Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

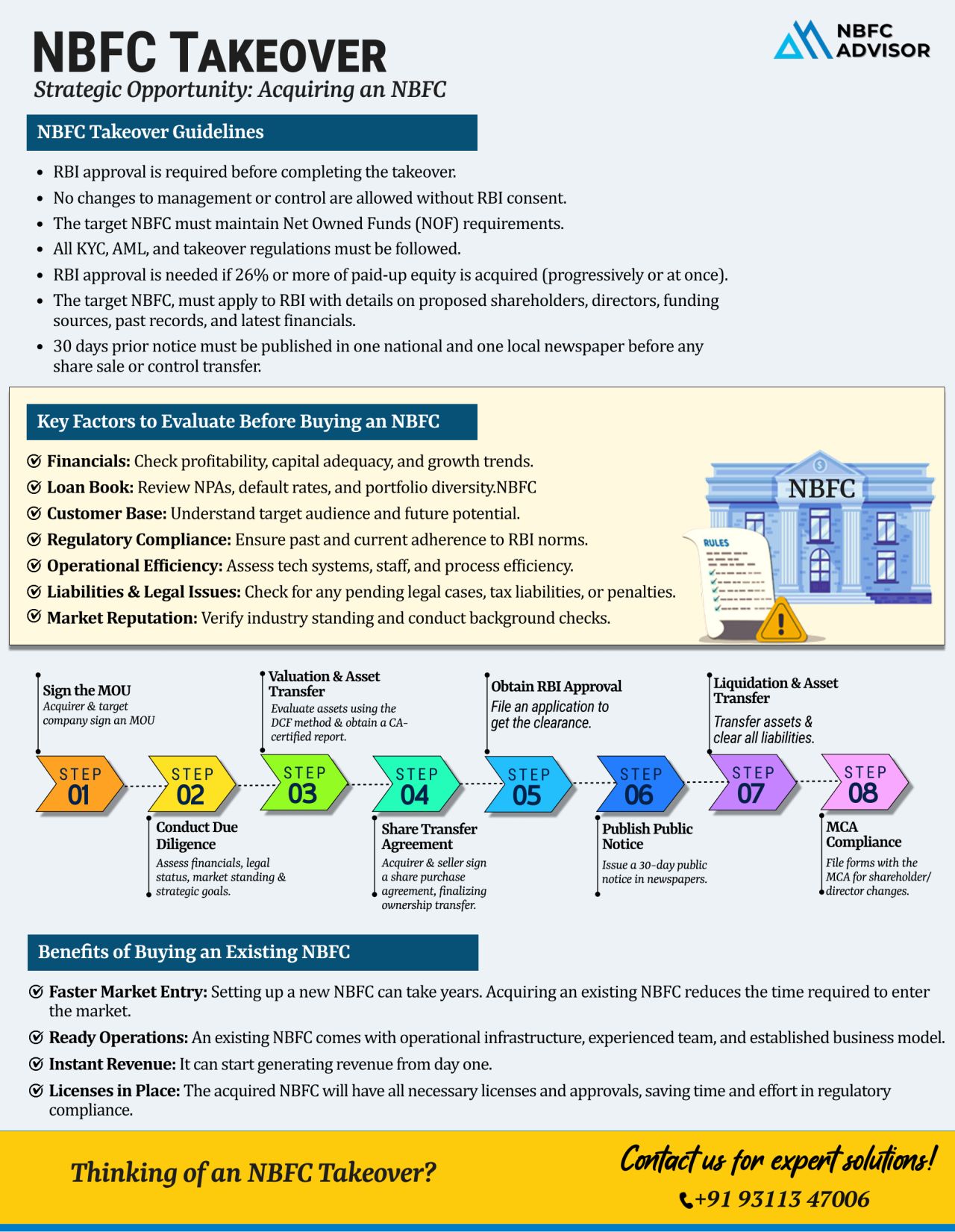

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

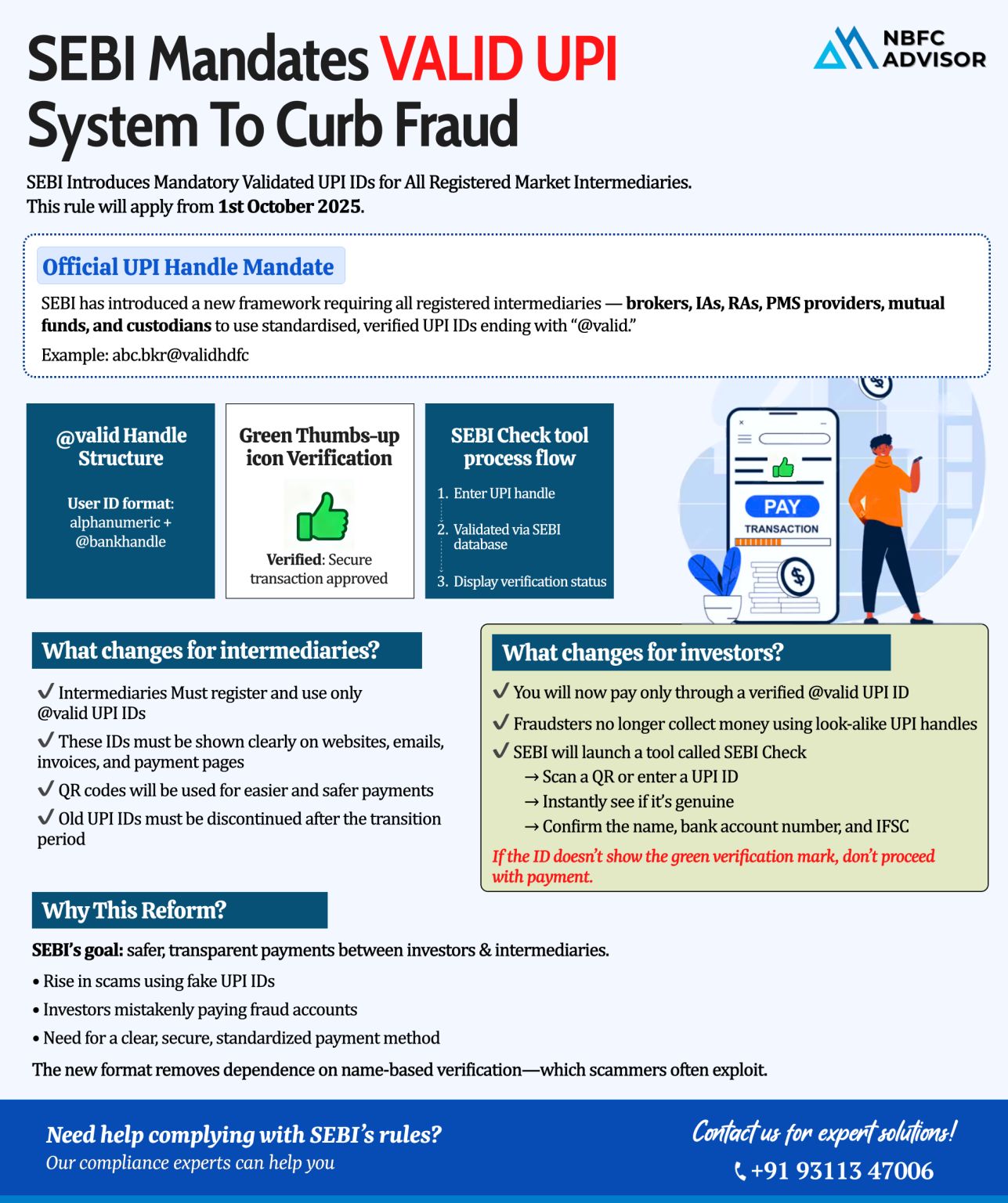

SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fa...

Thinking of Entering India’s Fast-Growing NBFC Space? Choose an NBFC Takeover for Faster Market Entry

India’s Non-Banking Financial Company (NBFC) sector has emerged as one of the most dynamic segments of the financial market — o...

Why Many NBFC Applications Get Rejected by the RBI — And How to Avoid It

Applying for an NBFC (Non-Banking Financial Company) license from the Reserve Bank of India (RBI) is an exciting step for any finance or fintech entrepreneur. However, ...

Comprehensive Financial & Tax Services for Non-Residents (NRIs & Foreign Nationals)

