Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

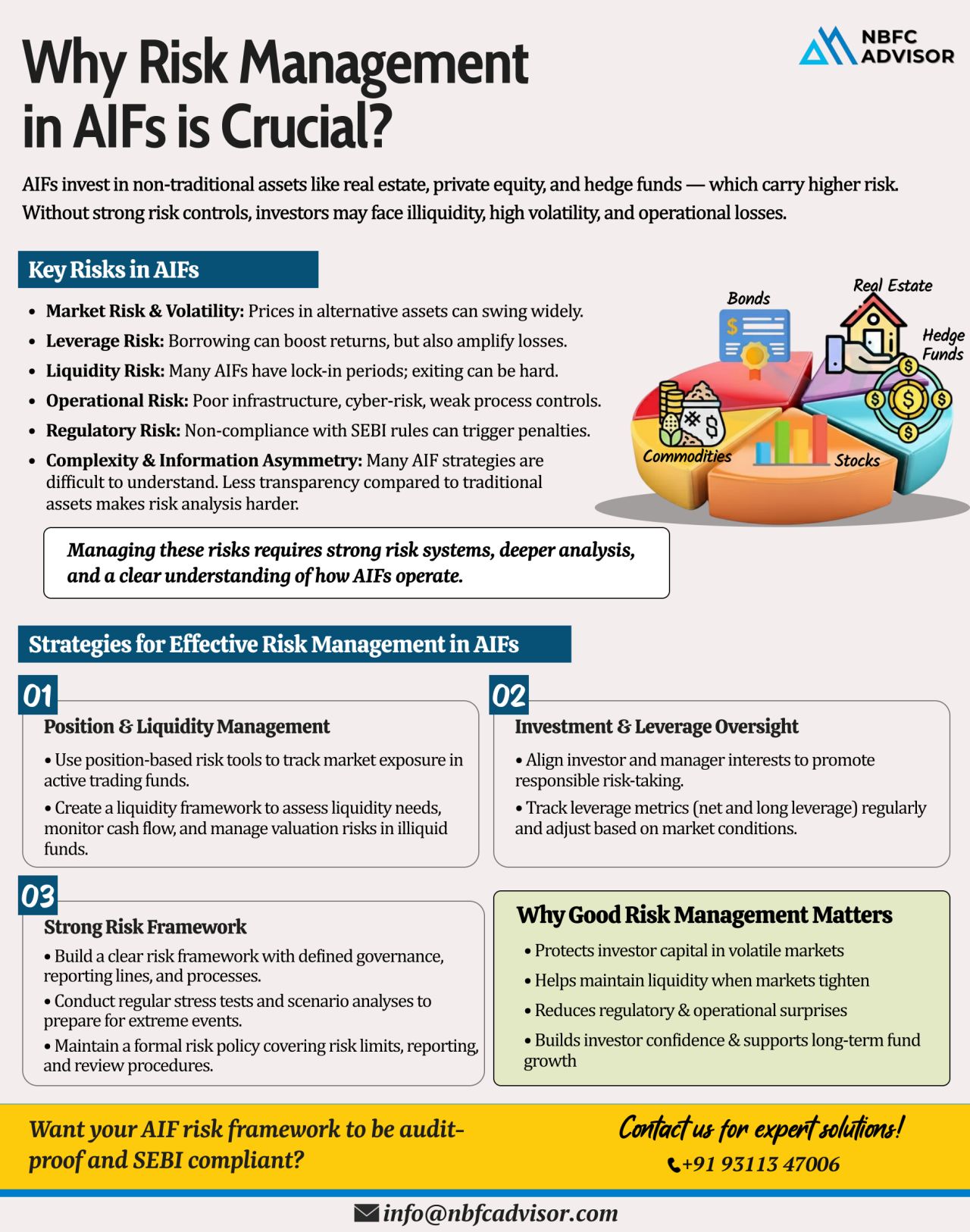

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The fintech industry is experiencing an unprecedented evolution, driven by groundbreaking innovations that are transforming how we manage, invest, and think about money. From artificial intelligence to blockchain, the financial landscape is being red...

In recent months, the Reserve Bank of India (RBI) has implemented several stringent measures affecting non-banking financial companies (NBFCs). These measures include restrictions on important business areas such as gold loans and securities financin...

.jpeg)

.jpeg)

.jpeg)