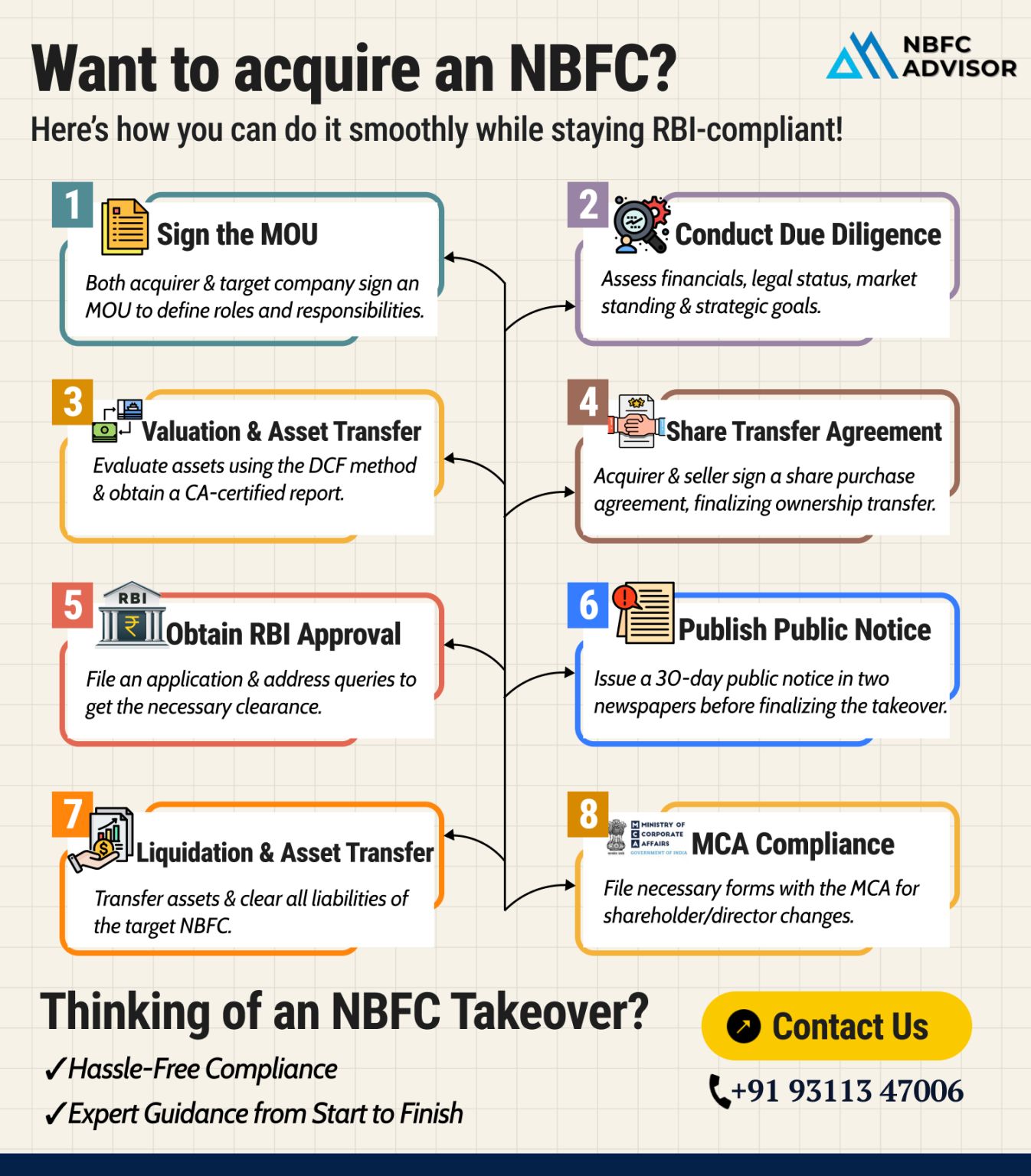

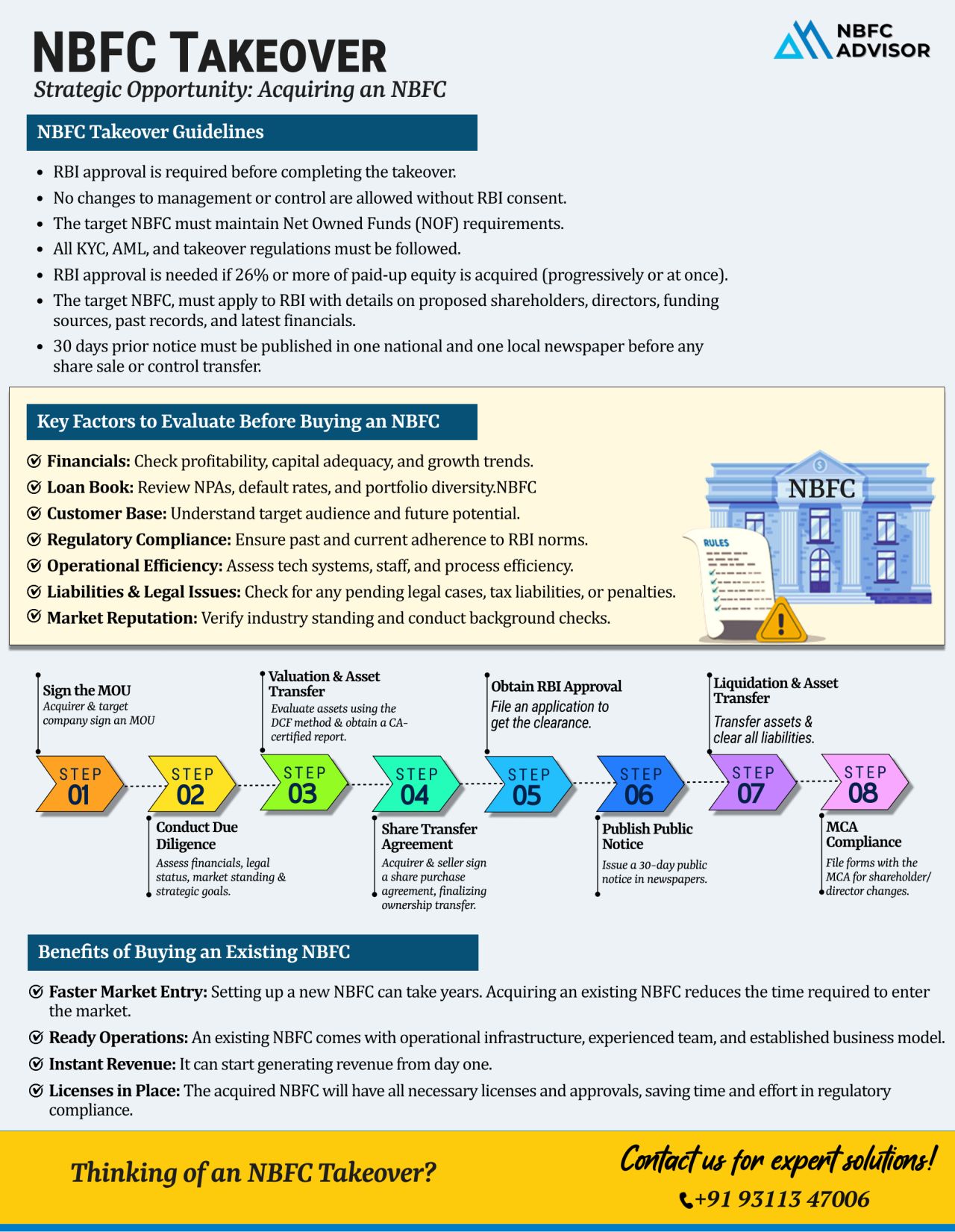

NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

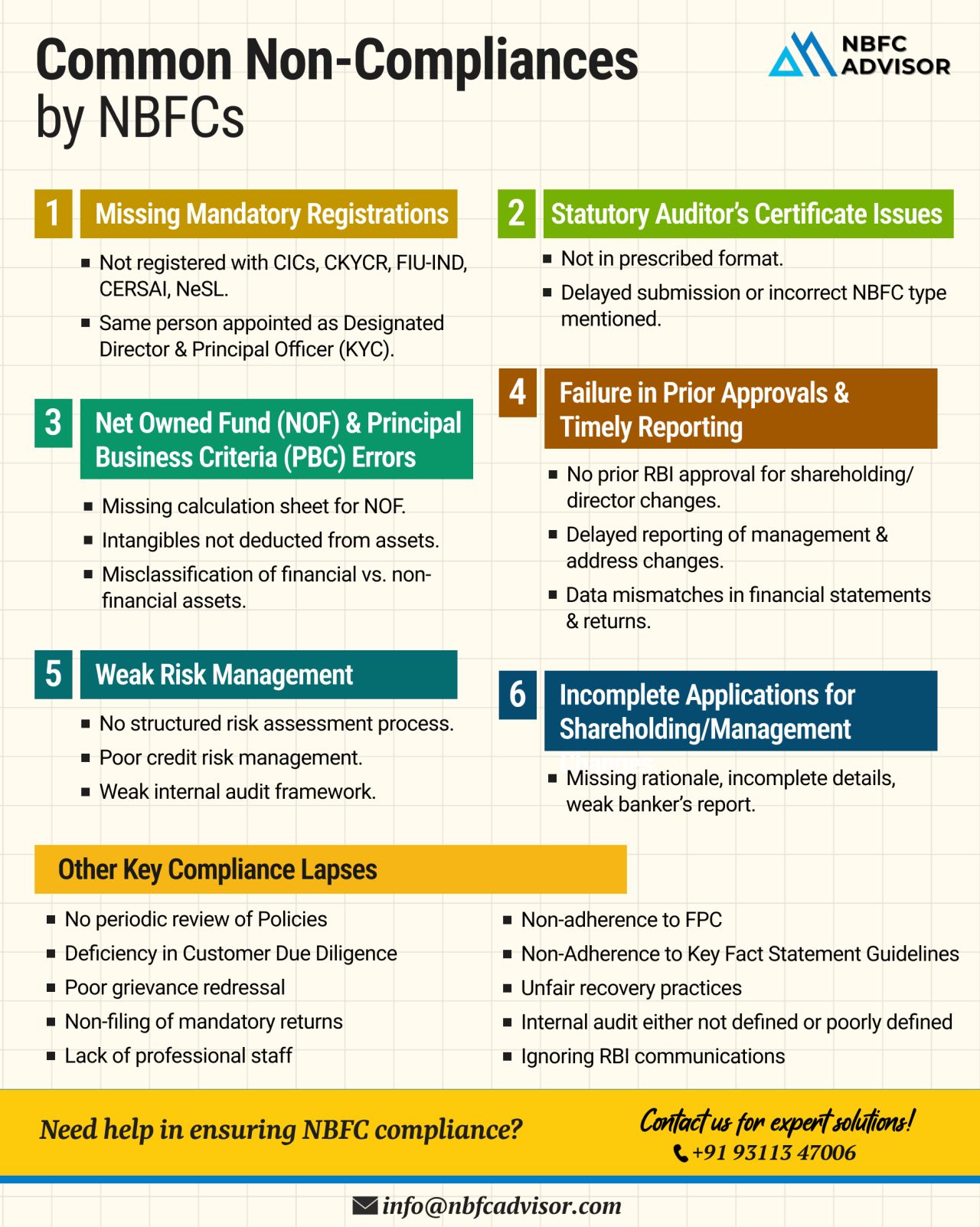

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Running a Non-Banking Financial Company (NBFC) in India is not just about lending, growth, and profitability. In today’s tightly regulated environment, compliance failures...

