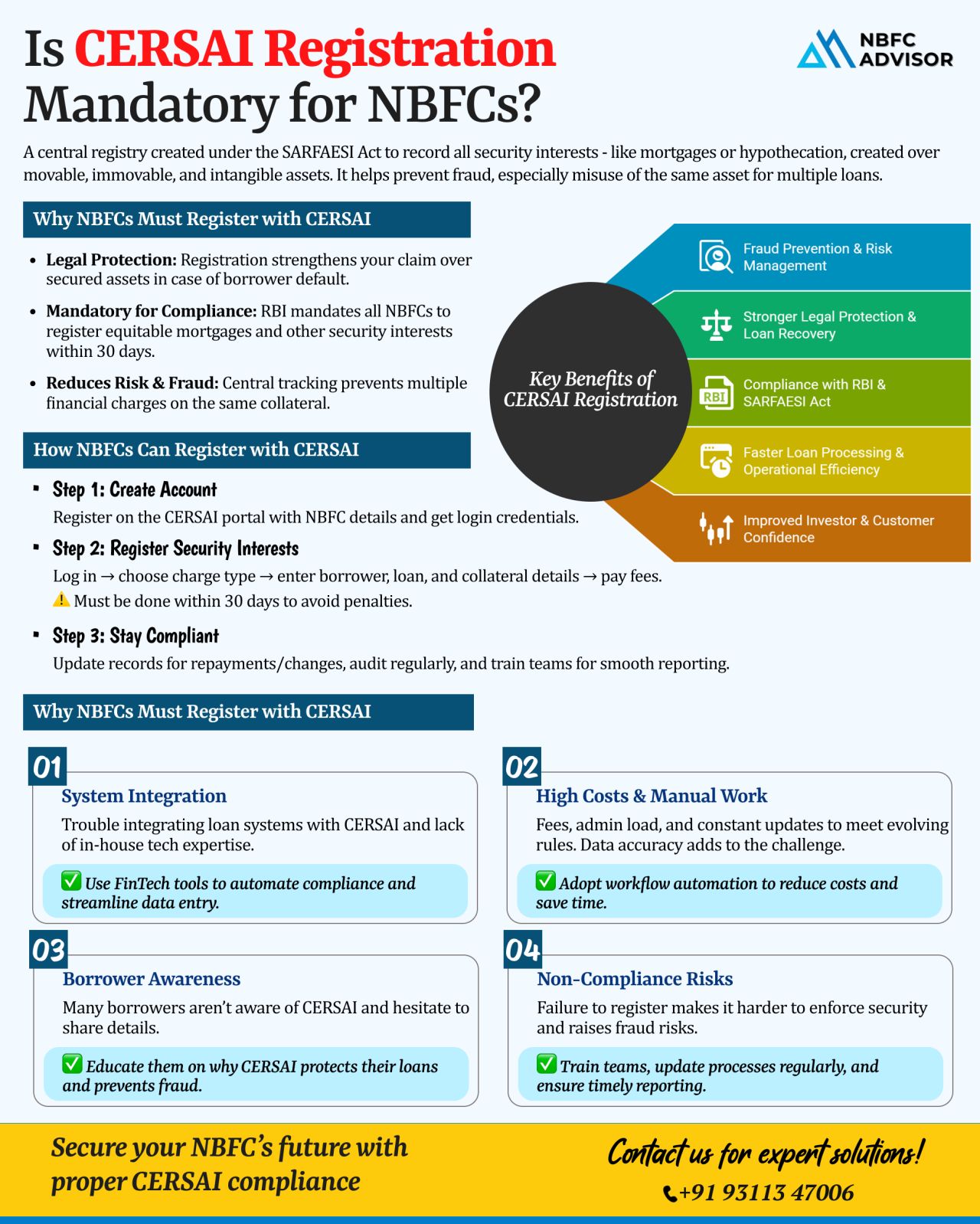

Is CERSAI Registration Mandatory for NBFCs?

One of the most overlooked compliance areas for NBFCs is CERSAI registration. While RBI norms, customer due diligence, and credit processes get proper attention, many lenders fail to recognize that CERSA...

