SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

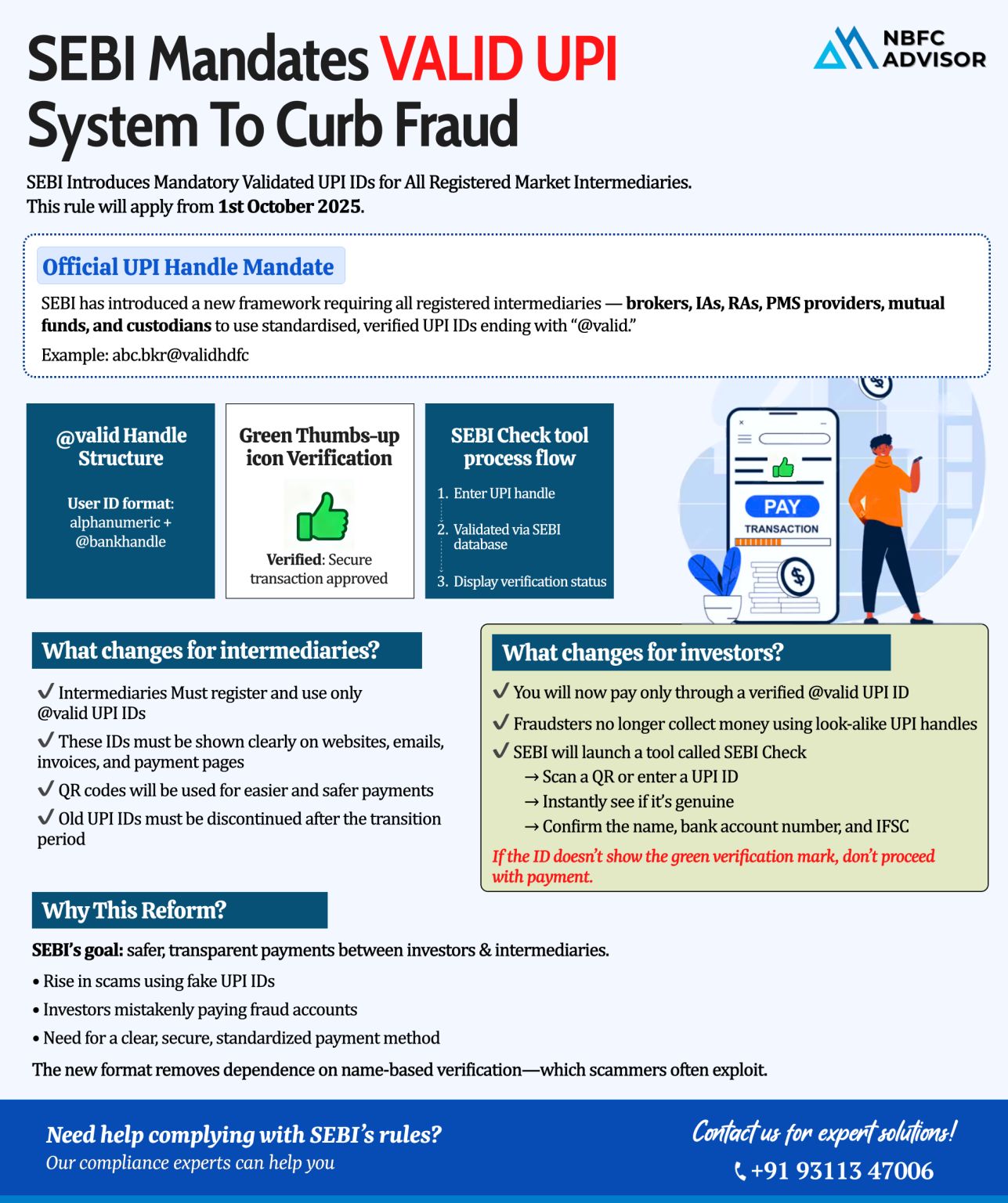

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fake UPI IDs and fraudulent payment links, SEBI has now made it mandatory for all market intermediaries—including brokers, Investment Advisers (IAs), Research Analysts (RAs), PMS providers, mutual funds, and custodians—to adopt the VALID UPI System.

This initiative is designed to ensure greater transparency, prevent payment fraud, and enhance investor protection.

\What is the VALID UPI System?

VALID UPI is SEBI’s new framework that allows only SEBI-verified UPI IDs to be used for receiving payments. These IDs are authenticated and approved, ensuring investors always pay to the right entity.

📌 Key Mandates Under the New SEBI Guidelines

✓ Use Only SEBI-Verified (VALID) UPI Handles

All eligible intermediaries must switch to SEBI-approved UPI handles and discontinue older IDs after the transition period.

✓ Mandatory Display Across All Platforms

Verified UPI IDs must be clearly visible on:

-

Websites

-

Mobile applications

-

Invoices & client communications

-

Payment pages & onboarding journeys

✓ Replace Old or Unverified UPI IDs

Any existing UPI handle not part of the VALID UPI framework must be updated and replaced immediately.

✓ Use Verified QR Codes

To avoid fake QR scams, all QR codes used for investor payments must be generated under the VALID UPI system.

💡 Why This Matters

Fake payment scams have been increasing in the financial sector. Fraudsters often mislead investors using fake UPI IDs or disguised QR codes. SEBI’s VALID UPI system aims to:

-

Eliminate fraudulent payment channels

-

Safeguard investors’ money

-

Improve trust in India’s digital payments ecosystem

-

Strengthen compliance for intermediaries

This is a decisive move toward safer, smarter digital financial transactions.

📞 Need Help Complying With SEBI’s VALID UPI Guidelines?

If you're a broker, IA, RA, PMS provider, mutual fund, or fintech platform, ensuring compliance is now compulsory.

We can help you implement VALID UPI quickly and seamlessly.

Contact us for a FREE consultation:

📞 +91 93113 47006