NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

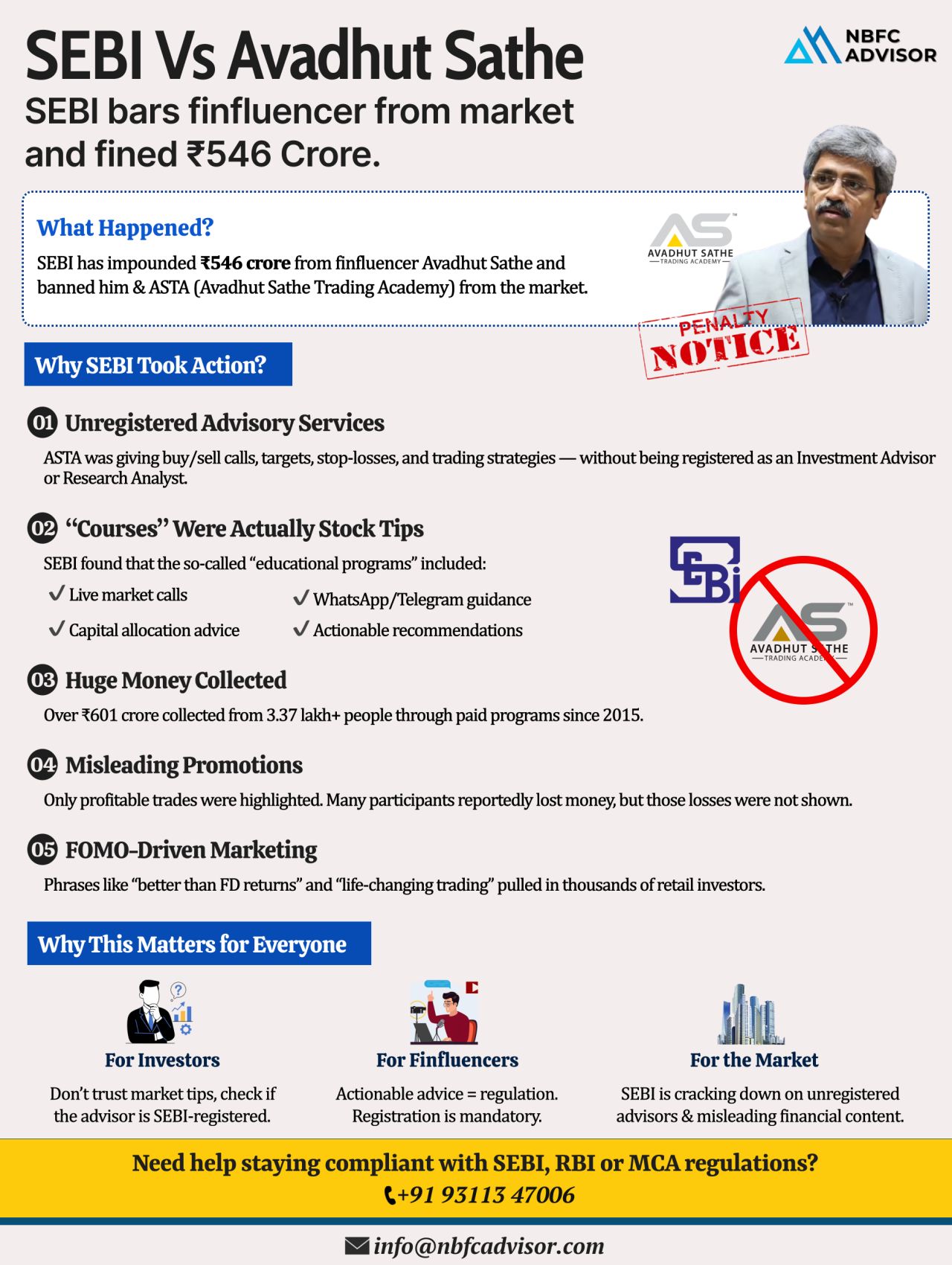

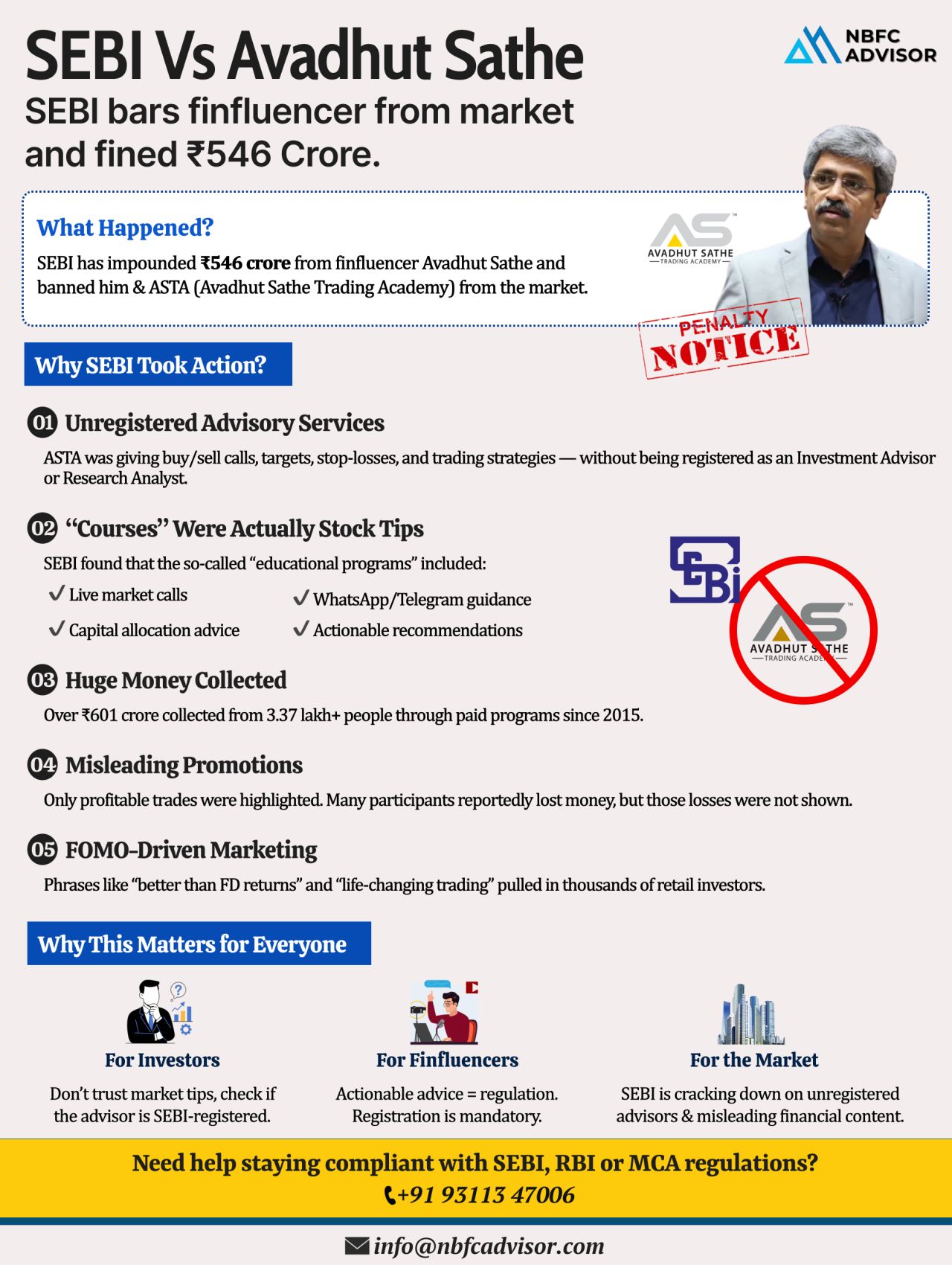

