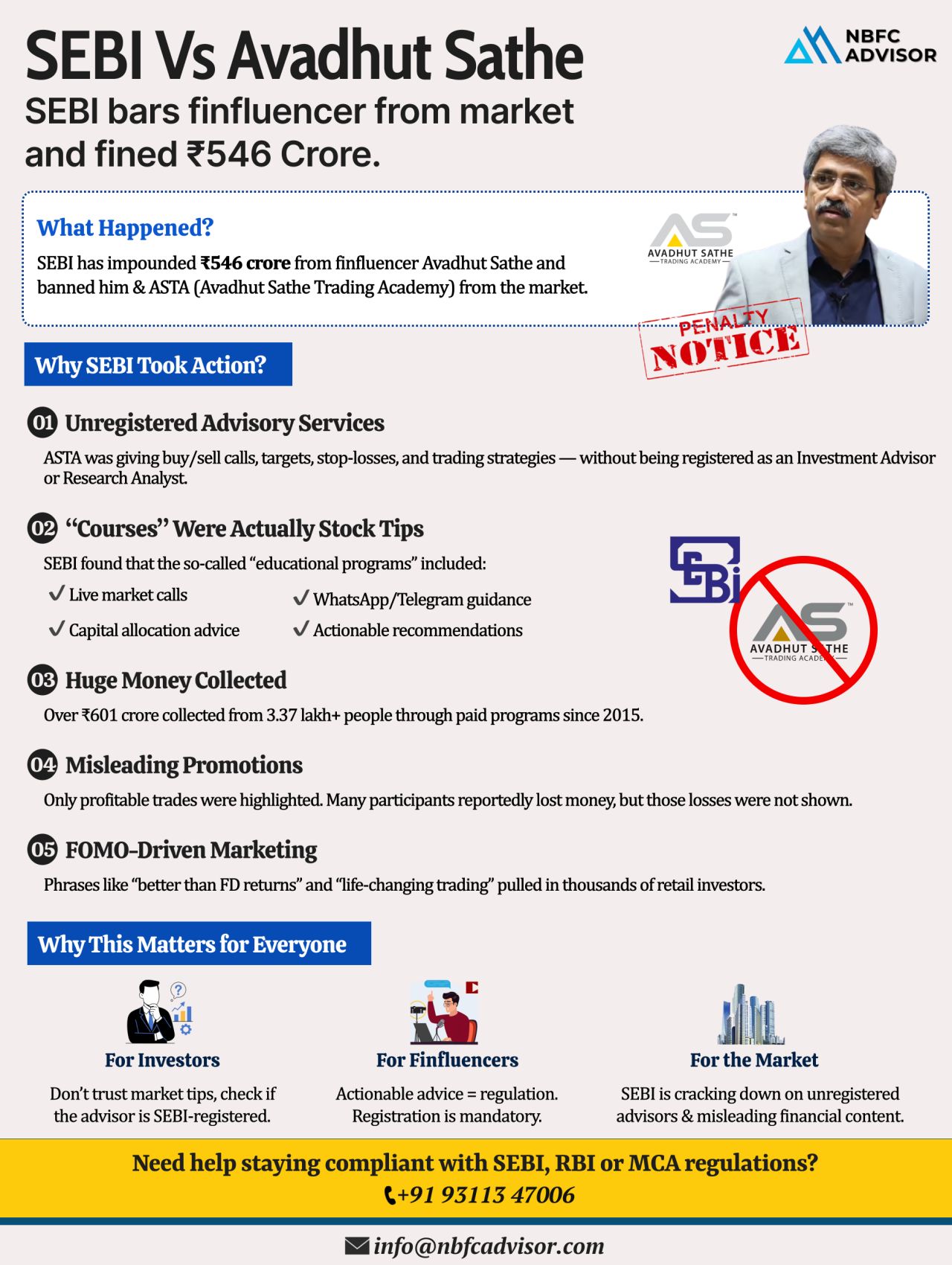

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

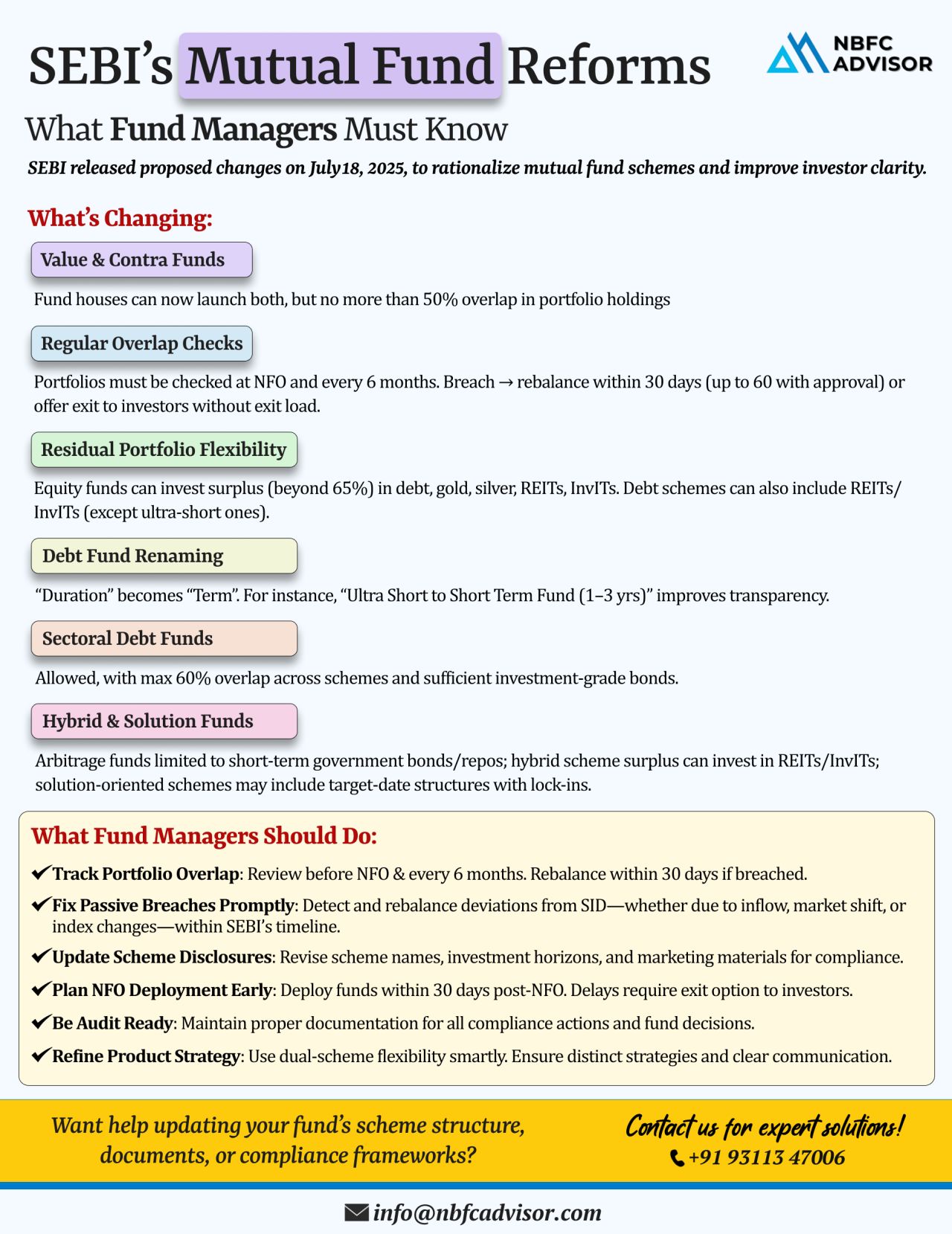

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

The Reserve Bank of India (RBI) has issued a directive that could significantly reshape how Non-Banking Financial Companies (NBFCs) and fintechs collaborate in the digital lending space.

Key Update

NBFCs can no longer rely on Default Loss Guara...

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

The International Financial Services Centres Authority (IFSCA) has introduced key updates to its Fund Management Regulations, 2022, effective February 19, 2025. These revisions align with the December 2024 proposals and bring significant changes for ...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

In the dynamic landscape of Non-Banking Financial Companies (NBFCs), the right guidance can make all the difference. This blog unveils the comprehensive support and expertise offered by NBFC Advisor, empowering financial entities to not only thrive b...

Rules.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)