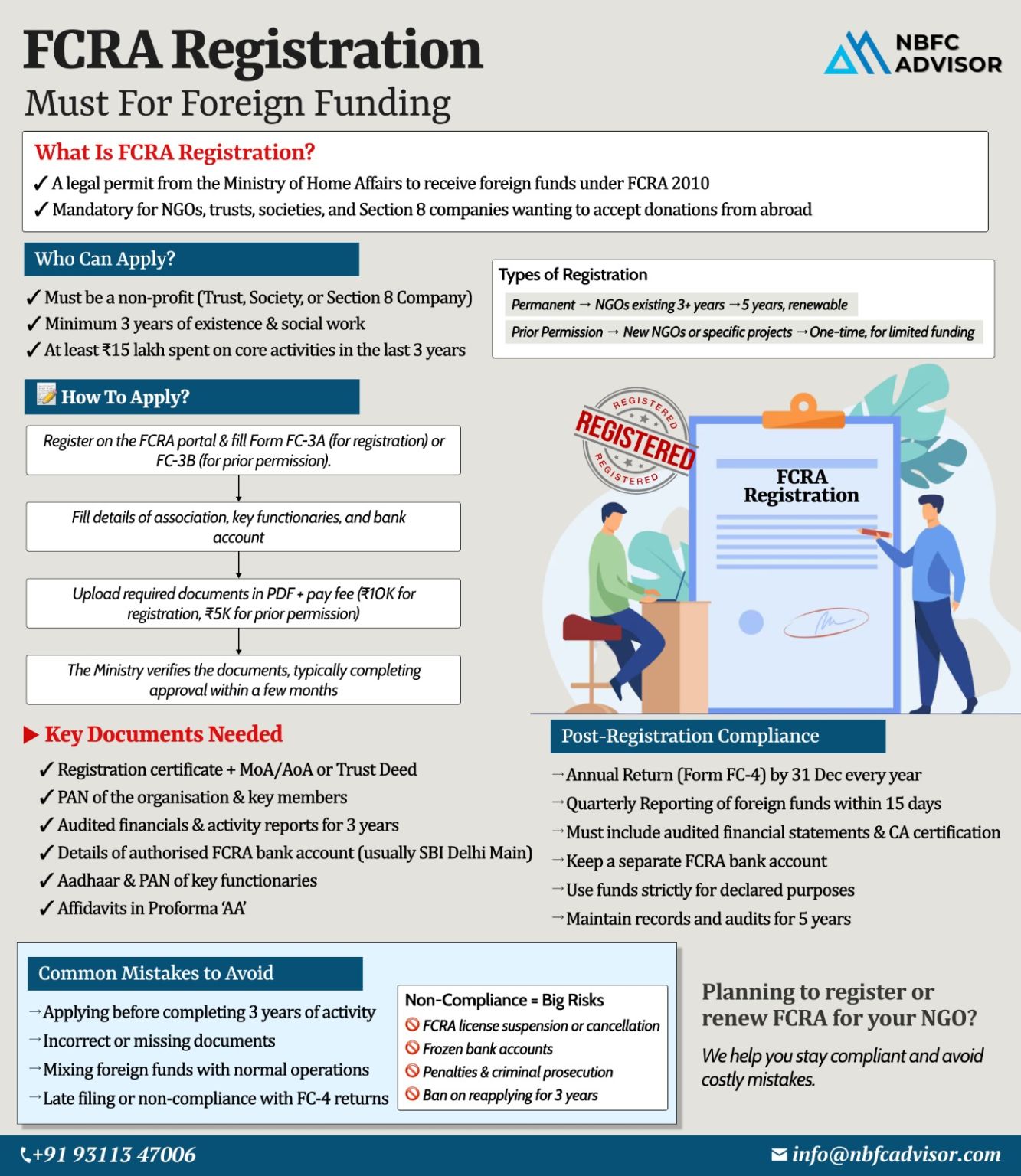

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

Foreign funding can be a lifeline for NGOs working in education, healthcare, human rights, environment, and social welfare. Yet every year, hundreds of NGOs in India lose their ability to ...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

