SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

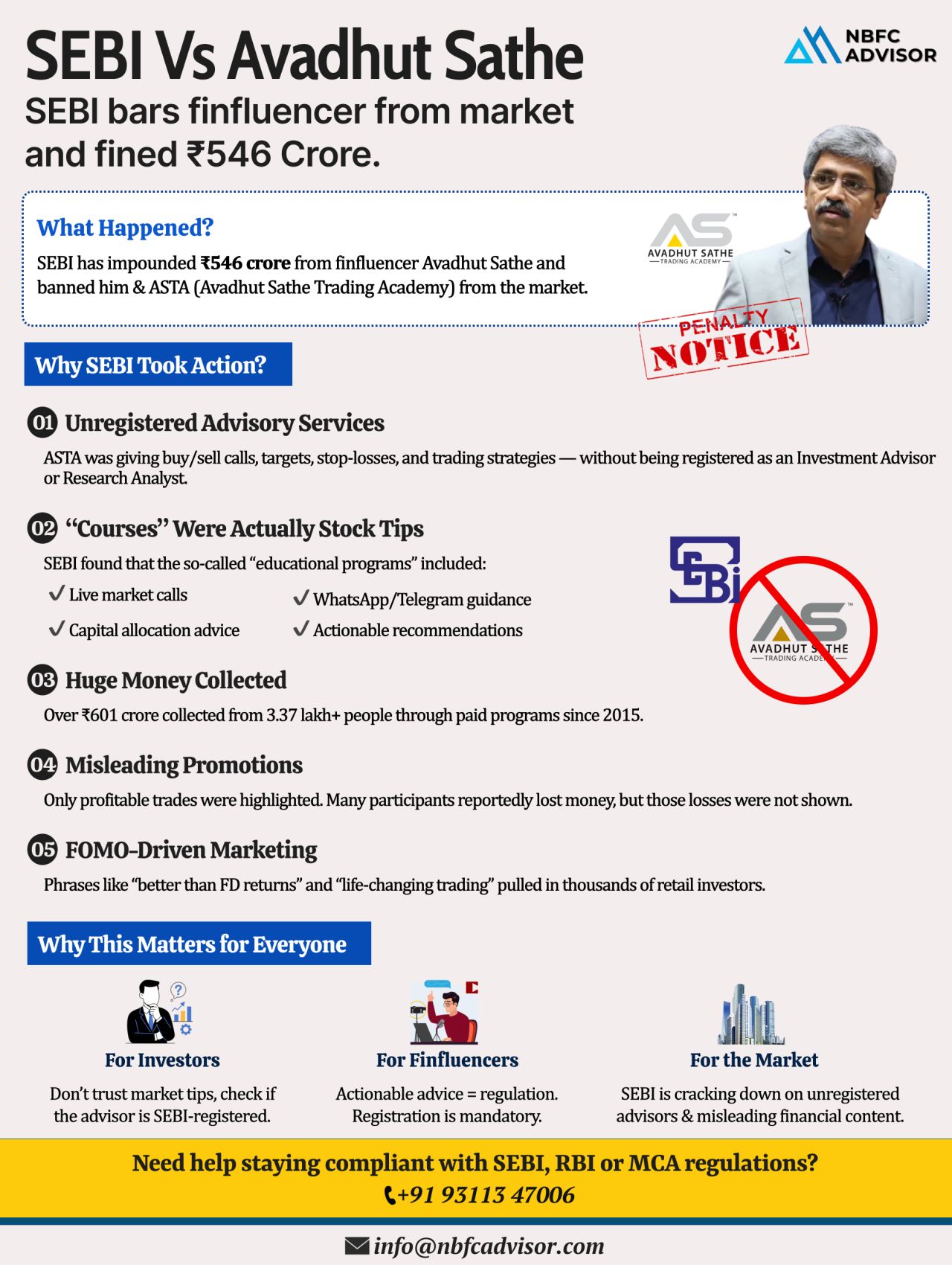

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe and his academy, ASTA. The move has sent shockwaves across the fintech, financial education, and advisory ecosystem.

This case clearly highlights one message from the regulator:

Compliance is not optional.

What Exactly Happened?

According to SEBI’s findings, ASTA collected nearly ₹600 crore from over 3.37 lakh individuals since 2015 under the guise of financial education.

However, SEBI observed that the activities went far beyond education.

What SEBI Found

SEBI’s investigation revealed several serious violations:

-

ASTA offered so-called “courses” that included

-

Live trading tips

-

Buy/sell recommendations

-

WhatsApp-based trading guidance

-

-

These activities qualify as investment advisory services, not education.

-

The advisory services were provided without SEBI registration, making them illegal.

-

Promotional material showcased only profitable trades, misleading investors.

-

A large number of participants reportedly suffered financial losses.

SEBI’s Action

As a result, SEBI has:

- Frozen ₹546 crore of collected funds

- Banned the individuals and entities from trading

- Prohibited them from providing investment advisory services

- Issued a show-cause notice with 21 days to respond

This is among SEBI’s most significant crackdowns on unregistered financial advisory operations.

Education vs Investment Advice: The Thin Line

This case reinforces a critical distinction:

✔ Financial education is allowed

✘ Unregistered investment advice is not

If your course, webinar, Telegram group, or WhatsApp channel includes:

- Stock-specific recommendations

- Entry/exit calls

- Profit assurances

you may fall under SEBI’s regulatory framework, regardless of how you label the service.

Why This Matters to Finfluencers & Finance Businesses

With the rapid growth of:

- Finfluencers

- Online trading academies

- Fintech platforms

- Portfolio and advisory services

SEBI is tightening scrutiny. Non-compliance can now result in:

- Fund freezes

- Trading bans

- Heavy penalties

- Permanent reputational damage

Compliance Is No Longer Optional

Running a finance academy, advisory firm, or fintech platform requires:

- Correct SEBI registration

- Clear content boundaries

- Proper disclosures

- Ongoing regulatory compliance

Ignoring these requirements can cost crores—and your business.

How We Can Help

We help finance businesses:

- Assess whether their activities require SEBI registration

- Structure offerings to remain compliant

- Obtain necessary approvals and licenses

- Avoid regulatory penalties and enforcement actions

📩 DM us for a quick compliance check and expert guidance.

Hashtags

#NBFCAdvisor #FinancialEducation #Compliance #SEBIRegulations #InvestmentAdvice

#Fintech #NBFC #RBI #RegulatoryCompliance