Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

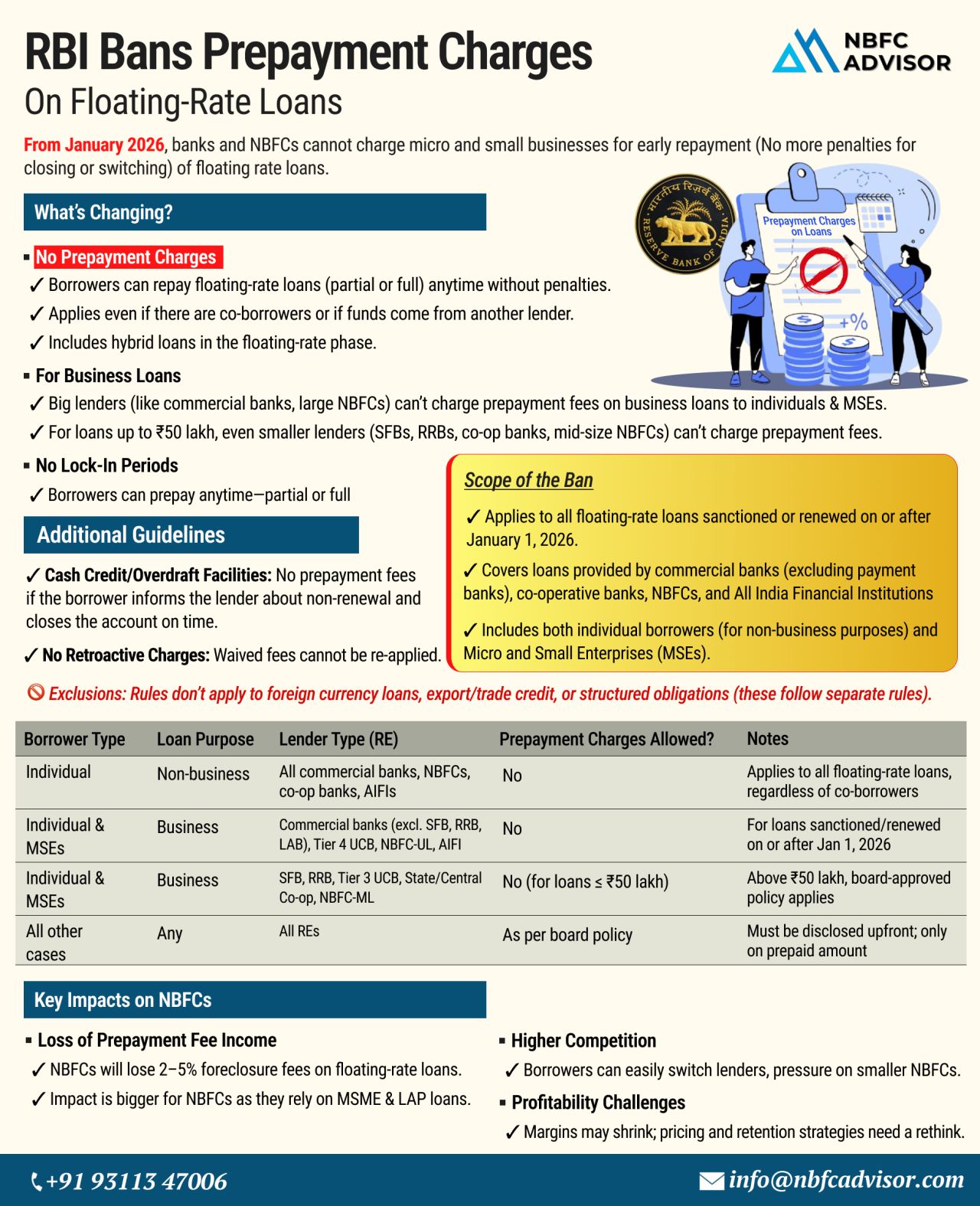

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

The Reserve Bank of India (RBI) has introduced a new framework to regulate penal charges on loans — marking a significant shift toward more transparent and borrower-friendly lending practices.

Key Highlights:

No More Penal Int...

The Reserve Bank of India’s (RBI) revised Net Owned Fund (NOF) requirements will impact thousands of NBFCs across India. Whether you operate as an NBFC-ICC, NBFC-MFI, NBFC-Factor, or a Type I NBFC, understanding these regulatory changes is cruc...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

.jpeg)

.jpeg)