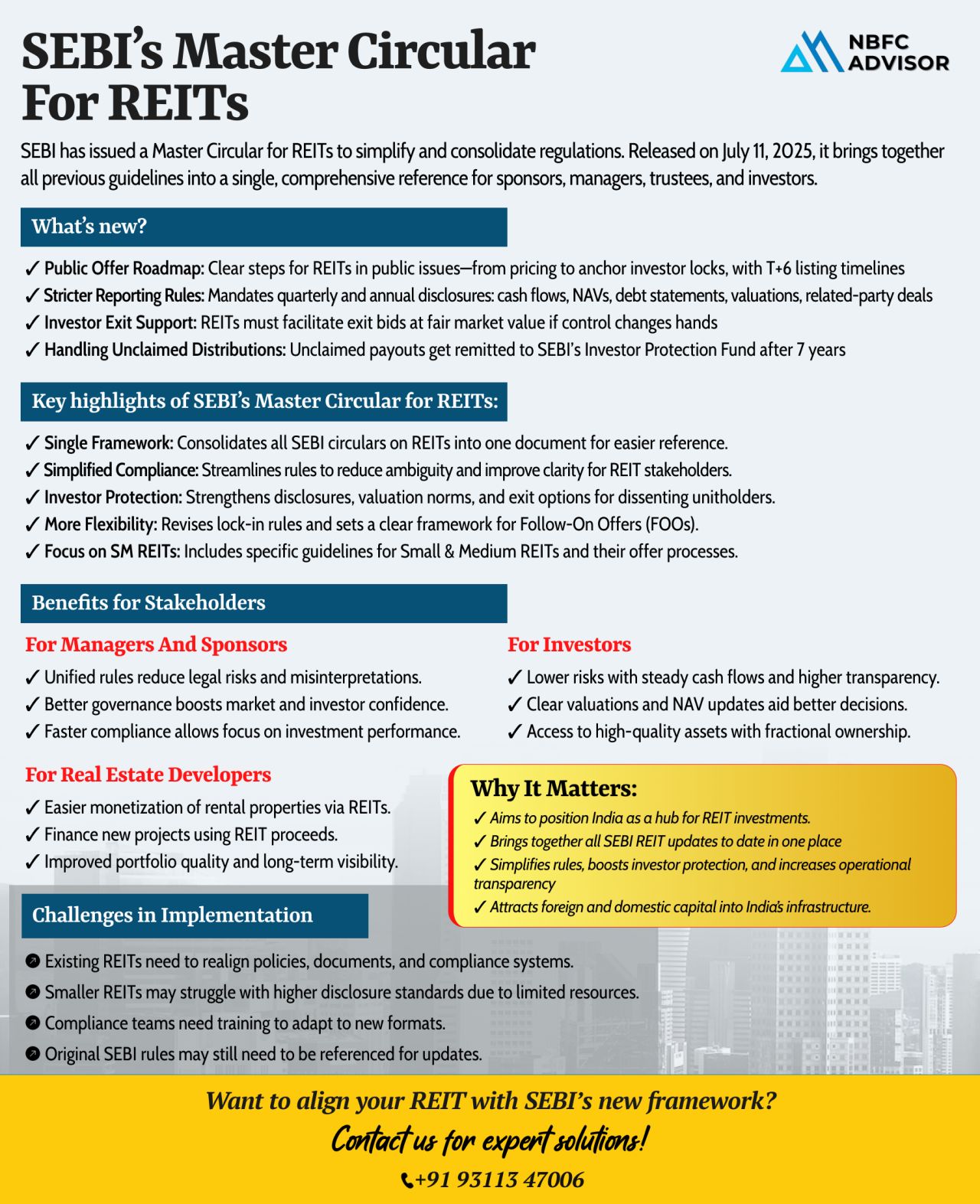

SEBI’s New Master Circular: A Landmark Move for India’s REIT Market

In a strategic step toward regulatory simplification and investor protection, the Securities and Exchange Board of India (SEBI) has released a comprehensive Master Cir...

