Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compli...

Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

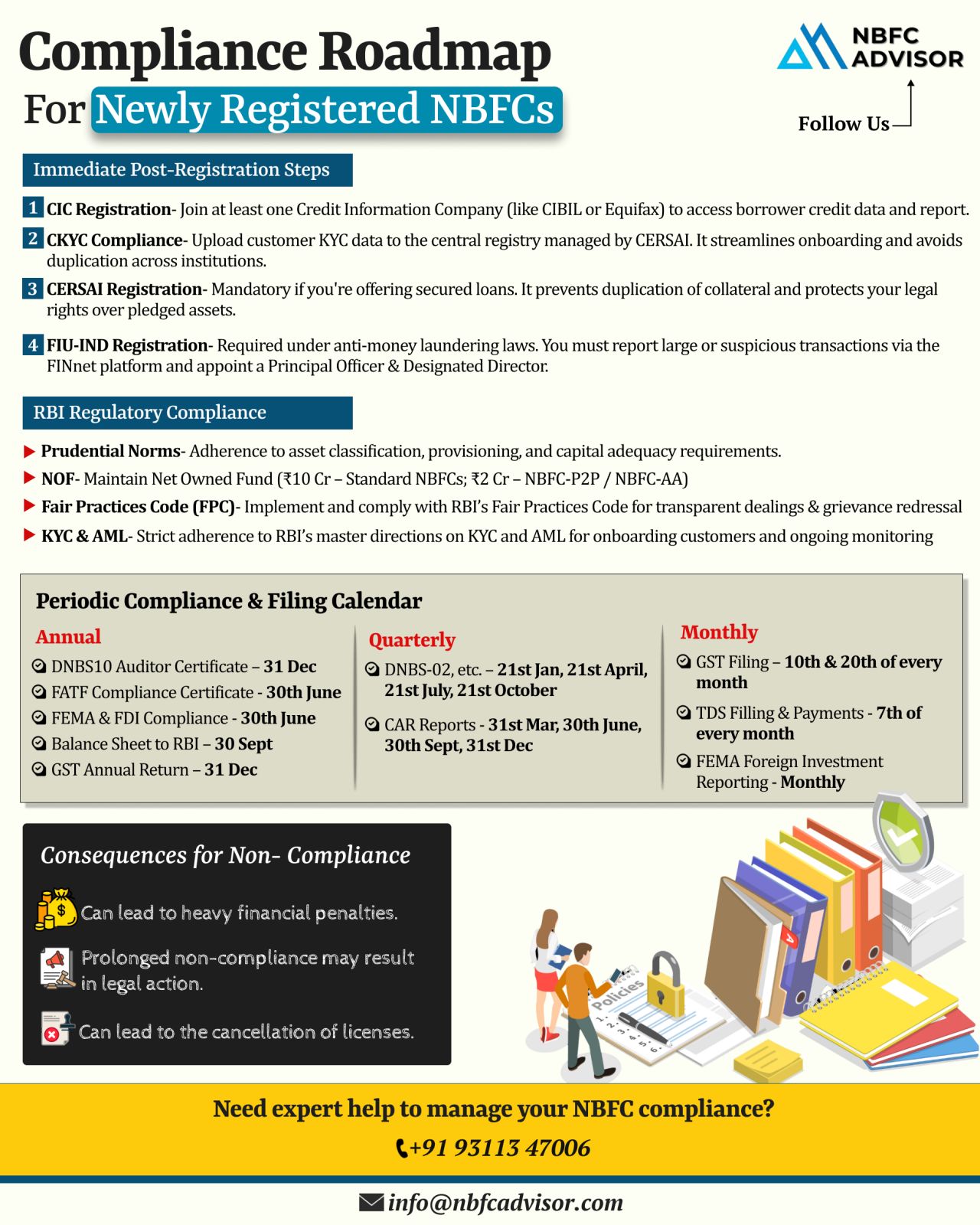

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

𝐈𝐬 𝐘𝐨𝐮𝐫 𝐍𝐁𝐅𝐂 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

Compliance Isn’t Optional — It’s Essential.

It’s not just about following rules. Compliance is the foundation of trust, sustainable growth, and long-term success for every NBFC.

...

