NBFC Compliance Services: Stay RBI-Compliant, Avoid Penalties & Build Long-Term Trust

In today’s regulated financial environment, compliance is the backbone of every successful NBFC. With increasing supervision by the Reserve Bank of Ind...

FinTech–NBFC Collaboration Service: Powering Scalable, RBI-Compliant Digital Lending Partnerships

The future of financial services lies in collaboration. FinTech companies bring technology, customer experience, and innovation, while NBFCs br...

NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

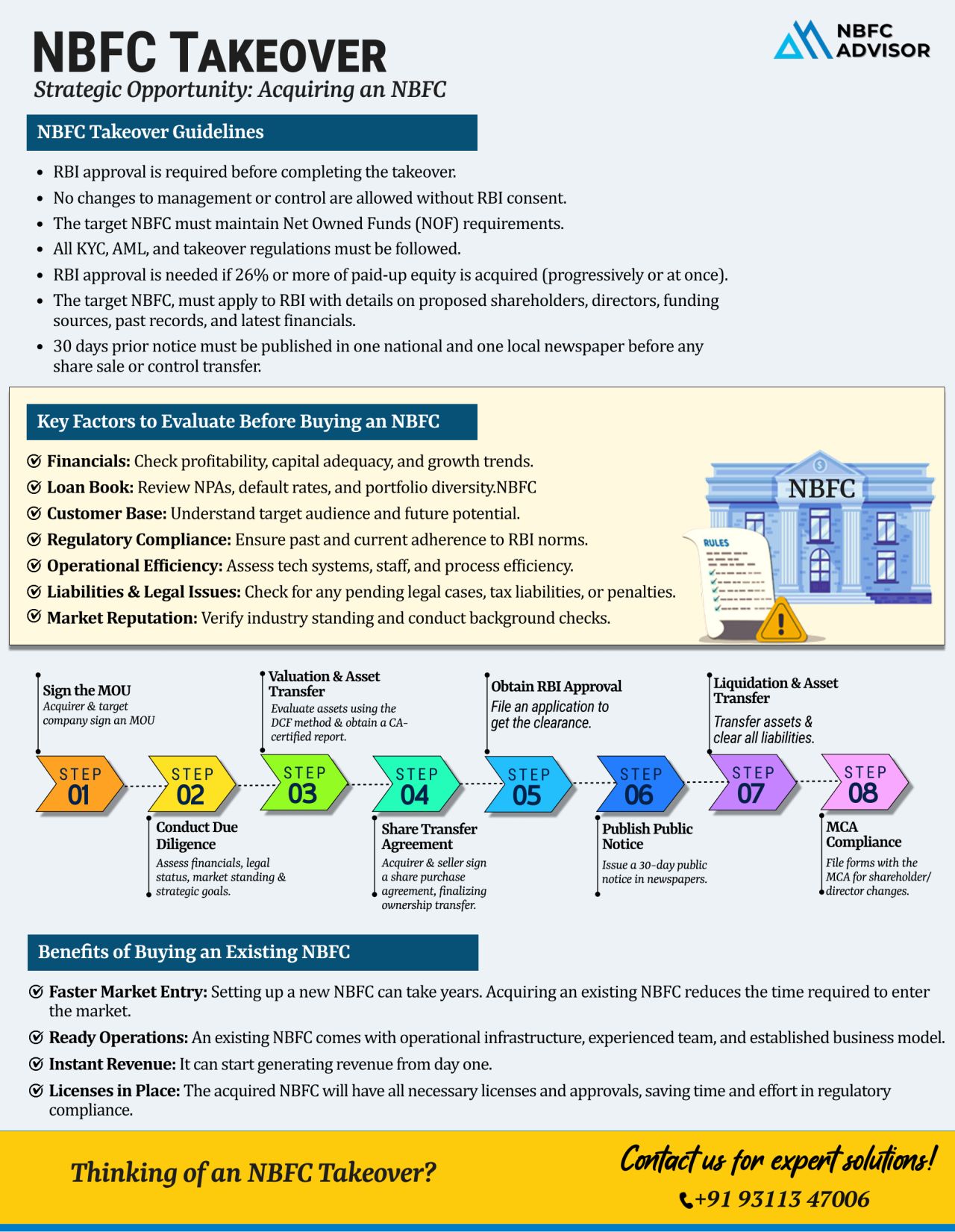

NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

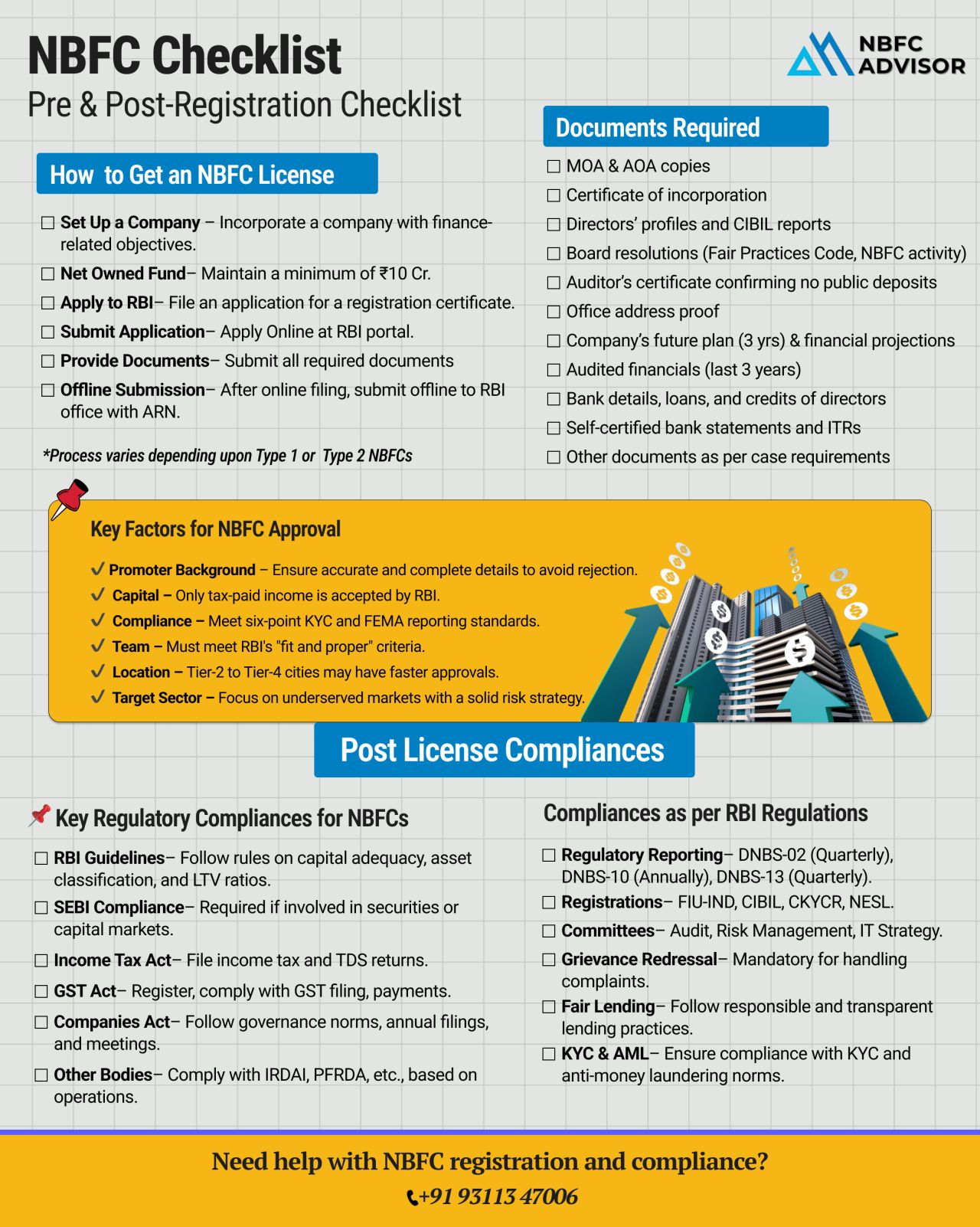

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

Thinking of Entering India’s Fast-Growing NBFC Space? Choose an NBFC Takeover for Faster Market Entry

India’s Non-Banking Financial Company (NBFC) sector has emerged as one of the most dynamic segments of the financial market — o...

Thinking of Starting an NBFC? Here’s Why a Takeover Might Be Smarter Than a Fresh Registration

If you’re planning to enter the lending and finance industry, setting up a Non-Banking Financial Company (NBFC) can be a powerful way to gro...

