NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Running a Non-Banking Financial Company (NBFC) in India is not just about lending, growth, and profitability. In today’s tightly regulated environment, compliance failures...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

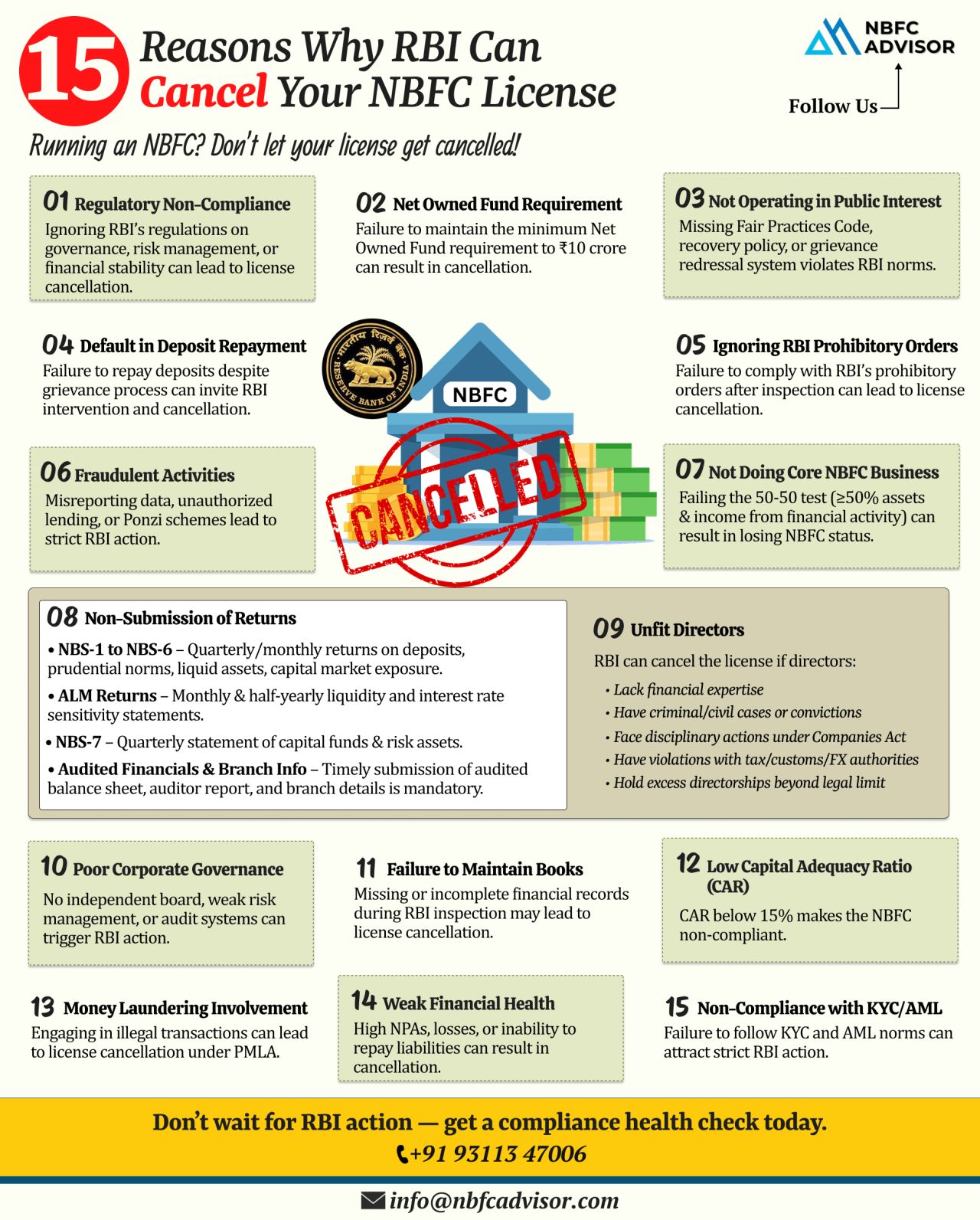

15 Warning Signs That Could Put Your NBFC License at Risk

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Interestingly, most of these cancellations are not due to fraud, but result ...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐮𝐥𝐞𝐬 — 𝘈𝘳𝘦 𝘠𝘰𝘶𝘳 𝘖𝘱𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘴 𝘊𝘰𝘮𝘱𝘭𝘪𝘢𝘯𝘵?

India’s digital lending ecosystem is expanding at an unprecedented pace. But with rapid growth comes increasing...