Top Mistakes NBFC Founders Make While Applying for an RBI License (and How to Avoid Them)

Top Mistakes NBFC Founders Make While Applying for an RBI License

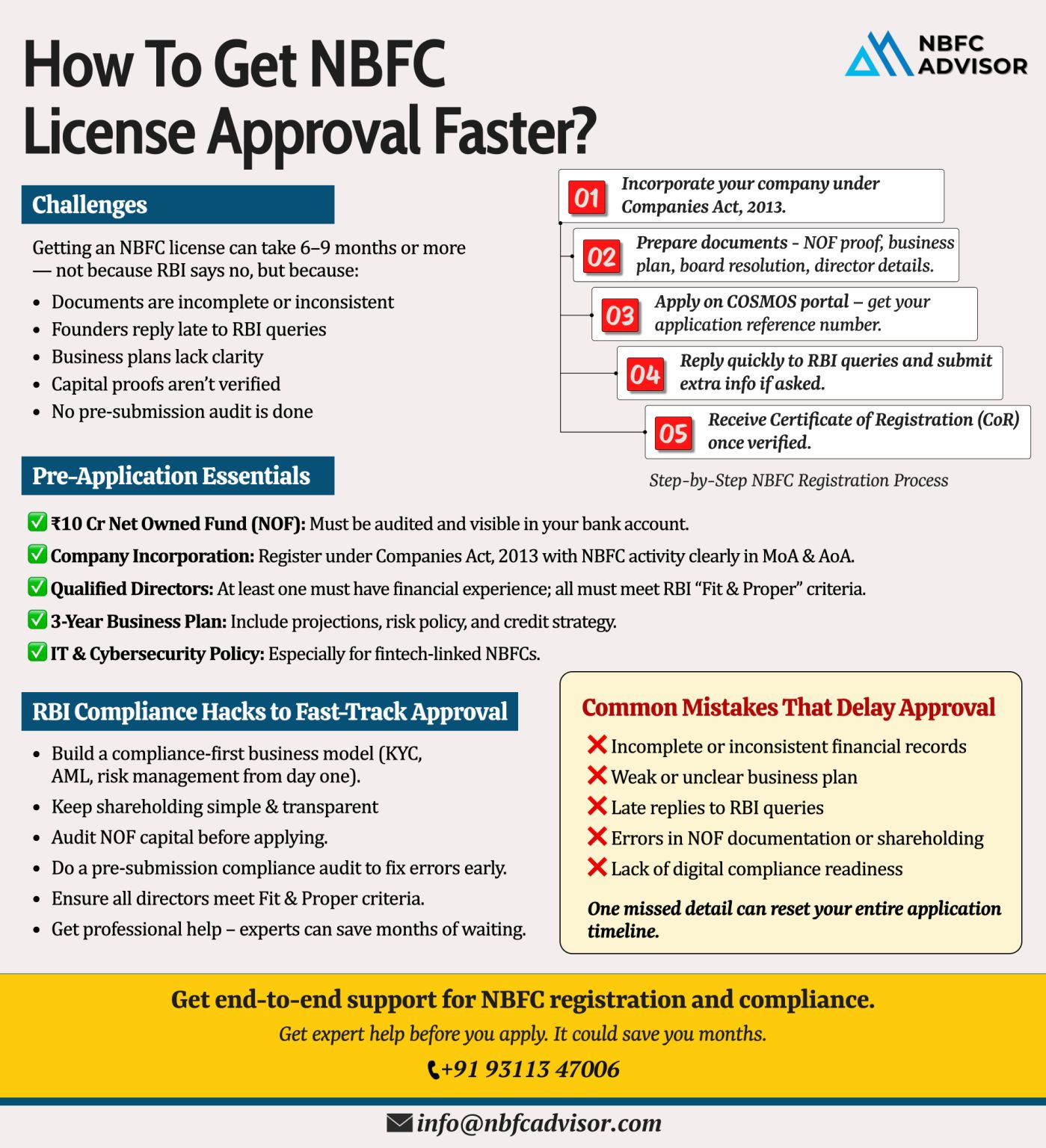

Getting an NBFC (Non-Banking Financial Company) License from the Reserve Bank of India (...

Why Many NBFC Applications Get Rejected by the RBI — And How to Avoid It

Applying for an NBFC (Non-Banking Financial Company) license from the Reserve Bank of India (RBI) is an exciting step for any finance or fintech entrepreneur. However, ...

Getting an IRDAI Corporate Agency License? Don’t Make These Costly Mistakes

If your company, LLP, or bank is planning to sell or distribute insurance policies—whether it’s life, health, or motor insurance—you’ll...

The NBFC Account Aggregator (AA) framework is revolutionizing financial data sharing in India. An NBFC-AA is a regulated intermediary that allows individuals to securely consolidate and share their financial data—such as bank, insurance, mutual...

The Reserve Bank of India (RBI) has introduced updated guidelines aimed at strengthening gold loan practices and enhancing the co-lending framework for better transparency, responsible lending, and financial inclusion.

Key Highlights:

✅ L...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

India’s Future of Financial Data Sharing.png)

.jpeg)

.jpeg)