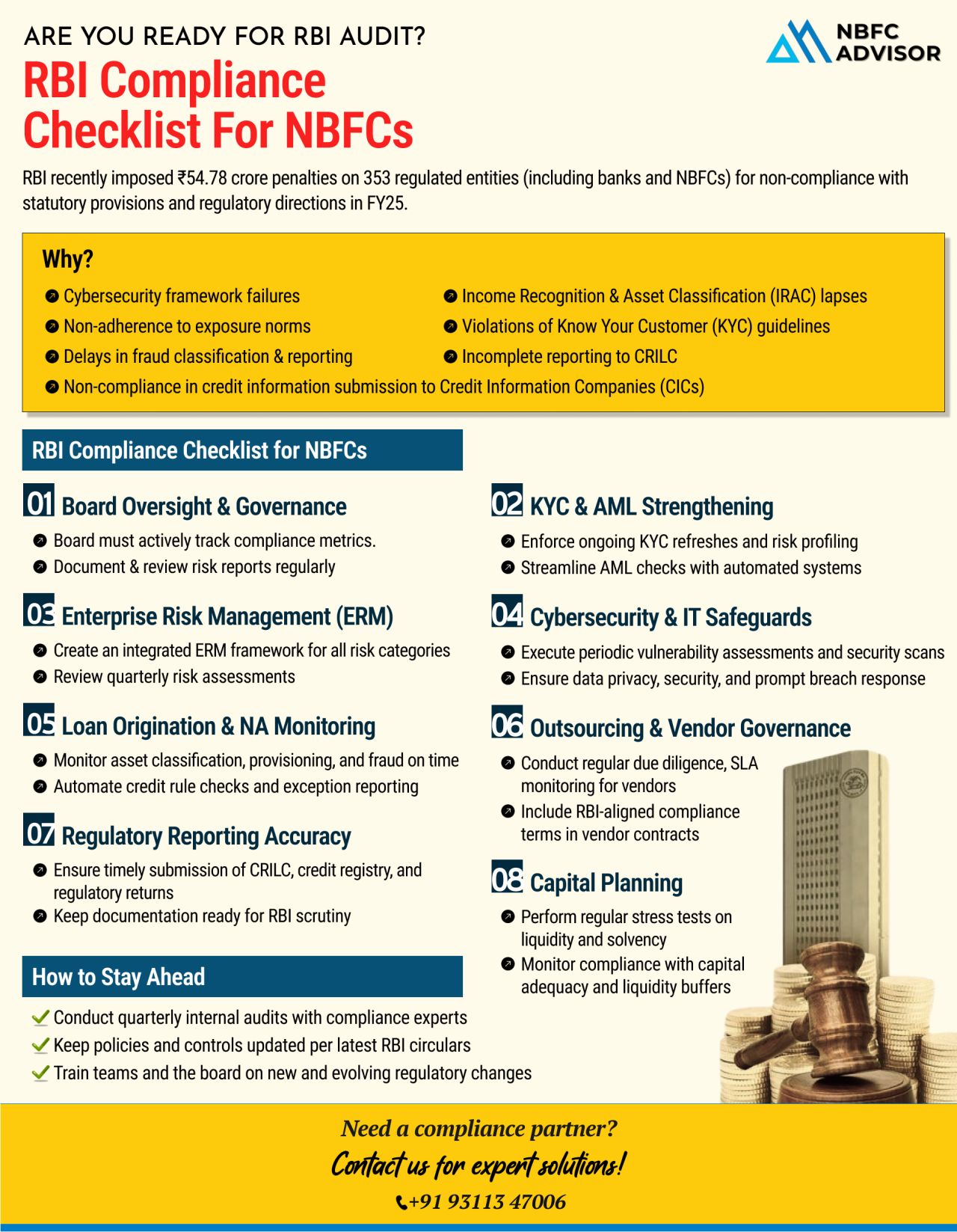

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

The gold loan industry in India is experiencing rapid growth. It is expected to cross ₹10 lakh crore in FY25 and reach ₹15 lakh crore by 2027.

NBFCs Are Leading the Surge

Non-Banking Financial Companies (NBFCs) are playing a major role in this ...

Microfinance has long been a cornerstone of financial inclusion in India, supporting small businesses and underserved communities. However, the latest Micrometer Q3 FY 2024-25 report unveils alarming trends, raising concerns about the sector's st...

Did you know? Gold loans in India are projected to cross ₹10 lakh crore in FY25 and surge to ₹15 lakh crore by 2027!

🏆 NBFCs are leading the charge, growing at 17-19% YoY, thanks to:

✅ Faster approvals

✅ Flexible repayment options

✅ Higher LTV...

In recent months, the Reserve Bank of India (RBI) has implemented several stringent measures affecting non-banking financial companies (NBFCs). These measures include restrictions on important business areas such as gold loans and securities financin...

.png)

.jpeg)