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

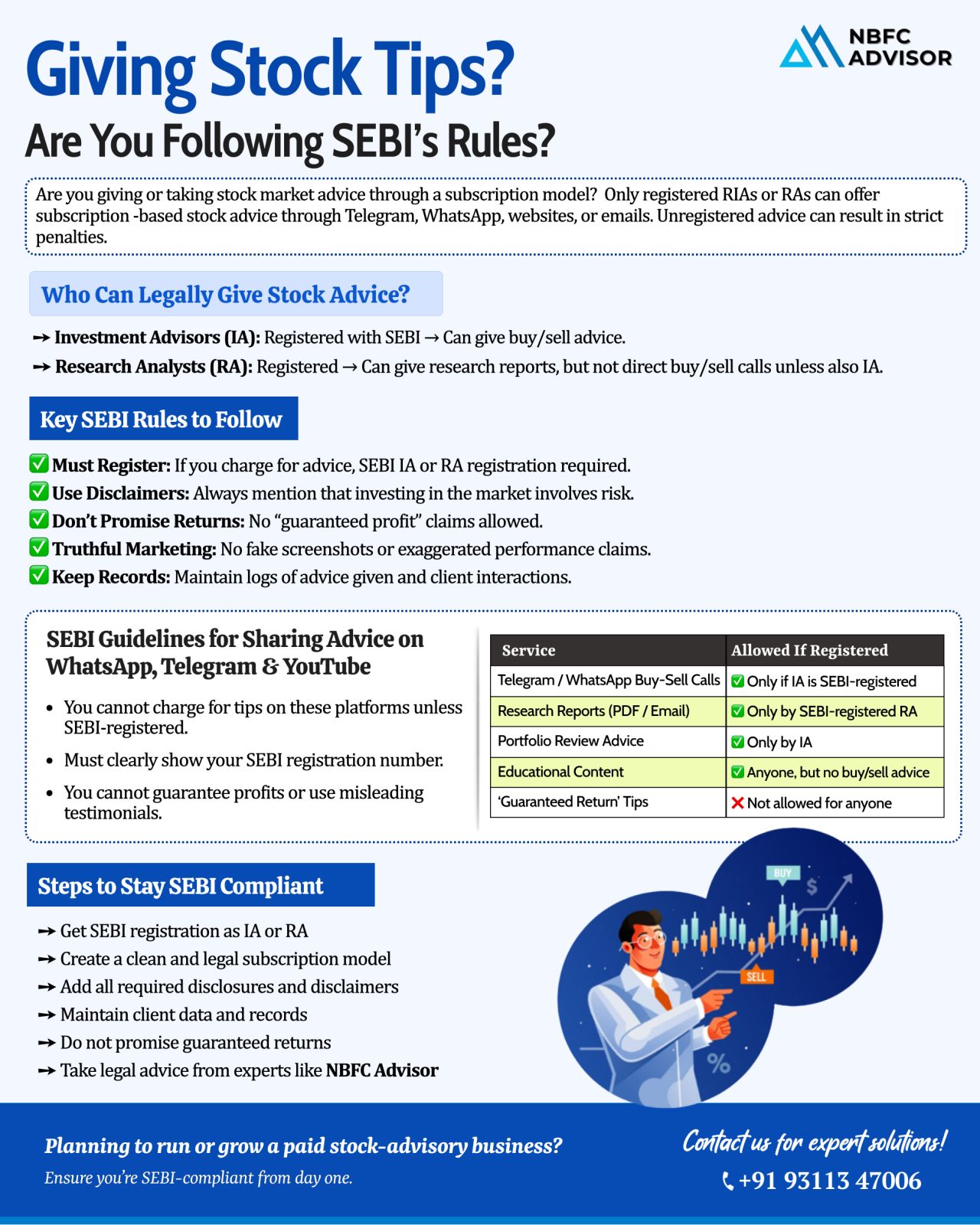

Selling Stock Tips on Telegram, WhatsApp, or Instagram? SEBI Has Strict Rules You Must Follow

In recent years, social media has become a major hub for stock market discussions. From Telegram channels to WhatsApp groups and Instagram pages, thousan...