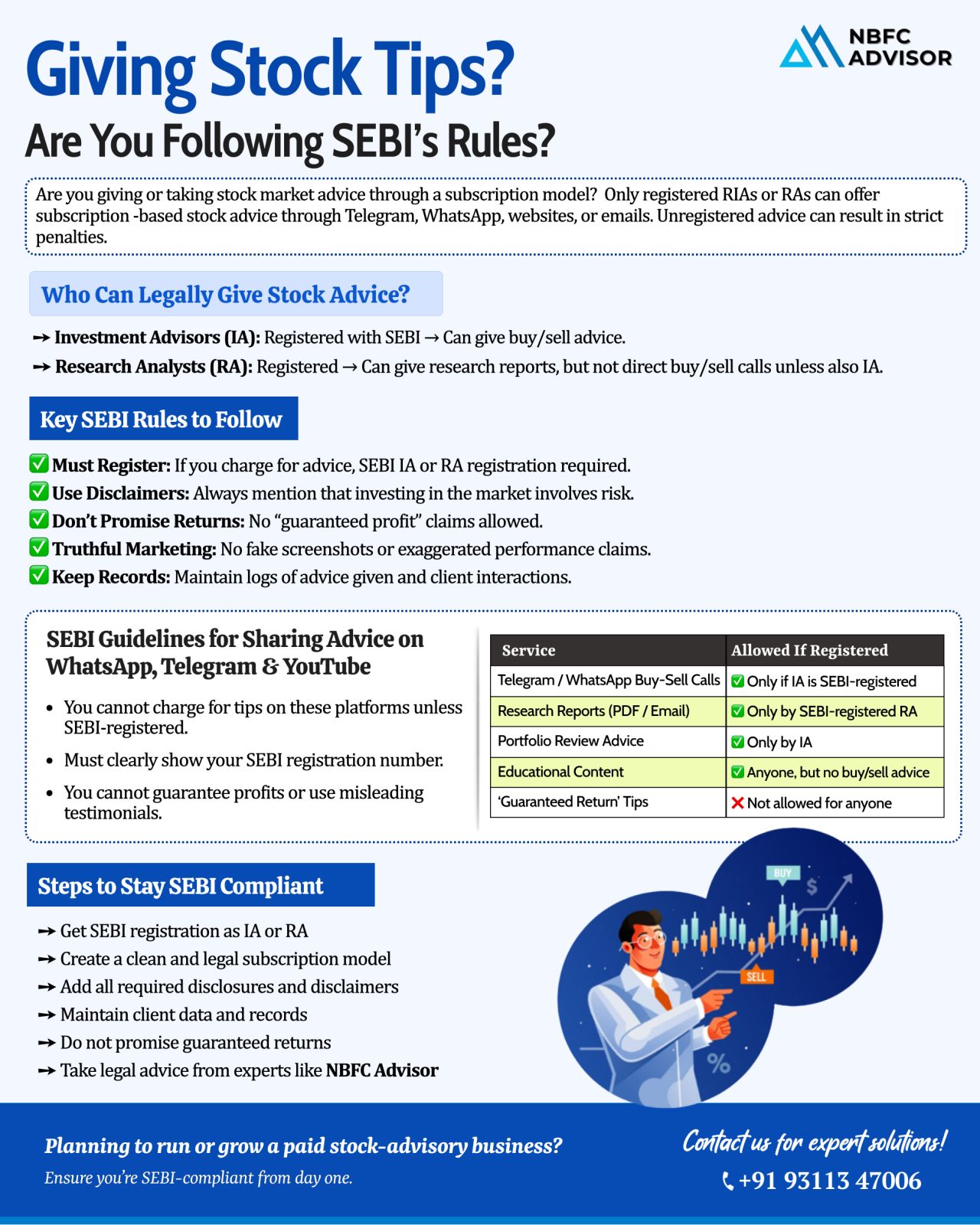

Selling Stock Tips on Telegram, WhatsApp, or Instagram? SEBI Has Strict Rules You Must Follow

In recent years, social media has become a major hub for stock market discussions. From Telegram channels to WhatsApp groups and Instagram pages, thousan...

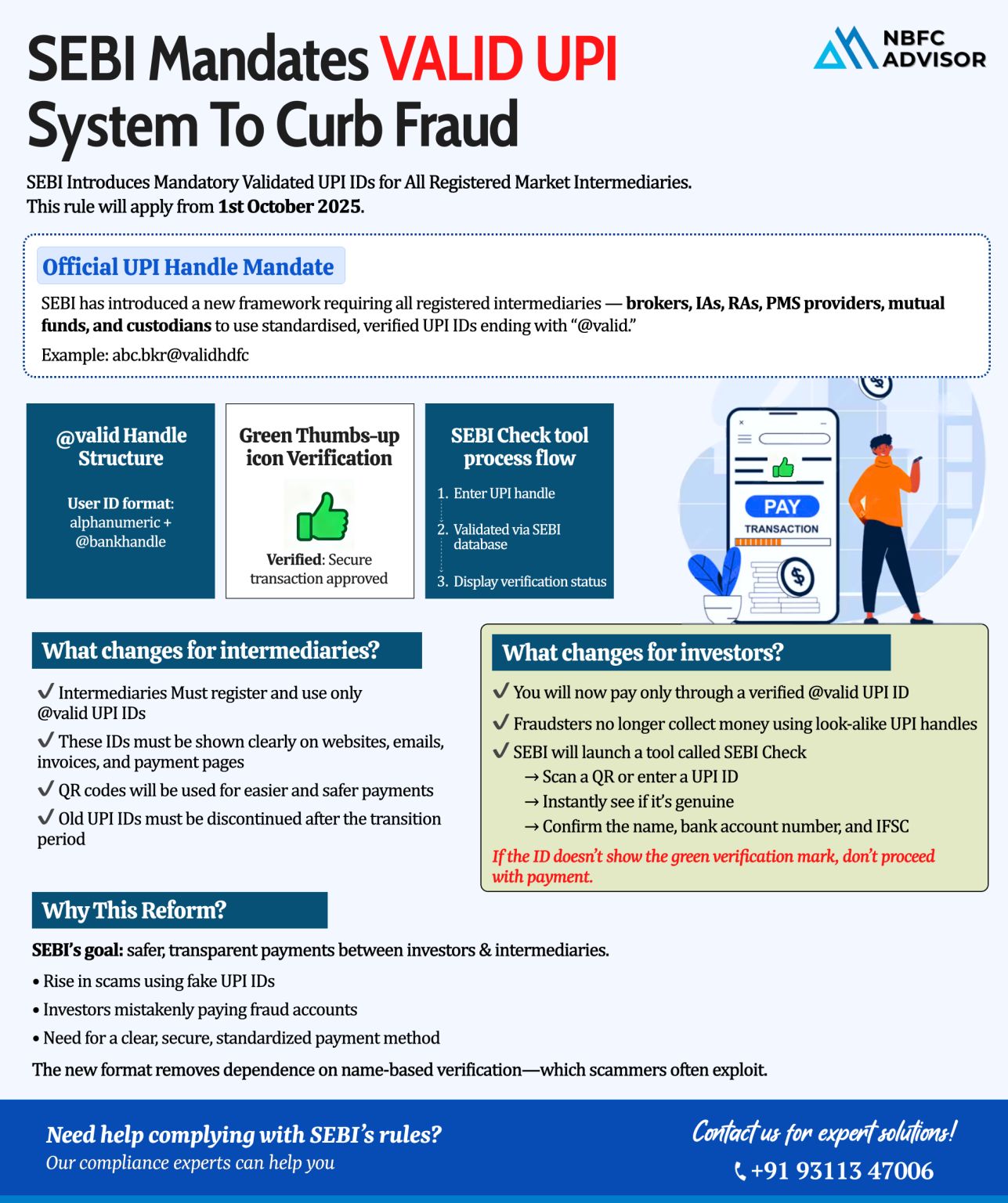

SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fa...

