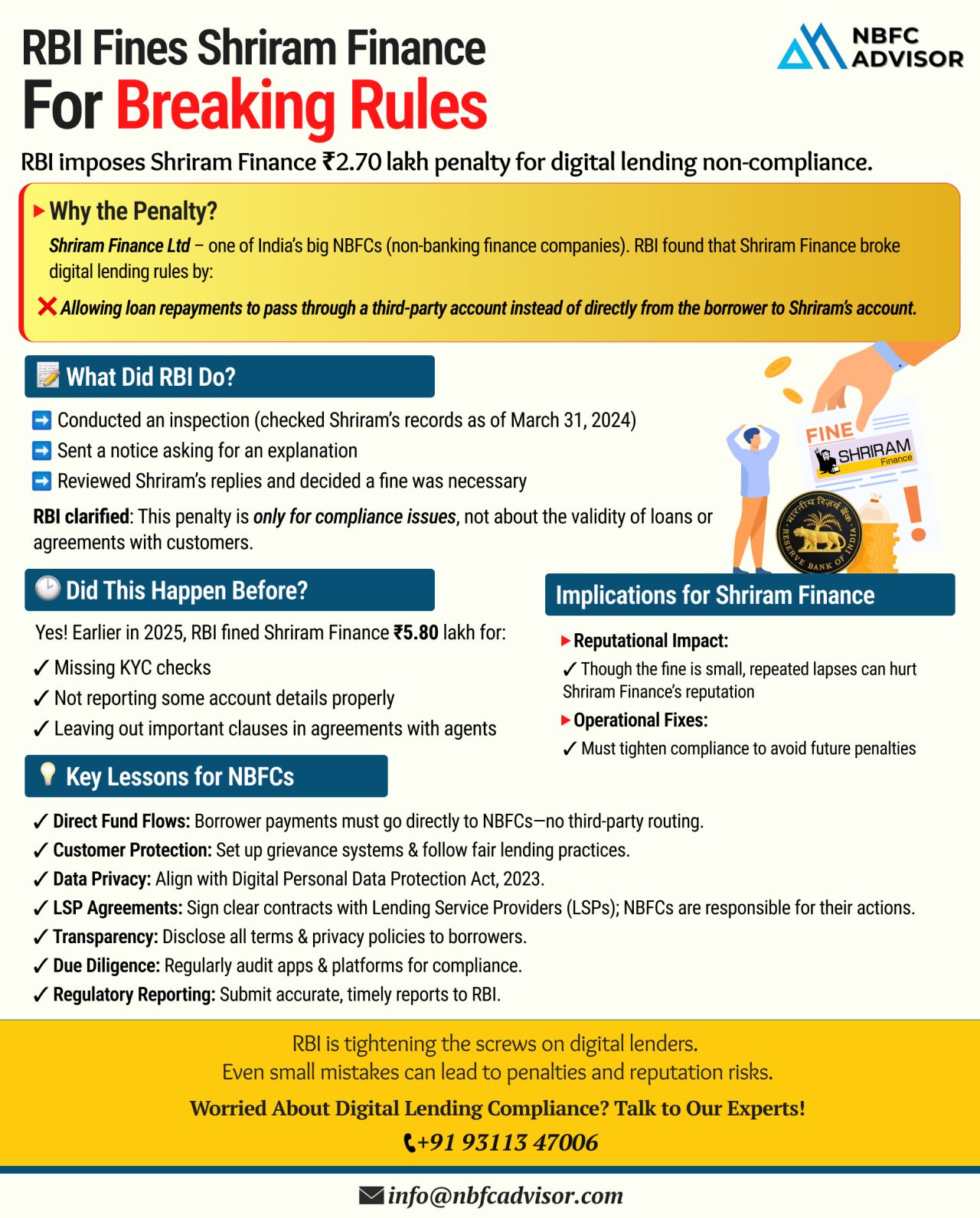

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. This penalty sends a clear message to NBFCs and fintech companies across the country—compliance is non-negotiable.

What Triggered the Fine?

Shriram Finance allowed borrowers to make repayments via a third-party account instead of directly depositing the funds into the company’s official account. This is a direct violation of RBI’s digital lending norms.

RBI’s Key Rules on Digital Lending:

-

Repayments must go directly from the borrower to the lender

-

Third-party involvement is strictly prohibited

-

All fund flows must be fully transparent and trackable

Such violations, even if unintentional, can attract serious regulatory consequences.

The Bigger Picture: Why This Matters

As digital lending continues to expand rapidly, RBI is increasing its vigilance. Even small gaps in processes—like unmonitored loan service providers or unclear fund flows—can lead to fines, audits, and reputational harm.

Action Points for NBFCs & Fintechs

To steer clear of compliance risks, companies must:

🔍 Review internal systems to ensure alignment with RBI norms

🔍 Closely monitor LSPs and any third-party involvement

🔍 Audit fund transfers to verify direct borrower-to-lender payments

🔍 Keep up with RBI updates, as guidelines are frequently evolving

Too Harsh or Justified?

Some in the fintech space believe the rules are overly strict. But from RBI’s perspective, these controls are crucial to protect borrowers and build trust in the digital finance ecosystem. It’s better to be safe—and compliant—than sorry.

Stay Compliant, Stay Ahead

We help NBFCs and fintechs remain 100% compliant with RBI’s digital lending framework—so you can avoid costly penalties and grow with confidence.

📞 Book a free consultation: +91 93113 47006