SEBI Eases the Way for PMS Transfers — A New Era of Flexibility and Transparency

Until recently, transferring a Portfolio Management Services (PMS) business in India was almost impossible.

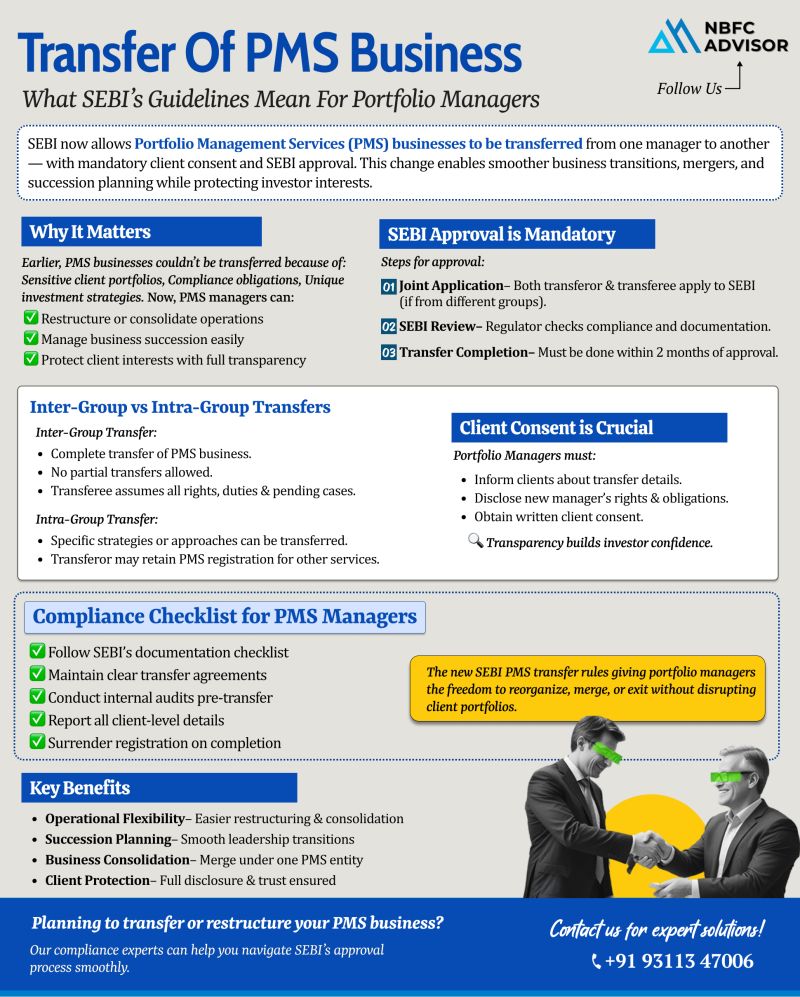

However, with SEBI’s new framework, the process has now become structured, time-bound, and transparent, opening up smoother opportunities for portfolio managers to restructure, merge, or transfer their businesses without disrupting client confidence.

🔍 What’s New Under SEBI’s PMS Transfer Guidelines?

The Securities and Exchange Board of India (SEBI) has issued a clear set of rules governing how PMS transfers can be carried out — ensuring investor protection and operational clarity for portfolio managers.

Here are the key highlights of the new framework:

✅ SEBI approval is mandatory before any transfer takes place.

✅ The transfer must be completed within two months of approval.

✅ Client consent and transparent communication are required throughout the process.

✅ For full business transfers, the original registration must be surrendered after completion.

This marks a major regulatory milestone — encouraging responsible consolidation and smooth transitions in India’s rapidly evolving portfolio management industry.

💼 What This Means for Portfolio Managers

Thanks to SEBI’s new approach, Portfolio Managers can now:

-

Restructure or consolidate operations for better efficiency.

-

Plan successions, mergers, or acquisitions seamlessly.

-

Preserve client trust by ensuring clarity and regulatory compliance.

Whether you’re merging your PMS firm, transferring clients to another entity, or restructuring your business, these new guidelines bring clarity, flexibility, and regulatory support to the process.

⚙️ The Importance of Doing It Right

While SEBI has simplified the process, getting approval and maintaining compliance still require meticulous documentation and procedural accuracy. Any error can delay approvals or attract regulatory scrutiny.

That’s where expert support matters.

At Induce India, we assist portfolio managers and financial entities with:

-

End-to-end SEBI approval and documentation

-

PMS registration, transfer, and restructuring

-

Compliance audits and client consent management

-

Advisory for mergers, takeovers, and regulatory reporting

Our goal is to make your PMS transfer or restructuring smooth, compliant, and timely.

📞 Plan a Seamless PMS Transfer — Get Expert Help

If you’re looking to transfer, merge, or restructure your PMS business, our experts can guide you through the entire SEBI-approved process with precision and efficiency.

Contact us for a free consultation:

📞 +91 93113 47006

#NBFCAdvisor #SEBI #PortfolioManagement #PMS #Compliance #Finance #RegulatoryUpdates #PortfolioManager #SEBIUpdates