Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and regulatory-heavy process.

Looking for a faster alternative?

Purchasing an existing NBFC can get you up and running immediately.

🚀 Why Buying an NBFC is a Smart Move

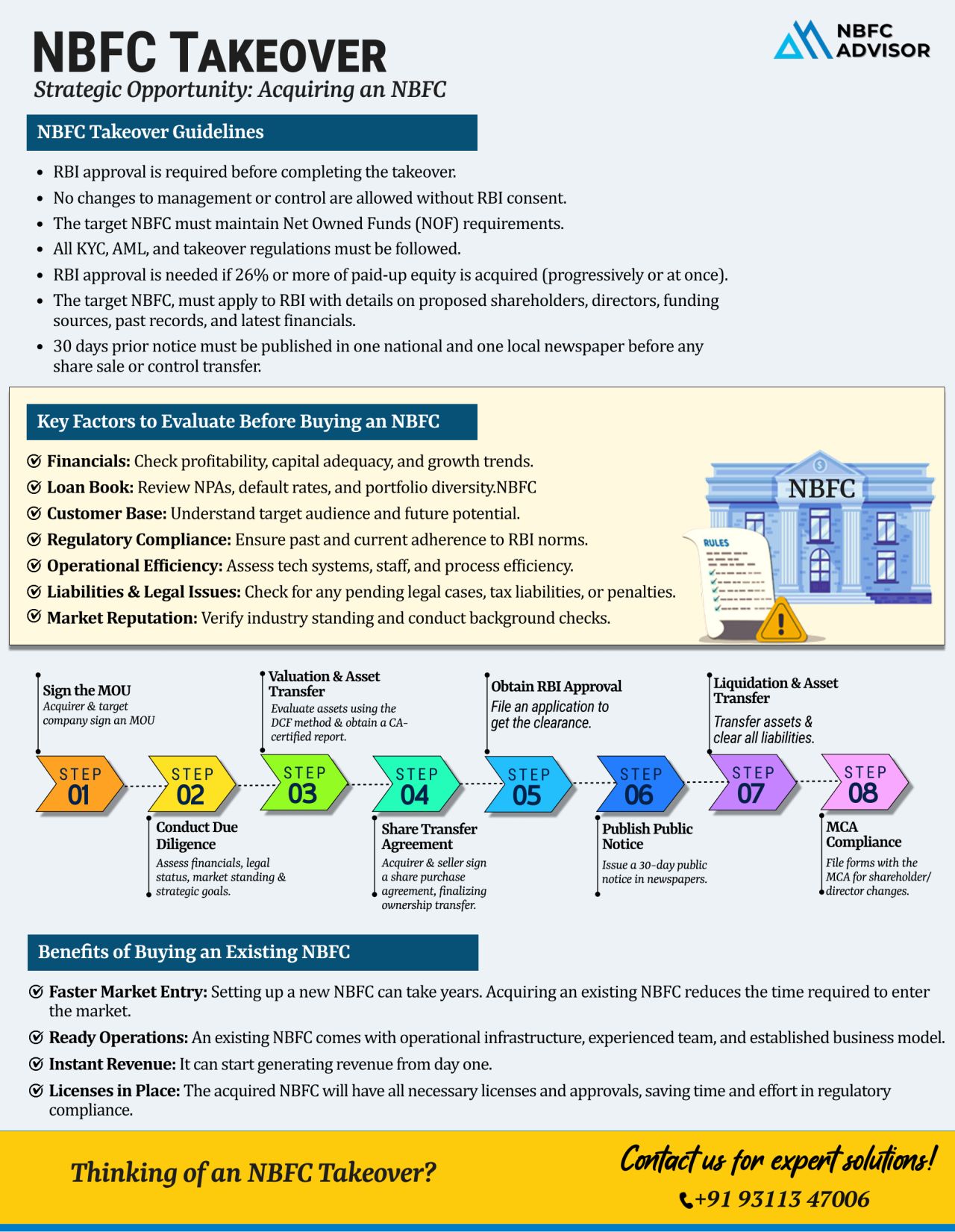

Acquiring a registered NBFC offers a strategic shortcut into the lending ecosystem:

-

✅ Already approved by the RBI

-

✅ Instantly operational with existing systems

-

✅ Active loan book and experienced staff

However, a takeover isn’t as simple as signing an agreement—it involves detailed checks, due diligence, and strict compliance with RBI rules.

🔍 What You Must Evaluate Before Taking Over an NBFC

To ensure a secure and compliant acquisition, pay attention to:

-

Financial Strength & Capital Adequacy

Ensure the NBFC meets regulatory financial requirements and is fiscally sound. -

Quality of the Loan Portfolio

Assess NPA levels, credit risk, and portfolio performance. -

Operational Readiness

Evaluate the team, technology, and internal systems. -

Compliance Track Record

Check for RBI compliance history, legal disputes, or hidden liabilities. -

Reputation in the Market

Understand the company’s brand perception and borrower feedback.

📌 RBI Approval is Mandatory

You must obtain prior approval from the Reserve Bank of India before any change in control. Key steps in the process include:

-

Submitting an application with required documentation

-

Drafting and signing a Share Purchase Agreement (SPA) and MOU

-

Issuing public notices in newspapers

-

Filing updates with the Ministry of Corporate Affairs (MCA)

-

Verifying the buyer’s “fit and proper” status

Skipping or mishandling any of these steps can lead to delays or regulatory pushback.

🧩 Need Help with a Seamless NBFC Takeover?

We guide you through the entire 8-step acquisition process—from financial due diligence to RBI filings and final approval.

Our services include:

-

Full legal and financial checks

-

Documentation and agreement drafting

-

Public notice compliance

-

RBI application preparation and liaison

-

Post-acquisition transition support

📞 Let’s make your NBFC acquisition simple, swift, and compliant.

Book your free consultation today!

+91 93113 47006

#NBFCAdvisor #NBFCtakeover #RBI #FinancialServices #Fintech #NBFC #Compliance #DueDiligence #DigitalLending #RBIapproval #NBFCsetup