Meta Title: Expert Services for Non-Residents (NRIs & Foreign Nationals) | Tax, FEMA, and RBI Consultancy

Meta Description: Simplify your India-relate...

Thinking of Starting an NBFC? Here’s Why a Takeover Might Be Smarter Than a Fresh Registration

If you’re planning to enter the lending and finance industry, setting up a Non-Banking Financial Company (NBFC) can be a powerful way to gro...

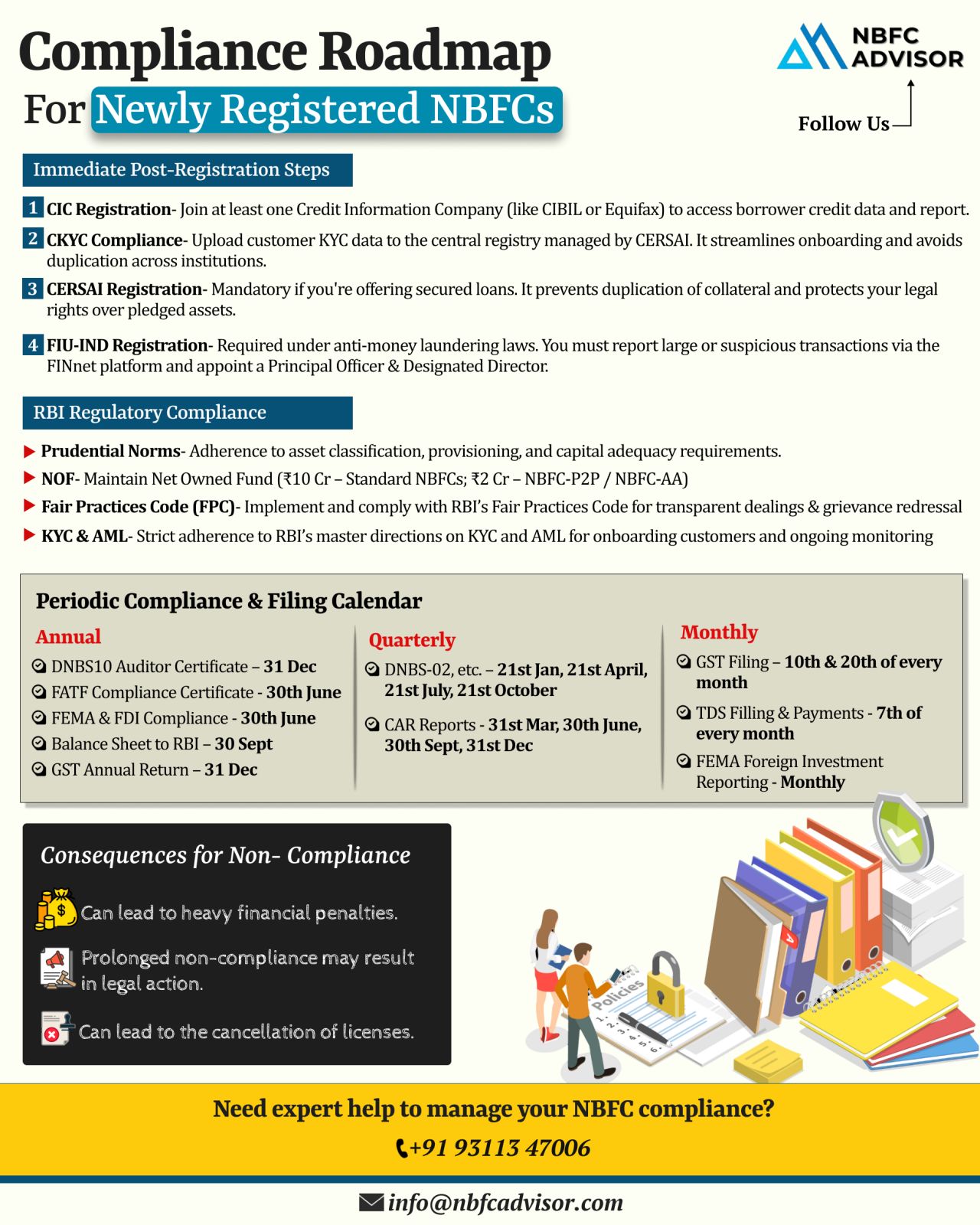

Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compli...

Cheques Will Clear in Just Hours – Rolling Out October 2025

Big changes are coming for India’s banking sector! The Reserve Bank of India (RBI) is all set to transform cheque clearance, cutting down waiting times from days to only a few...

