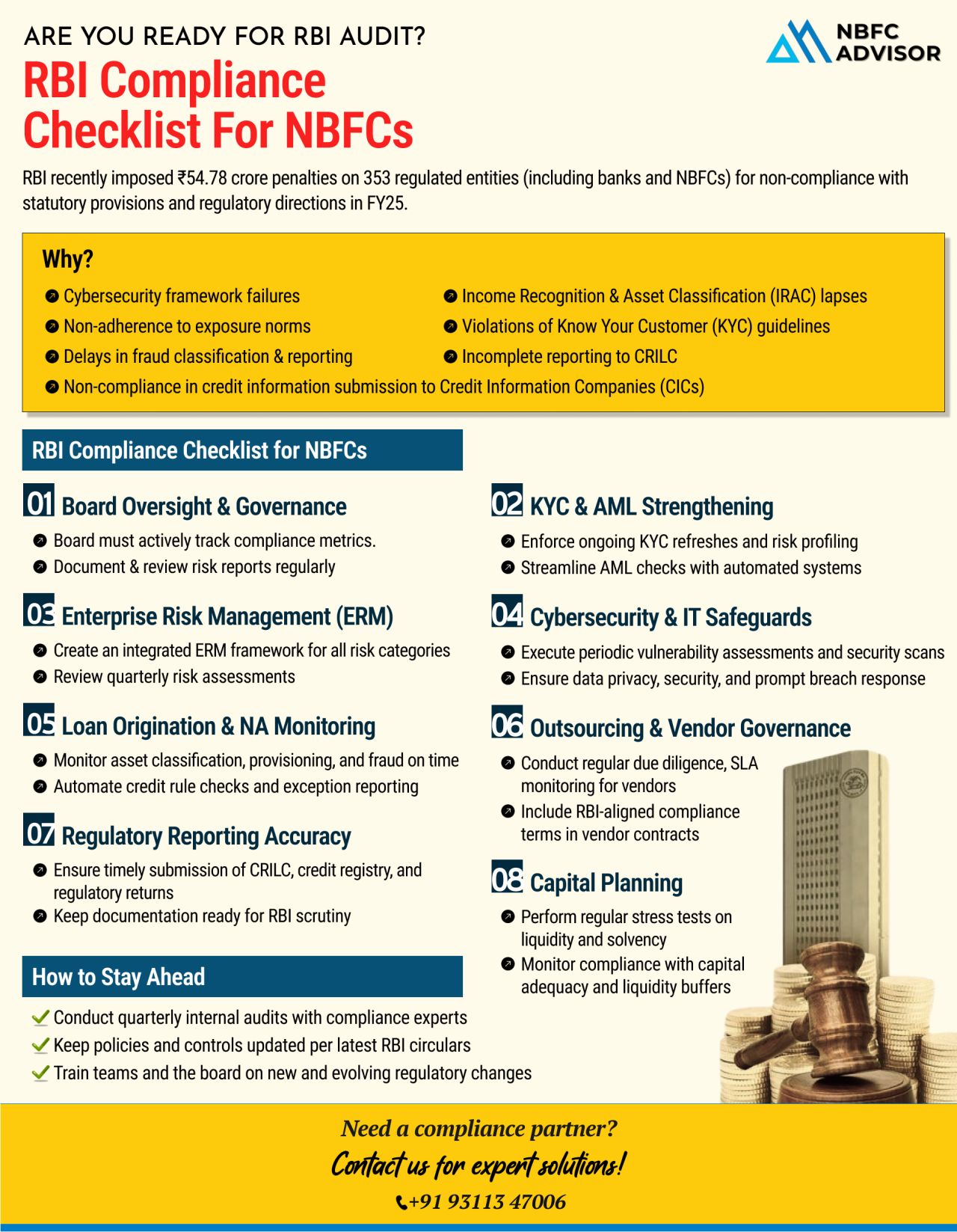

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

Fintech–NBFC–Bank partnerships are leading a significant transformation — reshaping lending models, expanding access, and simplifying financial services.

Opportunities

Digital loans and banking are now reaching Tier 2 an...

Driven by the rapid rise of digital payments and widespread technology adoption, India's Fintech sector is on an explosive growth trajectory.

For entrepreneurs looking to establish a Fintech company, navigating the regulatory, legal, and opera...

In the era of Open Finance, NBFC Account Aggregators (AA) are revolutionizing how financial data is shared, accessed, and utilized. If you're a fintech, NBFC, or financial service provider, an NBFC-AA license could be your key to unlocking a futu...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

To combat rising cyber threats and protect consumers from online fraud, the Reserve Bank of India (RBI) has launched a dedicated domain—‘.bank.in’—exclusively for Indian banks. This initiative aims to establish a secure, relia...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

The finance world is experiencing a profound transformation, driven by the pervasive influence of the digital realm. One of the most intriguing shifts is the collaboration between Non-Banking Financial Companies (NBFCs) and Fintech startups. This par...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

.png)

.jpeg)

.jpeg)

.jpeg)