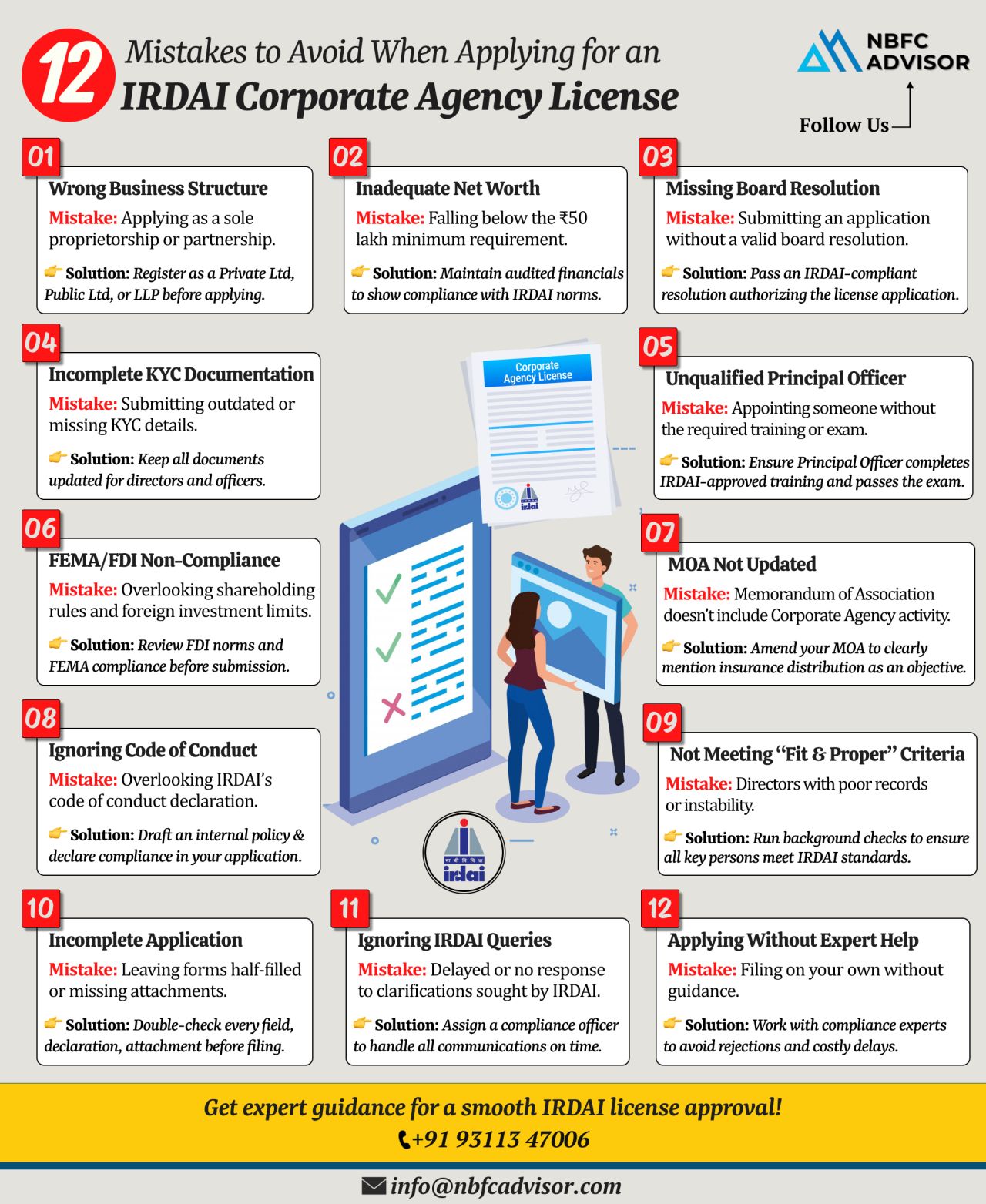

Getting an IRDAI Corporate Agency License? Don’t Make These Costly Mistakes

If your company, LLP, or bank is planning to sell or distribute insurance policies—whether it’s life, health, or motor insurance—you’ll...