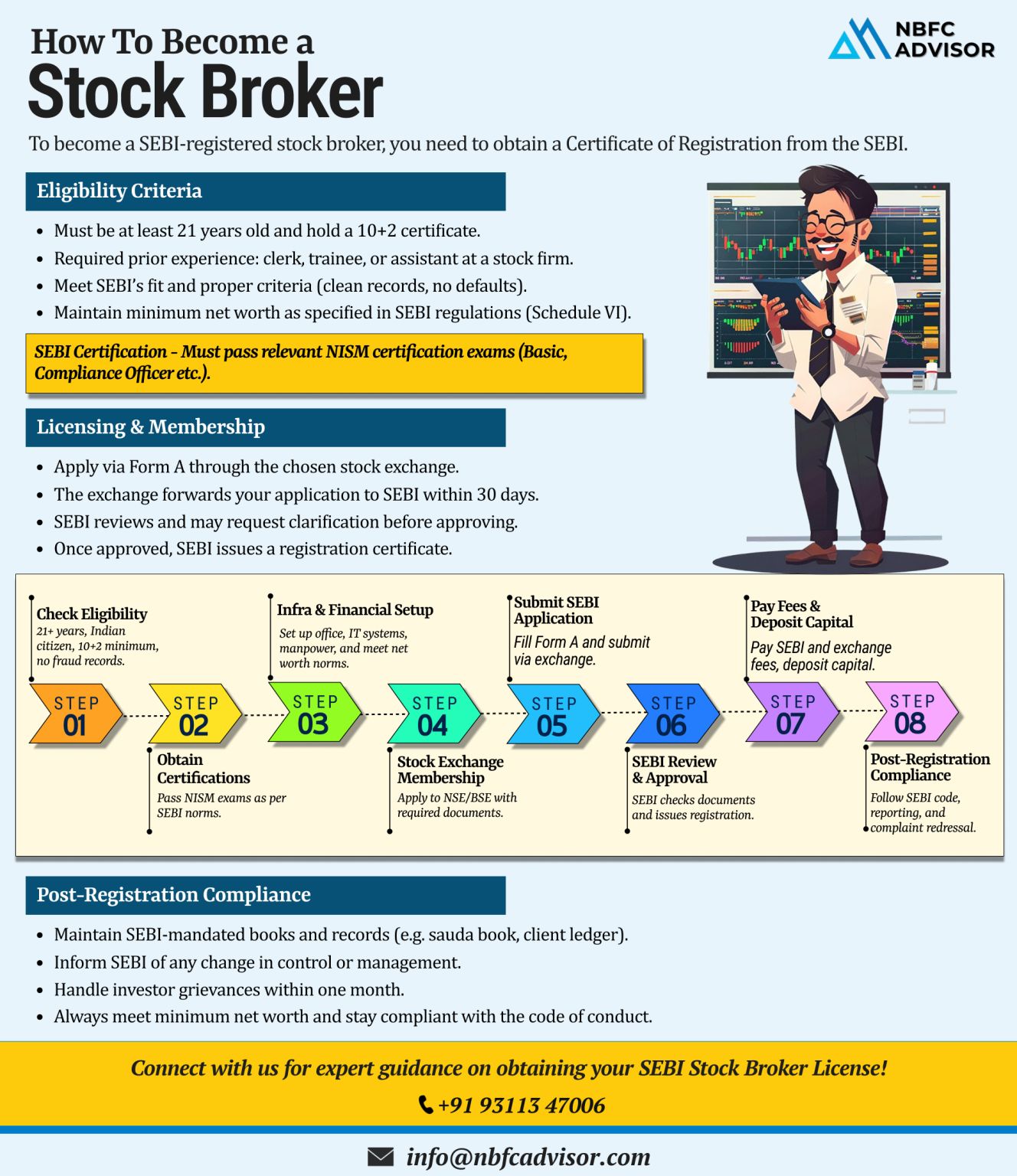

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

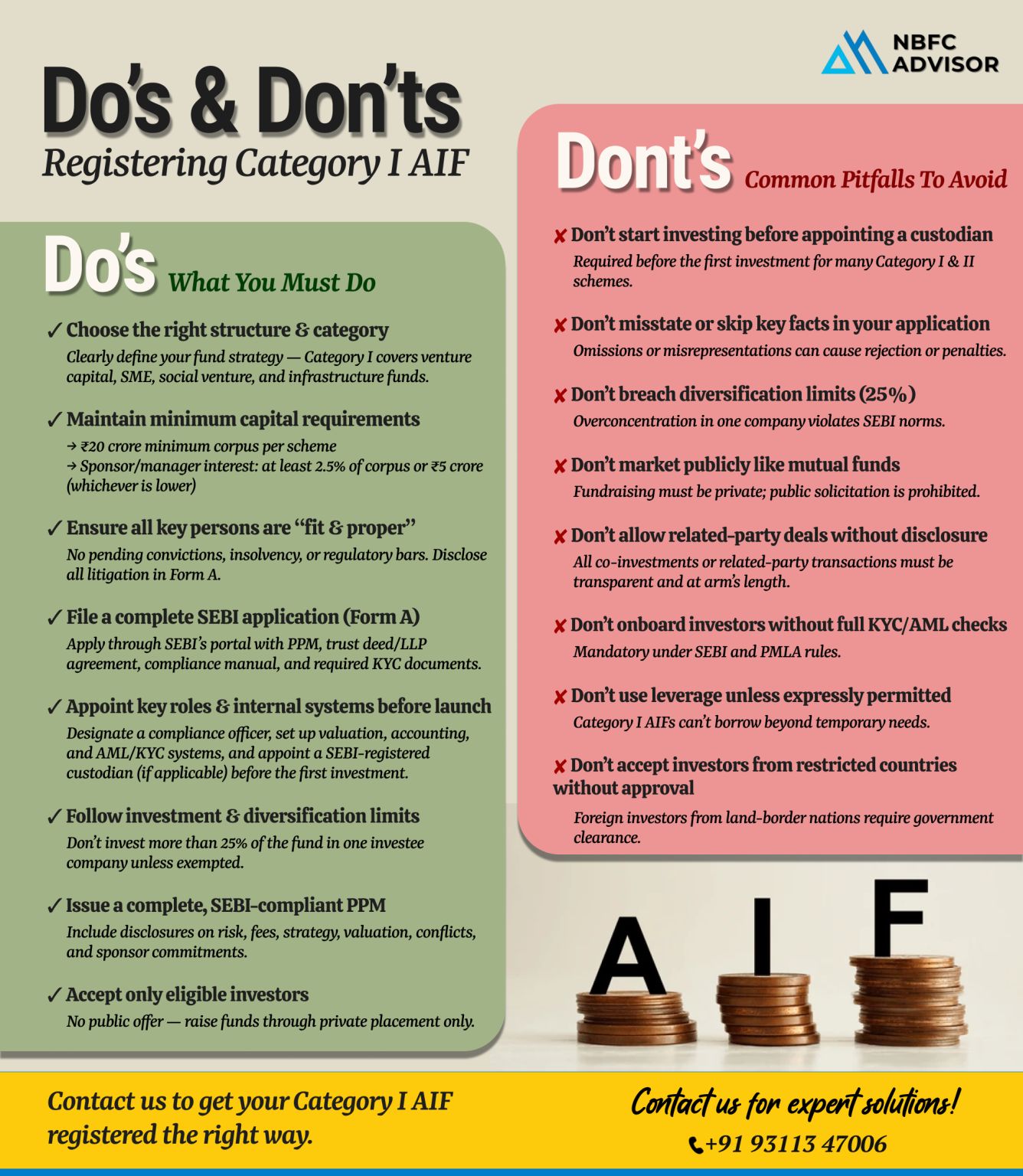

Top 10 Mistakes to Steer Clear of During AIF Registration

Registering an Alternative Investment Fund (AIF) with SEBI is a critical step toward launching a compliant and successful investment vehicle in India. However, many fund managers and promot...

