Thinking of Starting an Alternative Investment Fund (AIF)? Here’s What You Should Know

India’s financial landscape is rapidly evolving, and Alternative Investment Funds (AIFs) have emerged as one of the most attractive investment vehicles for high-net-worth individuals (HNIs) and institutional investors. These funds provide flexibility, diversification, and access to unique asset classes beyond traditional equity and debt instruments.

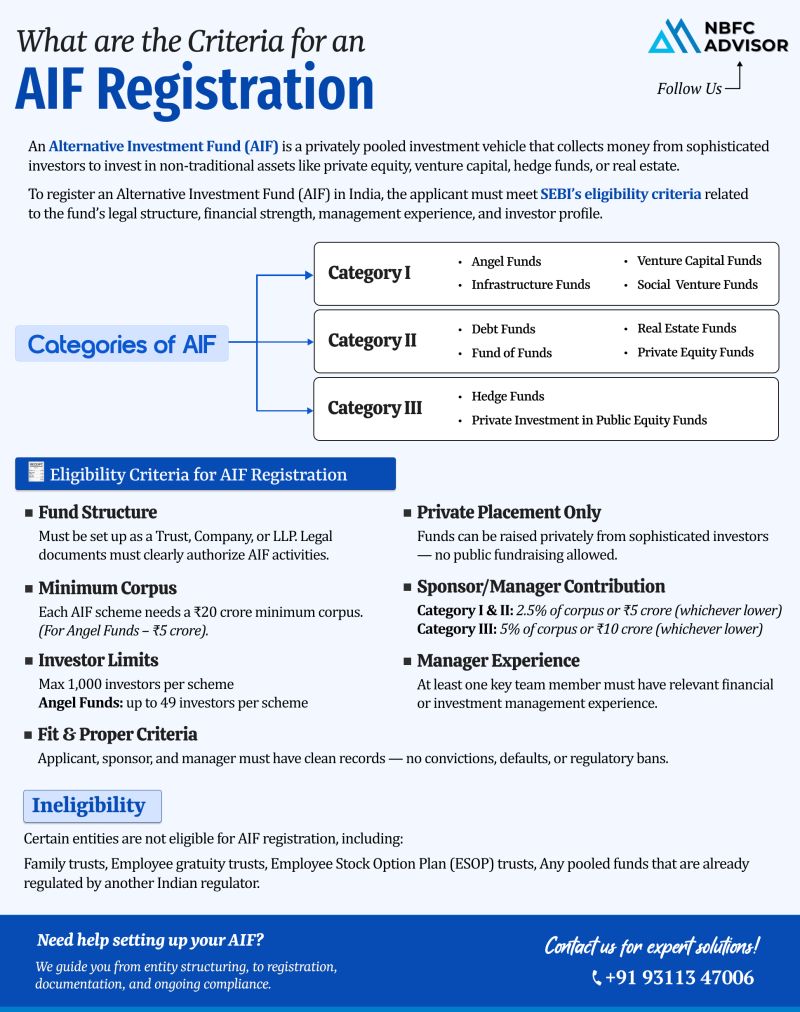

However, before launching your AIF, it’s important to understand the regulatory framework laid out by the Securities and Exchange Board of India (SEBI). Here’s a quick guide to help you get started:

Key SEBI Regulations for Setting Up an AIF

-

Fund Structure

Your AIF must be registered as a Trust, Company, or Limited Liability Partnership (LLP). The structure you choose impacts your governance, compliance, and tax strategy. -

Minimum Fund Size

-

For most AIFs: ₹20 crore

-

For Angel Funds (a sub-category under Category I AIFs): ₹5 crore

-

-

Fundraising Rules

AIFs can raise funds only through private placement—that means no public advertisements or solicitations are allowed. -

Sponsor Contribution

The sponsor must contribute at least 2.5% of the corpus or ₹5 crore, whichever is lower. This ensures that sponsors have a vested interest in the fund’s success. -

Investor Limit

Each AIF scheme can have a maximum of 1,000 investors. This helps maintain exclusivity and regulatory oversight. -

Professional Expertise

At least one key personnel of the AIF management team must have prior experience in finance, investment, or fund management.

Why Compliance Matters

SEBI’s framework ensures transparency, investor protection, and sound fund governance. Failing to comply with these guidelines can delay registration or even lead to penalties, so expert assistance is crucial.

How We Help

At NBFC Advisor, we specialize in helping businesses and fund managers set up and register their AIFs with SEBI, ensuring full regulatory compliance and smooth documentation.

From structuring the fund and drafting documents to liaising with SEBI and final registration, our experts handle the process end-to-end.

Get Expert Guidance

Thinking of launching your own AIF? Let’s make it simple and compliant.

Contact us today for a free consultation!

📞 +91 93113 47006

#NBFCAdvisor #AIF #SEBI #InvestmentFunds #PrivateEquity #NBFC #VentureCapital #WealthManagement