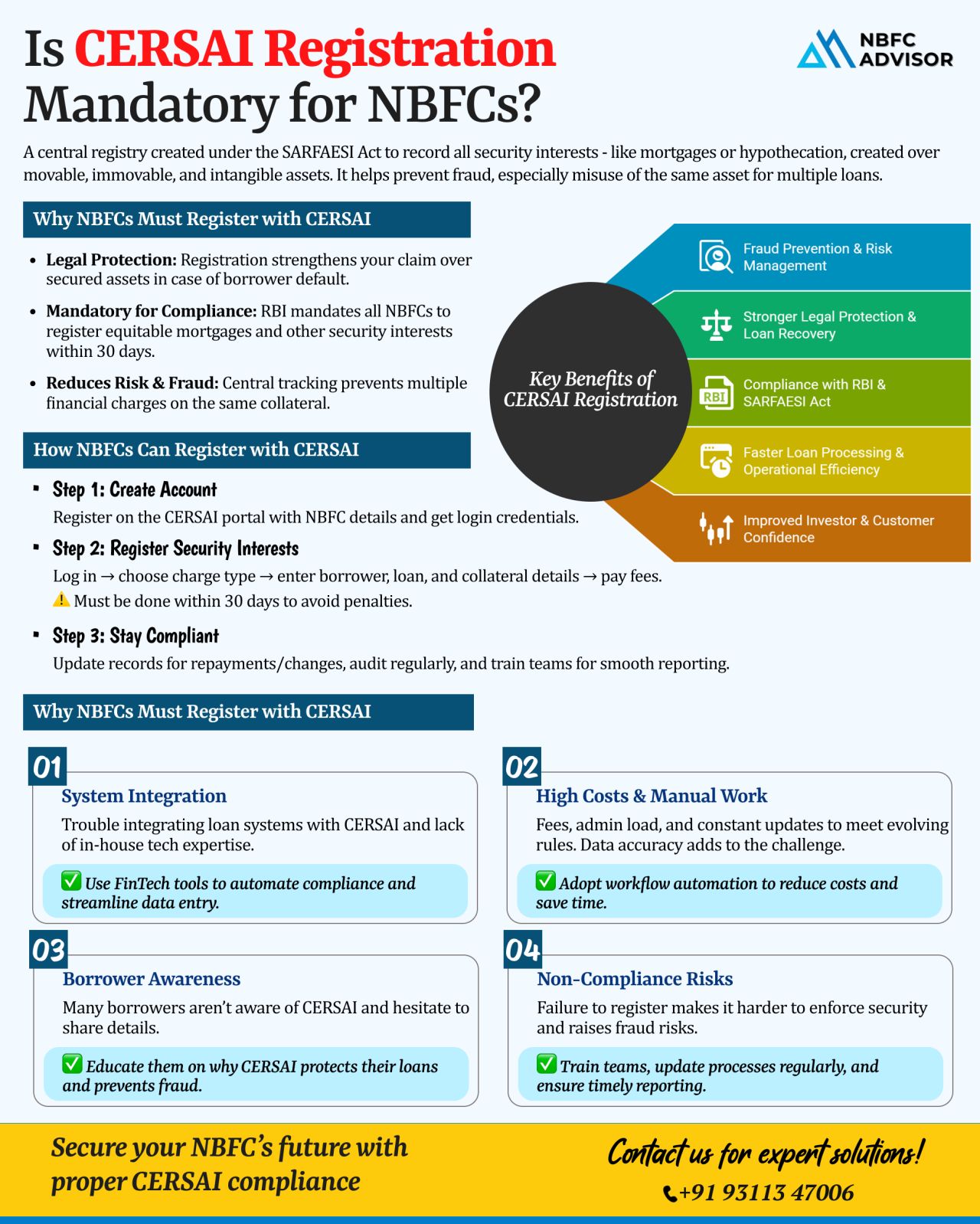

Is CERSAI Registration Mandatory for NBFCs?

One of the most overlooked compliance areas for NBFCs is CERSAI registration. While RBI norms, customer due diligence, and credit processes get proper attention, many lenders fail to recognize that CERSA...

