India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

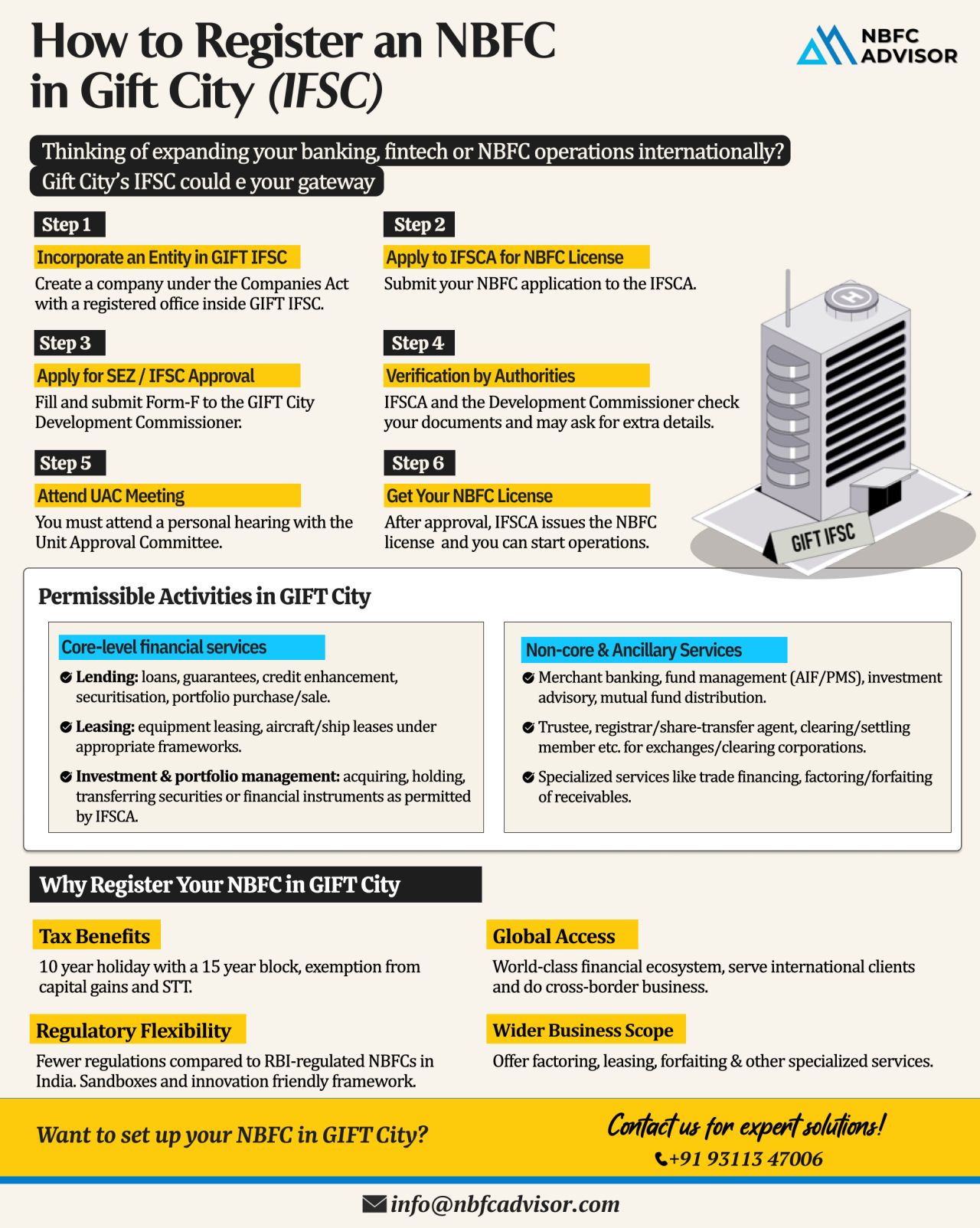

Why GIFT City? India’s Fastest-Growing Financial Gateway for NBFCs

India’s financial landscape is changing rapidly—and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Increasingly, NBFC...

