Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

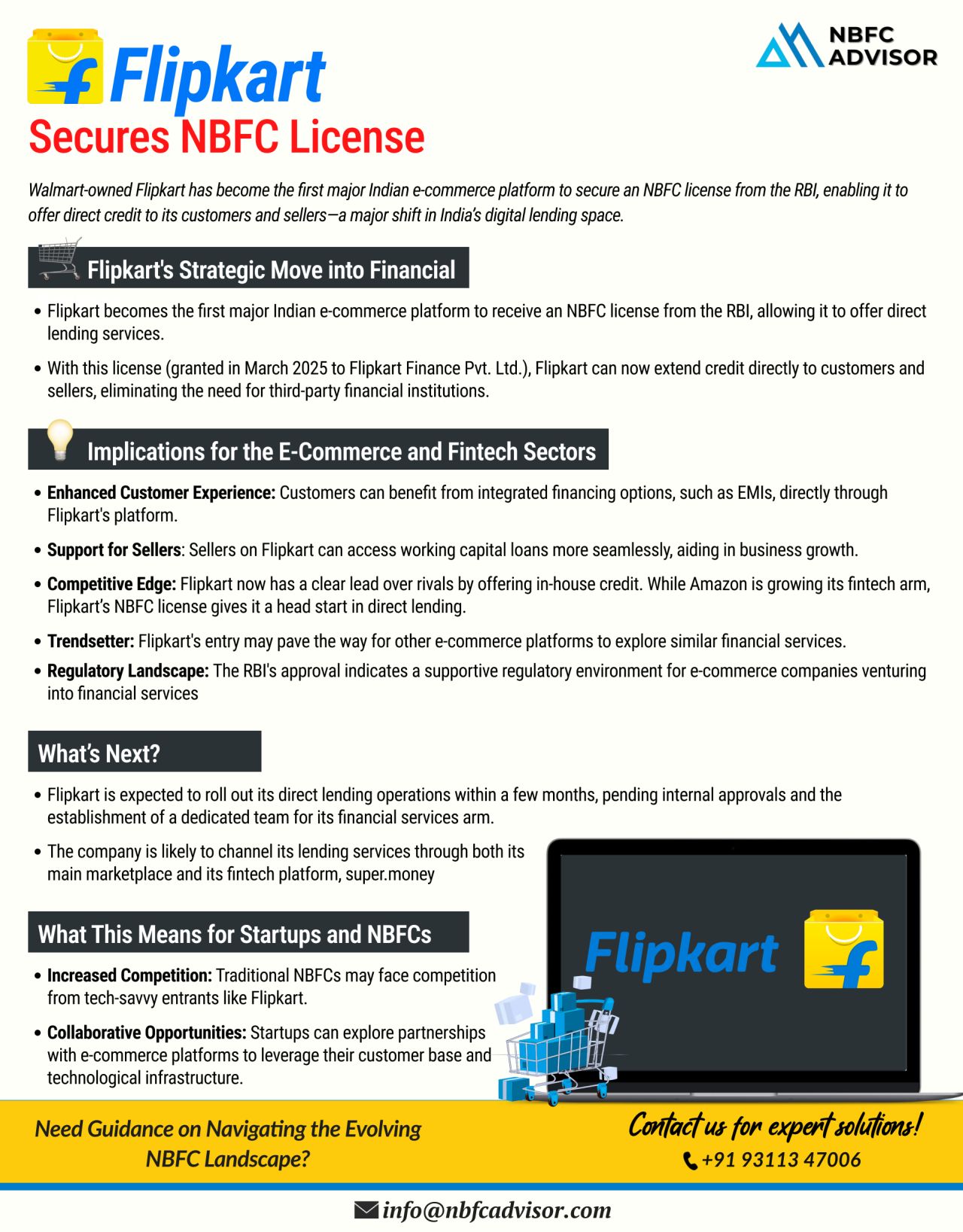

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This development is poised to reshape the landscape of digital commerce and lending in India.

What Does This Mean?

With the NBFC license in hand, Flipkart now has the regulatory power to offer direct lending services to both its customers and its vast network of sellers.

-

✅ Direct Lending to Customers and Sellers:

Flipkart can now provide credit options like personal loans, Buy Now Pay Later (BNPL), and EMIs without relying on external banks or financial partners. -

✅ Independence from Third-Party Financial Institutions:

Flipkart no longer needs to collaborate with third-party banks or NBFCs to facilitate lending. This will allow them to control the entire lending process, from credit approval to disbursal. -

✅ Seamless Integrated Digital Lending:

Flipkart is ushering in a new era of e-commerce-powered credit, where financial services are deeply embedded into the shopping experience.

Why Is This Important?

Here’s why this move is a game-changer:

-

🚀 Enhanced Customer Experience:

Customers can now enjoy instant EMIs and BNPL options directly at checkout, making purchases more affordable and the overall experience more convenient. -

💼 Easier Working Capital for Sellers:

Sellers on the Flipkart platform will gain quicker and more seamless access to credit, which can help them manage inventory, expand operations, and grow their businesses without lengthy approval processes. -

🥇 First-Mover Advantage:

Flipkart gains a critical edge over rivals like Amazon by becoming the first in India to integrate e-commerce and lending at this scale. -

✅ Regulatory Confidence:

The Reserve Bank of India’s approval is a strong signal that regulators are open to innovative digital finance models led by e-commerce giants.

The Bigger Picture

This milestone is not just a step into fintech for Flipkart — it is a complete reimagining of how credit is delivered in the digital age.

-

📉 Traditional NBFCs:

Should prepare for more competition from tech-led lending platforms that offer faster, more customer-centric credit solutions. -

🤝 Fintech Startups:

Must look for collaborative opportunities, as big players like Flipkart may either become competitors or valuable partners in shaping the future of digital finance.

Strategic Timing

This move aligns with Flipkart’s upcoming Initial Public Offering (IPO) and its recent decision to shift its parent company to India—a signal of its long-term commitment to the Indian market.

Need Expert Guidance on the New NBFC Landscape?

The NBFC environment in India is rapidly evolving, and staying ahead requires insight and agility.

If you want to explore lending opportunities, assess the competitive impact, or build fintech partnerships, we can help.

📞 Contact us for a free consultation: +91 93113 47006