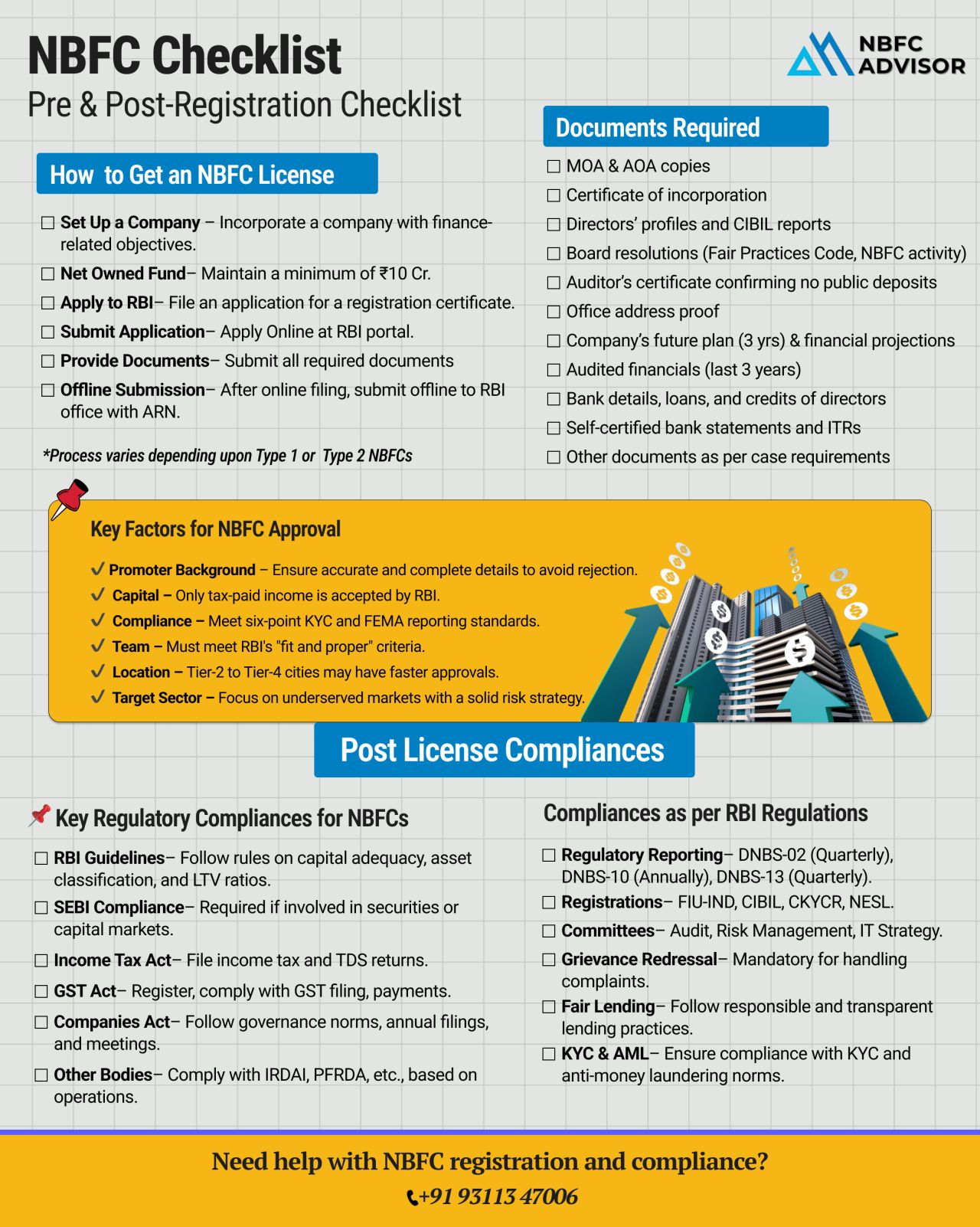

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

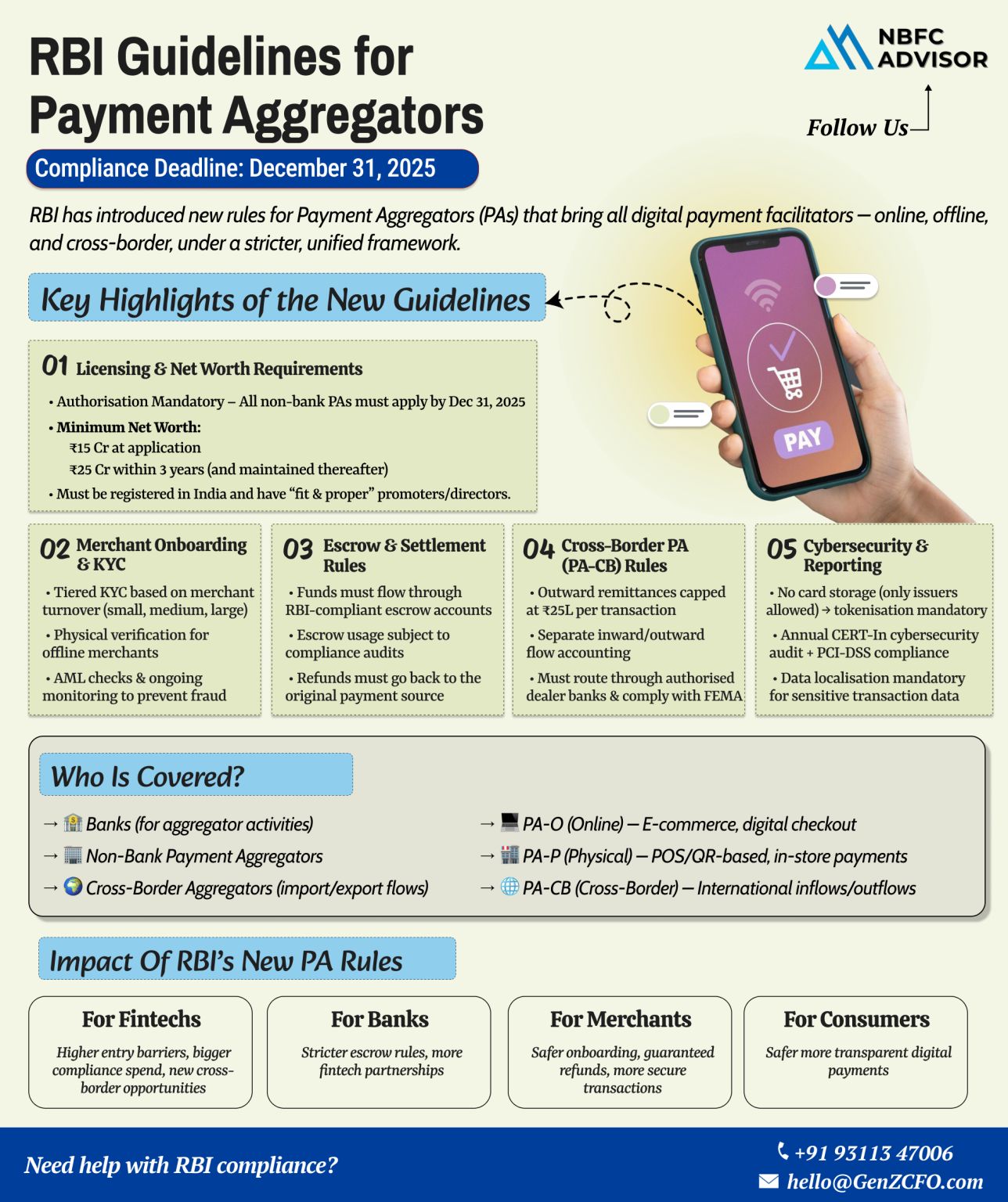

RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovatio...

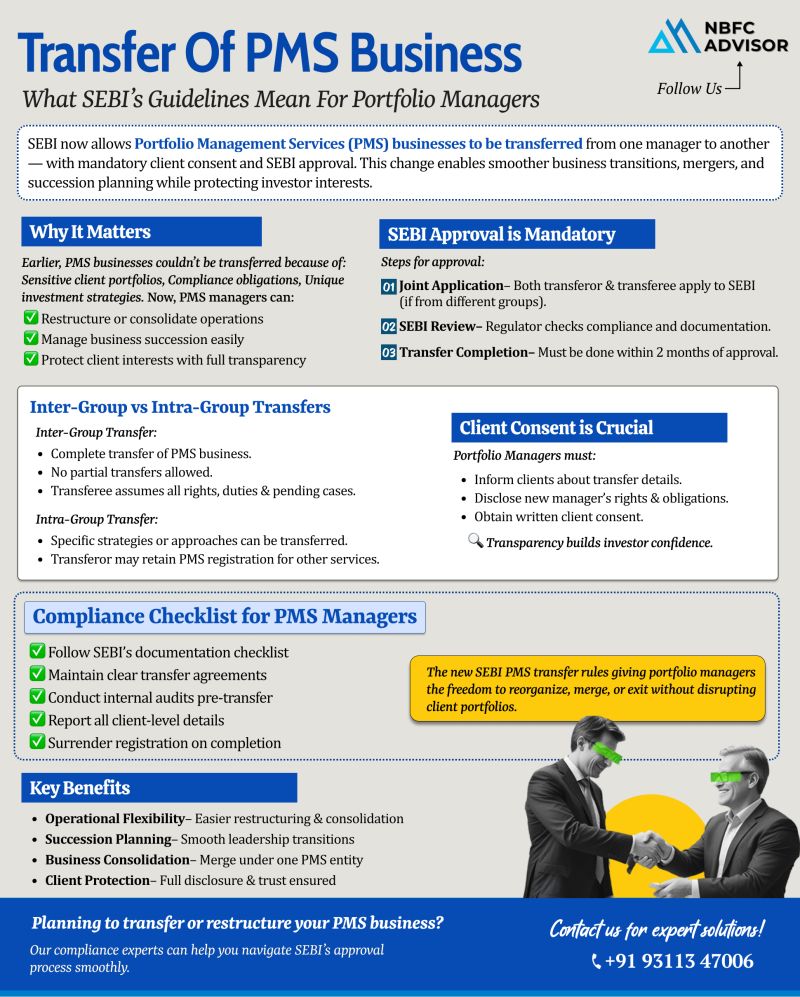

SEBI Eases the Way for PMS Transfers — A New Era of Flexibility and Transparency

Until recently, transferring a Portfolio Management Services (PMS) business in India was almost impossible.

However, with SEBI’s new framework, the proce...

Comprehensive Financial & Tax Services for Non-Residents (NRIs & Foreign Nationals)

Meta Title: Expert Services for Non-Residents (NRIs & Foreign Nationals) | Tax, FEMA, and RBI Consultancy

Meta Description: Simplify your India-relate...