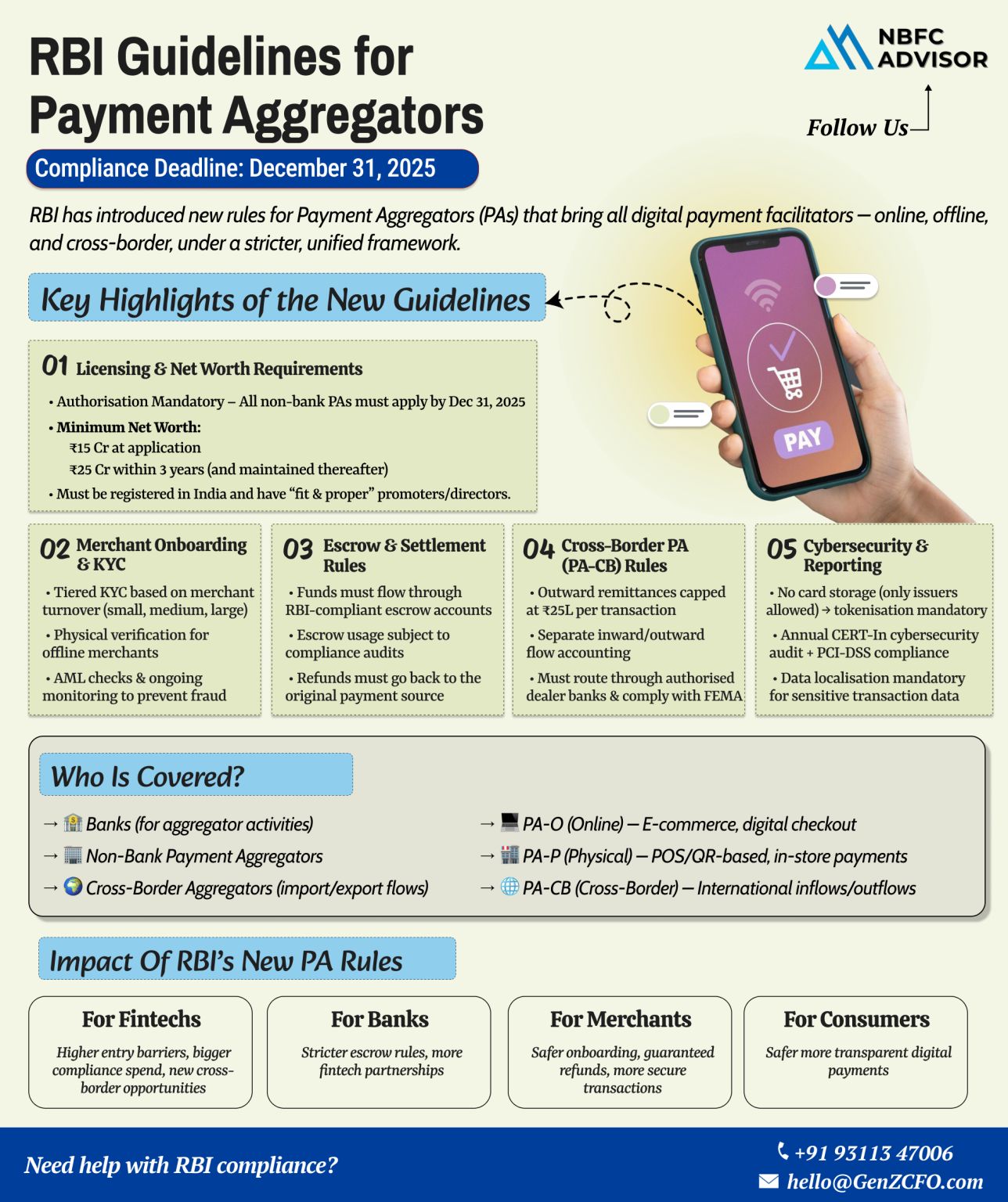

RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovatio...

Thinking of Starting a Digital Lending Business? Here’s What You Should Know

India’s credit ecosystem is undergoing a digital revolution. By 2030, the country’s digital lending market is projected to reach $515 billion — al...

Why Many NBFC Applications Get Rejected by the RBI — And How to Avoid It

Applying for an NBFC (Non-Banking Financial Company) license from the Reserve Bank of India (RBI) is an exciting step for any finance or fintech entrepreneur. However, ...

Why Are NBFCs Turning to Loan Against Property (LAP)?

India’s Non-Banking Financial Companies (NBFCs) are entering a new growth phase — and Loan Against Property (LAP) is leading the way.

The Shift Toward Secure, Reliable, and Scala...

Getting an IRDAI Corporate Agency License? Don’t Make These Costly Mistakes

If your company, LLP, or bank is planning to sell or distribute insurance policies—whether it’s life, health, or motor insurance—you’ll...