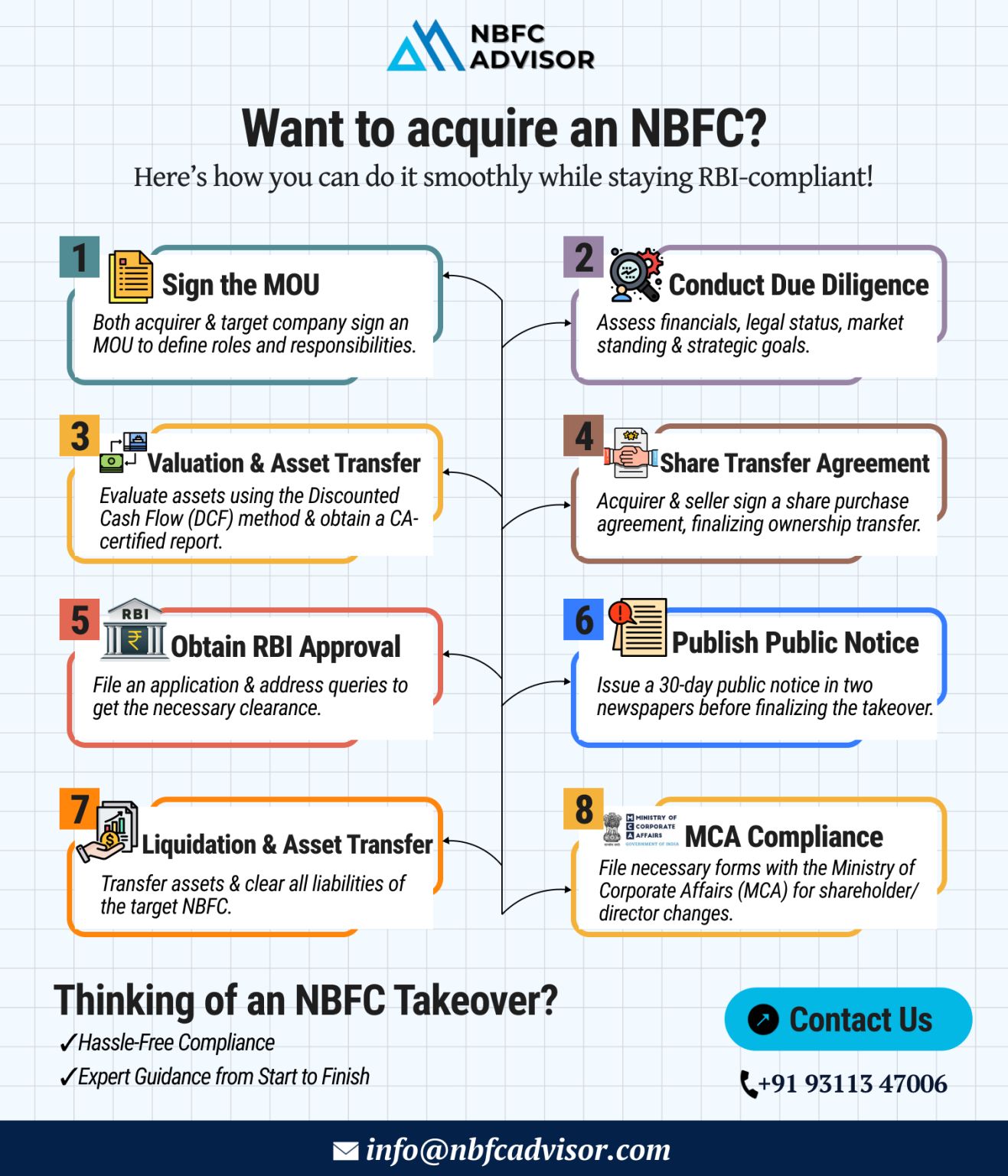

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

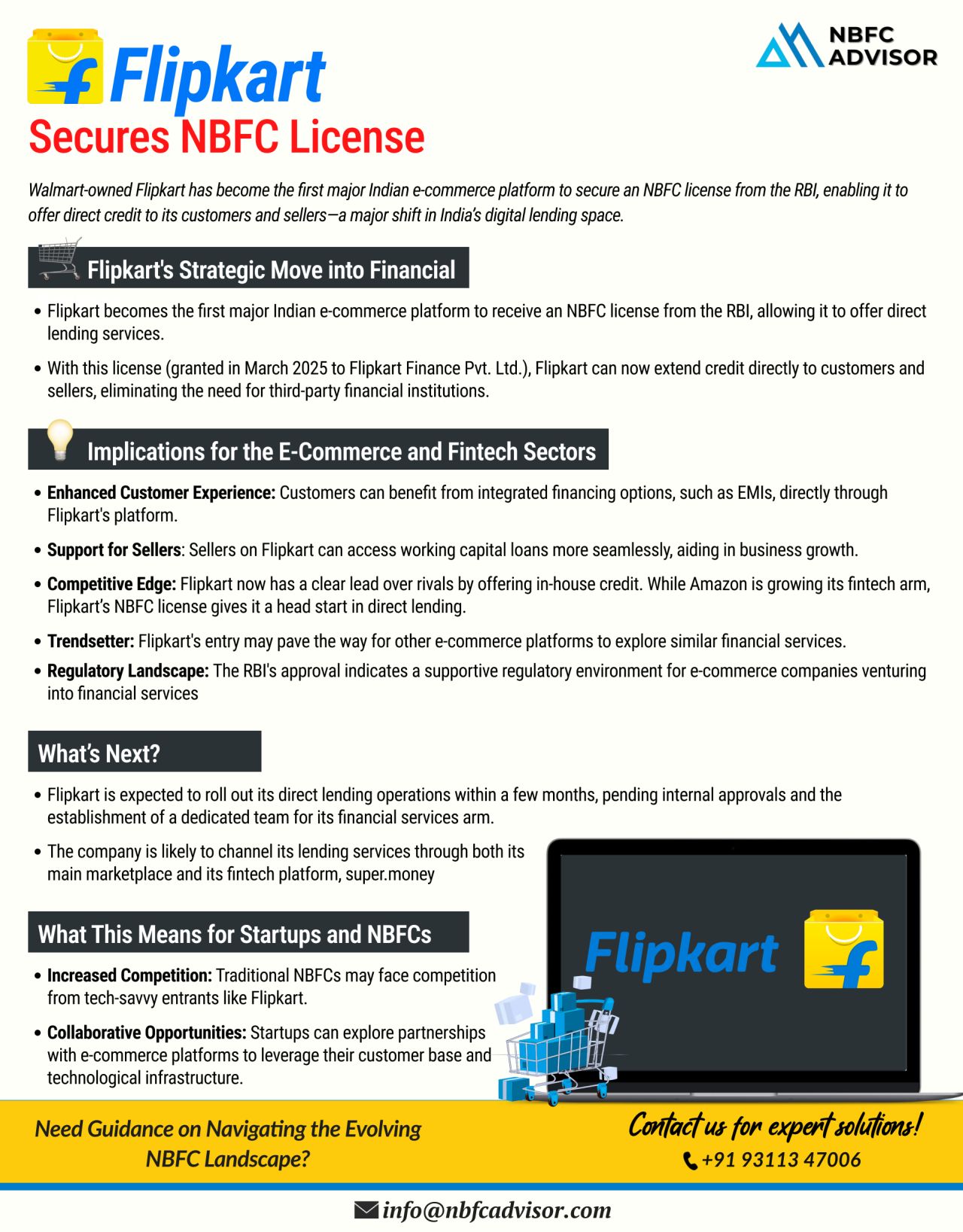

Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This developm...

Acquiring a Non-Banking Financial Company (NBFC) can unlock exciting growth opportunities—but staying compliant with RBI regulations is non-negotiable.

Here’s how to acquire an NBFC the right way:

