Are You Truly Ready for an RBI Audit?

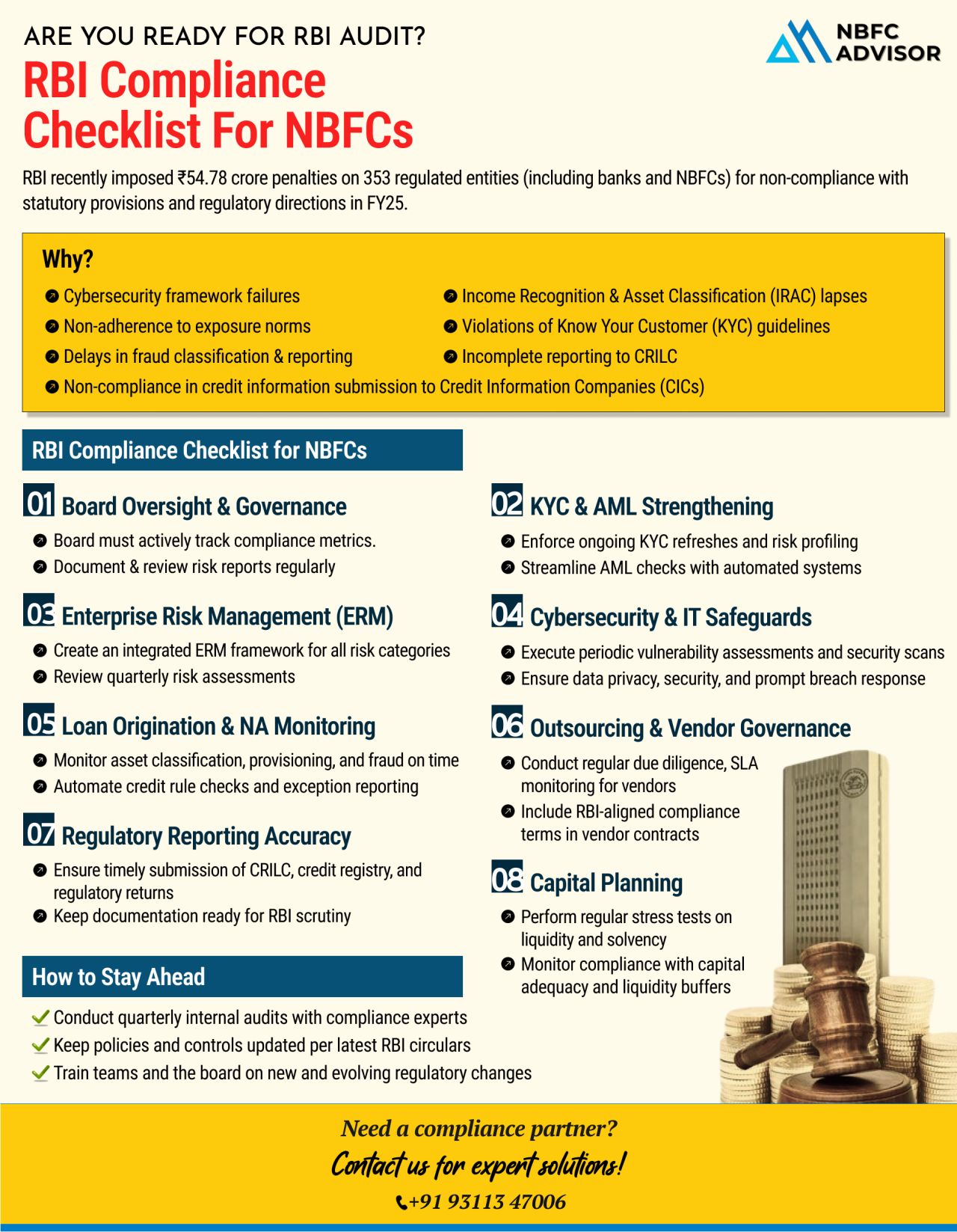

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive compliance strategies.

Why Are NBFCs Getting Penalized?

🔸 Inadequate cybersecurity frameworks

🔸 Weak KYC/AML controls

🔸 Delayed or inaccurate regulatory reporting

🔸 Exposure to regulatory norm violations

🔸 Lapses in CRILC/CIC submissions

The reality is simple:

If you’re running an NBFC, you must be audit-ready — always.

The RBI’s approach is becoming more stringent, more technology-driven, and less forgiving.

✅ Where Should NBFCs Focus Now?

🔹 Board-Level Compliance Oversight:

Your leadership must actively monitor, review, and take responsibility for compliance processes.

🔹 Strengthening KYC & AML Controls:

A robust customer verification and anti-money laundering framework is critical to protect your NBFC from fines and reputational damage.

🔹 Enterprise Risk Management (ERM):

Build a strong risk management culture with periodic internal audits, stress testing, and scenario analysis.

🔹 Cybersecurity Readiness:

Your systems should be fully aligned with RBI’s cybersecurity framework, regularly tested for vulnerabilities.

🔹 Accurate Credit Reporting & Loan Classification:

Timely and correct submissions to CRILC and CIC are essential to avoid non-compliance penalties.

🔹 Vendor Due Diligence:

Third-party risks can directly impact your audit outcomes. Ensure service level agreements (SLAs) are monitored and vendors are periodically evaluated.

🔹 Capital Planning & Stress Testing:

Ensure capital adequacy through realistic planning and regular stress tests that align with regulatory expectations.

💼 Compliance is Not a One-Time Task.

It’s an ongoing process that demands:

-

Regular policy updates

-

Routine staff training

-

Proactive internal audits

-

Prompt corrective actions

📢 Need Expert Help to Stay Audit-Ready?

We offer tailored RBI compliance, risk management, and audit support designed to keep your NBFC ahead of regulatory changes and fully prepared for any audit.

📞 Contact us today for a FREE consultation: +91 93113 47006