Top Mistakes NBFC Founders Make While Applying for an RBI License (and How to Avoid Them)

Top Mistakes NBFC Founders Make While Applying for an RBI License

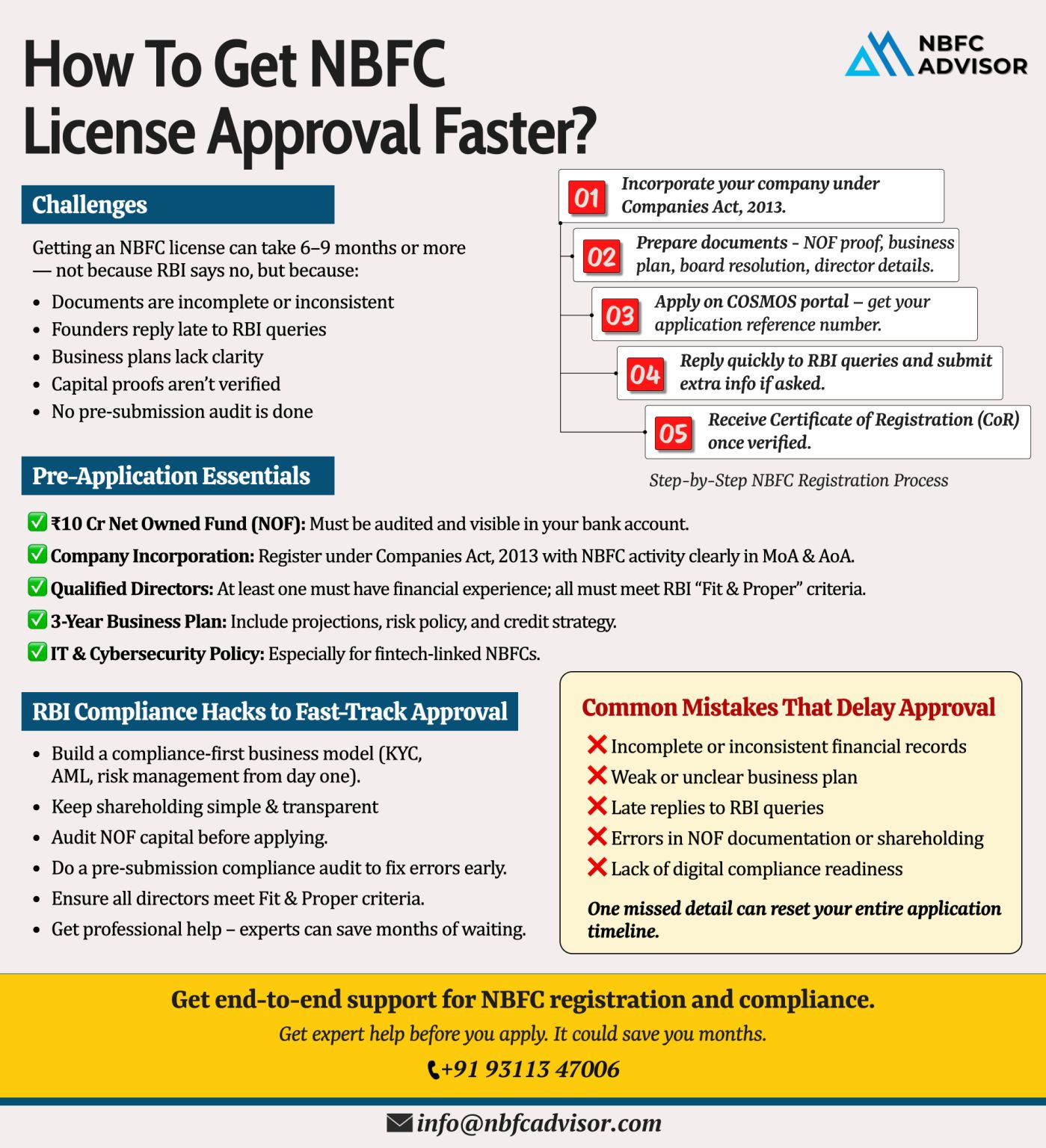

Getting an NBFC (Non-Banking Financial Company) License from the Reserve Bank of India (RBI) is a major milestone for fintech entrepreneurs and financial institutions. However, many founders face unnecessary delays—or even rejections—because of small yet critical compliance mistakes.

Let’s look at the most common errors and how to avoid them:

❌ 1. Missing NOF Proof (Net Owned Fund)

RBI mandates a minimum ₹10 crore Net Owned Fund (NOF), backed by audited financial statements. Many applicants fail to provide valid proof or rely on unaudited capital, leading to outright rejection.

✅ Tip: Ensure your NOF is properly audited, verified, and reflected in your balance sheet before filing your application.

❌ 2. Unclear Business Plan

Your business plan is the backbone of your application. Vague models or unrealistic growth projections make RBI question your financial soundness.

✅ Tip: Present a clear, 3–5 year business plan covering your target market, lending model, risk management policy, and revenue forecast.

❌ 3. Delayed Replies to RBI Queries

Once you submit your NBFC application, RBI may raise multiple queries. Delayed or incomplete responses can pause your file for months.

✅ Tip: Keep all relevant documents and experts ready to respond promptly and accurately to RBI’s requests.

❌ 4. Weak Compliance Framework

RBI expects NBFCs to have strong internal controls, KYC policies, and risk management systems in place before granting the license.

✅ Tip: Build a compliance-first business model with defined SOPs, internal audit mechanisms, and regulatory reporting systems.

✅ Pro Tips to Fast-Track Your RBI NBFC Approval

-

Prepare all supporting documents before applying.

-

Maintain ₹10 crore audited NOF.

-

Keep shareholding structure simple and transparent.

-

Conduct a pre-submission audit by professionals.

-

Create a robust compliance and governance policy.

How Expert Guidance Can Help

At Induce India, we’ve helped multiple NBFC founders secure their RBI approvals faster by conducting detailed pre-submission audits and ensuring every compliance box is ticked. Our experts simplify the process, minimize delays, and strengthen your business documentation.

📞 Contact us today for a free consultation: +91 93113 47006

🌐 Visit: www.induceindia.com

#NBFCAdvisor #RBI #Fintech #Compliance #NBFCRegistration #Finance #Entrepreneurship #NBFC