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

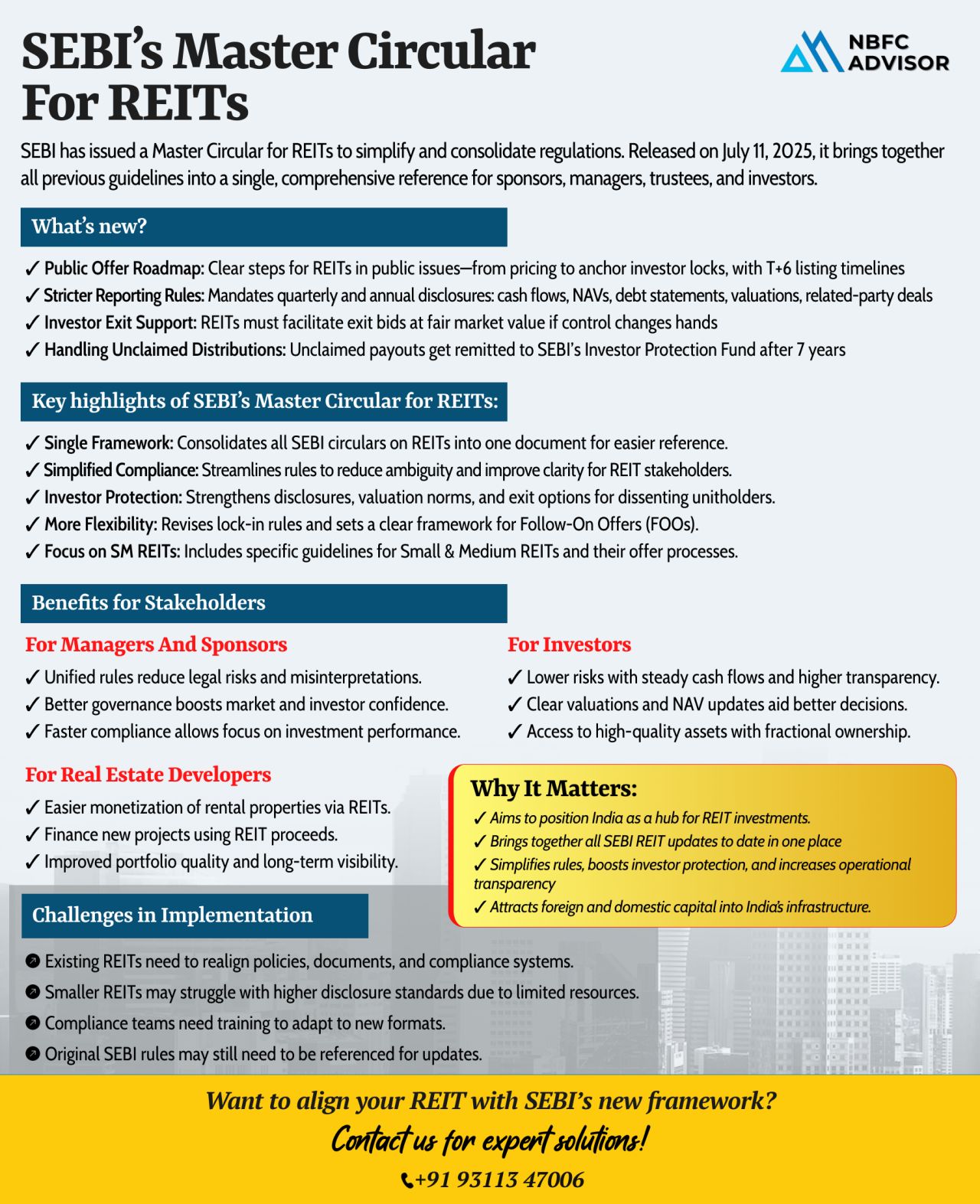

SEBI’s New Master Circular: A Landmark Move for India’s REIT Market

In a strategic step toward regulatory simplification and investor protection, the Securities and Exchange Board of India (SEBI) has released a comprehensive Master Cir...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

