Why GIFT City? India’s Fastest-Growing Financial Gateway for NBFCs

India’s financial landscape is changing rapidly—and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Increasingly, NBFCs, banks, fintechs, and global financial institutions are shifting operations to GIFT City.

The reason is simple: GIFT City offers flexibility, tax efficiency, and global reach that the domestic system cannot match.

What Makes GIFT City Different?

GIFT City operates as an International Financial Services Centre (IFSC) regulated by the International Financial Services Centres Authority (IFSCA). Unlike traditional Indian financial jurisdictions, IFSCs are designed for cross-border business and global finance.

This makes GIFT City a powerful alternative to offshore hubs like Singapore or Dubai.

Key Advantages of Setting Up in GIFT City

1. Lower Compliance Burden

Regulatory requirements under IFSCA are simpler and more business-friendly compared to domestic RBI and SEBI frameworks, especially for international operations.

2. 10-Year Tax Holiday & Major Exemptions

Entities in GIFT City enjoy:

- 100% tax exemption for 10 consecutive years

- No capital gains tax on certain transactions

- Exemptions on dividend distribution and MAT

This significantly improves profitability.

3. Single-Window Regulation

Instead of dealing with multiple regulators, GIFT City entities are governed by IFSCA as a single authority, reducing regulatory overlap and approval delays.

4. Freedom to Operate in Foreign Currency

NBFCs in GIFT City can:

- Operate in USD, EUR, GBP, and other foreign currencies

- Undertake cross-border lending and financing

- Serve global clients seamlessly

This is a major advantage for international business expansion.

5. Lower Operating Costs

Compared to global financial hubs like Singapore or Dubai, GIFT City offers:

- Lower office and infrastructure costs

- Competitive talent costs

- Reduced compliance-related expenses

6. World-Class Infrastructure & Talent Access

GIFT City provides:

- Modern office spaces

- Advanced digital infrastructure

- Access to India’s strong finance and technology talent pool

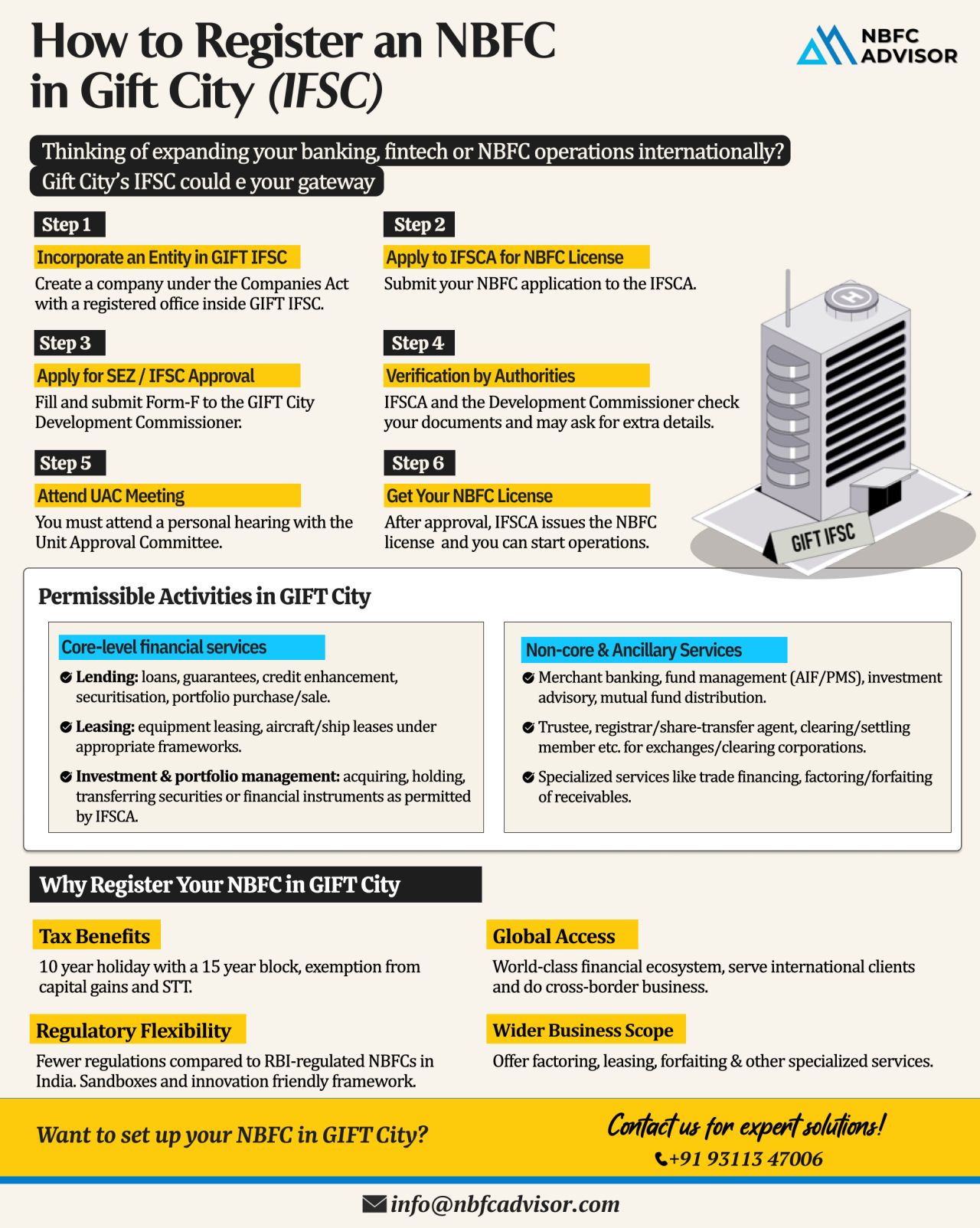

Simple & Structured Registration Process

Setting up in GIFT City is far more streamlined than many expect. The process typically includes:

- Incorporating an entity in the IFSC

- Applying to IFSCA with a business plan

- Appearing before the Unit Approval Committee (UAC)

- Receiving the operational license

With proper guidance, the process is efficient and predictable.

Growing Confidence from Major Institutions

- PFC became the first government-owned NBFC to establish operations in GIFT City

- Global banks such as HSBC and MUFG are expanding large-scale lending operations in the IFSC

These developments reflect strong confidence in GIFT City’s regulatory and economic framework.

GIFT City Is India’s Global Financial Hub

GIFT City is no longer a future vision—it is actively shaping India’s role in global finance. For NBFCs, moving early means:

- Regulatory clarity

- Cost efficiency

- International expansion opportunities

- Long-term competitive advantage

Need Help Setting Up Your NBFC in GIFT City?

From entity structuring and IFSCA registration to compliance and licensing support, we help NBFCs establish and scale operations in GIFT City smoothly.

📩 DM us to start your GIFT City journey with complete compliance support.

#NBFCAdvisor #NBFC #GIFTCity #IFSCA #Fintech

#Banking #Compliance #SEZ #FinancialServices