Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

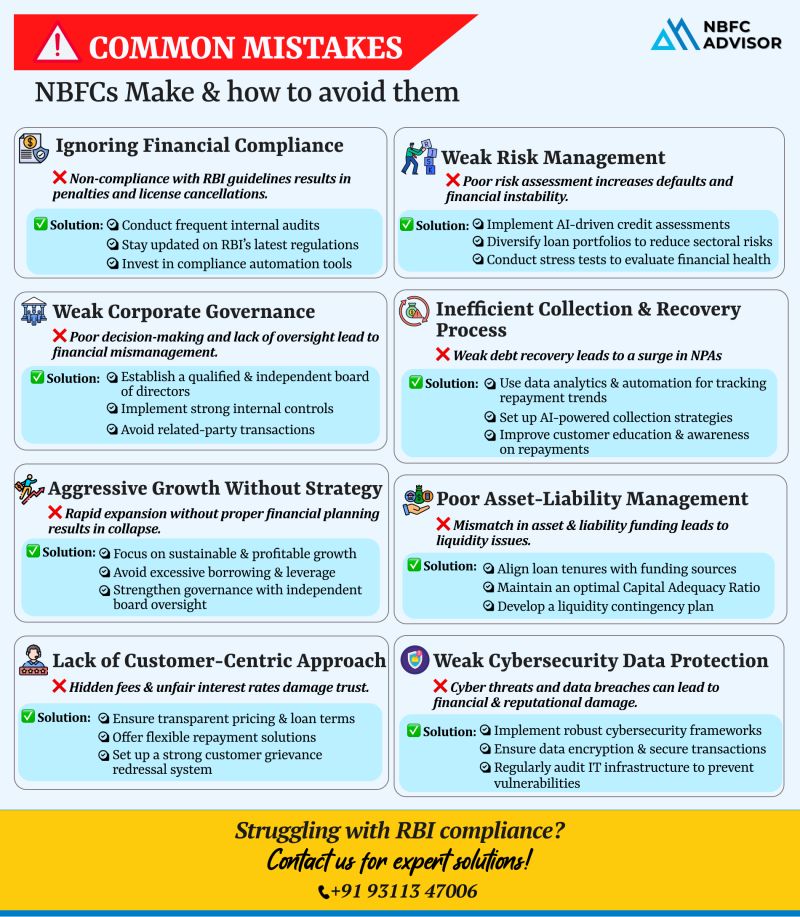

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

RBI Is Cracking Down on NBFCs — Is Your Company Compliance-Ready?

The Reserve Bank of India (RBI) has intensified its scrutiny of Non-Banking Financial Companies (NBFCs)—and the message is loud and clear: compliance is no longer negoti...

