RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovation, the Reserve Bank of India (RBI) has introduced a detailed framework for Payment Aggregators (PAs) that strengthens compliance, enhances customer safety, and ensures smoother financial operations.

Why It Matters

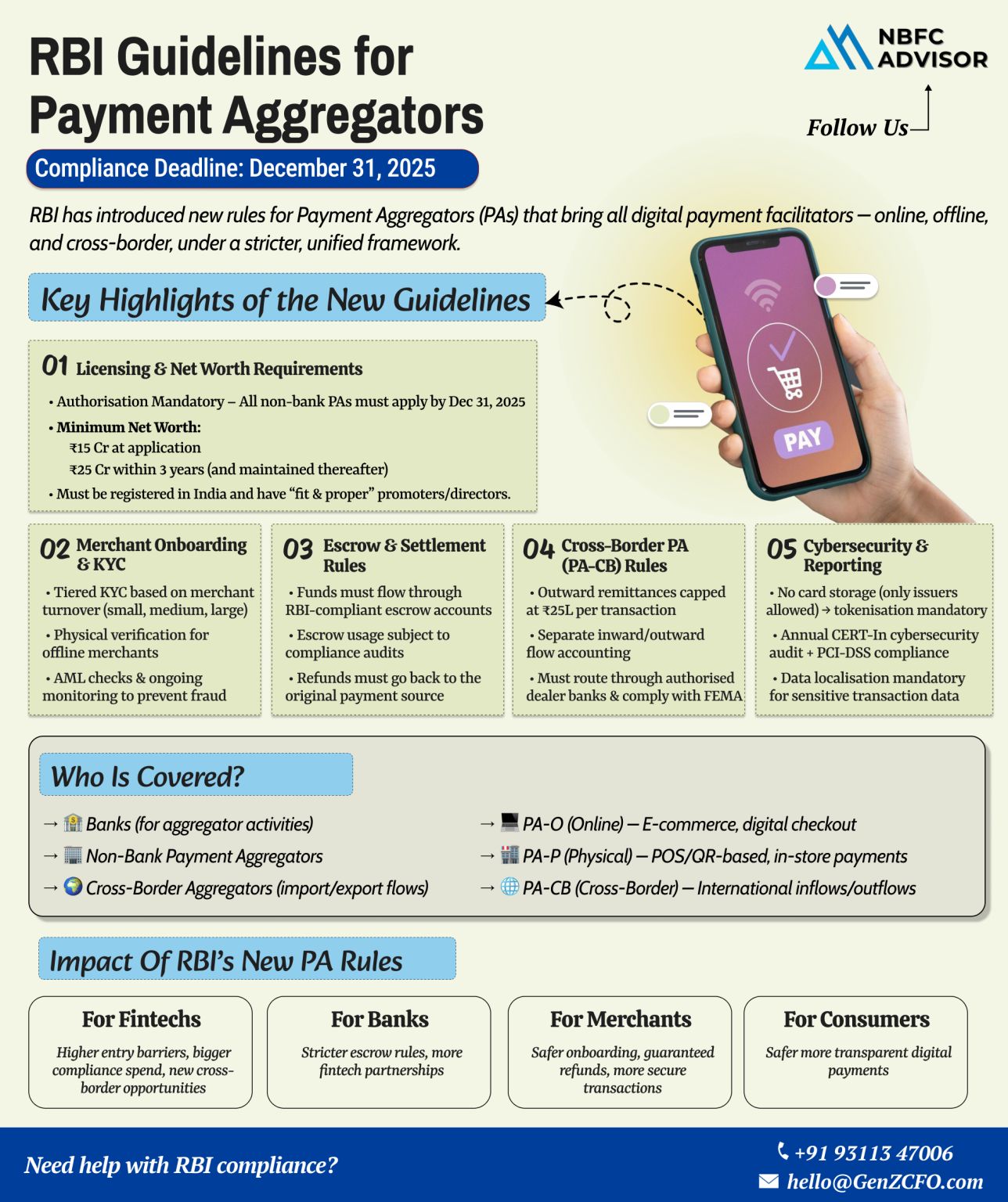

The RBI’s updated PA framework aims to bring transparency, accountability, and uniformity across all payment players. Here’s what’s changing:

✅ Clear Categorization of PAs – Distinction between existing and new Payment Aggregators for faster and more structured approval processes.

✅ Stricter Merchant Onboarding – Enhanced due diligence and KYC checks to prevent fraud and money laundering.

✅ Escrow Account Regulations – Mandatory escrow mechanisms to protect consumer funds and ensure timely settlements.

✅ Unified Framework for Domestic & Cross-Border Flows – A single, standardized set of rules for both local and international transactions.

What It Means for You

The new RBI framework impacts every stakeholder in the payments ecosystem:

💼 For Businesses:

Easier onboarding, faster settlements, and improved transparency while dealing with regulated PAs.

💳 For Consumers:

More secure, compliant, and trustworthy digital payment experiences with fund protection and clear refund timelines.

🚀 For Fintechs:

A strong compliance roadmap is now essential — from licensing and net worth criteria to escrow audits, data localization, and periodic reporting. Innovation must now align closely with regulatory expectations.

RBI’s Key Requirements for PAs

-

Minimum net worth of ₹15 crore, increasing to ₹25 crore within 3 years.

-

Escrow account maintenance with scheduled commercial banks.

-

Annual system audits by CERT-IN empaneled auditors.

-

Data localization — all transaction data to be stored within India.

-

Customer grievance redressal framework for timely dispute resolution.

This approach is not just about regulation — it’s about building trust and resilience in India’s fintech ecosystem.

Is Your Business Ready for RBI’s New PA Framework?

At Induce India, we help fintechs and payment startups navigate RBI’s regulatory requirements — from Payment Aggregator Licensing to NBFC registration and compliance audits.

📞 Contact us for a free consultation: +91 93113 47006

💼 Email: info@induceindia.com

#NBFCAdvisor #RBI #PaymentAggregator #Fintech #DigitalPayments #RBIUpdates #Compliance #NBFC #FinancialRegulation #InduceIndia