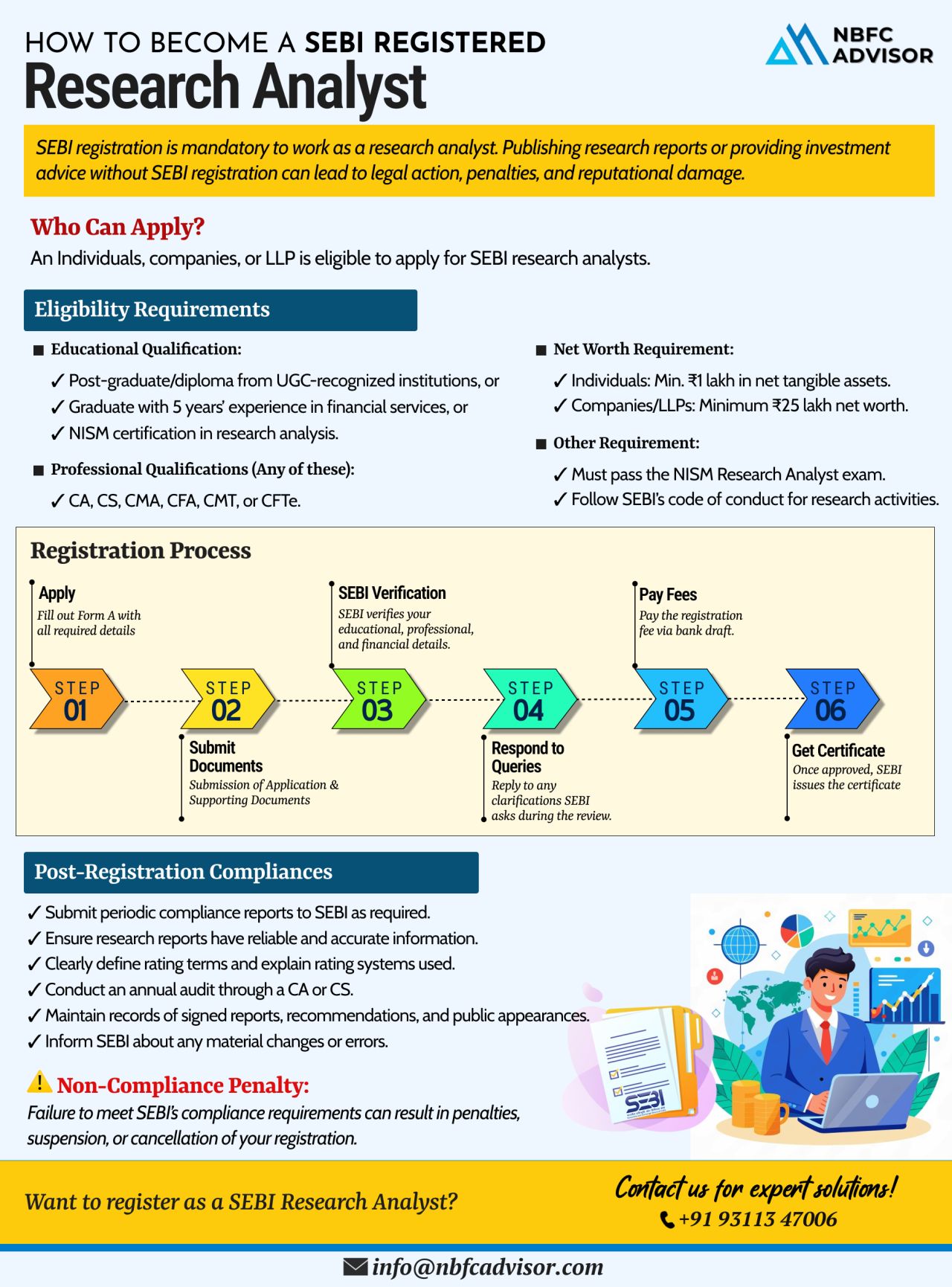

Publishing Research Reports Without SEBI Registration?

That’s a Shortcut to Penalties, Suspension & Reputational Damage

In India’s regulated financial ecosystem, publishing equity research or market analysis without SEBI registr...

📉 Is Your NBFC at Risk of RBI Action?