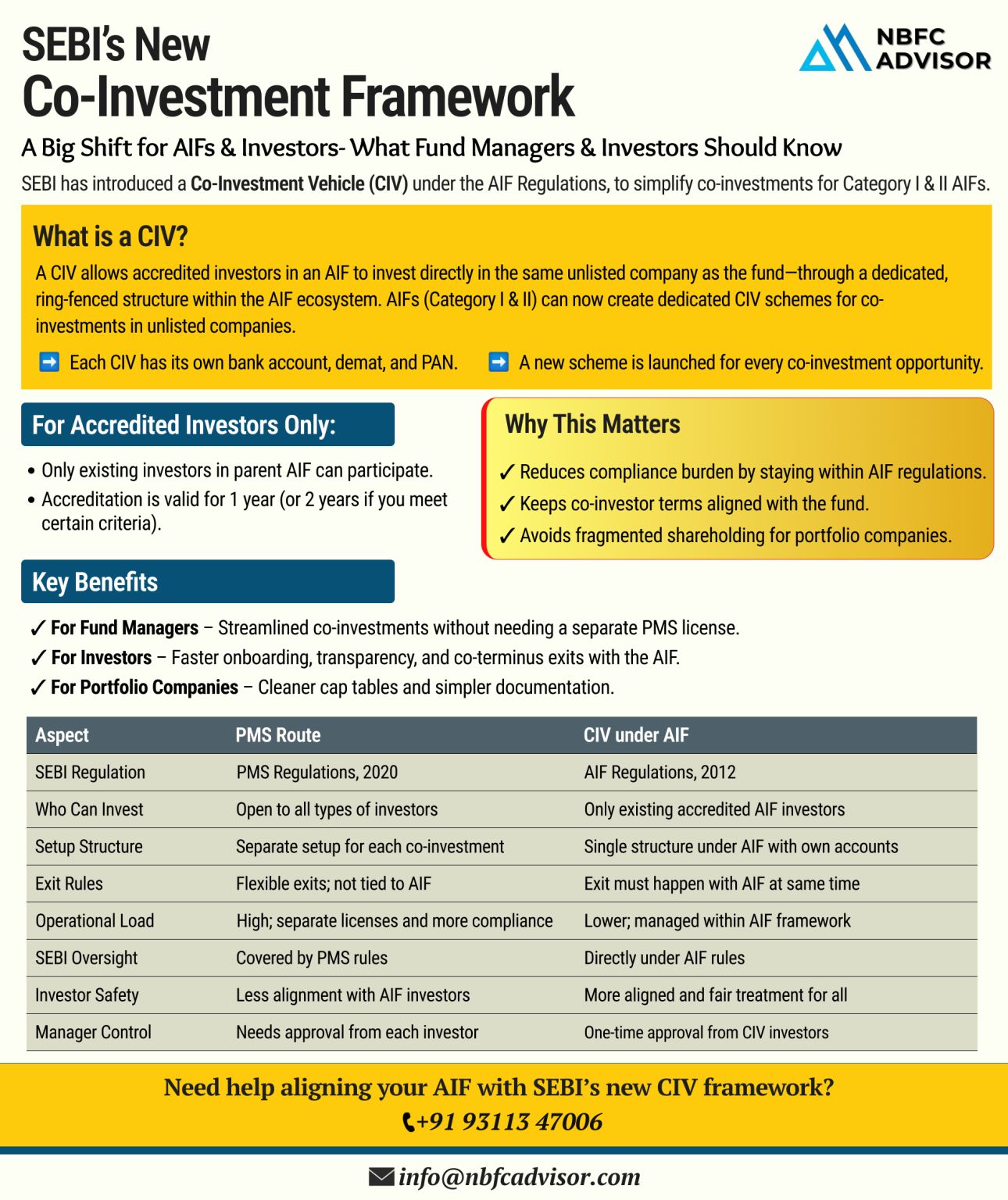

SEBI’s New Co-Investment Vehicle (CIV) Framework: A Game Changer for India’s Private Capital Market

In a major regulatory development, the Securities and Exchange Board of India (SEBI) has introduced the Co-Investment Vehicle (CIV) str...

