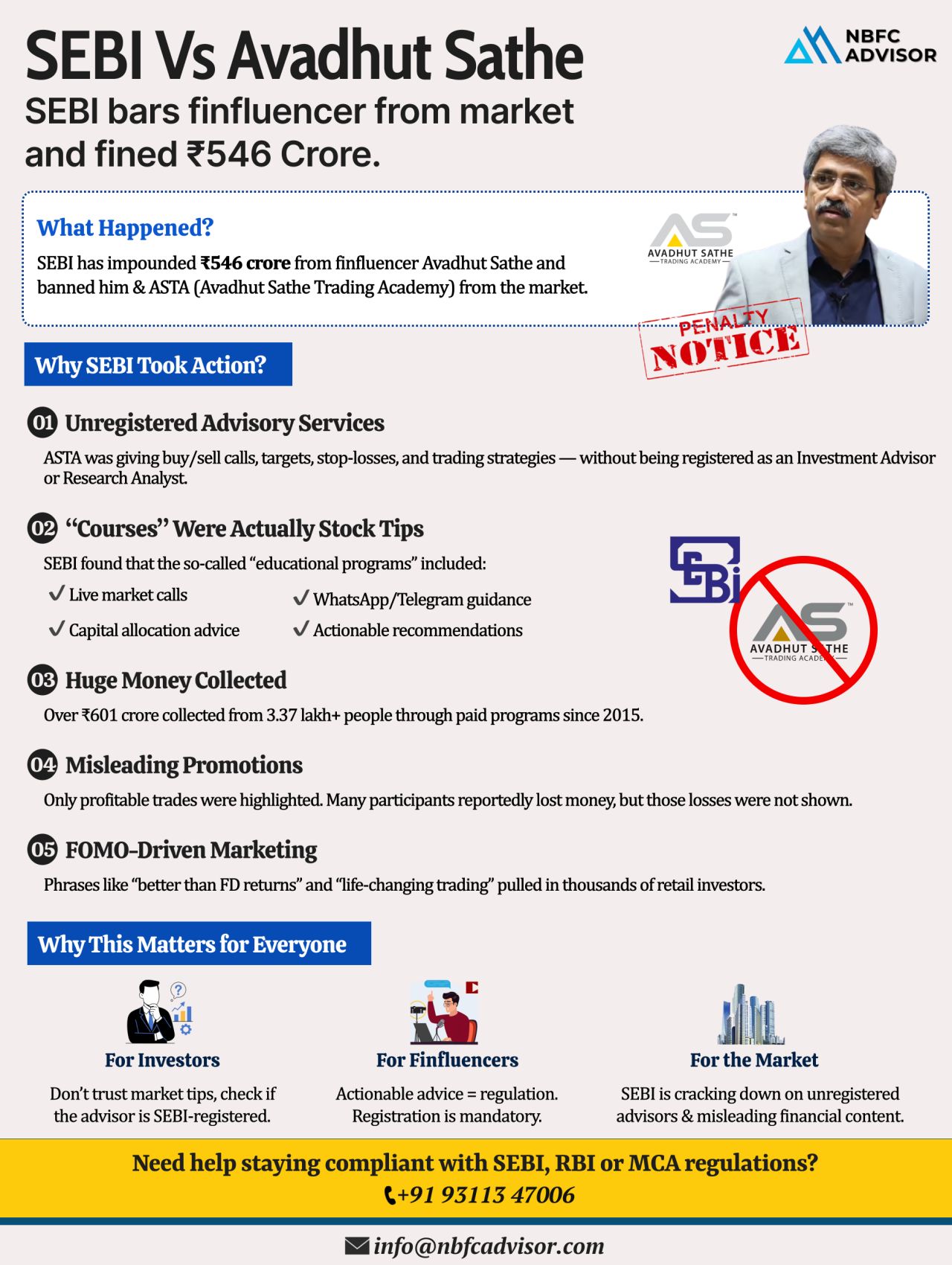

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

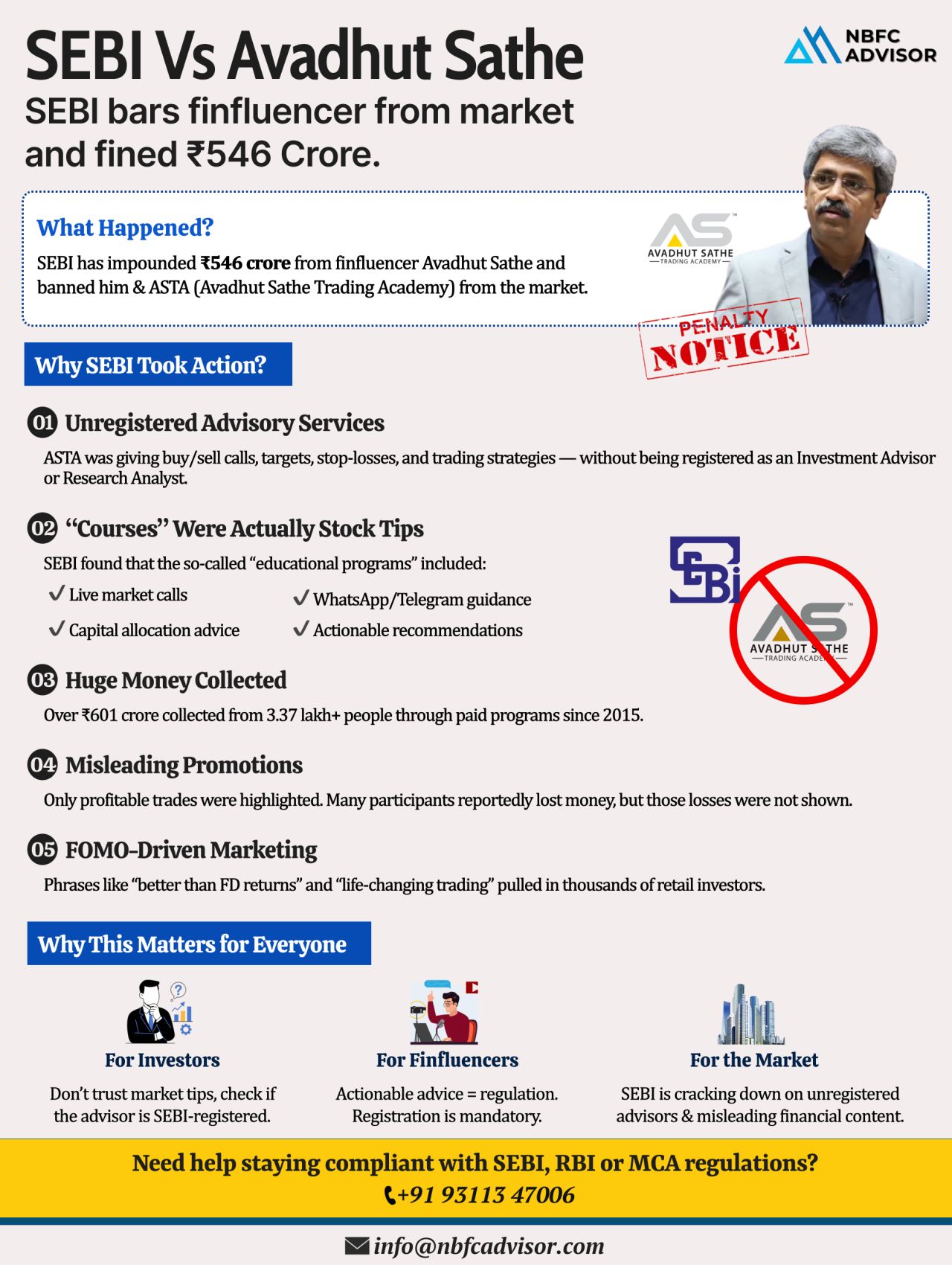

Thinking of Starting an Alternative Investment Fund (AIF)? Here’s What You Should Know

India’s financial landscape is rapidly evolving, and Alternative Investment Funds (AIFs) have emerged as one of the most attractive investment vehic...