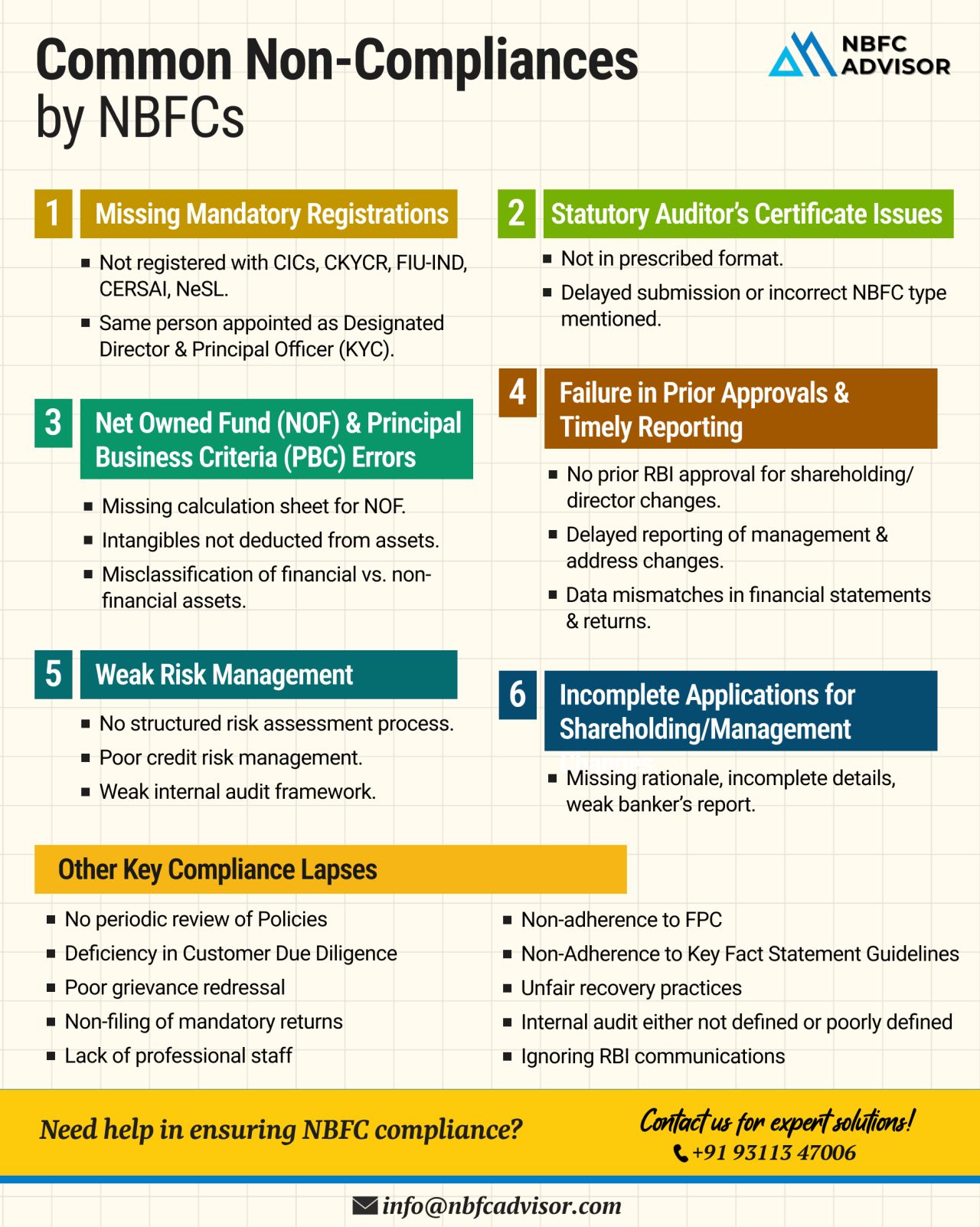

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

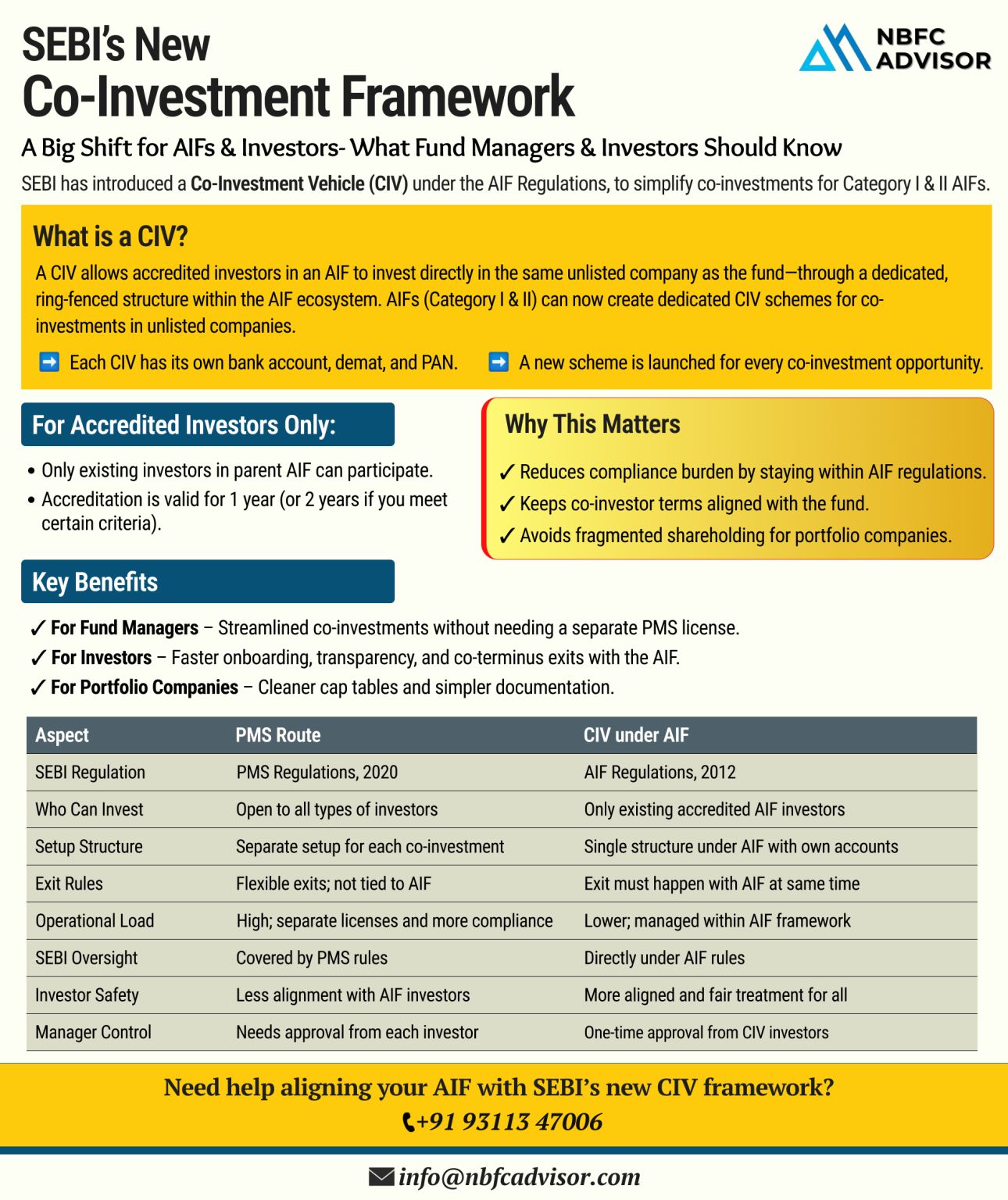

SEBI’s New Co-Investment Vehicle (CIV) Framework: A Game Changer for India’s Private Capital Market

In a major regulatory development, the Securities and Exchange Board of India (SEBI) has introduced the Co-Investment Vehicle (CIV) str...

