FinTech–NBFC Collaboration Service: Powering Scalable, RBI-Compliant Digital Lending Partnerships

The future of financial services lies in collaboration. FinTech companies bring technology, customer experience, and innovation, while NBFCs br...

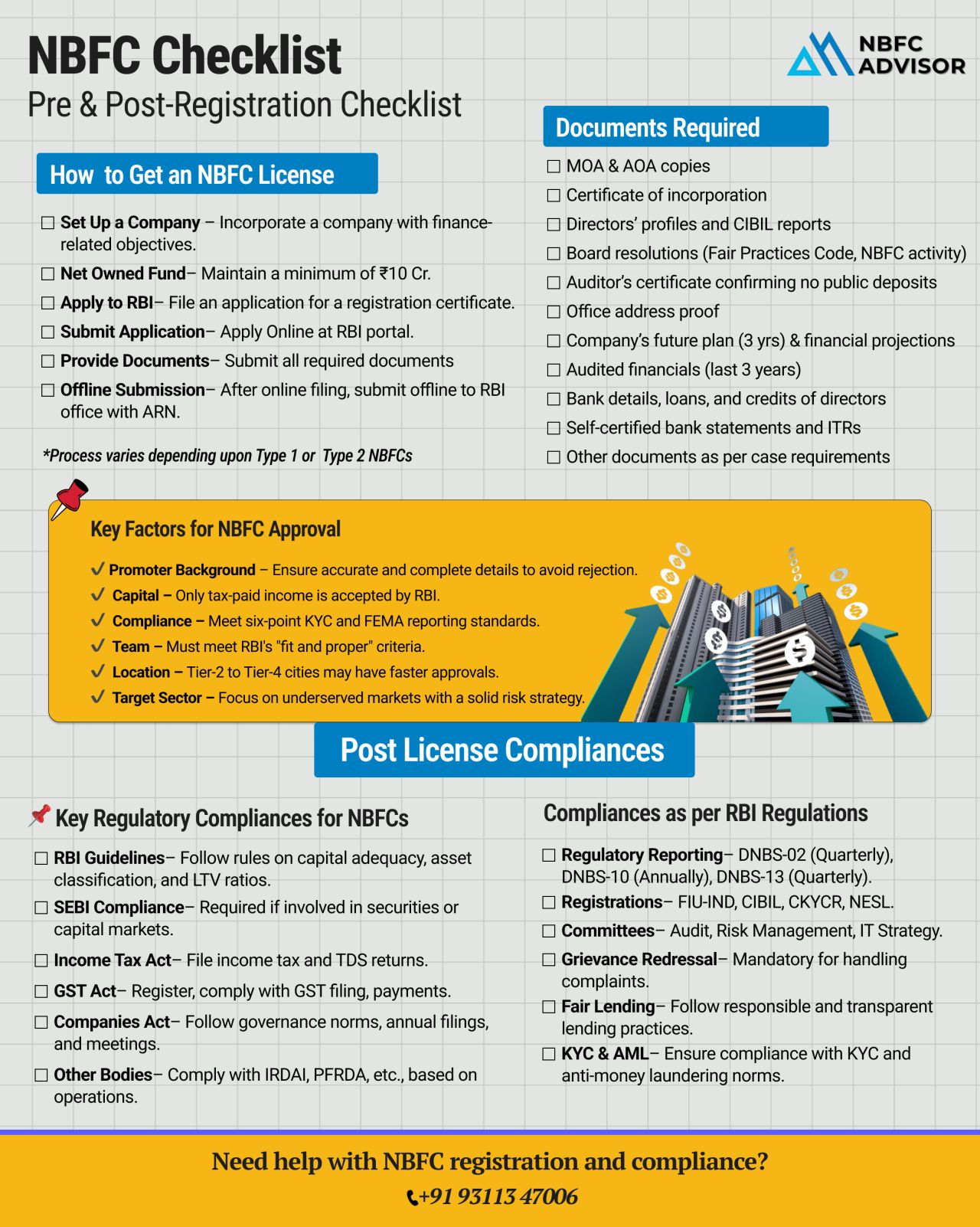

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

Why Are NBFCs Turning to Loan Against Property (LAP)?

India’s Non-Banking Financial Companies (NBFCs) are entering a new growth phase — and Loan Against Property (LAP) is leading the way.

The Shift Toward Secure, Reliable, and Scala...

