Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

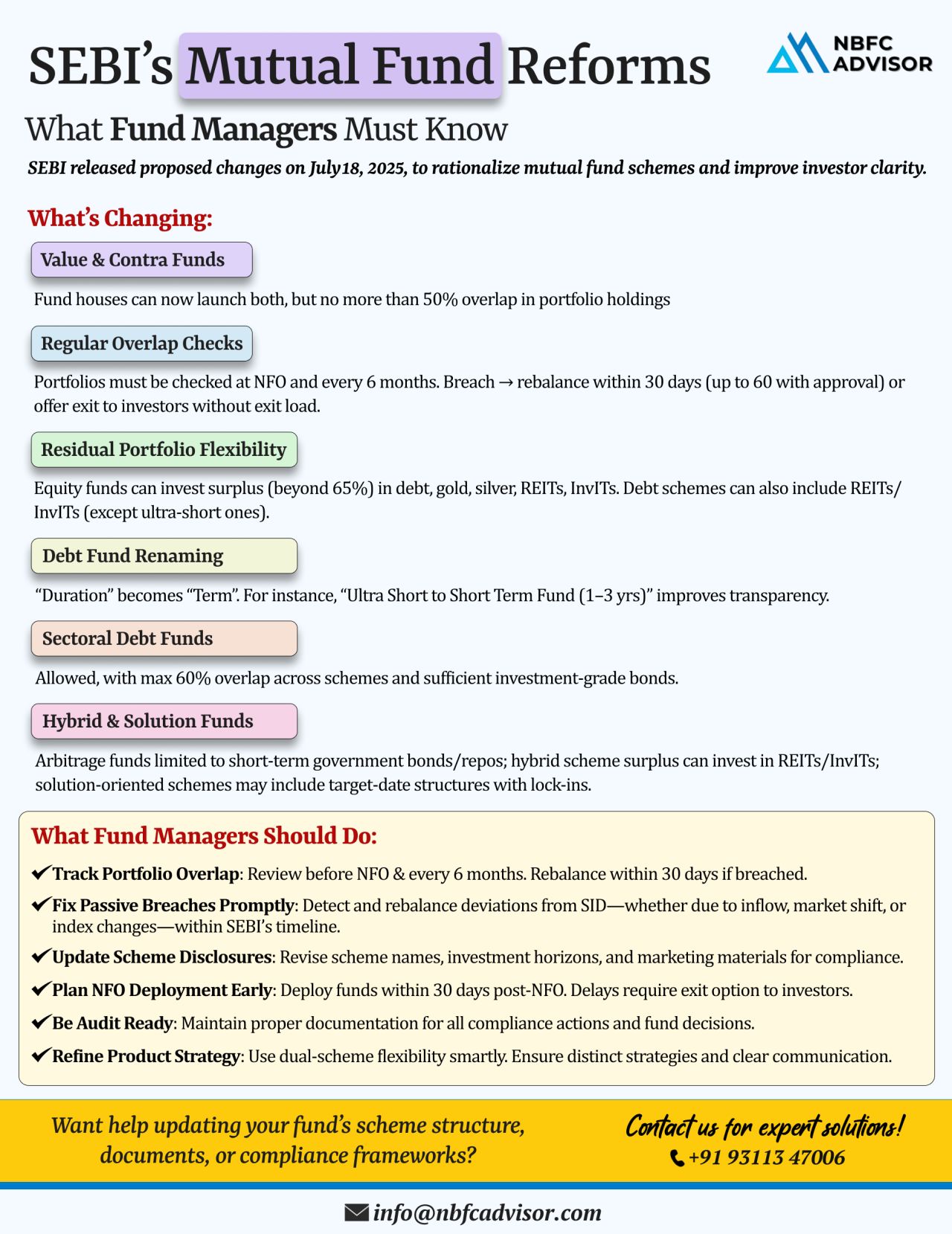

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The Reserve Bank of India (RBI) has introduced draft guidelines that aim to bring transparency and fairness to the digital lending space. These guidelines are specifically targeted at regulating Lending Service Providers (LSPs), previously known as l...

.jpeg)

.jpeg)