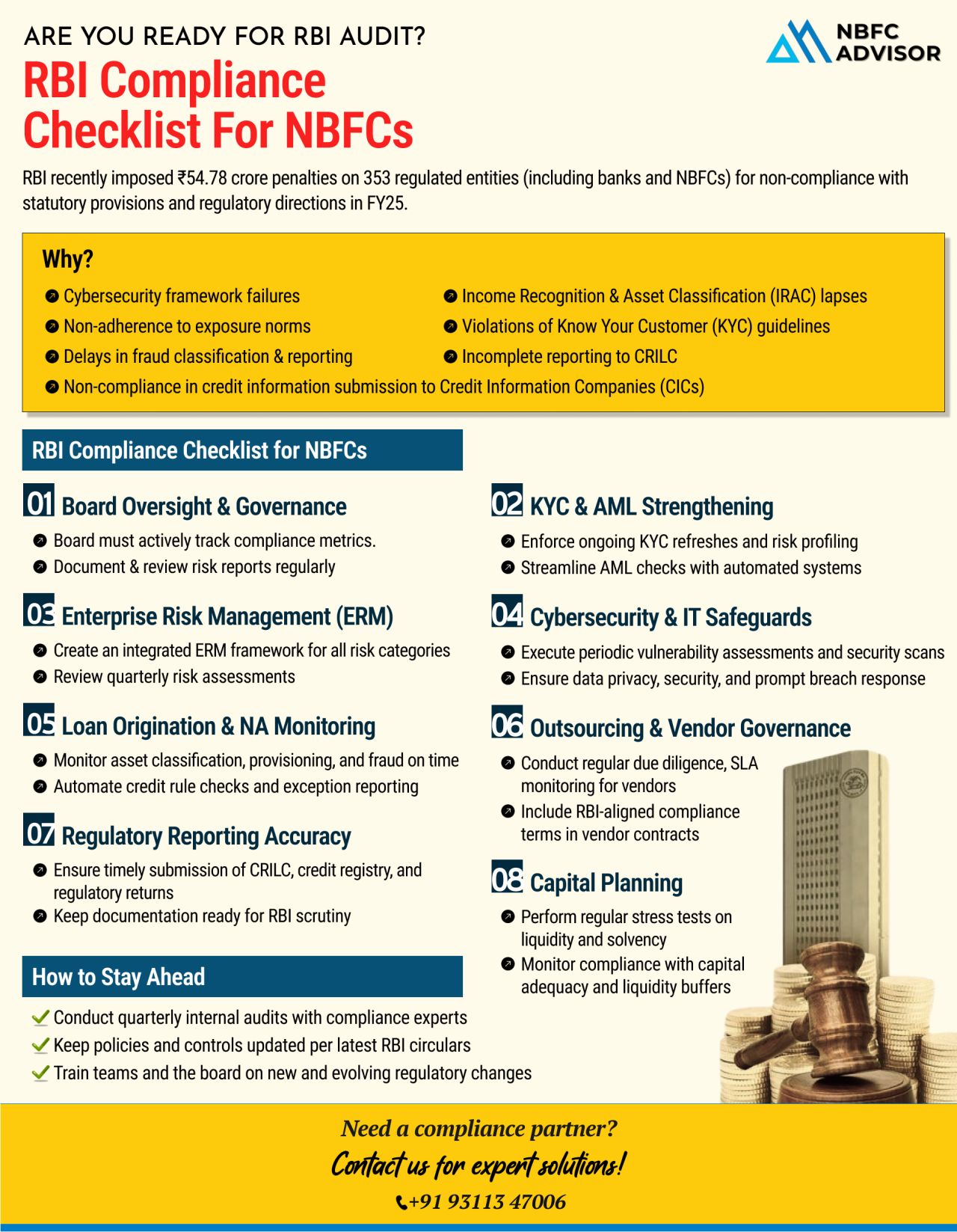

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

Become a Leader in the Financial Sector with Expert Guidance

Are you looking to start your own Non-Banking Financial Company (NBFC) or FinTech Lending Company?

Our team of Consultants & Ex-Bankers will guide you every step of the way!

CO...

Introduction

Jio Financial Services (JFS), a financial arm of the energy-to-telecom conglomerate Reliance Industries Limited (RIL), has recently transitioned from a Non-Banking Financial Company (NBFC) to a Core Investment Company (CIC). This sign...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

.jpeg)

.jpeg)

.jpeg)