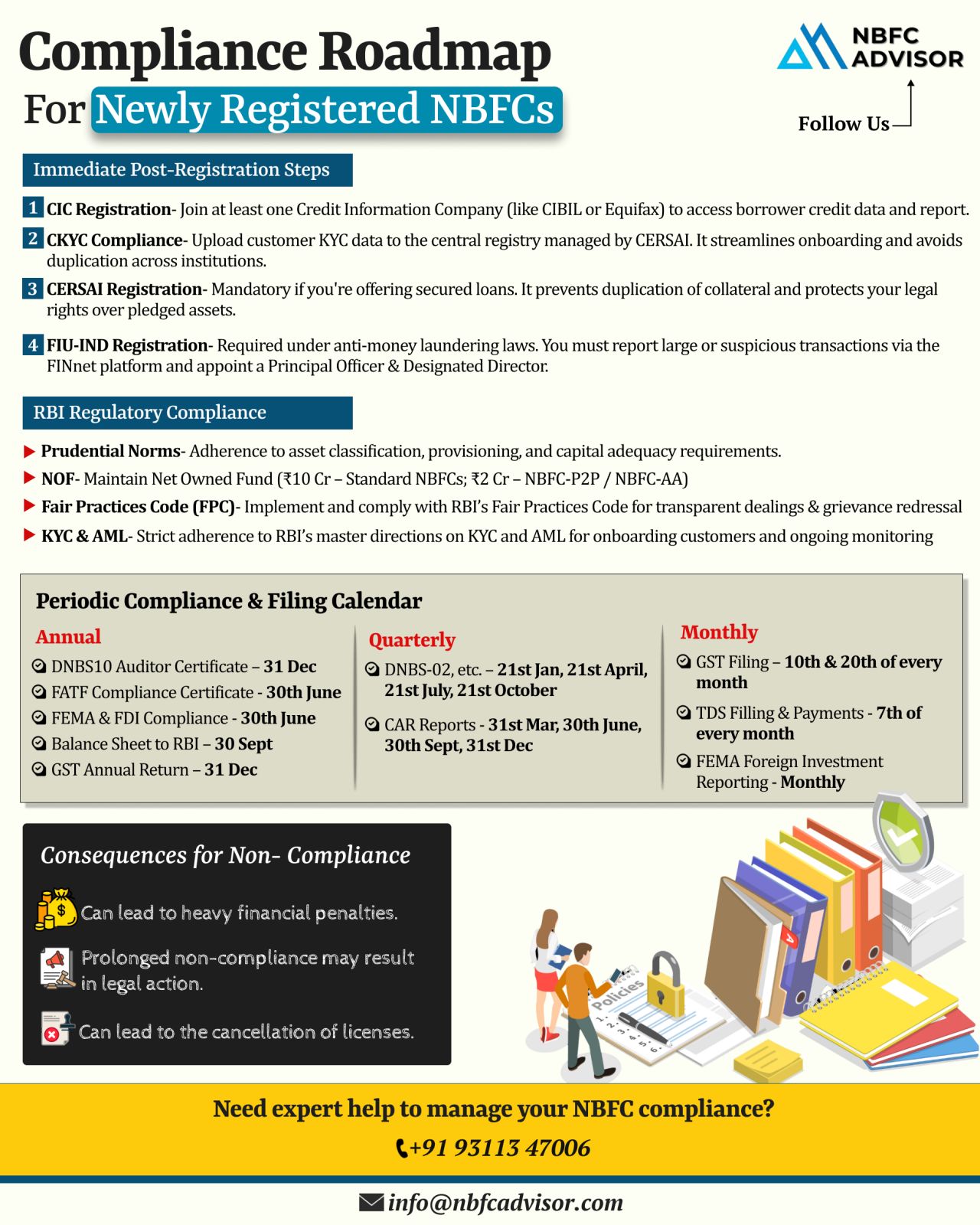

Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compli...

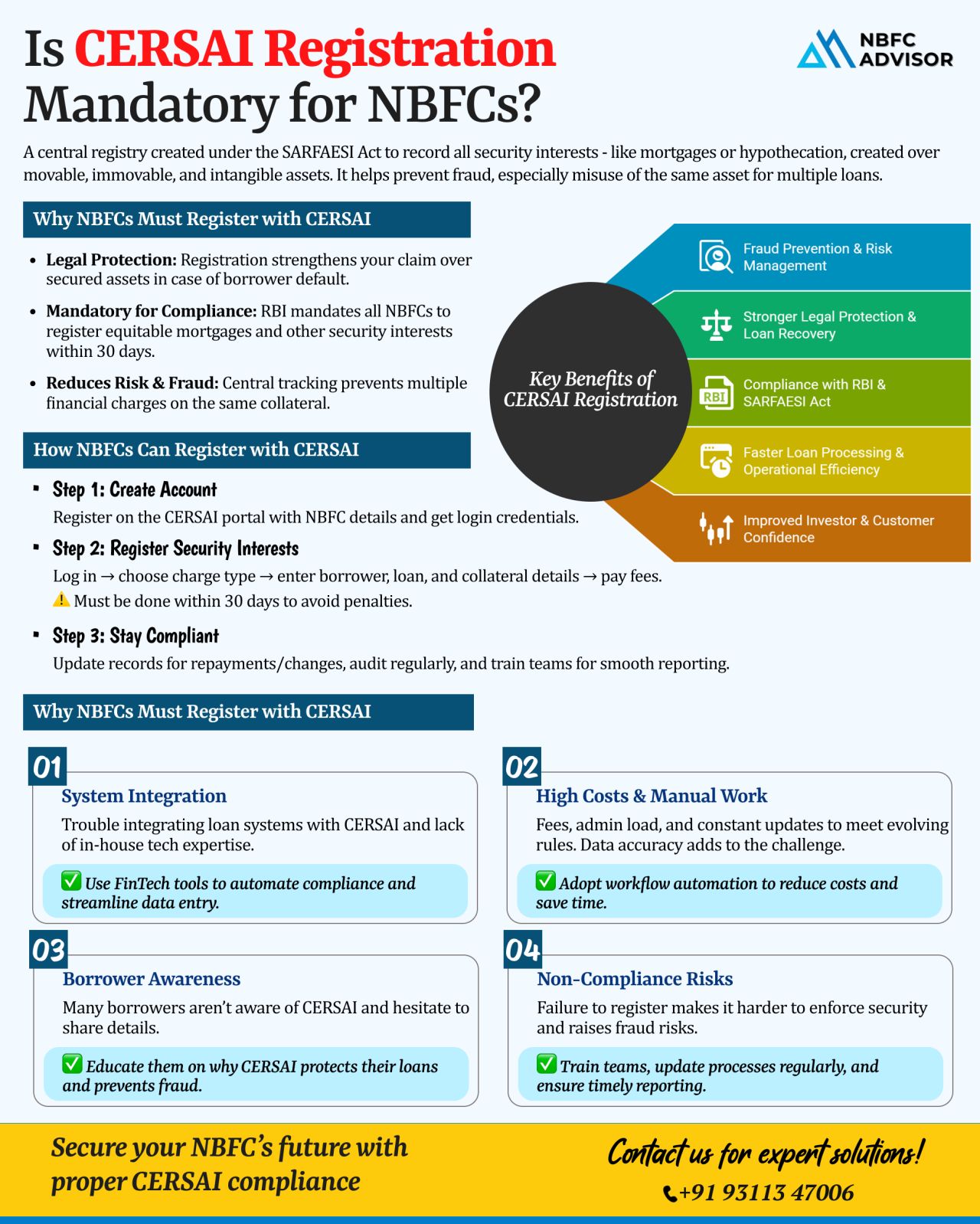

Is CERSAI Registration Mandatory for NBFCs?

One of the most overlooked compliance areas for NBFCs is CERSAI registration. While RBI norms, customer due diligence, and credit processes get proper attention, many lenders fail to recognize that CERSA...