RBI Is Cracking Down on NBFCs — Is Your Company Compliance-Ready?

The Reserve Bank of India (RBI) has intensified its scrutiny of Non-Banking Financial Companies (NBFCs)—and the message is loud and clear: compliance is no longer negoti...

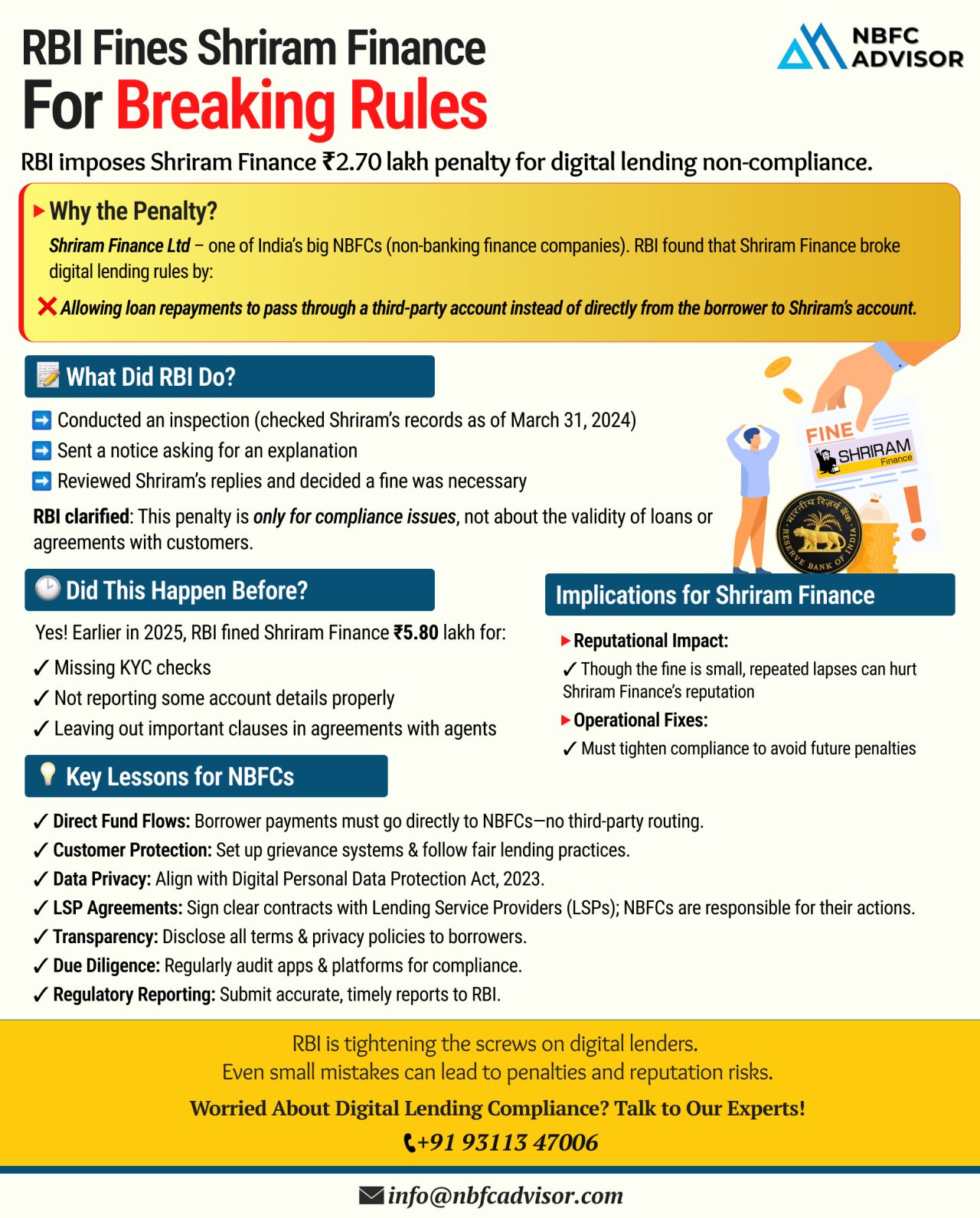

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

The Reserve Bank of India (RBI) has introduced updated guidelines aimed at strengthening gold loan practices and enhancing the co-lending framework for better transparency, responsible lending, and financial inclusion.

Key Highlights:

✅ L...