1️⃣ Sign the MoU

Define roles, res...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

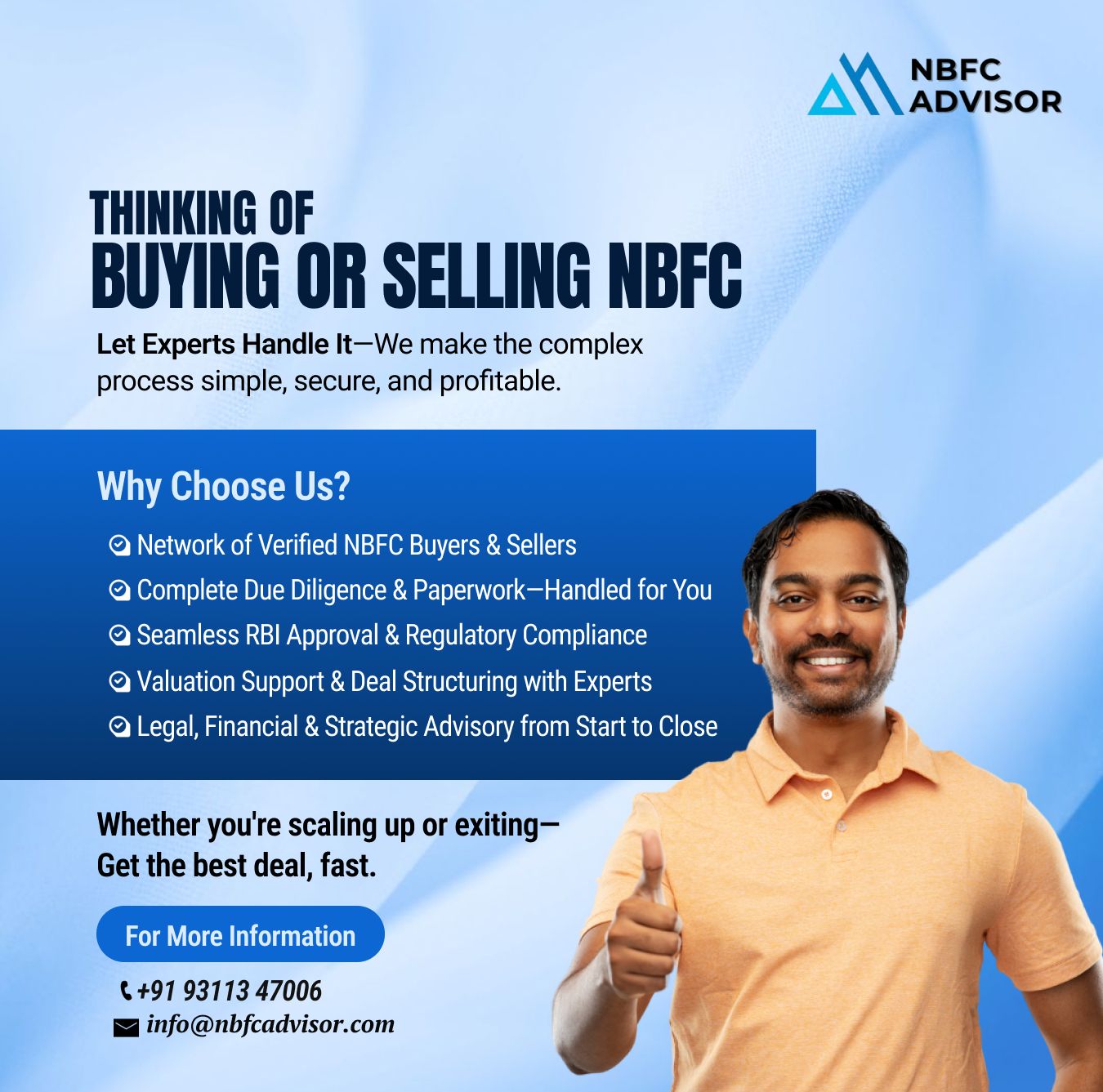

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Unlock Your Financial Future with NBFC Advisor

Transform your NBFC deal into a seamless, secure, and successful venture with our expert guidance. At NBFC Advisor, we take the complexity out of the process, handling everything from meticulous due d...

In today’s competitive market, delayed payments can create major cash flow challenges—especially for Micro, Small, and Medium Enterprises (MSMEs). That’s where factoring steps in as a powerful financial solution.

What is Factor...

India’s credit landscape is rapidly evolving, and Pass-Through Certificates (PTCs) are driving this transformation.

What Are PTCs?

PTCs are financial instruments backed by loan pools, allowing NBFCs to transfer loan ownership to ban...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

The LendingTech sector in India is witnessing rapid growth, driven by the rising demand for digital lending solutions that target unbanked and underserved populations. This article delves into how LendingTech startups are differentiating themselves, ...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The Reserve Bank of India (RBI) has introduced draft guidelines that aim to bring transparency and fairness to the digital lending space. These guidelines are specifically targeted at regulating Lending Service Providers (LSPs), previously known as l...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)