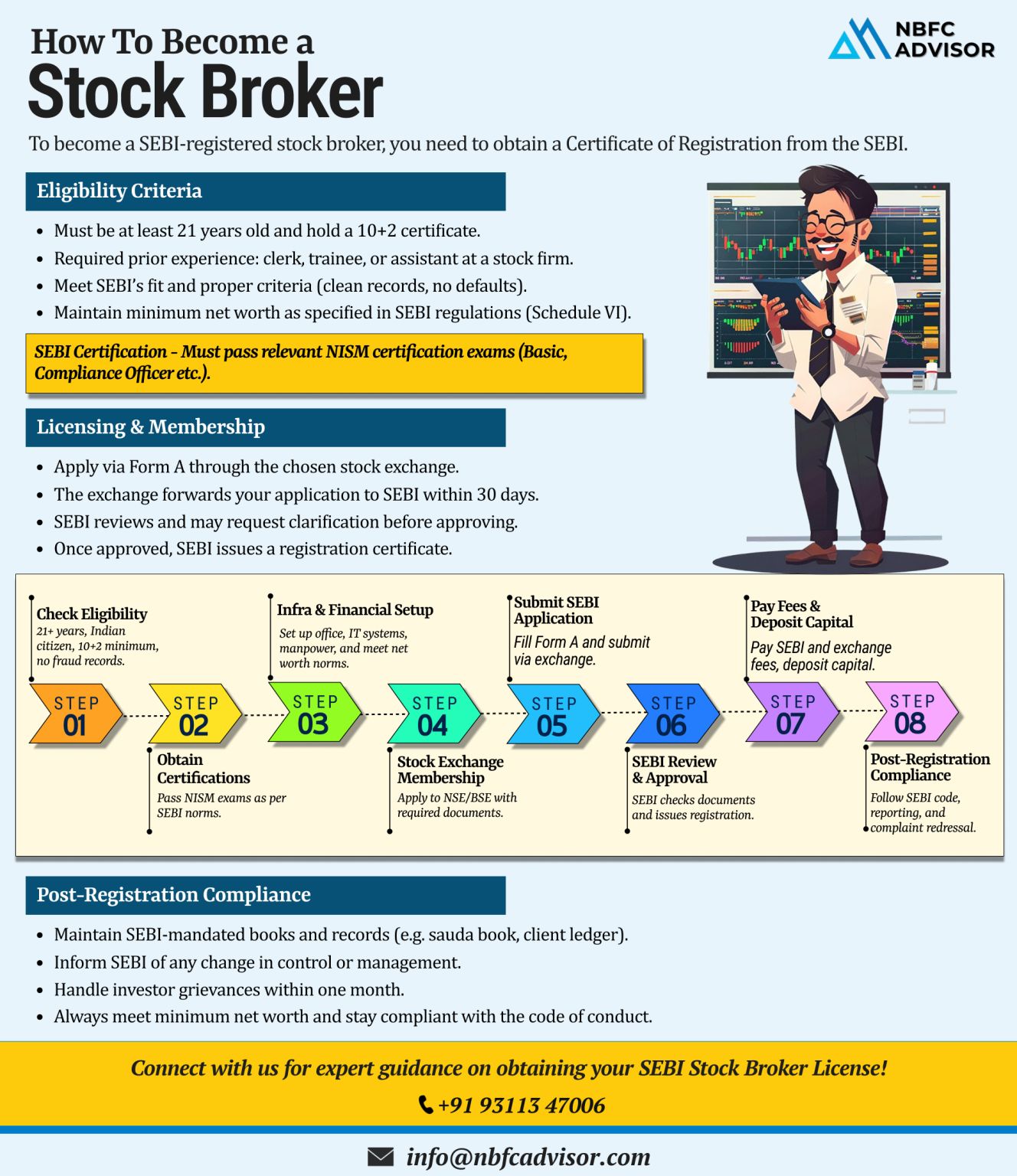

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

Dreaming of Launching Your NBFC?

Avoid These Top 5 Pitfalls to Secure Your RBI License!

Setting up a Non-Banking Financial Company (NBFC) in India can be a game-changer—but getting the RBI license is where many dreams hit a wall. Each yea...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

India’s fintech and lending ecosystem is evolving at a rapid pace. As a result, more entrepreneurs, family offices, and investors are exploring the Non-Banking Financial Company (NBFC) route to tap into new opportunities in the financial sector...

The NBFC (Non-Banking Financial Company) sector in India is witnessing rapid growth, offering immense opportunities for businesses looking to establish themselves in the financial landscape.

However, launching an NBFC requires strategic planning, ...

India’s NBFC sector is expanding rapidly — but regulatory hurdles, compliance requirements, and operational complexities can slow down even the most promising ventures.

That’s where we come in.

We offer end-to-end support for ...

India’s NBFC sector is projected to reach ₹60 trillion by FY26—now is the perfect time to enter the market.

Why Start an NBFC?

✔ Fintech NBFCs are growing rapidly

✔ Huge demand in credit-deprived sectors

✔ Faster loan disbursals t...

Become a Leader in the Financial Sector with Expert Guidance

Are you looking to start your own Non-Banking Financial Company (NBFC) or FinTech Lending Company?

Our team of Consultants & Ex-Bankers will guide you every step of the way!

CO...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

Are you an entrepreneur with a vision to venture into the financial sector in India? Are you looking to establish a Non-Banking Financial Company (NBFC) but unsure of where to begin? Look no further! In this article, we'll delve into the intricac...

.jpeg)

.jpeg)

.jpeg)

.jpeg)