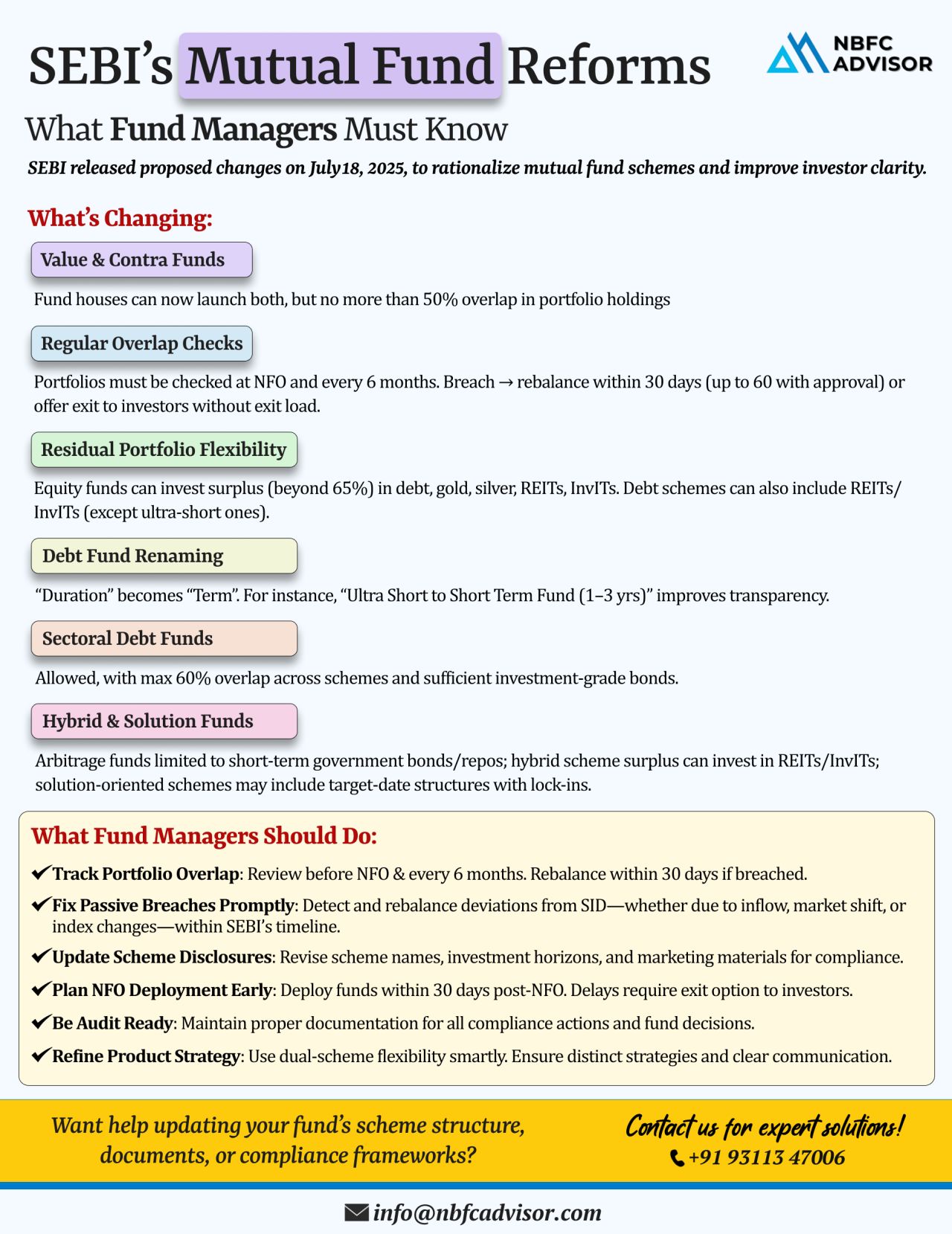

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘶𝘭𝘦𝘴 𝘈𝘳𝘦 𝘊𝘩𝘢𝘯𝘨𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under an entirely new regulatory framework—and the implications are significant for startups, inves...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

In today's rapidly changing financial landscape, traditional credit scoring methods often fail to meet the needs of millions of people worldwide who are underserved by formal banking systems. Emerging economies, such as the Philippines, struggle ...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

.jpeg)