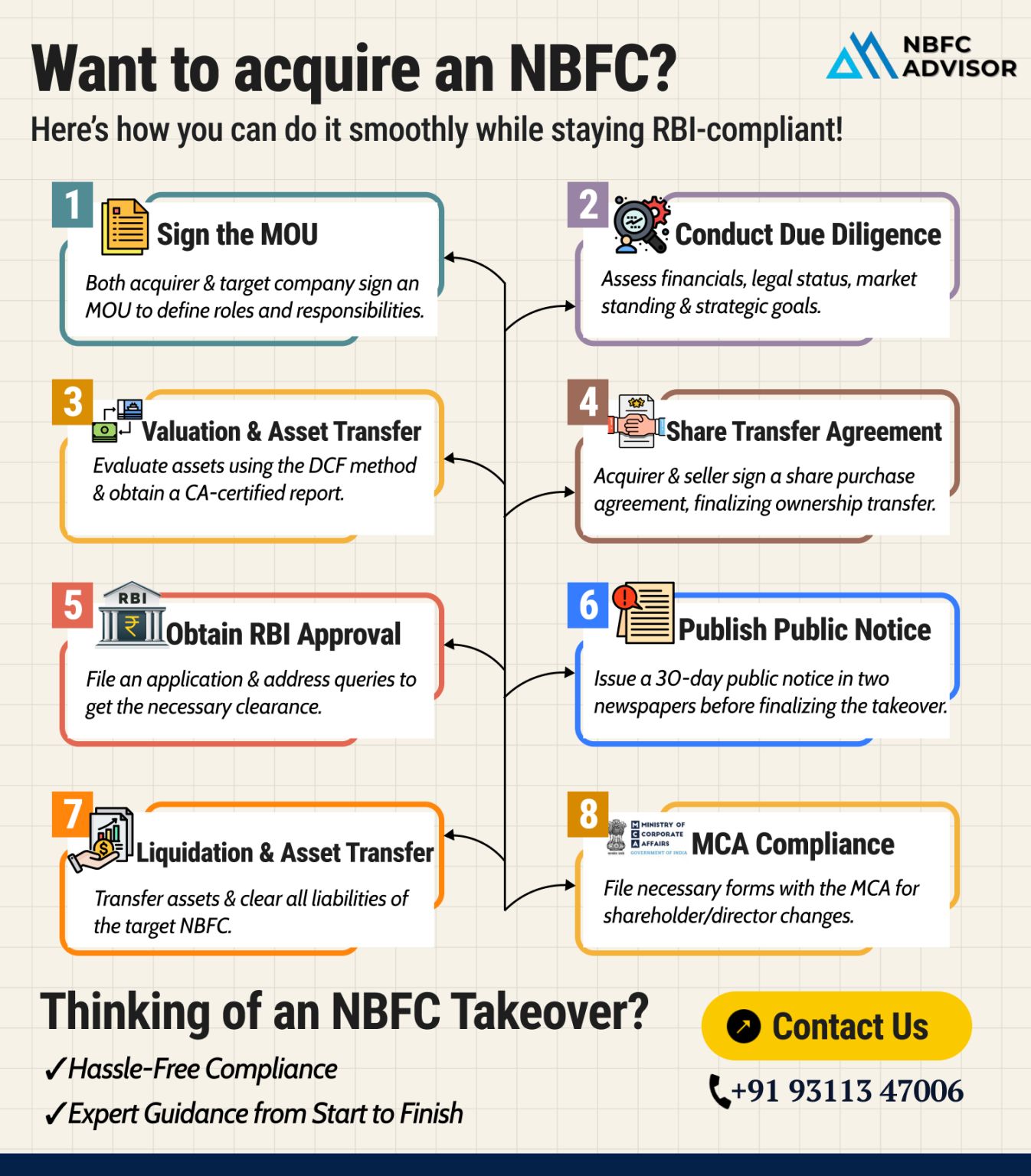

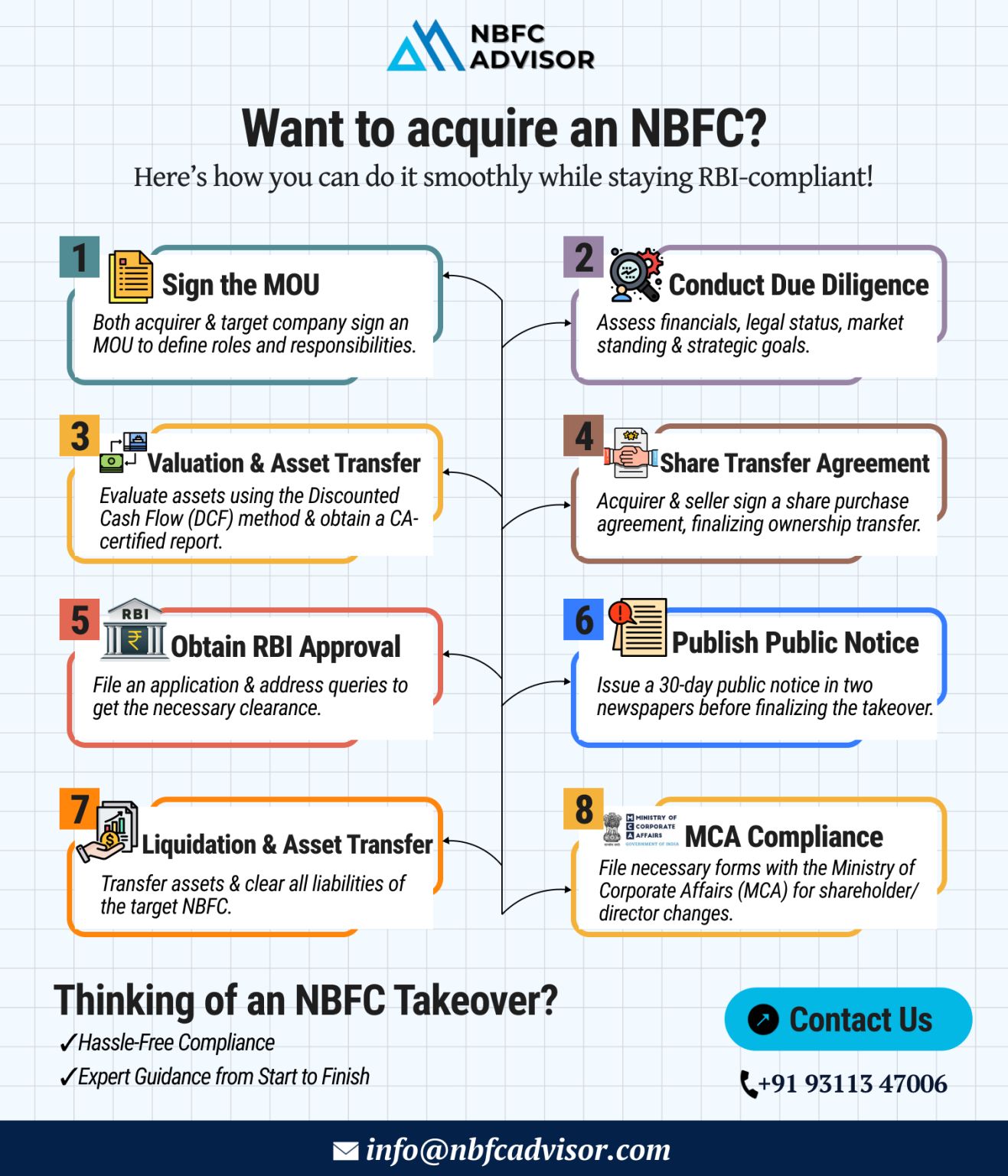

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐮𝐥𝐞𝐬 — 𝘈𝘳𝘦 𝘠𝘰𝘶𝘳 𝘖𝘱𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘴 𝘊𝘰𝘮𝘱𝘭𝘪𝘢𝘯𝘵?

India’s digital lending ecosystem is expanding at an unprecedented pace. But with rapid growth comes increasing...

📢 Attention NBFCs: Time to Align with RBI’s NOF Compliance Deadlines!

The Reserve Bank of India (RBI) is tightening regulations — and NBFCs need to act fast.

According to the RBI Master Direction – NBFC (Scale-Based Regulatio...

