NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey without complete clarity on documents, approvals, and compliance requirements.

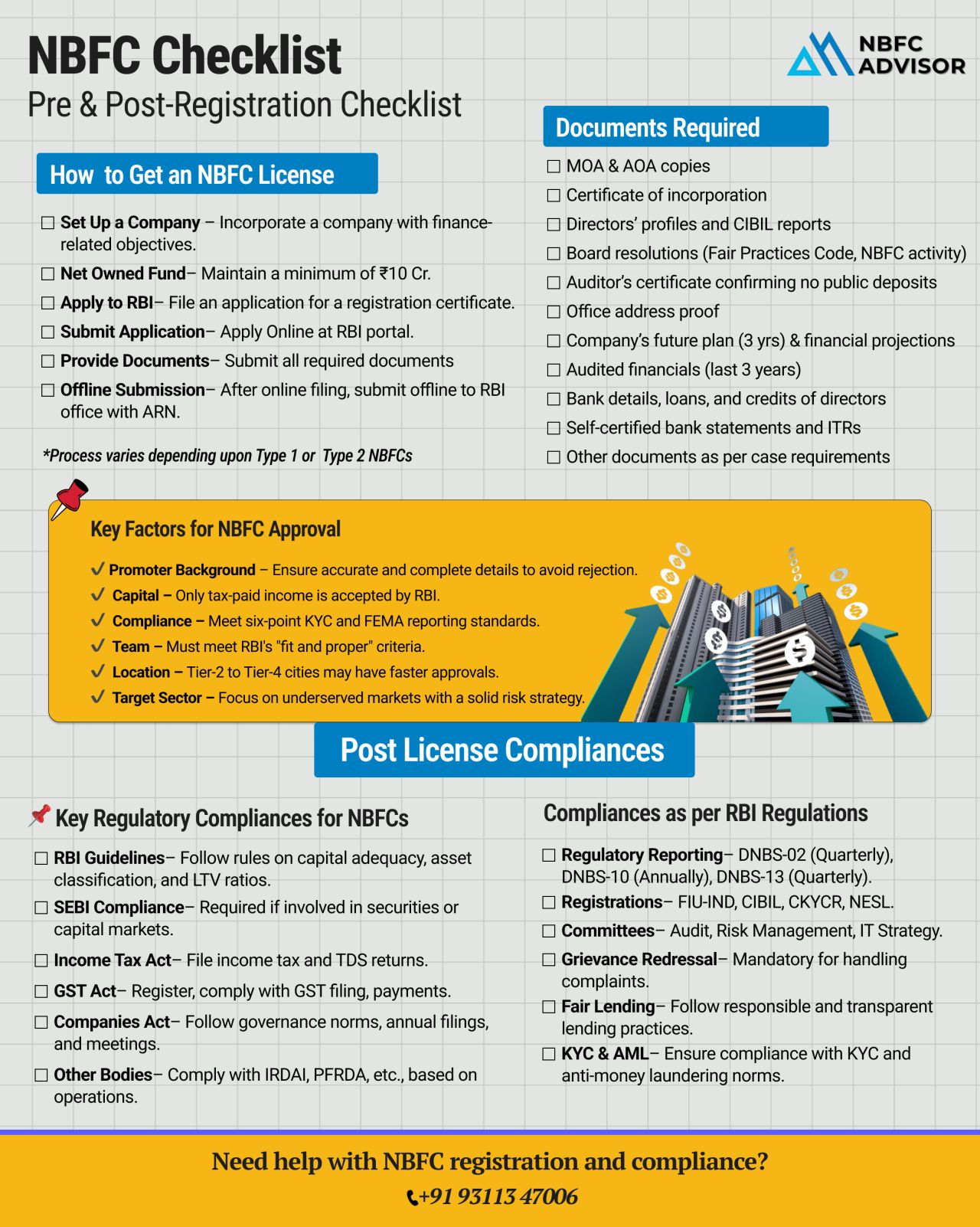

The RBI is very particular about who gets licensed. Approval depends on:

✔ Accurate and complete paperwork

✔ Clean promoter background

✔ Valid capital proof

✔ Compliance readiness

If you want to avoid delays, queries, or rejection, you must prepare the right documents before applying—and know exactly what compliances follow after registration.

This comprehensive checklist breaks down everything an aspiring NBFC founder needs.

1. What You Must Prepare Before Applying for NBFC Registration

Before submitting your application to RBI, ensure the following are ready:

-

Company incorporation under the Companies Act, 2013

-

Minimum Net Owned Fund (NOF) of ₹10 crore (as per updated RBI norms)

-

Clean financial background of promoters and directors

-

Business plan for 5–10 years, including lending model, target segment, risk framework

-

Proof of source of capital for NOF

-

Registered office address and utility proofs

-

KYC documents for directors and shareholders

-

Fit & Proper criteria documentation

A well-prepared file increases your chances of smooth approval.

2. Documents Required by RBI for NBFC Registration

The RBI requires a detailed set of documents, including:

-

Certificate of Incorporation & MOA/AOA

-

Board resolution for NBFC formation

-

Detailed business plan

-

Net worth certificate from CA

-

Audited financial statements

-

Bank account statements showing NOF

-

Director KYC & credit reports

-

Income tax returns of promoters

-

Organizational structure chart

-

Address proof, ownership proof/lease agreement

-

Compliance declarations and affidavits

Even a minor mismatch or missing document can trigger delays.

3. Key Factors That Influence RBI Approval

RBI evaluates multiple aspects before granting the NBFC license:

✔ Promoter Integrity & Background

Clean financial and legal history is mandatory.

✔ Capital Strength

Genuine, verifiable funding with proper documentation.

✔ Business Model Readiness

A practical and compliant lending framework.

✔ Technology & Reporting Systems

Strong IT systems for KYC, loan monitoring, and RBI reporting.

✔ Risk Management Structure

Policies for credit, liquidity, recovery, grievance redressal, and fair practices.

✔ Governance Standards

Independent directors, internal controls, and audit mechanisms.

Strong compliance preparation significantly increases approval probability.

4. Mandatory Compliances After Receiving NBFC License

Once registered, an NBFC must follow ongoing compliances such as:

-

Filing of DNBS returns

-

Maintaining minimum NOF

-

Fair practices code implementation

-

Statutory audits & internal audits

-

Appointment of compliance officer

-

Adhering to KYC/AML guidelines

-

Formation of risk management committee

-

Regular RBI inspections

-

Updating management changes with RBI

-

Grievance redressal officer appointment

Non-compliance can lead to penalties, restrictions, or cancellation of license.

Conclusion: Build the Right Foundation Before You Apply

If you want to build a strong, trusted NBFC, this checklist is your starting point. Proper preparation not only speeds up the RBI approval process but also ensures smooth operations once the license is issued.

Need help with NBFC registration, due diligence, or compliance?

We assist founders in completing documentation, building the right systems, and preparing a strong RBI-ready application.

📞 Call for a Free Consultation: +91 93113 47006

#NBFCAdvisor #RBI #Compliance #NBFCRegistration #LendingBusiness #RBIRegulations #NBFC