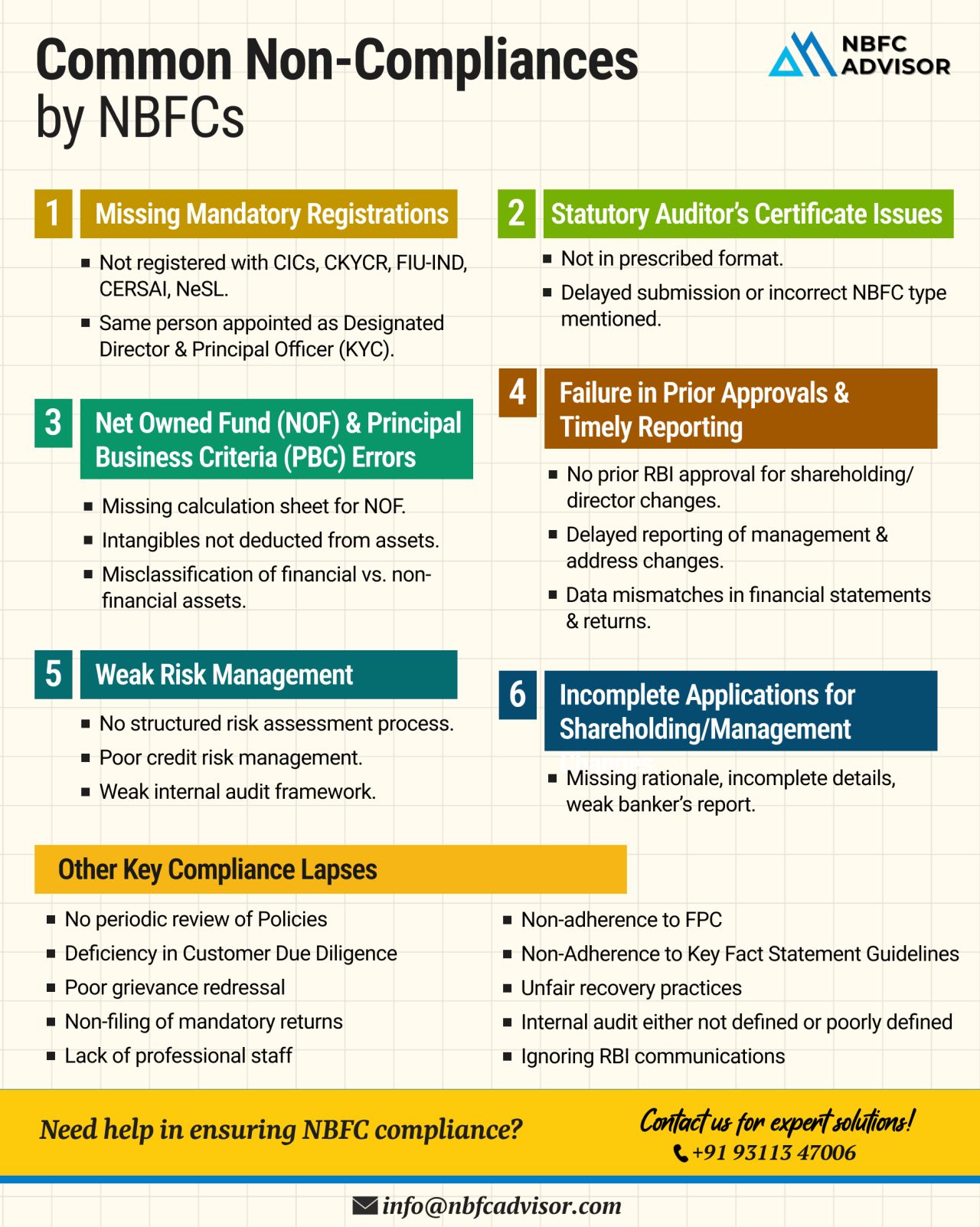

📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

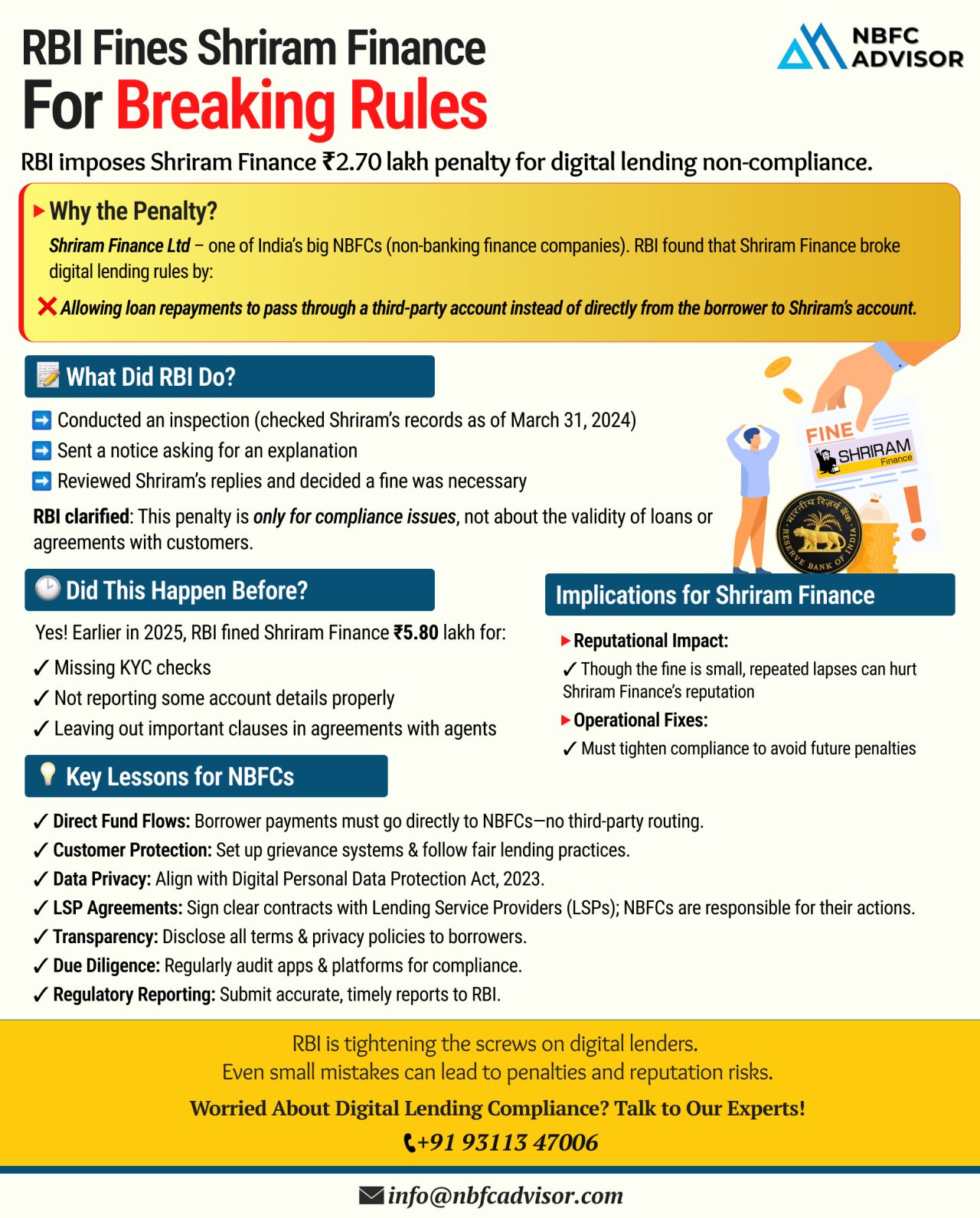

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐮𝐥𝐞𝐬 — 𝘈𝘳𝘦 𝘠𝘰𝘶𝘳 𝘖𝘱𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘴 𝘊𝘰𝘮𝘱𝘭𝘪𝘢𝘯𝘵?

India’s digital lending ecosystem is expanding at an unprecedented pace. But with rapid growth comes increasing...

📢 Attention NBFCs: Time to Align with RBI’s NOF Compliance Deadlines!

The Reserve Bank of India (RBI) is tightening regulations — and NBFCs need to act fast.

According to the RBI Master Direction – NBFC (Scale-Based Regulatio...

The Reserve Bank of India (RBI) has issued a directive that could significantly reshape how Non-Banking Financial Companies (NBFCs) and fintechs collaborate in the digital lending space.

Key Update

NBFCs can no longer rely on Default Loss Guara...

Fintech–NBFC–Bank partnerships are leading a significant transformation — reshaping lending models, expanding access, and simplifying financial services.

Opportunities

Digital loans and banking are now reaching Tier 2 an...

With increasing regulatory scrutiny, fintech startups and NBFCs must ensure alignment with global and local data protection laws to remain competitive and trusted:

Key Regulations to Watch:

→ GDPR – Emphasizes a consent-first approac...

The Reserve Bank of India (RBI), led by Governor Sanjay Malhotra, recently held a crucial meeting with leading Non-Banking Financial Companies (NBFCs)—his first such interaction since taking office. The meeting brought together MDs and CEOs fro...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In the intricate world of finance, regulatory compliance stands as the bedrock of stability and credibility. This blog explores the profound impact of NBFC Advisor, showcasing how its expert guidance has been instrumental in steering Non-Banking Fina...

Rules.png)

.jpeg)

.jpeg)

.jpeg)