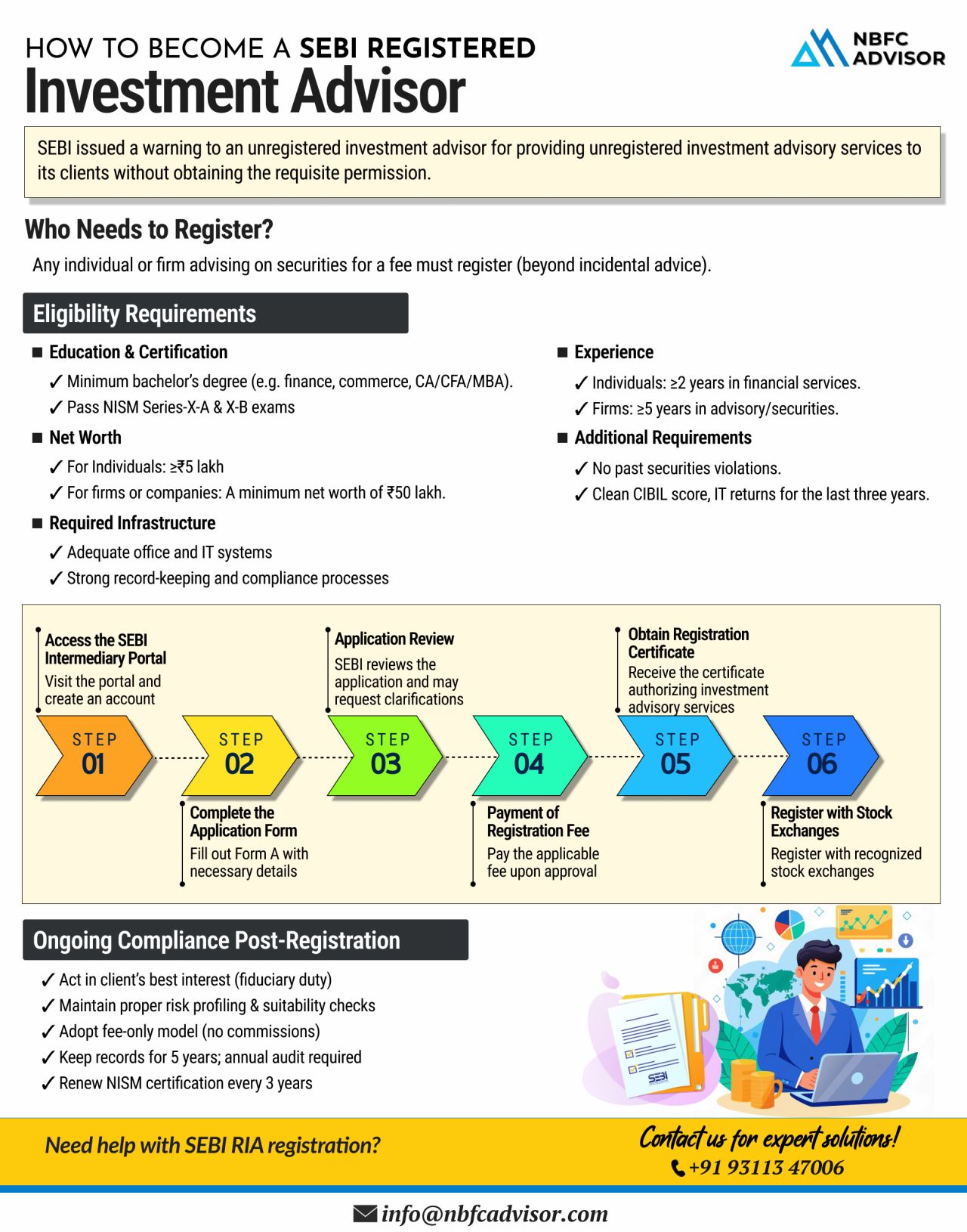

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This developm...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

In a landmark move towards enhancing transparency, efficiency, and digital convenience, the Securities and Exchange Board of India (SEBI) has made DigiLocker integration mandatory for all intermediaries.

This mandate is a significant step forward ...

Have you ever wondered how credit rating giants like CRISIL, ICRA, and CARE operate?

It’s not just about analyzing financial statements—it’s about aligning with SEBI’s stringent regulations and building a strong internal fr...

The NBFC (Non-Banking Financial Company) sector in India is witnessing rapid growth, offering immense opportunities for businesses looking to establish themselves in the financial landscape.

However, launching an NBFC requires strategic planning, ...

Acquiring a Non-Banking Financial Company (NBFC) can unlock exciting growth opportunities—but staying compliant with RBI regulations is non-negotiable.

Here’s how to acquire an NBFC the right way:

1️⃣ Sign the MoU

Define roles, res...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

In today’s competitive market, delayed payments can create major cash flow challenges—especially for Micro, Small, and Medium Enterprises (MSMEs). That’s where factoring steps in as a powerful financial solution.

What is Factor...

With over 190 million adults in India lacking a formal credit history, traditional credit scoring models fall short.

Alternative Credit Scoring taps into digital footprints—such as rent payments, utility bills, mobile transactions, and even ...

In the era of Open Finance, NBFC Account Aggregators (AA) are revolutionizing how financial data is shared, accessed, and utilized. If you're a fintech, NBFC, or financial service provider, an NBFC-AA license could be your key to unlocking a futu...

The RBI has recently canceled multiple NBFC registrations, leading to financial and operational disruptions. If your NBFC is affected, you have 30 days to appeal!

Key Reasons for Cancellation:

✔ Non-compliance with the RBI Act

✔ Inadequate cap...

Become a Leader in the Financial Sector with Expert Guidance

Are you looking to start your own Non-Banking Financial Company (NBFC) or FinTech Lending Company?

Our team of Consultants & Ex-Bankers will guide you every step of the way!

CO...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Digital lending is set to hit ₹5 TRILLION by FY28! 📈

With a 40% CAGR growth, the industry is expected to double its market share in India’s retail loan space in just four years.

And the best part? It’s just getting started!

What...

To combat rising cyber threats and protect consumers from online fraud, the Reserve Bank of India (RBI) has launched a dedicated domain—‘.bank.in’—exclusively for Indian banks. This initiative aims to establish a secure, relia...

At NBFC Advisor, we provide powerful tools to streamline your operations and enhance efficiency at every step. Whether you're in NBFC, Microfinance, Gold Loans, or Vehicle Loans, our tailored solutions have you covered!

Why Choose NBFC Advisor...

In a landmark move, the Karnataka government has strengthened its stance against the coercive recovery tactics used by Microfinance Institutions (MFIs). The latest draft of the Karnataka Microfinance (Prevention of Coercive Actions) Ordinance, 2025 i...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

In a significant move reinforcing its commitment to maintaining financial stability and consumer protection, the Reserve Bank of India (RBI) recently canceled the licenses of two non-banking financial companies (NBFCs) - Polytex India Ltd, based in M...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

The Reserve Bank of India (RBI) has introduced draft guidelines that aim to bring transparency and fairness to the digital lending space. These guidelines are specifically targeted at regulating Lending Service Providers (LSPs), previously known as l...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In the dynamic realm of Non-Banking Financial Companies (NBFCs), takeover processes play a crucial role in shaping market landscapes and strategic trajectories. Let’s delve into the intricacies of NBFC takeovers, exploring the reasons behind th...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

Are you an entrepreneur with a vision to venture into the financial sector in India? Are you looking to establish a Non-Banking Financial Company (NBFC) but unsure of where to begin? Look no further! In this article, we'll delve into the intricac...

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)