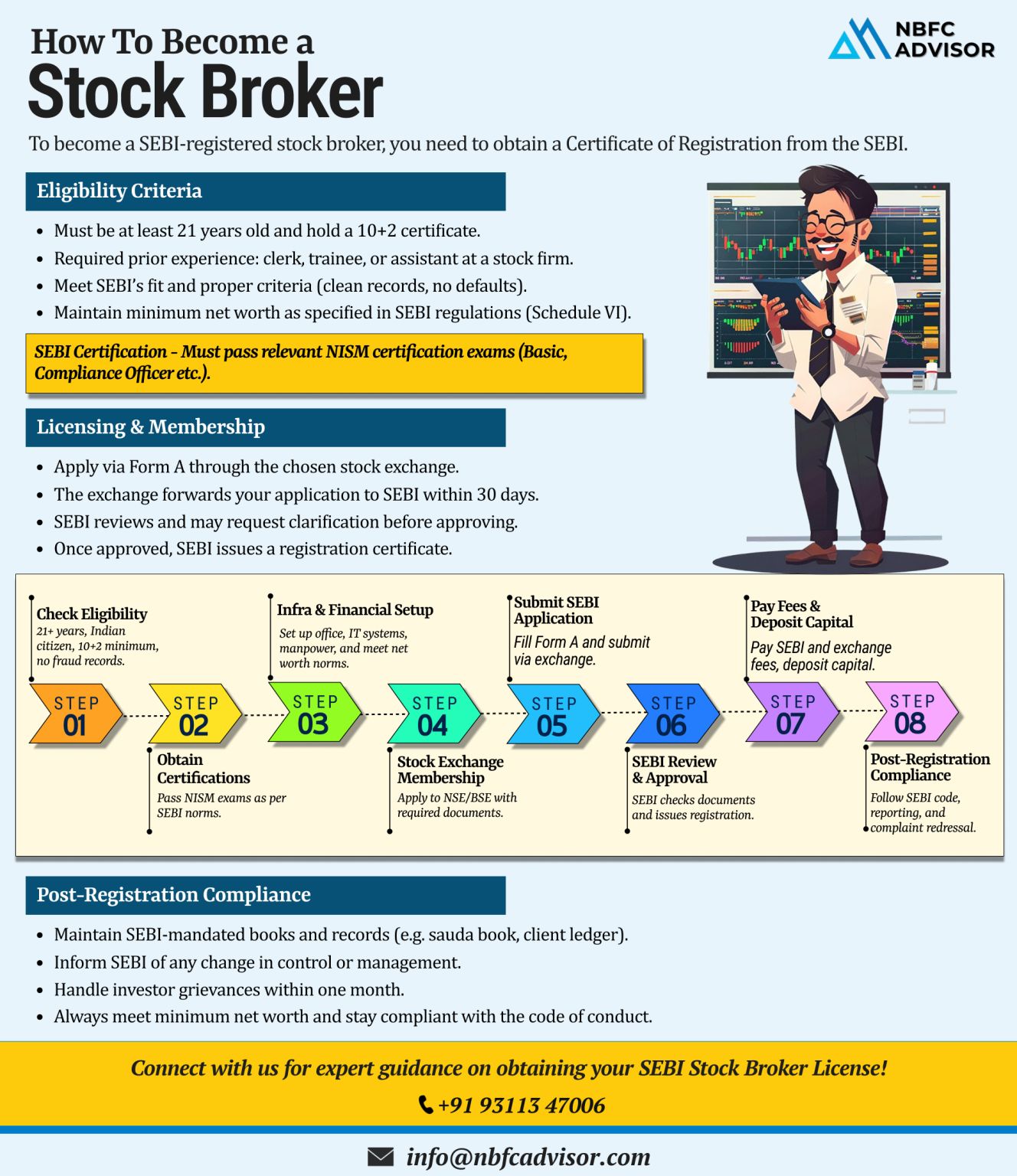

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

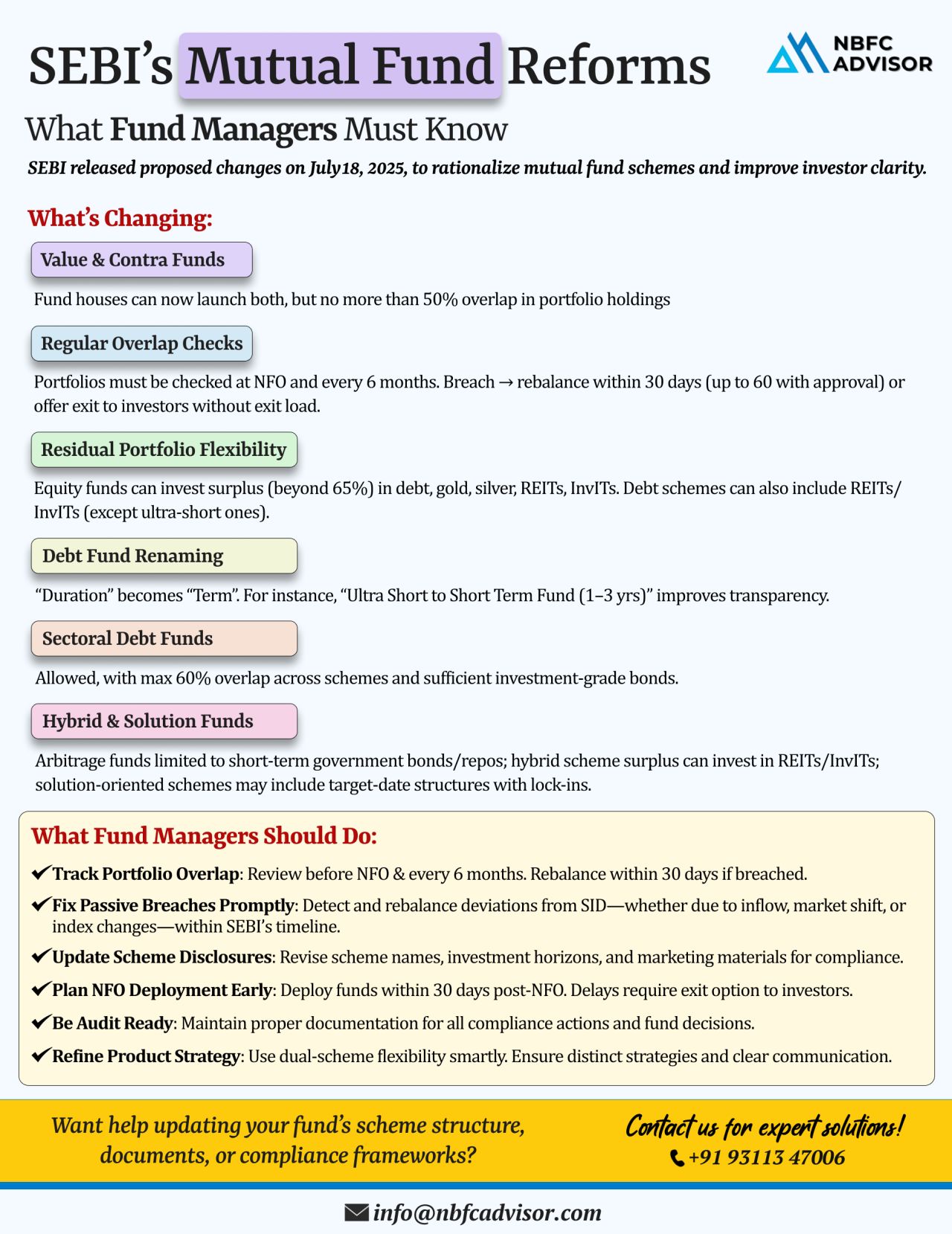

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

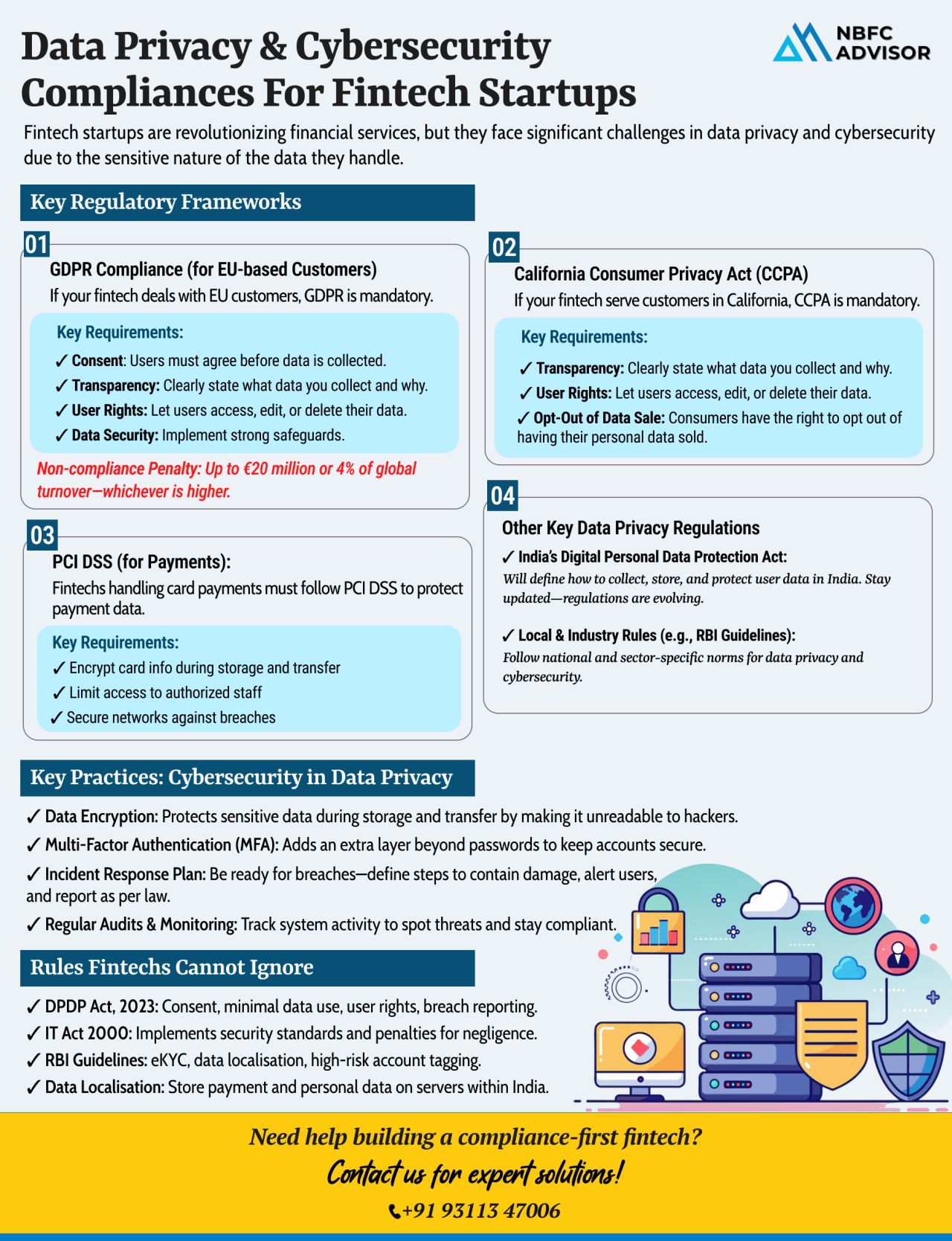

Building a Fintech Startup? One Data Breach Could Cripple Everything

In the high-stakes world of fintech, innovation isn’t enough—security and compliance are your foundation. With sensitive financial data at the heart of your operation...