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

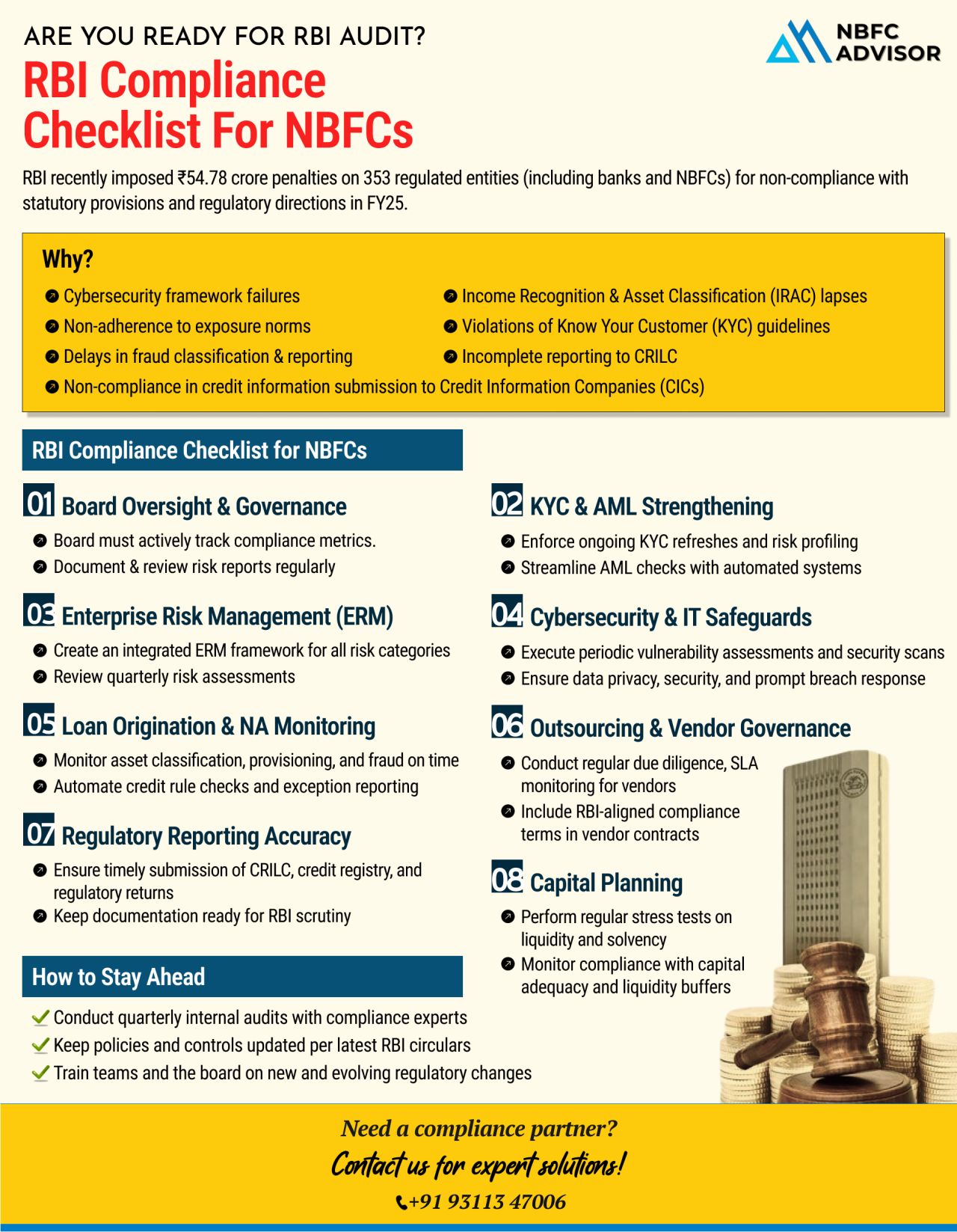

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

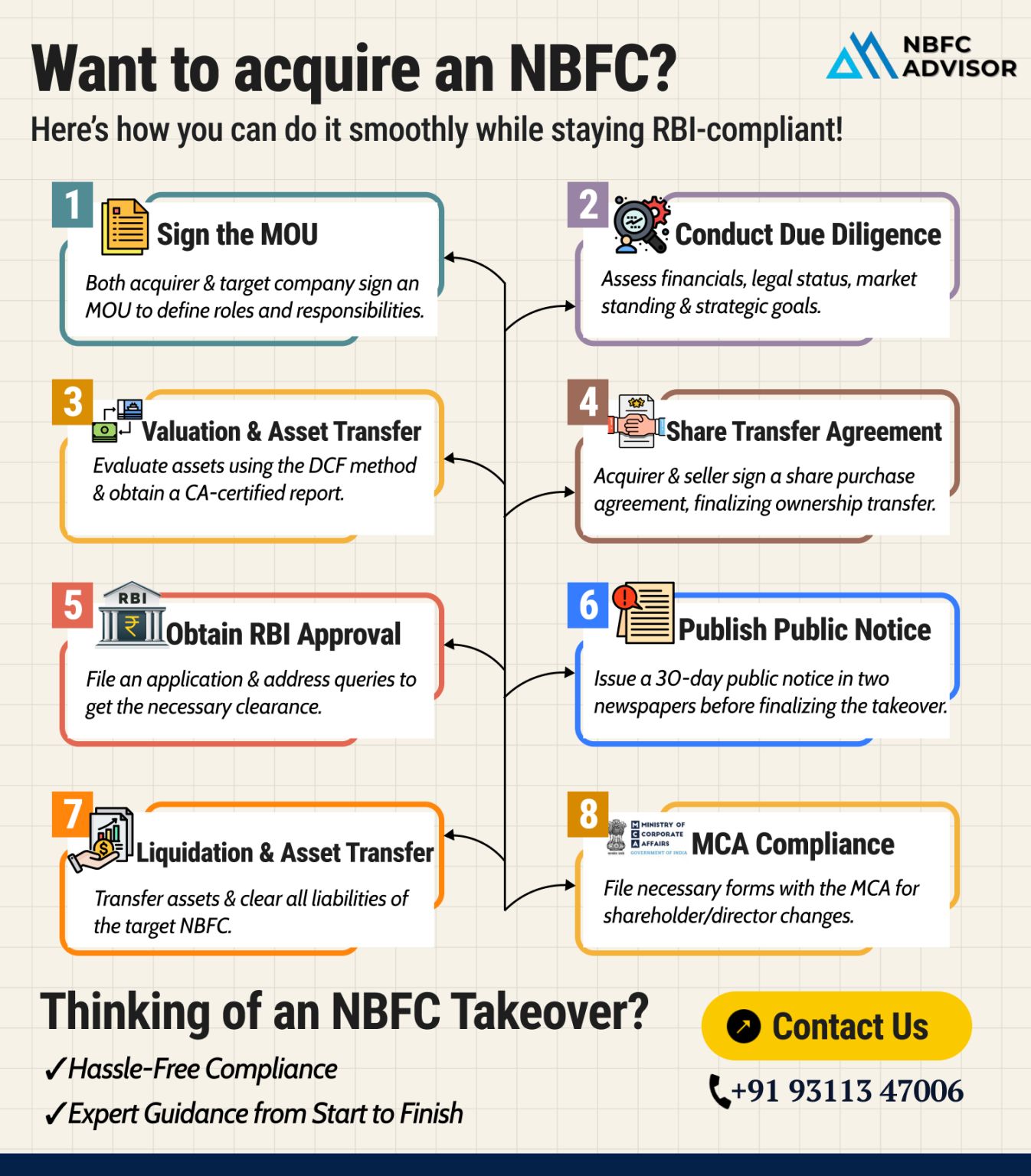

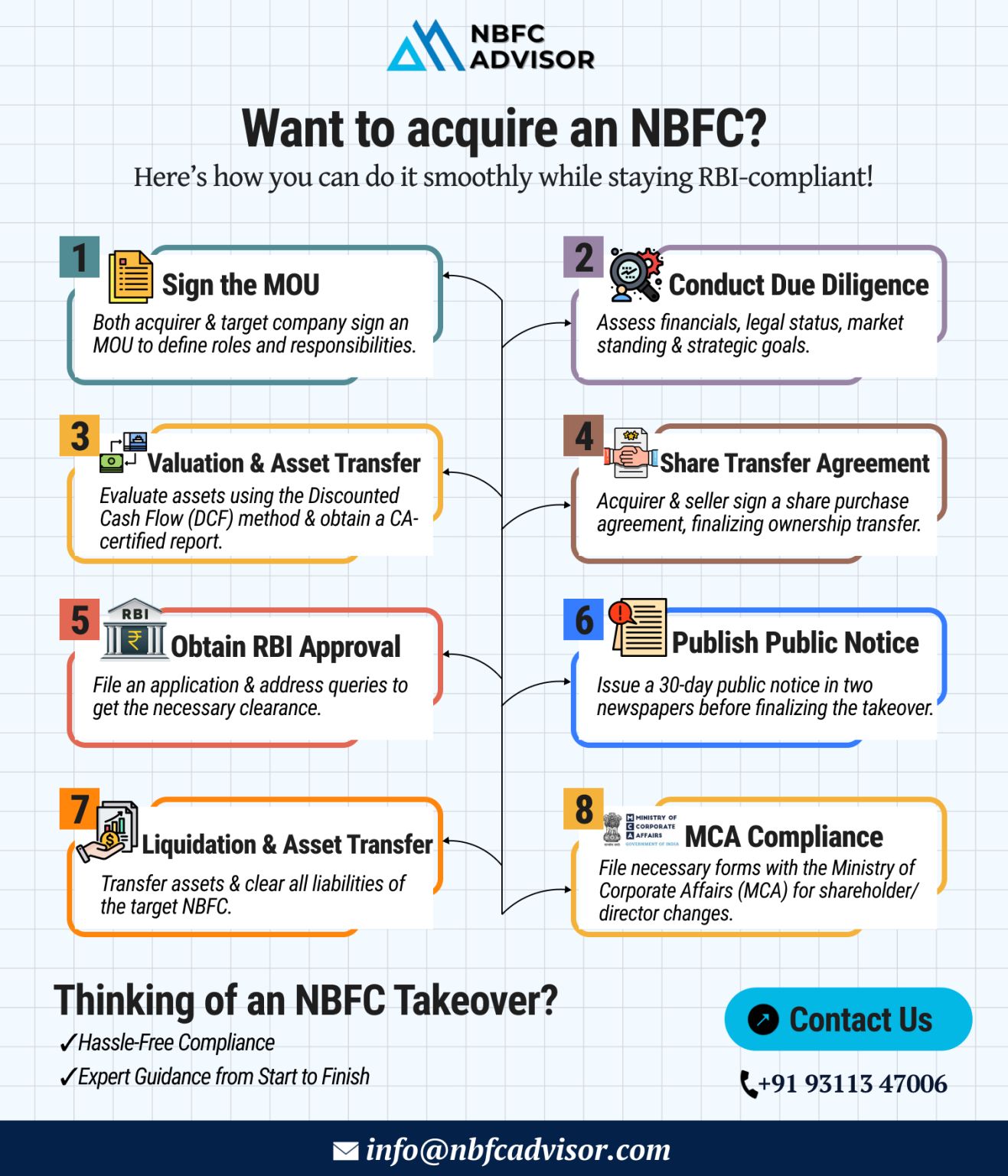

Acquiring a Non-Banking Financial Company (NBFC) can unlock exciting growth opportunities—but staying compliant with RBI regulations is non-negotiable.

Here’s how to acquire an NBFC the right way:

1️⃣ Sign the MoU

Define roles, res...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Unlock Your Financial Future with NBFC Advisor

Transform your NBFC deal into a seamless, secure, and successful venture with our expert guidance. At NBFC Advisor, we take the complexity out of the process, handling everything from meticulous due d...

The Reserve Bank of India (RBI) has issued guidelines for Non-Banking Financial Companies (NBFCs) to enhance financial stability and governance. Key compliance highlights include:

🔹 Scale-Based Regulation (SBR): NBFCs are classified into four lay...

What is DLG?

Default Loss Guarantee (DLG) allows lenders to secure compensation from third parties for loan defaults.

Key RBI Guidelines:

✔ DLG is permitted only between Regulated Entities (REs) and Lending Service Providers (LSPs).

✔ LSPs ...

When an ambitious NRI entrepreneur set out to acquire an NBFC in India, he faced a maze of consultants, delays, and false promises. Despite assigning the mandate to a consultant, he soon realized their approach wasn’t aligned with his vision.

...

The International Financial Services Centres Authority (IFSCA) has introduced key updates to its Fund Management Regulations, 2022, effective February 19, 2025. These revisions align with the December 2024 proposals and bring significant changes for ...

In the fast-paced world of fintech, many entrepreneurs are eyeing the potential of acquiring an NBFC (Non-Banking Financial Company) or applying for new NBFC registrations.

But here’s the reality: Most attempts fall short. Whether you're...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Co-lending, a collaborative lending model where multiple lenders join forces to provide financing to a borrower, has become increasingly popular in the financial sector. This approach allows lenders to capitalize on their individual strengths while s...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In the dynamic realm of Non-Banking Financial Companies (NBFCs), takeover processes play a crucial role in shaping market landscapes and strategic trajectories. Let’s delve into the intricacies of NBFC takeovers, exploring the reasons behind th...

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)