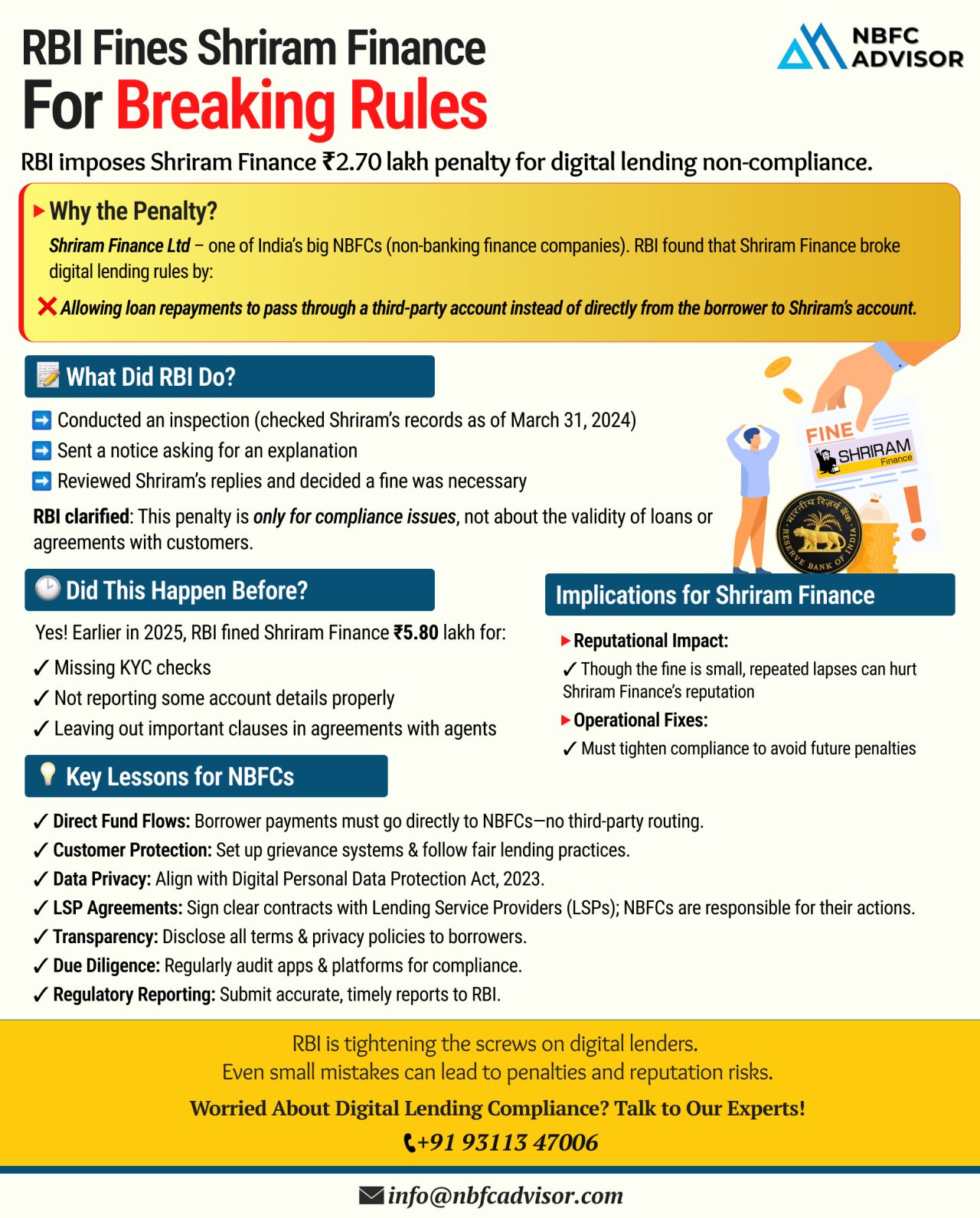

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

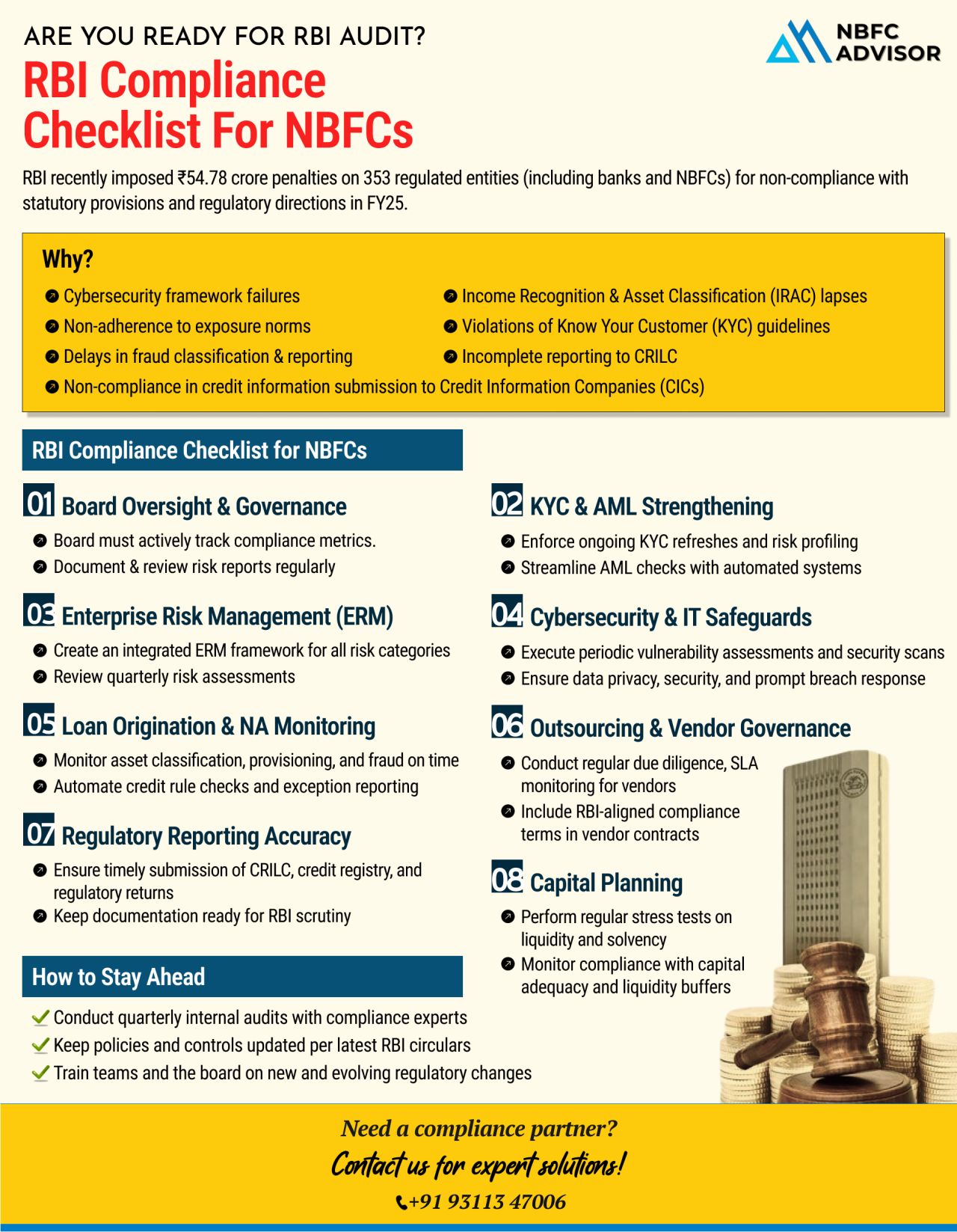

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

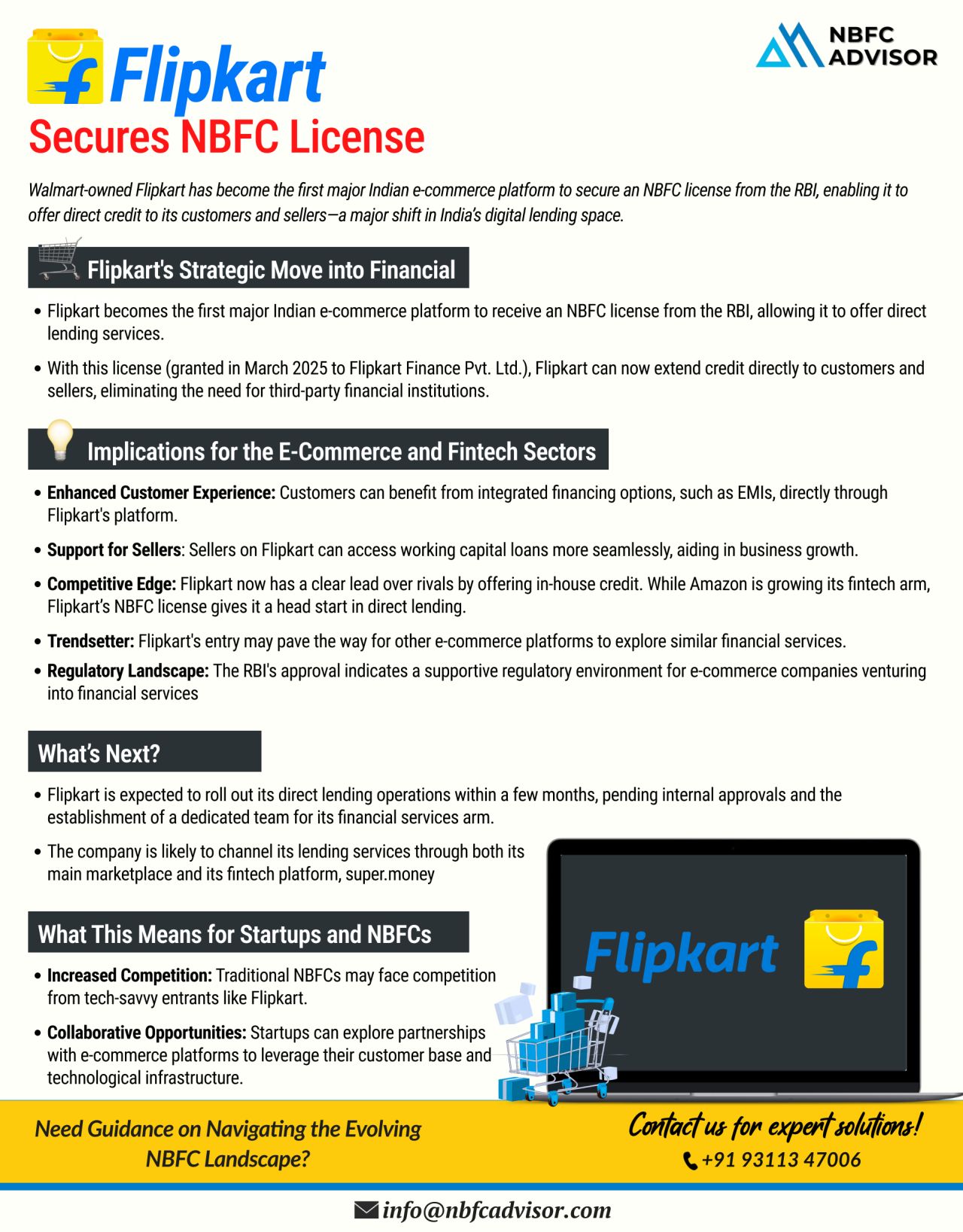

Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This developm...

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

The LendingTech sector in India is witnessing rapid growth, driven by the rising demand for digital lending solutions that target unbanked and underserved populations. This article delves into how LendingTech startups are differentiating themselves, ...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

The fintech industry is experiencing an unprecedented evolution, driven by groundbreaking innovations that are transforming how we manage, invest, and think about money. From artificial intelligence to blockchain, the financial landscape is being red...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

.jpeg)

.jpeg)

.jpeg)

.jpeg)