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

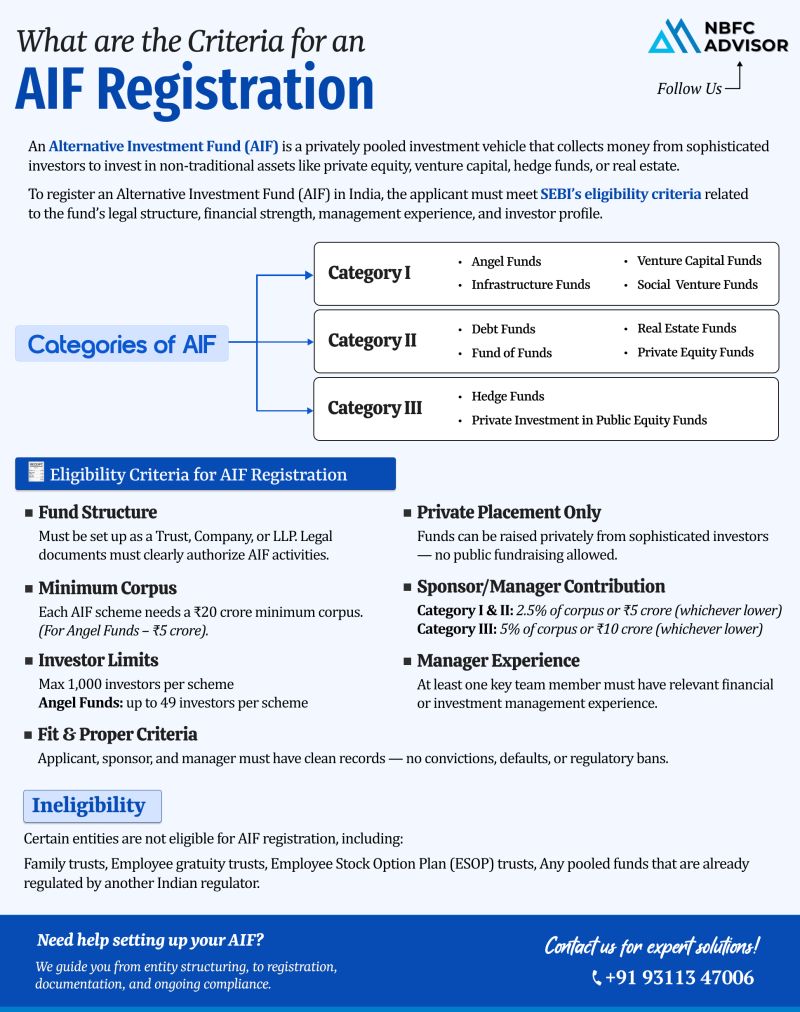

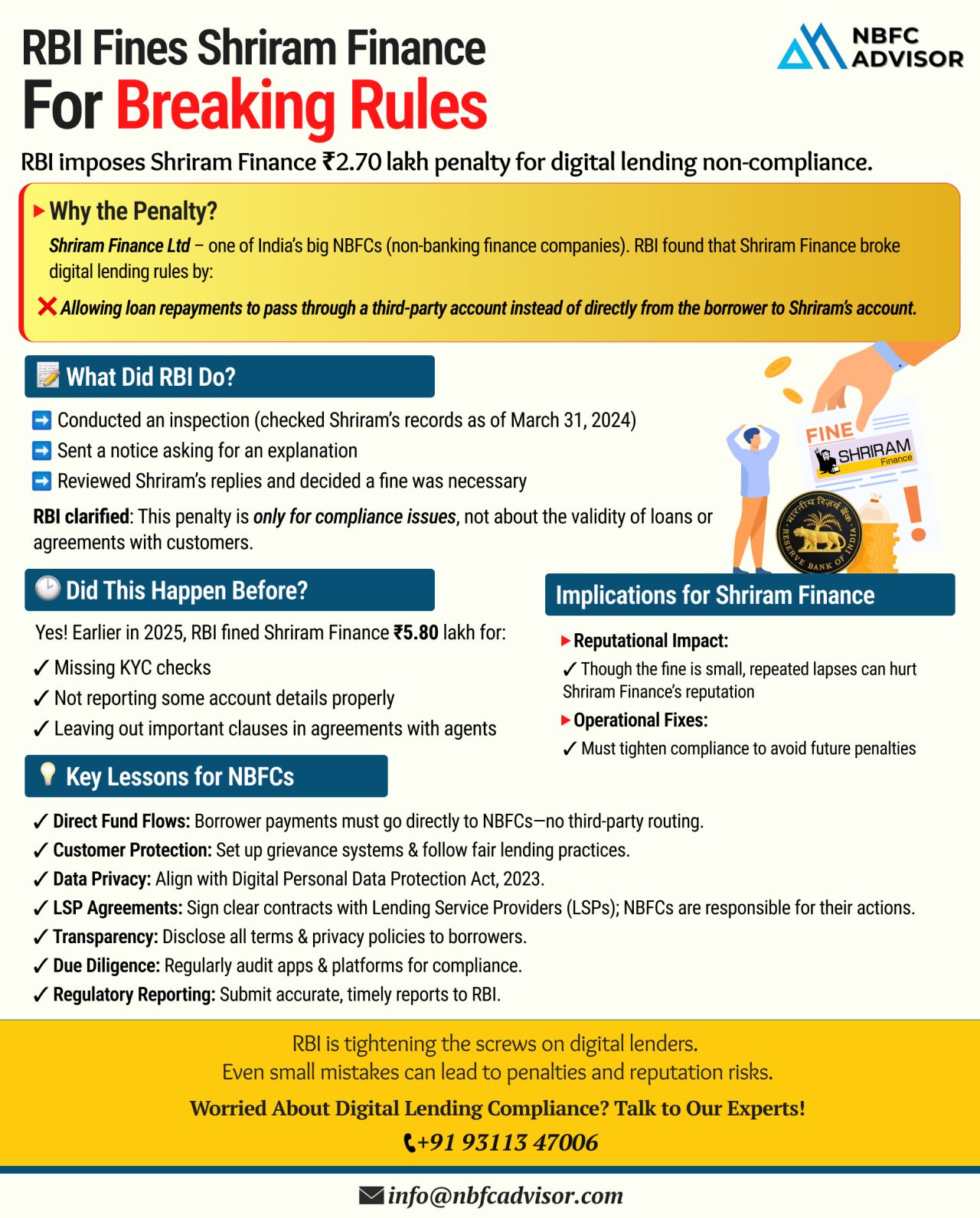

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘶𝘭𝘦𝘴 𝘈𝘳𝘦 𝘊𝘩𝘢𝘯𝘨𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under an entirely new regulatory framework—and the implications are significant for startups, inves...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

The Reserve Bank of India (RBI) has introduced updated guidelines aimed at strengthening gold loan practices and enhancing the co-lending framework for better transparency, responsible lending, and financial inclusion.

Key Highlights:

✅ L...

What is DLG?

Default Loss Guarantee (DLG) allows lenders to secure compensation from third parties for loan defaults.

Key RBI Guidelines:

✔ DLG is permitted only between Regulated Entities (REs) and Lending Service Providers (LSPs).

✔ LSPs ...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

The International Financial Services Centres Authority (IFSCA) has introduced key updates to its Fund Management Regulations, 2022, effective February 19, 2025. These revisions align with the December 2024 proposals and bring significant changes for ...

To combat rising cyber threats and protect consumers from online fraud, the Reserve Bank of India (RBI) has launched a dedicated domain—‘.bank.in’—exclusively for Indian banks. This initiative aims to establish a secure, relia...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

.png)

.jpeg)