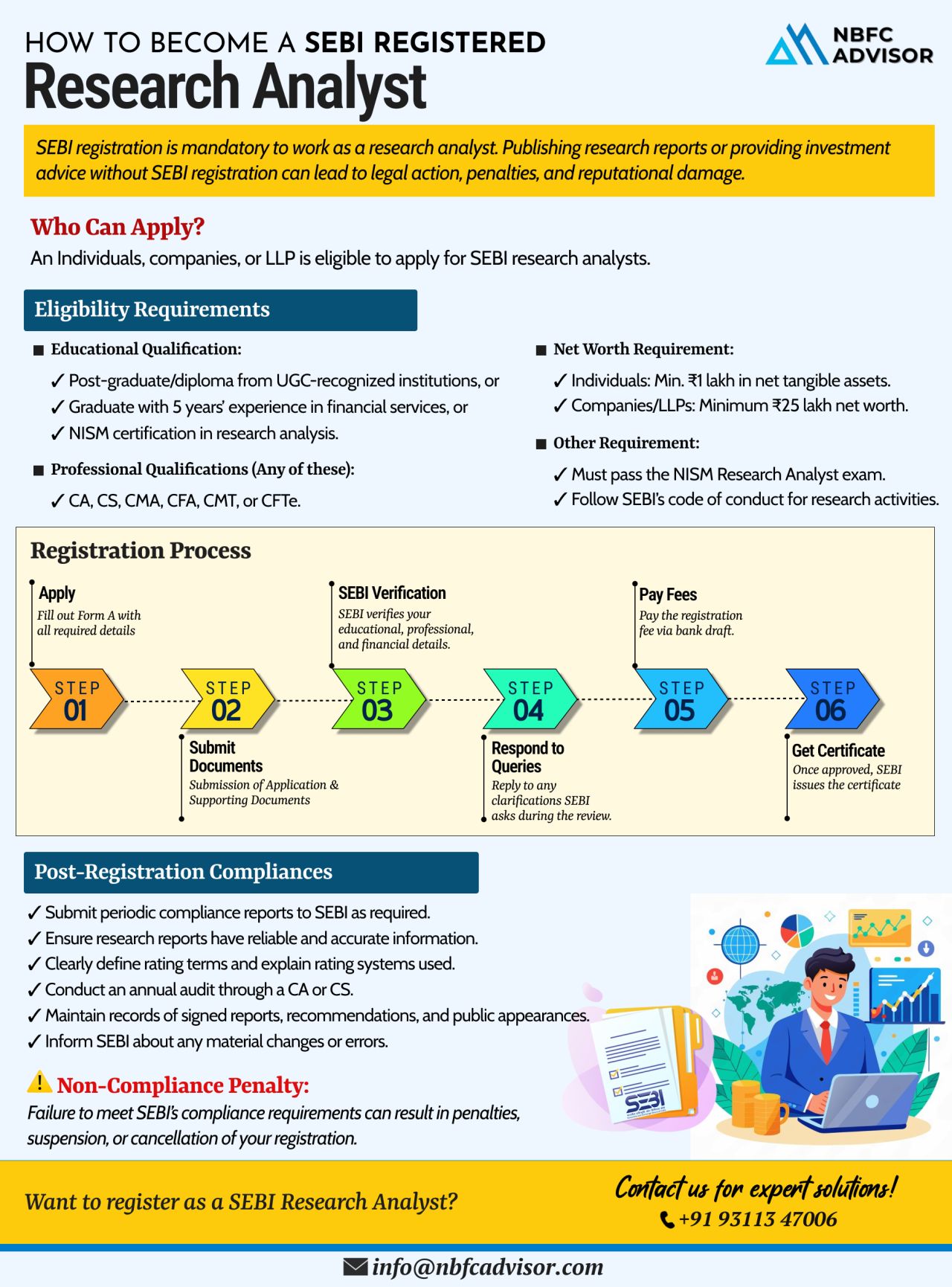

Publishing Research Reports Without SEBI Registration?

That’s a Shortcut to Penalties, Suspension & Reputational Damage

In India’s regulated financial ecosystem, publishing equity research or market analysis without SEBI registr...

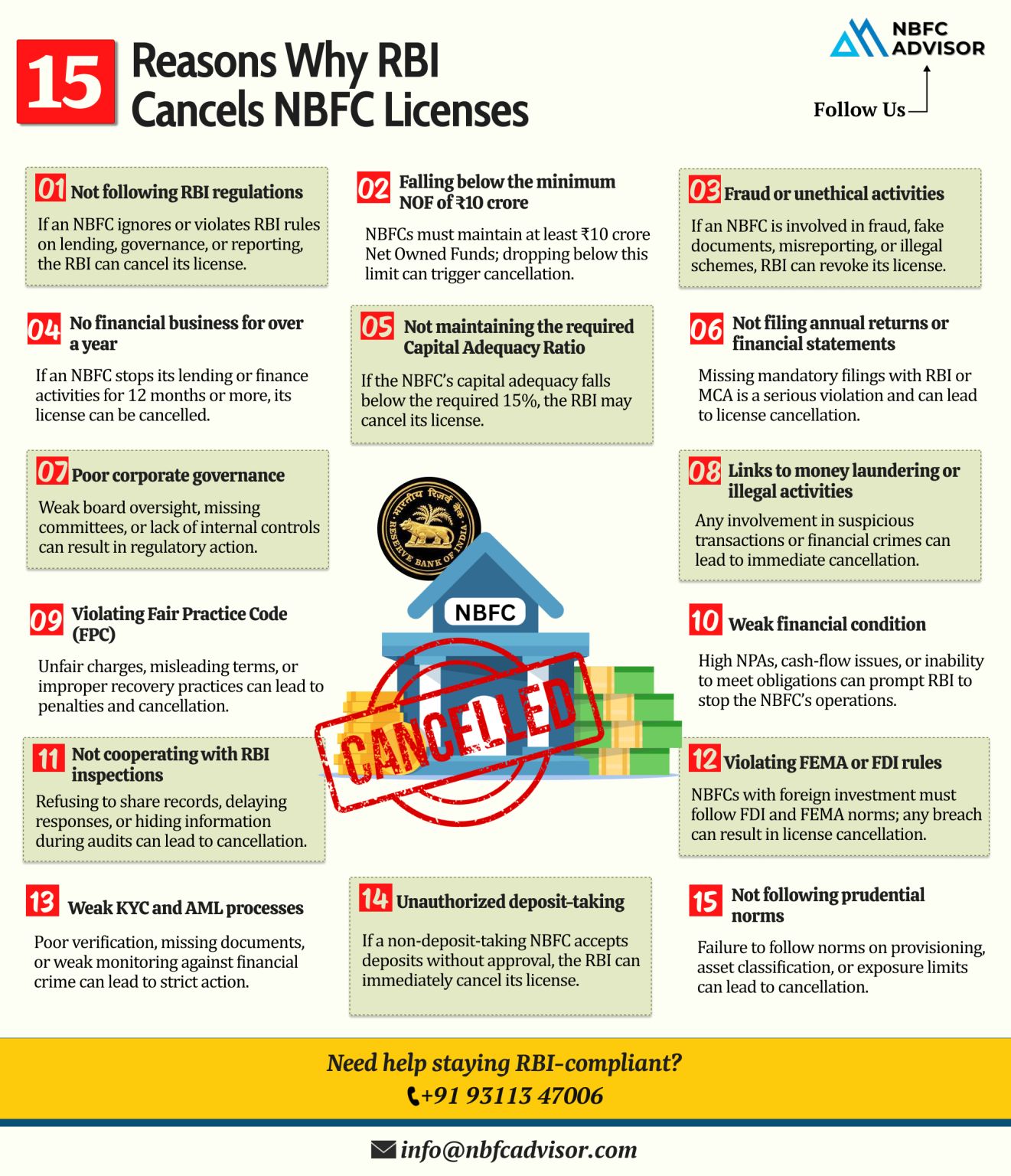

📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

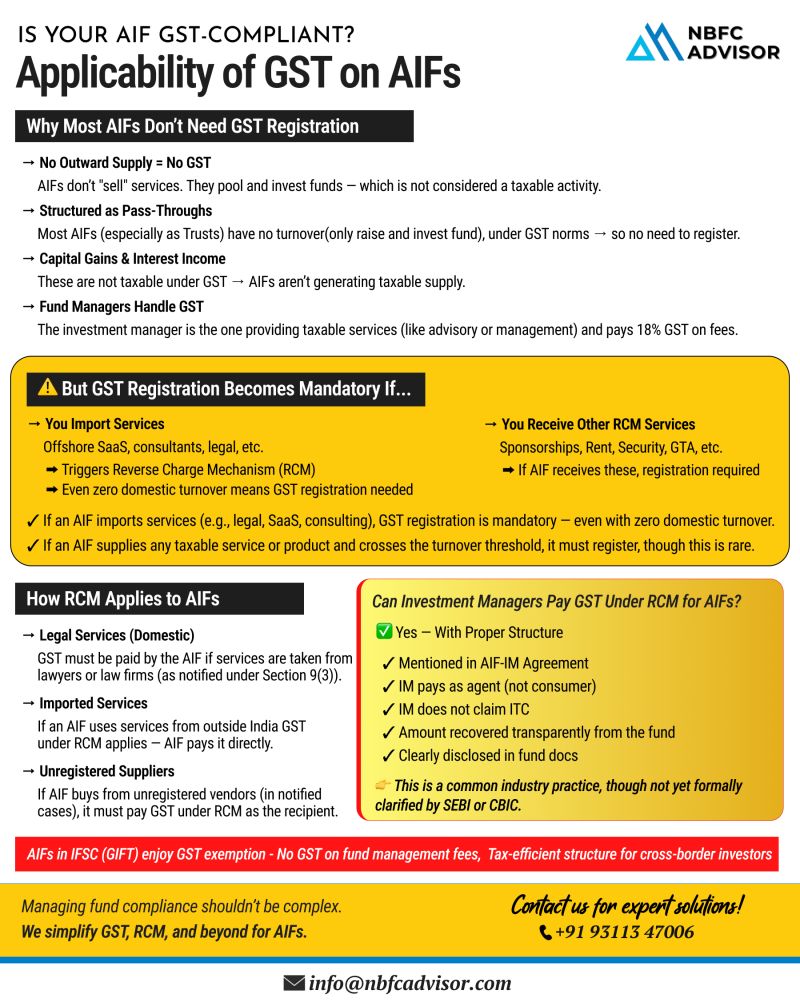

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity a...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐮𝐥𝐞𝐬 — 𝘈𝘳𝘦 𝘠𝘰𝘶𝘳 𝘖𝘱𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘴 𝘊𝘰𝘮𝘱𝘭𝘪𝘢𝘯𝘵?

India’s digital lending ecosystem is expanding at an unprecedented pace. But with rapid growth comes increasing...

Dreaming of Launching Your NBFC?

Avoid These Top 5 Pitfalls to Secure Your RBI License!

Setting up a Non-Banking Financial Company (NBFC) in India can be a game-changer—but getting the RBI license is where many dreams hit a wall. Each yea...

In a landmark move towards enhancing transparency, efficiency, and digital convenience, the Securities and Exchange Board of India (SEBI) has made DigiLocker integration mandatory for all intermediaries.

This mandate is a significant step forward ...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

The Reserve Bank of India (RBI) has introduced updated guidelines aimed at strengthening gold loan practices and enhancing the co-lending framework for better transparency, responsible lending, and financial inclusion.

Key Highlights:

✅ L...

If you're building in Fintech, Lending, or BFSI, obtaining an Account Aggregator (AA) License is your gateway to innovation and compliance.

An Account Aggregator is a platform regulated by the Reserve Bank of India (RBI) that enables users to ...

The Reserve Bank of India (RBI) has released draft guidelines on gold loans, aimed at improving transparency and regulatory consistency in the sector. While these new norms bring much-needed clarity, they also introduce stricter compliance requiremen...

With increasing regulatory scrutiny, fintech startups and NBFCs must ensure alignment with global and local data protection laws to remain competitive and trusted:

Key Regulations to Watch:

→ GDPR – Emphasizes a consent-first approac...

The Reserve Bank of India (RBI) has imposed fines on six NBFCs for violating key regulatory norms under the RBI Act, 1934. These penalties, totaling over ₹60 lakh, highlight RBI’s tightening grip on governance and compliance.

Who Got Fined...

The Reserve Bank of India (RBI) has issued guidelines for Non-Banking Financial Companies (NBFCs) to enhance financial stability and governance. Key compliance highlights include:

🔹 Scale-Based Regulation (SBR): NBFCs are classified into four lay...

In a landmark move, the Karnataka government has strengthened its stance against the coercive recovery tactics used by Microfinance Institutions (MFIs). The latest draft of the Karnataka Microfinance (Prevention of Coercive Actions) Ordinance, 2025 i...

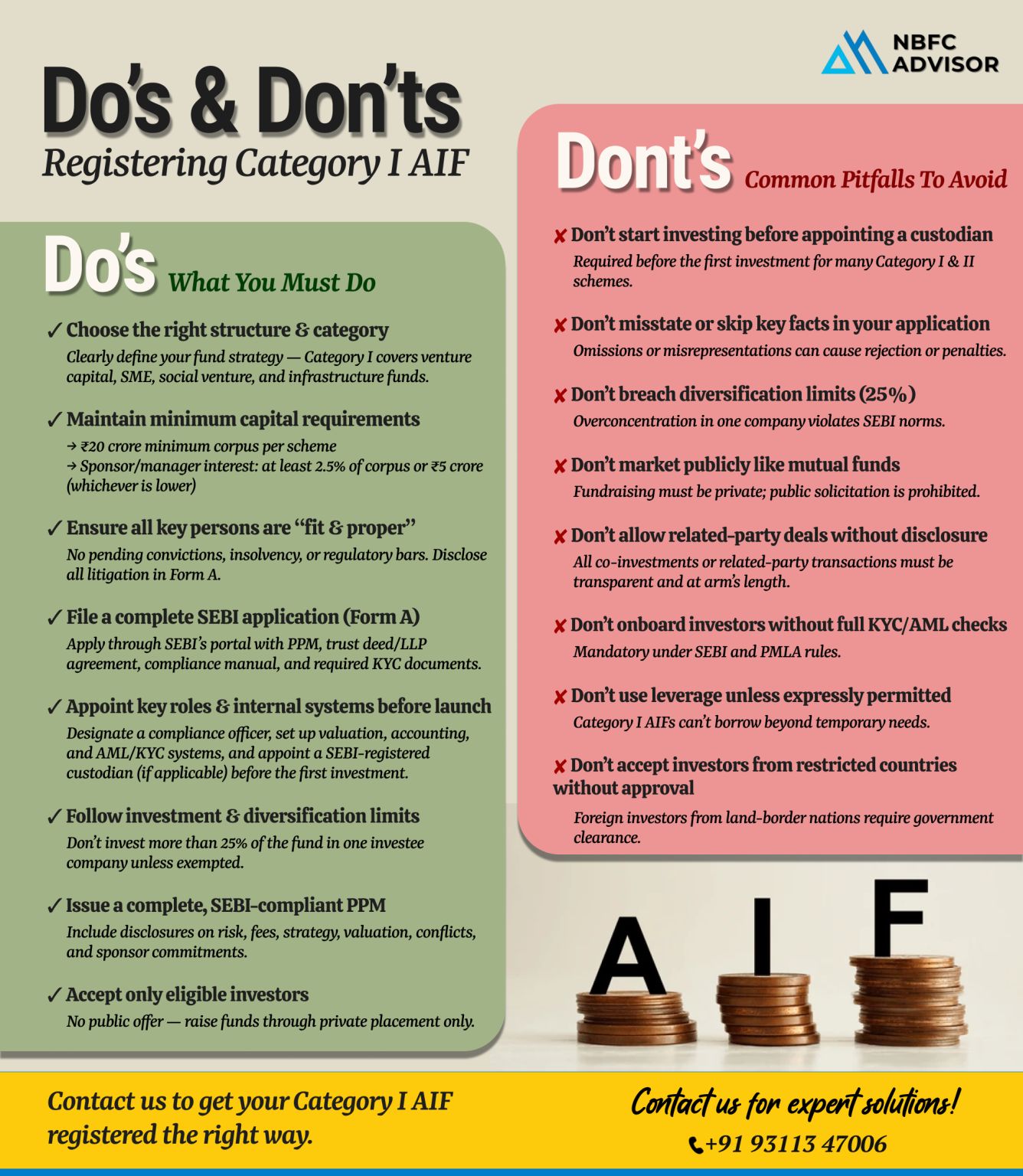

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)